The price of Bitcoin has increased by 2% in the last 24 hours. This reflects the overall upward trend in the cryptocurrency market, and the market capitalization has also increased by 2%.

According to on-chain data, this upward trend can continue and could pave the way for Bitcoin to approach $67,000. In this analysis, BeinCrypto explores the factors that could enable this.

Bitcoin Registers Uptrend in Accumulation

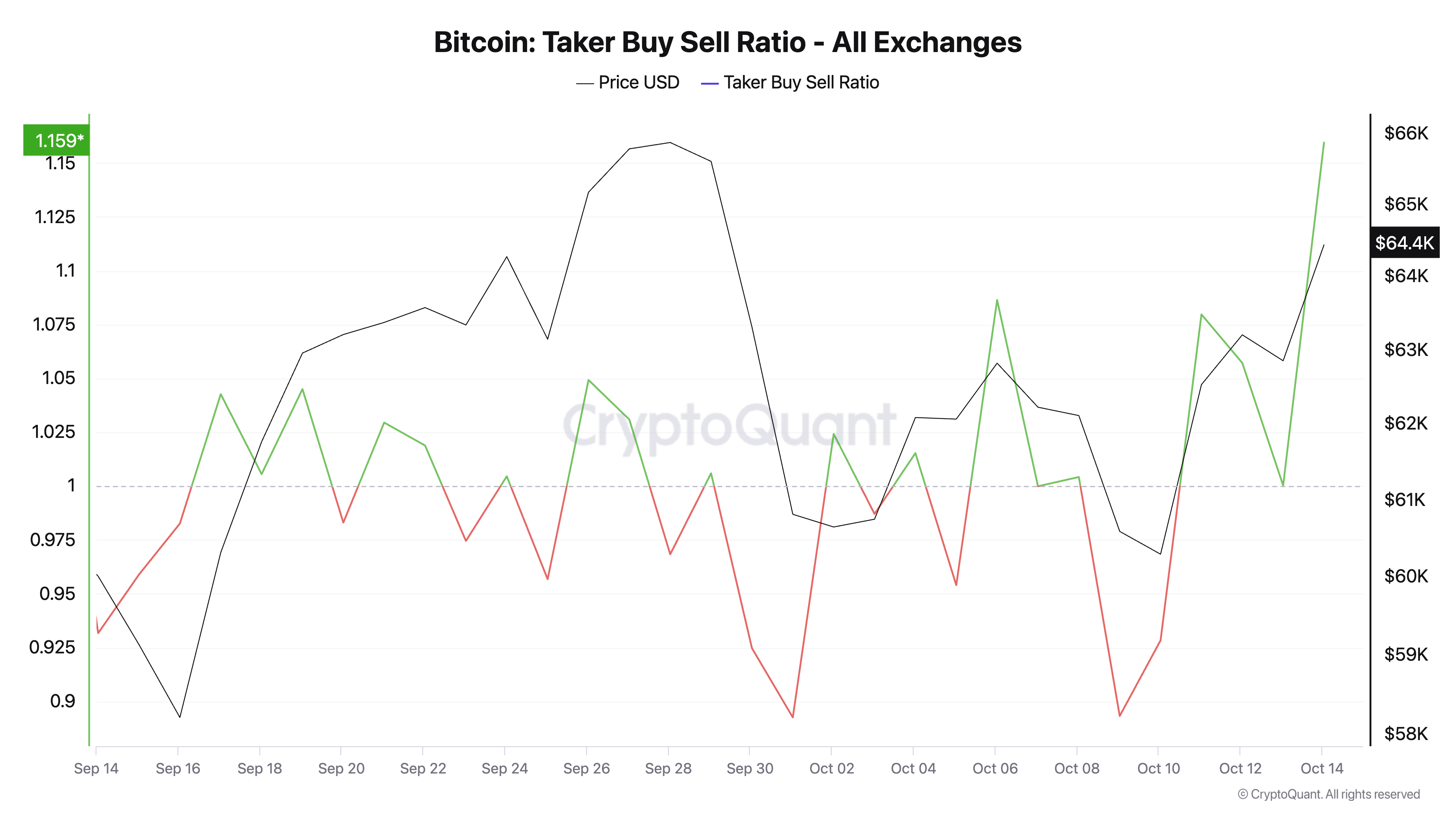

The Bitcoin buy-sell ratio has reached its highest level in the past month. Currently, this indicator, which tracks the ratio of BTC buy to sell trading volume in the futures market, is at 1.19.

Read more: Top 7 Platforms Offering Bitcoin Signup Bonuses in 2024

A ratio greater than 1 indicates that there are more buyers than sellers, reflecting a bullish market sentiment. This suggests that the demand for Bitcoin is increasing, implying a sustained upward trend.

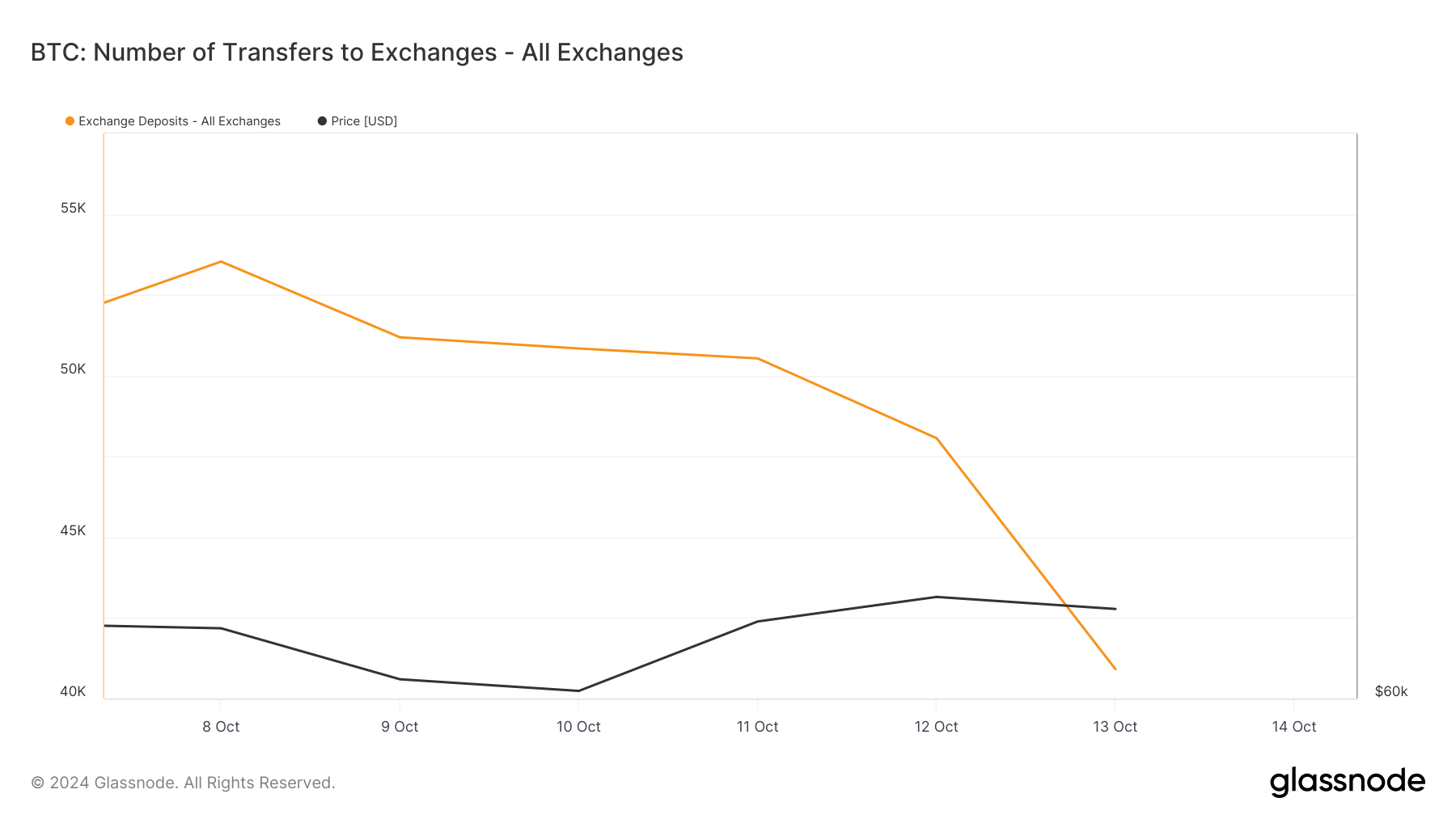

BeinCrypto's assessment of exchange activity supports this bullish outlook. According to Glassnode data, the amount of BTC deposited into cryptocurrency exchanges on Sunday fell to a weekly low of 40,908.

The decrease in deposits suggests that investors are sending fewer assets to exchanges to sell. This reflects confidence in the long-term value of BTC, implying that holders expect the price to continue rising.

Additionally, the holding period of Bitcoin increased by 301% last week. This confirms that coins are being held for longer before being traded, a bullish signal indicating that traders intend to hold their coins for the long term.

BTC Price Prediction: Rally to 5-Month Highs Possible

Bitcoin is currently trading at $64,315, slightly above the crucial resistance level of $63,289. If this uptrend continues, successfully retesting this resistance level could allow BTC to continue its rally to $67,078.

Breaching this critical threshold could see Bitcoin recover to its 5-month high of $71,906.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, this bullish outlook depends on sustained buying momentum. Increased selling pressure could push Bitcoin's price down to $60,627, invalidating the current upward projection.