When we look back at the GameFi-related projects (GambleFi is currently also classified as a GameFi project) that have received high financing and outstanding performance in the past 23 years, the high financing is mainly concentrated in the infra construction of the GameFi track such as game platforms and game Layer3, and the most eye-catching ones are the pump.fun casino, which has attracted countless people since the beginning of the year, and the popular Not and Telegram Dot Dot Dot mini-game ecosystems. This article will analyze the defensive investment logic behind such investment phenomena and our attitude towards this investment logic.

1. GameFi market financing overview

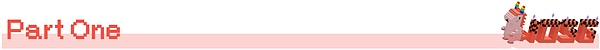

Source: InvestGame Weekly News Digest#35: Web3 Gaming Investments in 2020-2024

Looking at the investment volume and number of projects in the GameFi field every quarter from 2020 to 2024, even though Bitcoin has broken through the previous high in 21 years this year, the data in the past year is relatively sluggish and conservative in both overall volume and quantity. Compared with the same previous high in Q4 of 21, the total investment projects reached 83, with a total amount of $1,591M, and an average investment of $19.2M per project. In Q1, which broke the previous high this year, there were 48 projects with a cumulative investment of $221M, and an average investment of $4.6M per project, a year-on-year decrease of 76%. In terms of amount, the overall investment behavior presents a conservative defensive posture.

2. A detailed analysis of three market phenomena in the past year, the logic, changes and doubts behind them

2.1 Phenomenon 1: Game platforms evolve from pure platforms to new user acquisition channels

"In addition to strong survivability and long life cycle, gaming infrastructure has gradually evolved into a channel for attracting new users, which is also the reason why they are so favored by VCs."

Among the 34 GameFi-related projects that received more than $10m between June 2023 and August 2024, 9 were game platforms and 4 were game L3s, ranging from BSC to Solona, from Base to Polygon, and even self-built Layer 2 and Layer 3, large and small game platforms are blooming everywhere. Even with a sharp drop in the total amount of financing, 38% of the high-investment projects are still concentrated on game Infra, which has strong survivability and a long life cycle. The platform is a narrative that will not be falsified by the trend, and it is also a defensive investment option that stays in the market with low risk.

Source: PANTERA

In addition, for the top game ecosystem, there is more than one fund like Pantera that has invested heavily in the ecological tokens of the top game platform - Ton. Ronin is also the secondary first choice of many VCs. The reason why the Ton ecosystem and Ronin are so favored by VCs may be attributed to the gradual evolution of the platform's role. The nearly one billion users carried on Telegram, the new users attracted to Web3 by mini games such as Not, Catizen, and Hamster (30M Not users, 20M Catizen users, 1M paying users, and 0.3B Hamster users), or the new user groups that flow from the ecological traffic on Ton to the exchange after the listing of the coin, have brought new blood to the entire crypto world. Since March this year, Ton has announced more than 100 million US dollars in ecological incentives and multiple league bonus pools, but the later on-chain data shows that $Ton's TVL does not seem to have increased significantly with the outbreak of mini games. More users are mainly converted directly into exchanges through the pre-charge activities of exchanges. On Telegram, the CPC (Cost-Per-Click) is as low as $0.015, while the average cost of acquiring a new account or customer on an exchange is $5-10, and the cost of acquiring each paying user is even more than $200, averaging $350. The cost of acquiring customers and conversion costs on Ton are much lower than those of the exchange itself. This also indirectly confirms why exchanges are now scrambling to list various Ton mini game tokens and memecoins.

Ronin's own accumulated user base provides many more opportunities for individual games to find users on their own, as can be seen from the fact that high-quality games such as Lumiterra and Tatsumeeko have been migrated to the Ronin chain. The user growth and new user acquisition capabilities that game platforms can bring seem to have become a new angle of favor.

2.2 Phenomenon 2: Short-term projects dominate the market and become the new favorite, but the ability to retain users is questionable

"In the secondary market with poor liquidity, the flywheel and money-making effects of many games have been forcibly castrated, and the perpetual game has become a one-time game. In the current bad cyclical environment, these short-term projects are more in line with VCs' risk aversion defensive investment options, but we still have doubts whether the long-term retention ability of users is worthy of VCs' optimism and expectations."

Take a look at the economic model of Not (short-term project)

Source: PANTERA

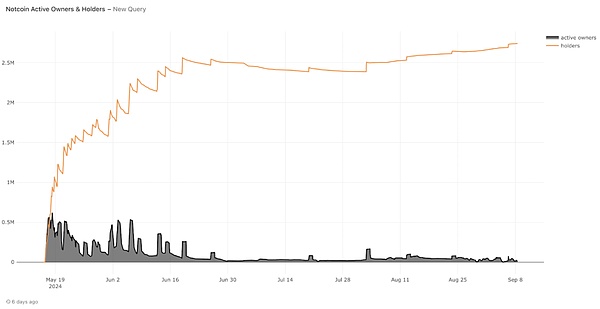

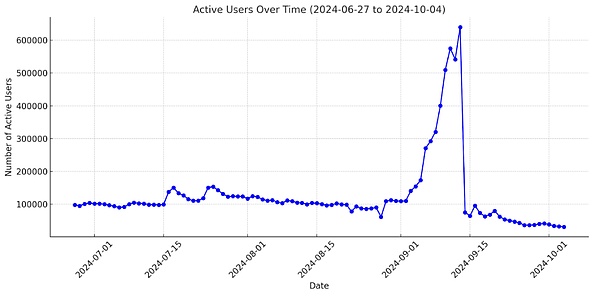

The number of active users of Not has been declining since the token was launched, from the initial 500,000 to 200,000 after TGE 5 days later, and then to a relatively stable 30,000. The decline in users reached 94%. If user data is used as a reference, Not is indeed a short-term project. Why are Dogs, Hamster Kombat and Catizen, which were recently launched on Binance, so popular with the market and VCs?

Source: Starli

From the former P2E game earning money, simple game level settings, auto chess mode, Pixel's vegetable planting and tree chopping to earn coins, to Not's popular click-to-earn, these projects with GameFi titles are gradually simplifying or even taking off the shell of Game. When the market is happy to pay, is everyone's acceptance increasing, or is everyone becoming impatient? Accept that since the essence of most GameFi is to use interaction instead of mining machines to run nodes to mine, why bother with those complicated game steps and modeling costs? It is better to use all the costs originally needed to develop the game as the initial cake of this Ponzi mine, so that both parties can benefit.

This economic model is different from the previous GameFi flywheel model. The one-time unlocking of full circulation does not require the investment of initial costs. Users can exit the airdropped tokens as soon as they get them, and VCs no longer have to worry about locking up for two or three years. The continuous mining model is directly castrated into a short-term version that is more similar to the full circulation of memecoin. In addition, similar to the platform's new user assignment, the simple monetization game mechanism attracts new users of Web2 to participate in Web3, and new users who receive airdrops and monetize are transferred to exchanges. The user traffic brought to the ecosystem and exchanges may be another reason why VCs are so optimistic about such projects.

The nature of the flywheel cycle and short-term projects are more suitable for the current market, and the returns on mid- and late-stage investments are questionable.

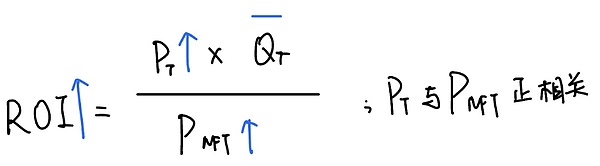

The previous P2E (Play-To-Earn) games had a complete economic cycle, and whether the flywheel of this economic cycle could run depended on whether the players could calculate an acceptable ROI (Return on Investment). ROI = Net Profit / Net Spend, which is the expected future income (the value of the mined ore) / NFT cost (mining machine cost) in P2E games. Therefore, in P2E games, the formula for calculating participants’ income is:

ROI = Value of Future rewards/Acquisition Cost of NFT

Ignoring wear and tear and electricity costs, the larger the calculated ROI, the stronger the incentives for players. How to make the ROI as large as possible? Let's break down the formula.

Source: Starli, IOSG Ventures

Path 1: Value of Future Rewards increase

Value of Future Rewards = Quantity of Future Rewards * Price of Future Rewards

V=P*Q

The value of future income = the amount of future income * the price of future income

When the value of income increases, either the amount of income obtained increases, that is, the token reward increases; or the price of income obtained increases, that is, the token price increases.

In the context of the Web3 economy, basically all token output settings are in a convergent arc, like the Bitcoin halving cycle. As time goes by, token output will decrease and mining difficulty will increase. Perhaps more expensive mining machines, i.e., rarer NFTs, will generate higher revenue, but it also adds extra costs. So it doesn’t make sense to increase revenue without changing the quality of mining machines.

The more likely scenario is that the price of future earnings will rise, that is, the price of the coins mined by players has been growing steadily. The secondary market has sufficient buying volume, and there will not be a situation where supply exceeds demand. Buying orders eat up all selling orders and there is still an upward trend. In this way, the numerator in ROI becomes larger.

Path 2: NFT cost reduction

When the denominator in ROI becomes smaller, ROI will naturally become larger, which means that the acquisition cost of NFT as a mining machine becomes lower. If the price of NFT traded in project tokens becomes lower, it is either because the demand for the NFT decreases and the supply increases, or because the price of the token as a medium of exchange and standard of measure decreases, causing the price of NFT to decrease externally.

The decrease in demand is naturally because the game's money-making attribute has weakened, and players have turned to other games with higher ROI to seek opportunities. For settlements in other fiat currencies such as Ethereum, solona, etc., affected by the market, the price of mainstream coins has fallen, and Altcoin will definitely not fare well. In this way, the price of NFTs and tokens must be positively correlated. Therefore, the numerator becoming larger and the denominator becoming smaller cannot exist at the same time. Their enlargement or reduction is synchronized, and there is even a certain proportion of interaction between them.

This means that the most likely way to achieve a larger ROI is to increase the price of the currency with expected returns, and NFT will rise synchronously, but the increase is less than or equal to the increase in the price of the currency. The ROI can maintain stability or slowly increase, constantly motivating players. In this case, the new funds entering the Ponzi scheme are external forces and new additions, acting as amplifiers, and only when the price of the currency goes up in the bull market can the flywheel of the P2E game run. When the ROI is stable or even rises slowly, players will continue to reinvest the money they earn to snowball, and injection exceeds withdrawal. Axie is the most successful example of a flywheel cycle.

Source: Starli, IOSG Ventures

Source: Starli, IOSG Ventures

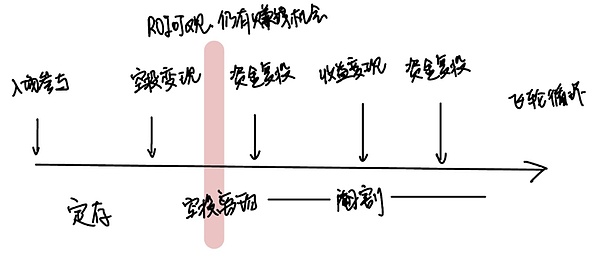

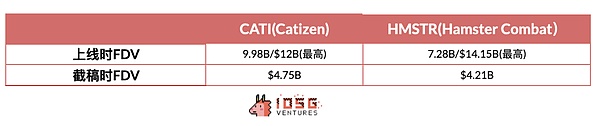

Looking back at the games in this cycle, it seems that most of them were short-term fomo before the launch, and fell to the bottom overnight after FG. All tokens unlocked by airdrops became selling pressure. After cashing out and leaving the market, they looked for the next one. There is no subsequent ROI, no reinvestment of funds and flywheel cycle, and Diamond Hands have to bear all the short-term. P2E is less heard, P2A has quietly become popular, play to airdrop is a very scary concept, this title is like a one-time label for the game. The purpose of rubbing is just to sell the airdrop and cash out when it is listed, rather than continuously looking for opportunities to earn in this game ecosystem. Although the times are different, the behavior of selling coins is the same, but in the current weak secondary market and the dead time of Altcoin, the secondary coin price cannot run the flywheel, and there is no strong market maker to protect the market. The flywheel and money-making effect of many games are directly forcibly castrated, from loop to short-term, and the perpetual game has become a one-time game. Looking back at the performance of Catizen and Hamster after TGE from this perspective, it also indirectly proves that the economic model is designed for the short term, and there is no need to run the flywheel behind, so there is no need to pull the stock. For such projects, we still have doubts whether the mid-to-late stage Token Funding is a profitable deal.

The flywheel cycle requires a more sophisticated economic model and cost investment, while in the short term, only the expectation of airdrop is needed, because the task is accomplished after listing, and the subsequent economic model can be castrated. The expectation of airdrop is to make money from the liquidity difference between the primary and secondary markets. We can understand these short-term projects as another form of fixed deposit before reinvesting into the economy. Players invest the cost and traffic of NFT or pass cards as the principal, give the time cost of retaining funds, and wait until the coin is listed to earn the airdrop income and leave.

Such projects do not require cross-cycle operation time and uncertain economic cycles, and are not completely dependent on the market environment and fomo sentiment. The short and brilliant life cycle and the full circulation unlocking model allow VCs to no longer have the trouble of locking positions and have a faster exit time. In the current cyclical environment, these short-term projects are closer to VCs' risk aversion defensive investment options.

Long-term user retention is questionable

Whether it is Not, Catizen, Hamsters or Dogs, they have all brought a large wave of new user growth to exchanges such as Binance. But how many long-term users actually remain in the ecosystem or on the exchange? Does the value of the new users match the expectations and investment of VCs?

Source: IOSG Ventures

Let's take a look at Catizen, one of the most popular mini-games in the Ton ecosystem. It only took one day for the number of active users to drop from 640,000 before the token issuance to 70,000, and the subsequent user retention data was even more sluggish. From the perspective of long-term users, even if the game content does not change, after the airdrop expectation no longer exists, up to 90% or more of the users immediately withdraw, and only about 30,000 people are finally retained. Does such a user retention rate meet the expectations of investors and achieve the purpose of attracting new users? Even if the users who received the airdrop turn to the exchange to bring an immediate wave of user growth, after selling the airdrop to realize the cash, will these users abandon Catizen like Catizen? When the product itself transforms into a viral campaign, a short-term project for the purpose of attracting new users, even if it brings a wave of increment to the ecosystem in the short term, can the users who really settle down meet the expectations of the ecosystem and the exchange and are worthy of this investment? We still have doubts.

2.3 Phenomenon 3: Top VCs invest in casinos to earn commissions, but lack the expectation of issuing coins and value capture

"Infra projects and secondary transactions are closely related to the macro market. When the market is strong, funds are more willing to stay in the market to take advantage of the gains of various hot spots. In an environment where there is no strong desire to buy and sell in the secondary market, relying on casinos and pump.fun's pvp to earn money from rake and kill rate has become a more prudent and conservative defensive choice for VCs. But where does the customer acquisition come from? The platform and tools lack the expectation of issuing coins. The rake is also inferior to GameFI project investment, which is also worth considering."

Multiple casino projects have begun to emerge, accounting for 15% of GameFi-related high financing in 2024. It seems that in this fast-paced crypto world, since meme and pump.fun can be reasonably accepted by everyone, games of all sizes no longer need to be implicitly covered with a GameFi coat as before, and appear in front of everyone openly.

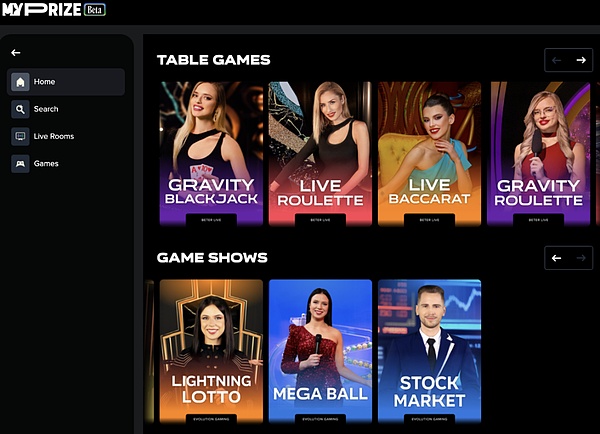

Monkey Tilt, which was led by Polychain Capital and followed by Hack VC and Folius Ventures on February 12 this year, provides everyone with a sports betting website and online casino backed by a large fund. Myprize, an online casino that announced on March 24 that Dragonfly Capital led the investment and a16z and other large VCs participated in the investment of $13 million, is even more bold. The homepage gameplay openly shows sexy dealers dealing cards online and live broadcast options.

Pump.fun, the logic of casino platform earning rake and cash flow

When the market is cold and volatile, the election is undecided, and the US interest rate cuts are delayed again and again, constantly consuming market expectations, in such garbage time, coupled with the double stimulation of the emergence of BOME (Book of MEME) and other god coins and 100x and 10000x coins this year, people's gambling nature is greatly stimulated, and more money flows into the chain and pump.fun to find the so-called next "large MC memecoin". Look at the time when pump.fun appeared, it was also during the period of continuous volatility after solona pulled up.

What is the biggest casino in Web3? Many people may have the answer to this question. Top exchanges such as Binance and OKX offer 125X leveraged perpetual futures contracts, while smaller exchanges offer 200X or even 300X leverage. Compared to the 10% maximum daily fluctuation of A-shares and 20% of the ChiNext, Tokens that are already T+0 and have no price limits and have 100X leverage, you only need less than 1% of the price fluctuation to lose all your capital.

The rising or falling contracts of the currency price can be participated in by long or short. In essence, the ultra-short-term contracts are just betting on the size of the period from entry to exit, with odds ranging from 5 times to 300 times. The exchange makes a lot of money by charging order opening fees, holding fees, forced liquidation (explosion) fees, etc. The logic is the same, and casinos usually earn money by rake or killing rate when they are the banker.

If we say that Infra projects and secondary transactions are closely related to the macro market environment, when the macro environment is clear and the market is going up, funds are more willing to stay in the market to take advantage of the large gains in various hot spots, with considerable returns and lower risk factors. However, in the current market volatility, funds seem to flow to casinos and pvp, using high leverage to gain returns that cannot be reached at the moment. High leverage amplifies the gains and naturally also amplifies the losses. In the current market where the market is jumping back and forth, the commissions earned by exchanges and platforms may be more objective than in unilateral market conditions.

As the market fluctuates and users' gambling tendencies increase, funds and enthusiasm seem to flow to casinos and PVP. The commissions earned by casinos and tool products have become a stable income with demand and increment, which also conforms to the defensive investment logic of earning commissions. However, there are also certain problems with the commission-based revenue of casinos or platforms.

Lack of coin issuance expectations and value capture

For platform projects like pump, even if they have become phenomenal platforms and have made a lot of money from trading, there is still a lack of expectations for issuing coins. Whether from the perspective of the token itself, the necessity and practicality of the token within the ecosystem, or from a regulatory perspective, as long as there is no issuance of coins, there will be no securitization violations that will be targeted by the SEC. Similar casinos or platforms lack real expectations for issuing coins.

On the other hand, without the expectation of issuing coins, pump money and casino logic are more applicable to the period of sideways fluctuations and cannot predict future hot spots. Pump money relies on the popularity and activity of memes or gambles on the chain. It is an intermediate tool to meet demand rather than the demand itself, lacking the value capture that truly relies on itself. The recent behavior of pump.fun selling sol on a large scale can also be seen (as of September 29, it has sold Solana tokens worth about 60 million US dollars, accounting for about half of its total revenue). In the absence of coin issuance expectations and value capture, pump.fun has relied on the prosperity of $SOL while causing considerable selling pressure on the market.

Although pump.fun will undoubtedly bring many positive effects to the entire Solana ecosystem, such as increased trading activity, new users attracted to the Solana ecosystem by meme summer, stable demand and buying for $SOL, purchasing power after seeing the price increase of $SOL, meme players gradually evolving into long-term users and ecosystem supporters of $SOL, promoting the prosperity of the entire ecosystem, driving premiums, etc. But the problem still exists, taking from the people and selling to the people, collecting $SOL as fees and throwing this selling order into the market. The closer the total sales amount is to the total revenue, the more neutral the impact of pump.fun itself on the price of solana will be, and it will be like a stabilizer, and there may even be a negative premium (only selling but no buying). When it is in the rising growth stage, pump.fun's positive impact on the solana ecosystem is very strong, and may show geometric growth; but when it is mature enough and in the plateau stage, the relatively fixed selling pressure (selling pressure as handling fee income) minus the smaller positive impact, at this time there may be greater selling pressure.

Taken together, similar gambling platforms will certainly lag behind GameFi projects that have real value capture.

In addition, the investment income of most VCs is the dividends of pumping money. Equity exit is unrealistic and there is a lack of logic for the expected coin issuance. They can only wait for the next round of mergers or acquisitions to exit. The exit cycle is long and difficult.

3. Conclusion: Casinos and platforms may underperform GameFi, short-term project retention has deteriorated, and past defensive investments are cautious

Whether it is to attract stagnant users to new games, or to convert new Web3 users based on the user base, one of the main functions and value directions of the gaming platform seems to have evolved into a new channel for attracting new users. However, for projects that rely on such platforms to convert users as real value through short-term projects, the long-term retention rate of users does not seem to have been proven by time and data. In the absence of coin issuance expectations and value capture, gambling platforms seem to underperform GameFi, which has real value capture and PMF, in a bull market.

We are still cautious about defensive investments in the past market, and we are more eager to find products and high-quality games that have not yet formed a consensus and are rarely invested in. Such games can convert future purchases into higher retention rates, higher in-game consumption and on-chain activity due to their quality. This will eventually translate into higher value for tokens.