Author: Arthur Cheong & Eugene Yap, DeFiance Capital; Compiled by 0xjs@Jinse Finance

The European Renaissance that began in the 14th century sparked a revival of art, culture, and thought, transforming modern civilization.

Today, we are witnessing a similar awakening in the cryptocurrency realm - the revival of Decentralized Finance (DeFi). Like historical movements of its kind, this movement is breaking down barriers and reshaping our perceptions of money and finance. Supported by blockchain and smart contracts, DeFi has democratized financial services, allowing people around the world to access the trustless economy without traditional financial intermediaries. It has the potential to fundamentally reshape finance.

Just as the European Renaissance flourished due to technological advancements and social changes, the DeFi revival is being driven by key factors that are pulling it out of early challenges and into a new phase of growth and innovation.

1. DeFi is Emerging from the Trough of Disillusionment

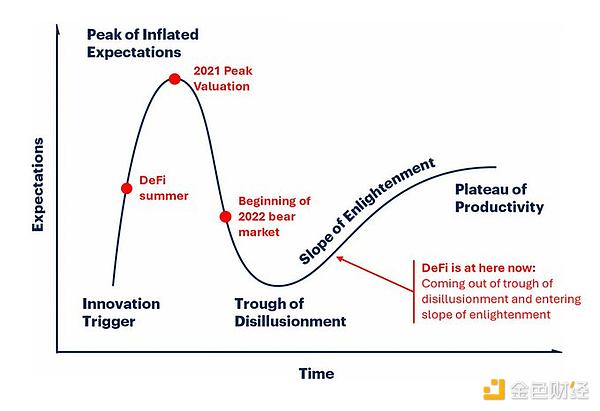

DeFi experienced a surge in 2020 and 2021 as many believed it would fundamentally transform traditional finance (TradFi). However, like most new technologies, when the underlying infrastructure proved to be inadequate, the early hype led to disappointment, resulting in a downturn in 2022.

Yet, like any revolutionary movement, DeFi has become stronger, emerging from the "Trough of Disillusionment" and beginning to climb the Slope of Enlightenment. The Gartner Hype Cycle is an effective framework to illustrate this journey, with DeFi now showing signs of revival.

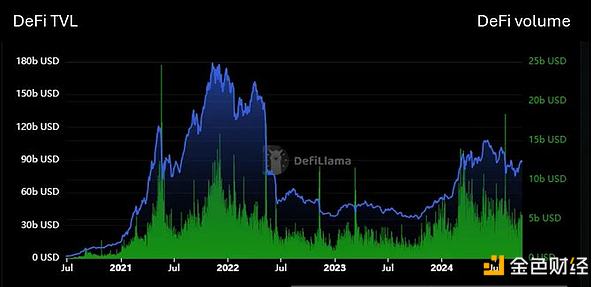

After two years of adjustment, key metrics such as Total Value Locked (TVL) are rebounding, as shown in the chart below. While some metrics have improved due to the rise in cryptocurrency asset prices, trading volumes on DeFi platforms have also increased significantly, nearly recovering to 2022 levels, demonstrating that the recovery is genuine.

After two years of adjustment, key metrics such as Total Value Locked (TVL) are rebounding, as shown in the chart below. While some metrics have improved due to the rise in cryptocurrency asset prices, trading volumes on DeFi platforms have also increased significantly, nearly recovering to 2022 levels, demonstrating that the recovery is genuine.

In fact, some core DeFi projects like Aave have even surpassed their 2022 peaks in various metrics. For example, Aave's quarterly revenue has exceeded Q4 2021 (which was considered the peak of the previous bull cycle).

In fact, some core DeFi projects like Aave have even surpassed their 2022 peaks in various metrics. For example, Aave's quarterly revenue has exceeded Q4 2021 (which was considered the peak of the previous bull cycle).

Our full Aave analysis can be found in "Aave is Severely Undervalued".

This indicates that DeFi is maturing and entering a new phase of productivity, preparing for long-term scalability.

2. A New Interest Rate Cycle Will Make DeFi Yields More Attractive

The revival of DeFi is driven not only by internal factors, but also by external economic changes. With changes in global interest rates, risk assets like cryptocurrencies, including DeFi, have become more attractive to investors seeking higher returns.

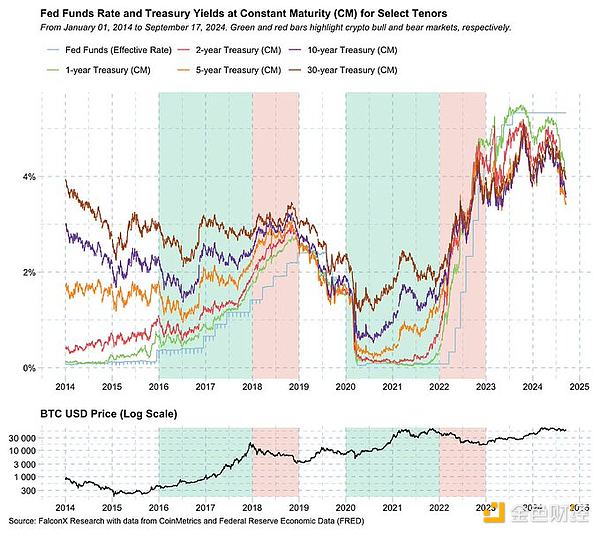

As the Federal Reserve implemented a 50-basis-point rate cut in September, interest rates may decline over the coming period, similar to the environment of the cryptocurrency bull markets in 2017 and 2020, as shown in the chart below. Bitcoin (and cryptocurrency) bull markets are highlighted in green, which have historically occurred during low-interest-rate regimes, while bear markets are highlighted in red, typically during periods of rising interest rates.

DeFi benefits from lower interest rates in two main ways:

1. Lowering the opportunity cost of capital - With interest rates declining, the returns on government bonds and traditional savings accounts are lower, so investors may shift towards DeFi protocols that offer higher yields, such as through yield farming, staking, and liquidity provision.

2. Cheaper borrowing - Financing costs become lower, encouraging DeFi users to borrow and use it for productive purposes, driving overall activity in the ecosystem.

While rates may not decline to the near-zero levels of past cycles, the opportunity cost of participating in DeFi will be significantly reduced. Considering that the difference between interest rates and yields can be leveraged, even a moderate decline in rates can have a significant impact.

Furthermore, we expect the new interest rate cycle to be a major driver of stablecoin growth, as it greatly reduces the capital cost for traditional financial funds to shift towards DeFi in search of yield.

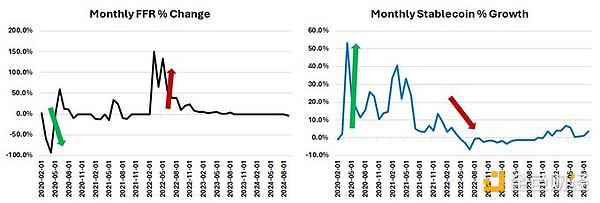

In the previous cycle, the FFR (Federal Funds Rate) was inversely related to the growth in stablecoin supply, as shown below. As rates decline again, stablecoin supply is expected to grow, providing more capital to accelerate DeFi.

3. Finance: (Still) the Biggest Product-Market Fit in Crypto

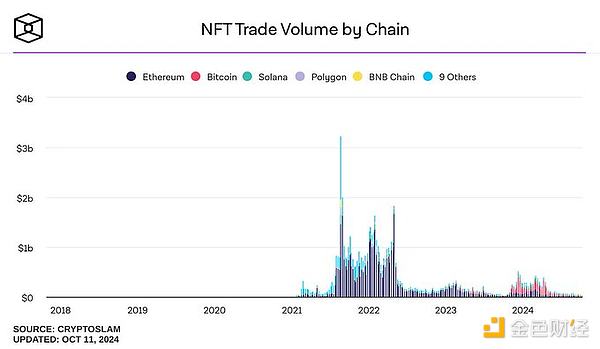

The crypto space has experimented with various crypto use cases, such as Non-Fungible Tokens (NFTs), metaverse, gaming, and social. However, based on most objective metrics, they have not truly found product-market fit (PMF).

Consider the following: Even if the Bitcoin Ordinals lead to a brief resurgence in 2024, NFT daily trading volumes will continue to decline.

As for metaverse and gaming, there are currently no breakthrough Web3 games that have gained global fan following. Even the two OG Web3 metaverses, Decentraland and Sandbox, struggle to attract even a few thousand daily active users, while Roblox has 80 million DAUs. The DAUs of TON games are impressive, but it's uncertain how many will continue playing on TON without more economic incentives.

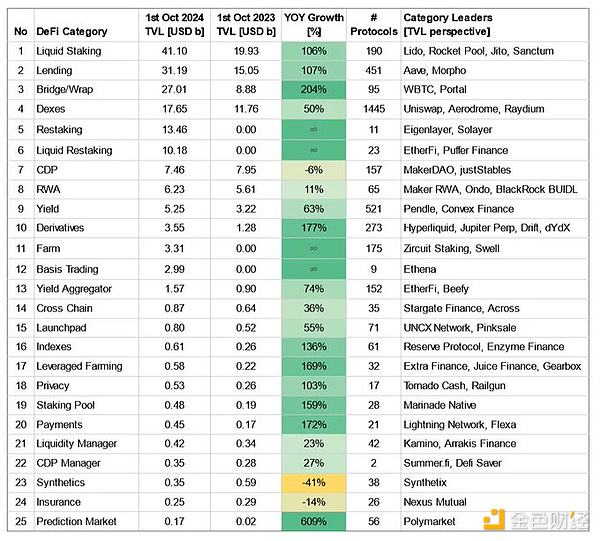

On the other hand, DeFi has proven its product-market fit. The growth of core DeFi categories like liquidity staking and lending (over 100% year-over-year) demonstrates their appeal. At the same time, new categories worth billions of dollars, such as Eigenlayer (re-staking) and Ethena (base trading), have emerged just a year ago. This explosive growth showcases the composability and permissionless nature of DeFi, where new financial "Lego bricks" stack on top of each other to unlock new use cases.

Regulatory barriers have long hindered DeFi's potential to disrupt TradFi, but the inherent advantages of DeFi are evident. For example:

Cross-border transactions and remittance fees average 6%, with transfers taking 3-5 business days.

The backend systems of securities exchanges are bloated and have limited operating hours, leading to inefficiency.

Real-world assets (e.g., real estate) can benefit from tokenization, liquidity unlocking, and achieving composability within DeFi, such as using them as collateral.

DeFi can operate 24/7, at low cost, with strong liquidity, and without intermediaries, making it a more efficient alternative. The technology already exists; the challenge is whether regulators will allow DeFi to disrupt the $100 trillion global finance industry, which thrives on inefficiency.

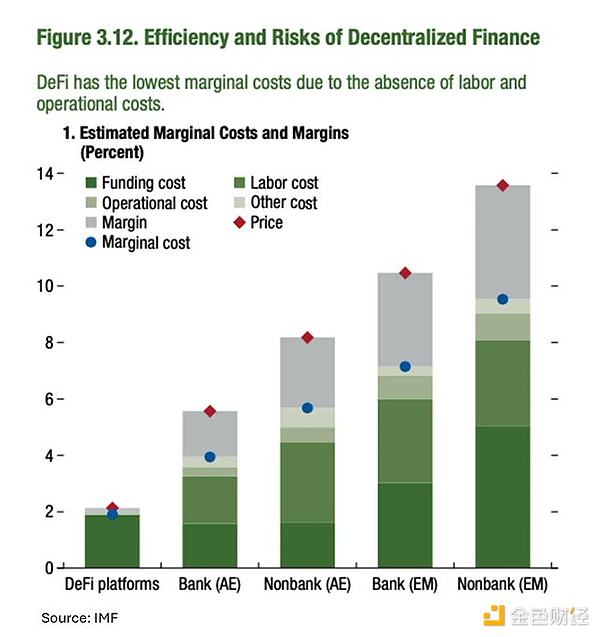

To illustrate how DeFi is more efficient than TradFi, let's compare the costs of running services in the two systems. The following is based on a study by the IMF:

Labor cost: The labor cost of DeFi is close to 0%, while the labor cost of TradFi is 2-3%. For example, DeFi loans are processed automatically without human intervention, while TradFi requires manual review and paperwork.

Operating cost: The operating cost of DeFi is only 0.1%, while the operating cost of TradFi is 2-4%. DeFi avoids the need for large offices or intermediaries, as smart contracts handle transactions and the blockchain provides verification.

Overall, the marginal cost of traditional finance reaches 6-8% in developed economies and 10-14% in emerging markets, and these costs are passed on to the end-user.

DeFi eliminates these inefficiencies. It's that simple.

Furthermore, the Fintech industry has seen almost no innovation in the past 15 years, echoing the research by Blockchain Capital. While we have made tremendous progress in areas like artificial intelligence and global internet access, Fintech remains stuck in outdated systems, such as the SWIFT system used by all banks, which still requires 1-4 business days for transfers.

Furthermore, the Fintech industry has seen almost no innovation in the past 15 years, echoing the research by Blockchain Capital. While we have made tremendous progress in areas like artificial intelligence and global internet access, Fintech remains stuck in outdated systems, such as the SWIFT system used by all banks, which still requires 1-4 business days for transfers.

Most Fintech advancements, such as digital payments, fractional shares, and APIs, focus on improving the user experience rather than addressing the core inefficiencies of traditional finance. For example, Robinhood and Plaid have created convenient solutions for everyone to buy stocks, but they still rely on the old financial infrastructure. The real problem is that Fintech connects to outdated systems to fully leverage them, rather than creating something entirely new. While these changes are helpful, they do not solve the deeper problems plaguing the traditional financial world.

DeFi, on the other hand, is digital from the ground up. DeFi does not operate around the old financial system, but rather embeds financial services directly into the internet. In DeFi, things like fractional stock ownership, overcollateralized lending, and global payments are not innovations - they are just basic functionalities. This marks a fundamental shift from incremental improvements to a complete overhaul of how finance operates.

By adopting DeFi, we can go beyond small adjustments and start unlocking vast new economic opportunities, improving financial service channels, and creating wealth in places often overlooked by TradFi.

Looking ahead, the 2024 US presidential election may bring regulatory clarity. A Trump presidency could lead to crypto-friendly regulations, while the Harris administration, which has recently taken a more positive stance on the industry, may maintain a constructive position. Regardless of the political outcome, the momentum behind DeFi is undeniable.

DeFi is just getting started, and the future of finance is decentralized and on-chain.

4. Improved UI/UX, Infrastructure, and Security

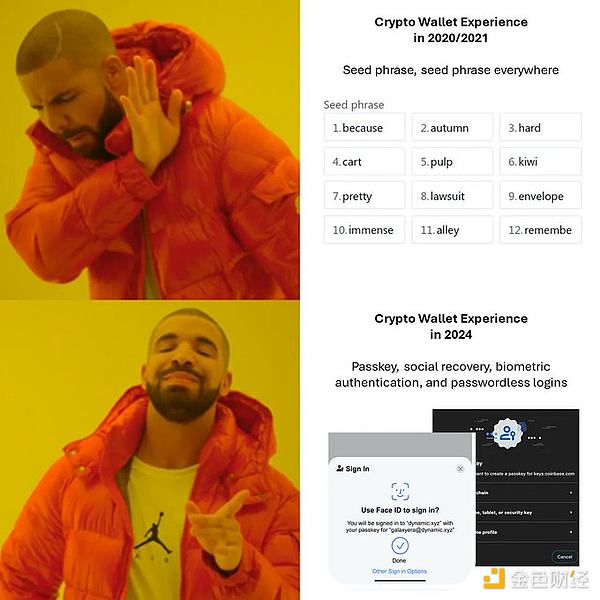

Early DeFi had drawbacks like clunky interfaces and technical complexity, leading to user attrition. However, over the past few years, user experience, infrastructure, and security have significantly improved, making DeFi more accessible to mainstream users.

One of the most notable improvements is in wallet infrastructure. Managing seed phrases and private keys was once a major hurdle, but new smart wallets and embedded wallets have made the process simpler and more secure. Features like social recovery, biometric authentication, and passwordless login now make it easier for users to manage their funds without the complexities of traditional Web3 wallets.

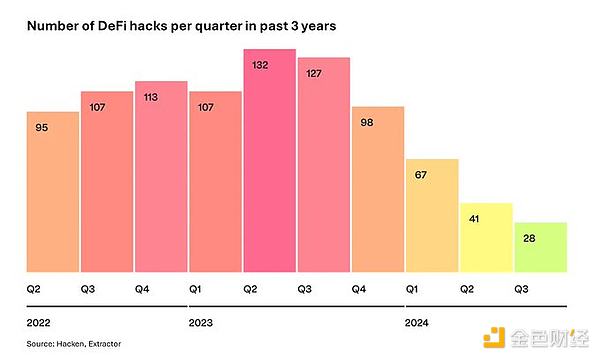

Security has also been enhanced, with more thorough smart contract audits becoming the standard before deployment. Platforms like ImmuneFi encourage white hat hackers to discover vulnerabilities and security issues through bug bounty programs, ensuring that vulnerabilities are addressed before they can be exploited. These developments in wallet infrastructure and security have made DeFi safer and more efficient for all users.This is reflected in the sharp decline in DeFi hacks over the past year.

With these improvements, DeFi is becoming increasingly mainstream-friendly, including institutional adoption, driving its continued growth.

With these improvements, DeFi is becoming increasingly mainstream-friendly, including institutional adoption, driving its continued growth.

Making DeFi Great Again

Just as the European Renaissance reshaped society, DeFi will fundamentally transform finance. The innovative potential of DeFi is immense, and we have only begun to see its impact. As more users and investors embrace DeFi, the future of global finance will increasingly shift on-chain, making the financial system more efficient, open, and accessible to everyone.

DeFi has the ability to eliminate inefficiencies, break down barriers, and create new opportunities for financial inclusion. This is not just a passing trend, but a fundamental shift in how the world interacts with money. From global payments to the democratization of financial services, DeFi offers a future where anyone can participate in the financial system.

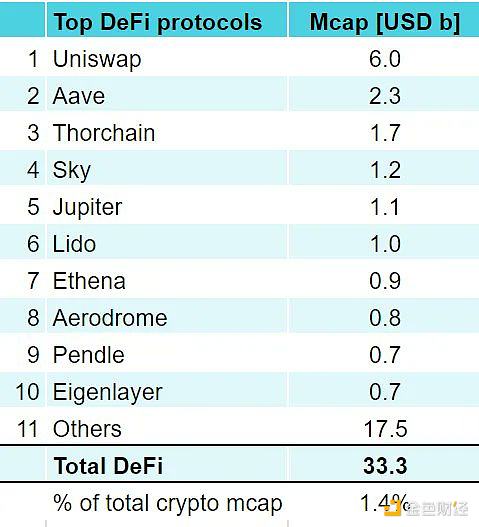

Currently, the total market value of all DeFi protocols is around $33 billion, accounting for only about 1.4% of the $2.3 trillion total cryptocurrency market value.

Data as of October 13, 2024

Given the severity of market conditions and industry environment, the growth and success of DeFi have been largely overlooked recently. However, this will change as DeFi protocols continue to grow at an astounding pace and return increasing value to token holders, as Aave has done with its recent token economic overhaul proposal. Market participants will further recognize the fundamentals and potential of DeFi and reallocate their capital accordingly.

With the continued growth of DeFi and the market's renewed awareness of its latest appeal and new potential, we expect the share of such DeFi assets to grow from 1.4% of the total cryptocurrency market value to 10% within the next 2 years.

Making DeFi Great Again.

Acknowledgments

1. The originator of the term "DeFi Renaissance"