It can be beneficial to reshuffle your loans or liquidity positions to earn a higher yield or lower your interest rate. However, the most crucial step before making any changes is to do the math.

Let’s break down an example.

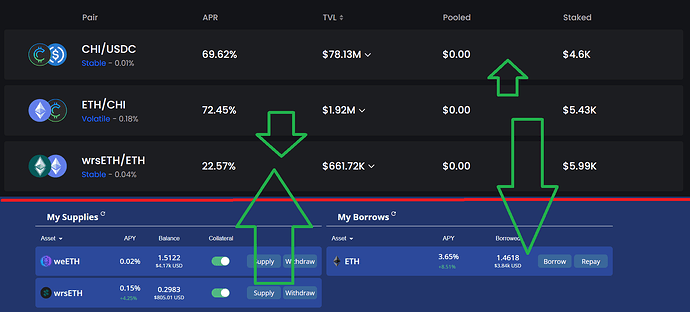

I considered shifting some funds to reduce exposure to volatile asset pairs and increase allocations in more stable ones. I thought this could also bump up my yield since more assets would be allocated to the liquidity pools.

Then I crunched the numbers:

- To withdraw $wrsETH from #Lore while maintaining the same health factor, I’d need to repay 77.16% of its value in $ETH, which amounts to about 0.23 ETH.

- To pair the entire amount of $wrsETH, I’d need an additional ~0.48 ETH.This means I’d need to withdraw ~0.71 ETH and 1,864 CHI (worth $3,750).

- I could then deposit $2,060 worth into the ETH/wrsETH pool.

- Additionally, I could deposit $1,864 into the CHI/USDC pool.

The resulting yield changes would be:

$3,750 * 0.7245 (withdrawn) + $2,060 * 0.2757 (new deposit) + $1,846 * 0.6762 (new deposit) = -$2,716 + $464 + $1,248 is even less then -$1000.

Although this shift would reduce my exposure to impermanent loss, the math showed it wasn’t worthwhile for a small allocation shift of just 0.48 ETH to a stable pool.

Always do the math first