BlackRock CEO Larry Fink has defined Bitcoin (BTC) as a unique asset class. Based on this belief, the asset management giant has launched an international campaign targeting institutional partners to promote mainstream adoption of cryptocurrencies.

The price of Bitcoin has continued to rise, surpassing $65,000 on Monday.

BlackRock CEO Leads Bitcoin Adoption Campaign

In the company's third-quarter earnings report, Larry Fink made these remarks, revealing that BlackRock is discussing digital assets with institutions around the world. Specifically, this discussion focuses on asset allocation that views Bitcoin as an alternative to commodities like gold.

Additionally, in the earnings report, Larry Fink noted that the expansion of Bitcoin is not dependent on regulation or who becomes the next US president. Rather, liquidity and transparency are the key drivers, and he, who was previously skeptical of Bitcoin, has called for enhanced analysis and investor adoption.

Through this, Fink suggested that Bitcoin and cryptocurrencies in general are similar to new financial products that may temporarily stagnate but ultimately scale in size.

Read more: What is a Bitcoin ETF?

Larry Fink's perspective on Bitcoin is a notable change, given that he had publicly expressed skepticism about it. Like JPMorgan CEO Jamie Dimon, BlackRock executives had previously assessed BTC as a speculative and potentially risky asset.

Nevertheless, Fink's assertions may represent the general view among BlackRock's managers. The company's Digital Assets Lead Robby Mitchum recently said that Bitcoin is a safe haven and fundamentally a risk-averse asset.

Mitchum added that Bitcoin is not tied to the economic health or policies of any particular country, and its scarcity provides immunity from the general risks of currency devaluation and political turmoil.

Earlier this month, another BlackRock executive, Jay Jacobs, said there is still ample room for Bitcoin adoption. The Head of US Thematic and Active ETFs estimated that the Bitcoin market could grow to $30 trillion in the next few years.

BlackRock's Bitcoin ETF Surges to $23 Billion

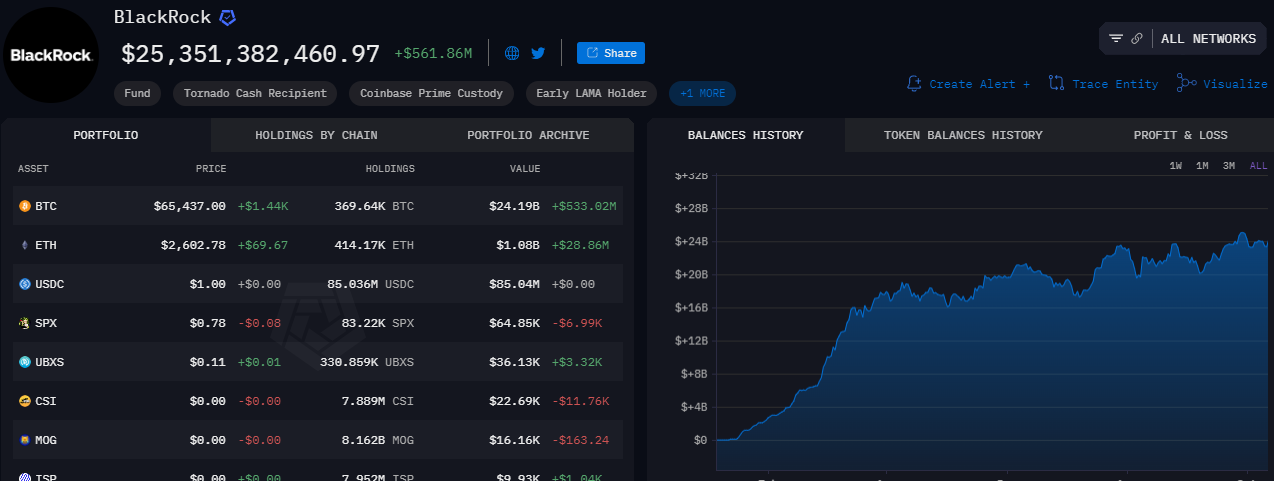

During the earnings call, CEO Larry Fink revealed that the company's IBIT ETF had surged to a $23 billion market in just nine months. Launched on January 11, this ETF provides institutional investors with indirect exposure to Bitcoin. During this period, the ETF has attracted billions in investment and set trading volume records, marking a remarkable success.

"...and we will continue to be pioneers in developing new products that make investing easier and more affordable," Fink added.

BlackRock's IBIT is the market leader in the US Bitcoin ETF space. It has emerged as one of the largest Bitcoin holders, managing nearly 37,000 BTC. IBIT has already surpassed MicroStrategy's Bitcoin holdings and is now behind only Satoshi Nakamoto and Binance. According to Arkham's data, BlackRock's Bitcoin holdings are valued at $2.535 billion.

Read more: Who Will Own the Most Bitcoin by 2024?

As BlackRock and other cryptocurrency ETF issuers continue to provide institutional access to Bitcoin, concerns have been raised about management risks. There are also worries that this could weaken the core principles of Bitcoin.

Cryptocurrencies were designed to decentralize financial power, but with increasing institutional control, some fear that the influence may shift back to the very institutions that Bitcoin sought to bypass.