A research report released on Wednesday by the web3 investment division a16z crypto of the venture capital firm Andreessen Horowitz (a16z) found that cryptocurrency activity and usage reached all-time highs this year, with the number of active mobile wallet users also hitting a new high.

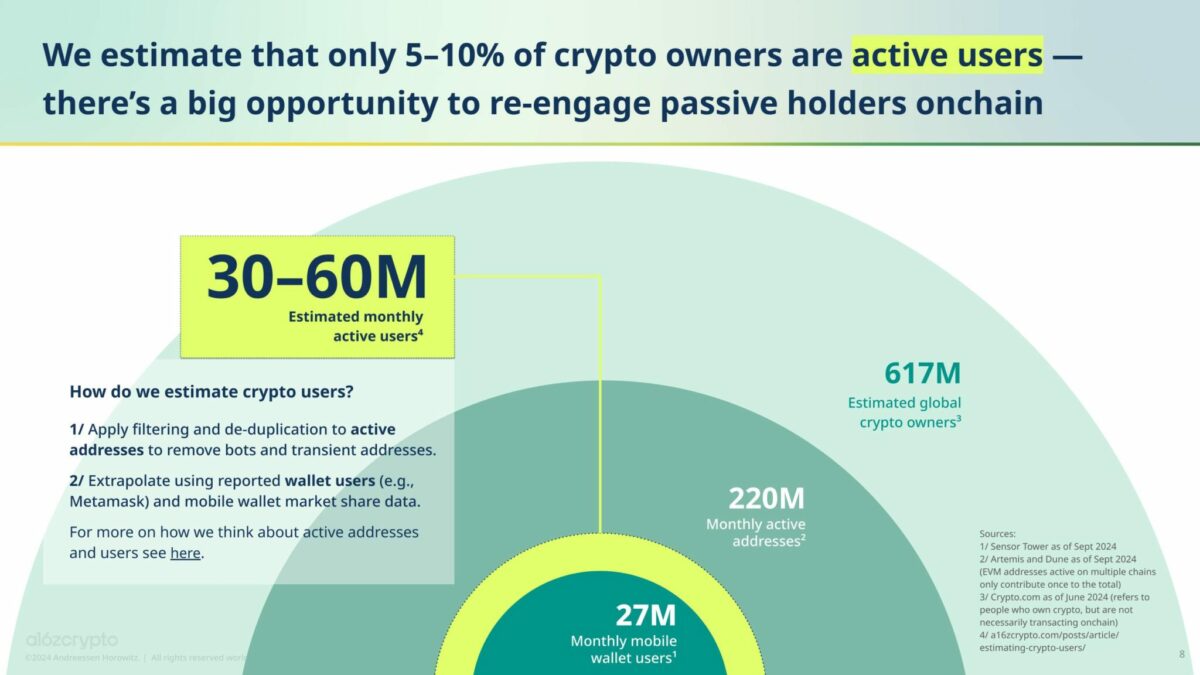

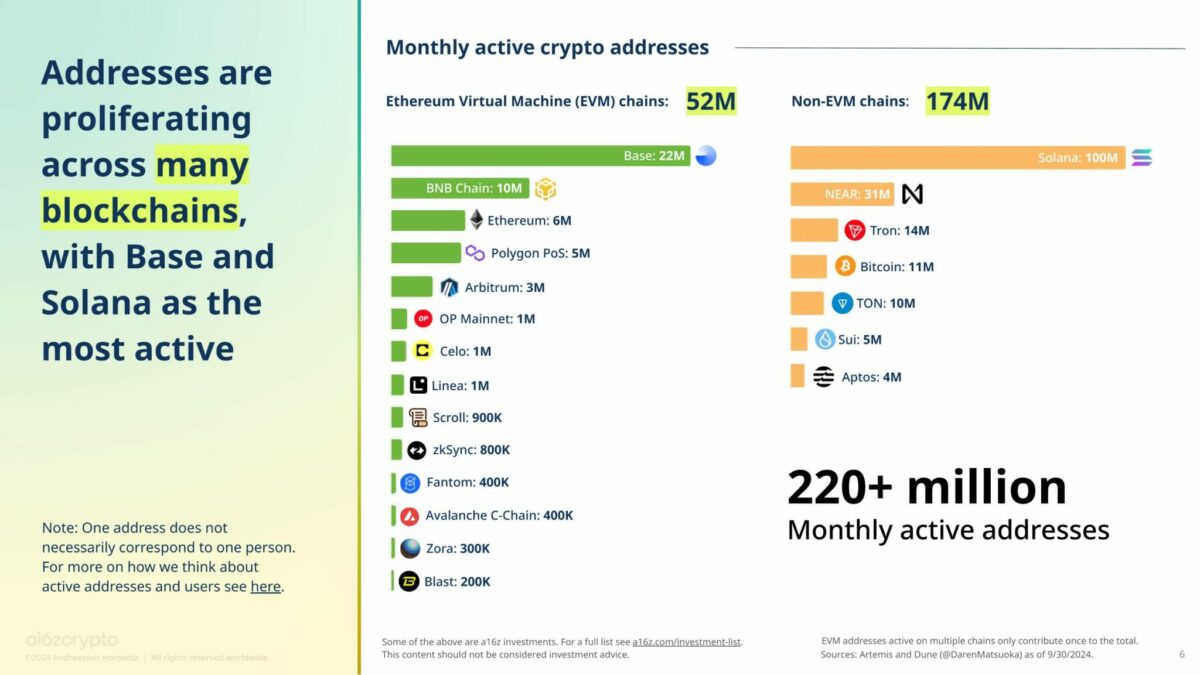

The report estimates that as of September this year, the number of monthly active cryptocurrency addresses has risen to over 220 million, more than doubling since the end of 2023. However, after various filtering methods, a16z estimates that there are 30 million to 60 million active cryptocurrency users globally, accounting for only 5% to 10% of the total 617 million cryptocurrency holders worldwide.

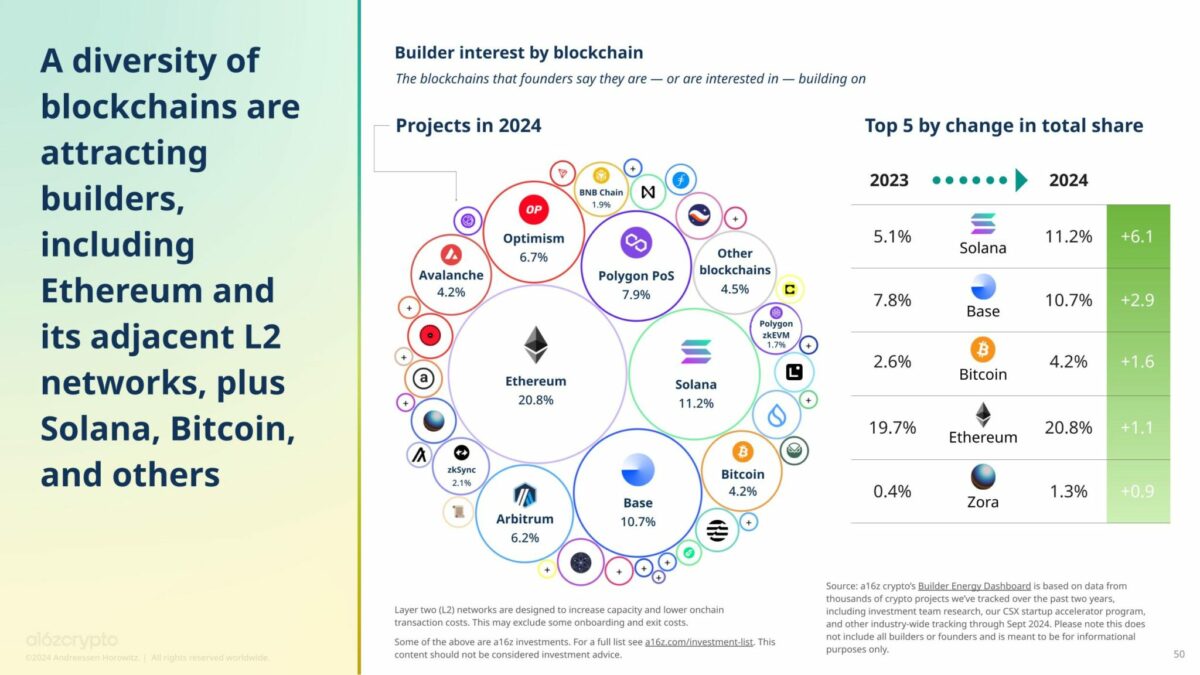

The surge in on-chain activity is primarily driven by Solana, which has reached 100 million monthly active addresses, followed by NEAR (31 million) and Base, the Layer 2 network developed by Coinbase (22 million), which ranks first among EVM (Ethereum Virtual Machine) chains. The report notes that these trends are also reflected in the changing interests of blockchain builders.

According to the statistics, the proportion of founders who have indicated they are building or have interest in building on the Solana chain has increased from 5.1% last year to 11.2% this year, followed by Base (7.8% to 10.7%) and Bitcoin (2.6% to 4.2%). While Ethereum only increased by 1.1%, it still attracts the most developer interest at 20.8%.

Furthermore, the report indicates that the Dencun upgrade implemented by Ethereum in March this year and the introduction of EIP-4844 have helped increase the value denominated in ETH on Layer 2 networks by 36%, while the proportion of fees paid on L2 relative to L1 has decreased by 94%.

"We seem to be at an inflection point in crypto infrastructure, where this infrastructure is rapidly advancing blockchain scaling and unlocking new possibilities for applications and user activity," Daren Matsuoka, a data scientist at a16z crypto, told The Block. "The dramatic drop in user transaction fees has helped stablecoins find product-market fit. We've also seen some very interesting new shifts in Non-Fungible Token (NFT) behavior, trending more towards low-cost social collectibles and less towards high-priced, speculative secondary market activity."