Bit continued to fluctuate above $68,000 over the past weekend, until after 6 am this (21st) morning when it surged again, breaking through the $69,000 mark, reaching a high of $69,546 before the writing, just a step away from the brief breakthrough of $70,000 at the end of July.

But whether Bit is about to set a new all-time high, or is about to fall back to the key resistance area of $70,000, remains to be seen.

Ethereum also reached a high of $2,769 earlier, a new high in nearly two months.

Ethereum also reached a high of $2,769 earlier, a new high in nearly two months.

Bitwise CEO: 7 Factors Pushing Bit to $100,000

Against this backdrop, Bitwise CEO Matt Hougan posted on X over the weekend stating that he expects 7 major factors to drive Bit to the $100,000 target:

We are heading towards six-figure Bit:

. Accelerated inflow of ETF funds;

. The US election is approaching;

. The US's unlimited deficit policy (bipartisan);

. Epic liquidity injection by China;

. Global central bank rate cuts (Fed, ECB);

. The Bit halving effect is starting to emerge;

. Whales are hoarding.

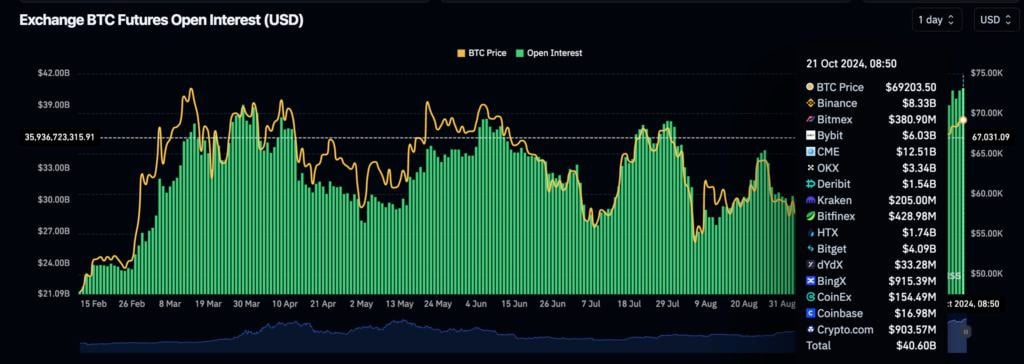

Bit Futures Open Interest Exceeds $40 Billion

However, in the face of Bit's rise, glassnode analyst James Check also reminded investors earlier that the current market sentiment is showing greed, and Bit futures open interest has reached a new high, so a market correction could happen at any time:

High leverage means a greater possibility of violent liquidation, and a price correction could happen at any time.

$13 Million in Liquidations in the Past 24 Hours

In the midst of Bit's rise, according to data from Coinglass, over the past 24 hours, the total amount of crypto liquidations across the network exceeded $13.3 million, with nearly 56,000 people being liquidated.

Although it was on the weekend, the liquidation data is not too severe yet, but the volatility may further amplify going forward.