After reaching a historic high of $73,777 in March this year, Bitcoin has failed to break the $70,000 mark on multiple occasions.

During the Asian trading session yesterday (21st), Bitcoin briefly rose above $69,000, but fell back below $67,000 during the US trading session. As of this morning's writing, Bitcoin has returned above $67,000, currently trading at $67,320.

VX: TTZS6308

Reasons for Bitcoin's Decline: Dual Pressure from Interest Rates and Stock Market

There are two main reasons for Bitcoin's recent pullback. Firstly, Bitcoin has been on a continuous rise from $60,000 over the past 11 days, and from a technical perspective, there was already pressure for a correction. Secondly, interest rates in Western economies have risen sharply, with the US 10-year Treasury yield and the German 10-year bond yield both rising by 10 basis points, putting pressure on risk assets.

Investors are concerned about the potential for a domino effect in the traditional financial markets, and have therefore reduced their exposure to Bitcoin.

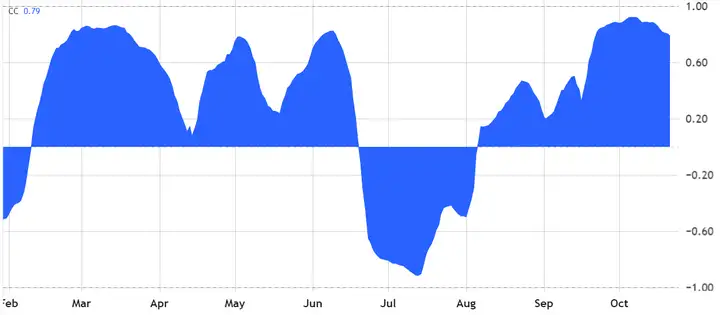

It is worth noting that the 40-day correlation between Bitcoin and the S&P 500 index remains above 80%, indicating that the two markets are still driven by similar factors, which is in stark contrast to the negative or low correlation seen between mid-July and mid-September.

The US 10-year Treasury yield may challenge 5% in the next 6 months, mainly due to rising inflation expectations and concerns over government fiscal spending.

The data showing that over 90% of investors are in profit and the significant increase in open interest contracts are warning signs that a correction may be imminent.

Where can we buy the dips?

Facing the market correction, Bitcoin may form a "higher low" around $66,000, which will be the next investment opportunity.

Bitcoin has performed well recently, but has been affected by the earnings season in the US stock market, making this week a "risk-off week". However, it is also expected that after a brief correction, with the US election approaching, Bitcoin may rebound again and set a new all-time high.

The Bitcoin Derivatives Market Remains Stable

Despite the correction in the spot market, the derivatives market has shown resilience.

Even if Bitcoin tests the $67,000 support level, the annualized premium rate of Bitcoin 2-month futures remains above 9%, indicating that market sentiment remains stable. Under normal market conditions, the premium rate typically falls between 5% and 10%.

In the options market, the 25% delta skew is in a neutral to slightly bullish range, between -7% and +7%, indicating that derivatives traders have not panicked over the decline in Bitcoin over the past 24 hours. If the market expects further downside, this value would typically move towards 0% or higher.

In terms of BTC ETFs, significant capital inflows have been recorded, with BTC ETFs attracting $273.7 million in inflows, mainly from Ark and BlackRock's IBIT ETF, which had an outstanding performance last week, attracting over $1.1 billion in inflows, the strongest since March, ranking third in year-to-date ETF inflows.

Break through $70,000 this week?

The probability of Trump winning the election has recently risen, which has had a positive impact on Bitcoin's price. It is expected that by Friday, Bitcoin will break through the important psychological threshold of $70,000. However, the possibility of setting a new all-time high (ATH) this week is still low.

Geopolitical factors, such as the US election, conflicts in the Middle East, and the evolving global regulation around stablecoins, could all potentially bring significant unexpected market events (black swans) to the cryptocurrency market before the holidays. In November, Bitcoin may surpass its all-time high and steadily grow towards the next important milestone - $100,000.

Whale activity is still increasing, with larger and larger accumulation volumes.

The downtrend line of this major cycle has been broken through and successfully retested, forming a bearish rising wedge pattern on the smaller timeframe, which will be weak in the short term. The pullback will retest the downtrend line of the major cycle and the 0.236 Fibonacci retracement level of this cycle, which is around $66,000 (and even better if it can reach $63,000), forming a larger bullish rising wedge pattern.

From the data perspective:

Spot: The aggregated spot market maintained small-scale selling in the late Sunday evening, but started to surge with increased volume in the early Monday morning, with the rally occurring in two stages;

Futures: The aggregated futures market first saw persistent small-scale selling from late Sunday evening to early Monday morning, still unwinding long positions and shorting during the first stage of the spot rally, but fully switched to buying after the second stage when Bitcoin decisively broke above $69,000;

It seems that the bears initially took short positions based on the idea of a potential false breakout at $69,000, but were then squeezed higher by the strong spot buying pressure. It's worth noting that Coinbase, which had been consistently offloading previously, started to make small but persistent purchases from Sunday, which is a relatively significant change; however, Binance Futures, apart from three volume-backed rallies, spent the rest of the time in small-scale long unwinding and shorting;

Spot buying pressure has started to emerge! Although the volume is not very large, if it can absorb the supply from the futures profit-taking, the price can stabilize above $69,000.