Author: Will Awang

For some, Stripe’s $1.1 billion acquisition of stablecoin API service provider Bridge seems like a surprise. But the fact is that stablecoins are taking the world by storm, with year-on-year growth exceeding 50% and global transaction settlement volume already more than double that of Visa.

As the saying goes, a duck knows when the river water warms in spring. After Stripe, one of the three major payment giants in the United States, tried Pay with Crypto this year, it finally made a big bet. It acquired Bridge.xyz, a stablecoin API company that was only established two years ago, for $1.1 billion, creating the largest acquisition deal in the crypto industry.

This article will start with stablecoins, look at Bridge’s business logic, and finally look at Stripe’s acquisition logic.

1. The rise of stablecoins

The State of Crypto Report 2024 recently released by A16z Crypto has clearly stated that stablecoins have become one of the most obvious "killer applications" in the Web3 field. Thanks to the popularity of smartphones and the implementation of blockchain technology, stablecoins may become the greatest financial empowerment movement in human history.

Stablecoins make value transfer simple, with quarterly transactions more than double Visa’s $3.9 trillion, and trillions of dollars of assets settled annually, fully demonstrating their practicality. In addition, measured by daily active addresses, stablecoins account for nearly a third of daily cryptocurrency usage, at 32%, second only to decentralized finance (DeFi), at 34%.

In addition, according to Visa's stablecoin report, the total supply of stablecoins is about $170 billion. They settle trillions of dollars worth of assets every year. About 20 million addresses on the chain conduct stablecoin transactions every month. More than 120 million addresses on the chain hold non-zero stablecoin balances. These figures all show that stablecoins are a currency that runs parallel to traditional financial infrastructure - it just started from close to zero five years ago.

Here are some crazy stablecoin statistics:

- Stablecoins are now the sixth-largest purchaser of U.S. Treasuries;

- 30% of cross-border remittances are conducted via stablecoins;

- Major companies such as Visa, PayPal, Square, and Mastercard all have stablecoin projects;

- SWIFT and some sovereign states are exploring the utility of stablecoin payments.

- The use of stablecoins for non-crypto purposes is gaining prominence, such as remittances, cross-border payments, payroll, trade settlements, and merchant settlements.

2. What is Bridge

Founded by entrepreneurs Sean Yu and Zach Abrams, Bridge is a stablecoin API engine that provides software tools that help companies accept stablecoin payments. The two founders previously sold Venmo competitor Evenly to Block in 2013; Abrams is also a former senior employee of Coinbase.

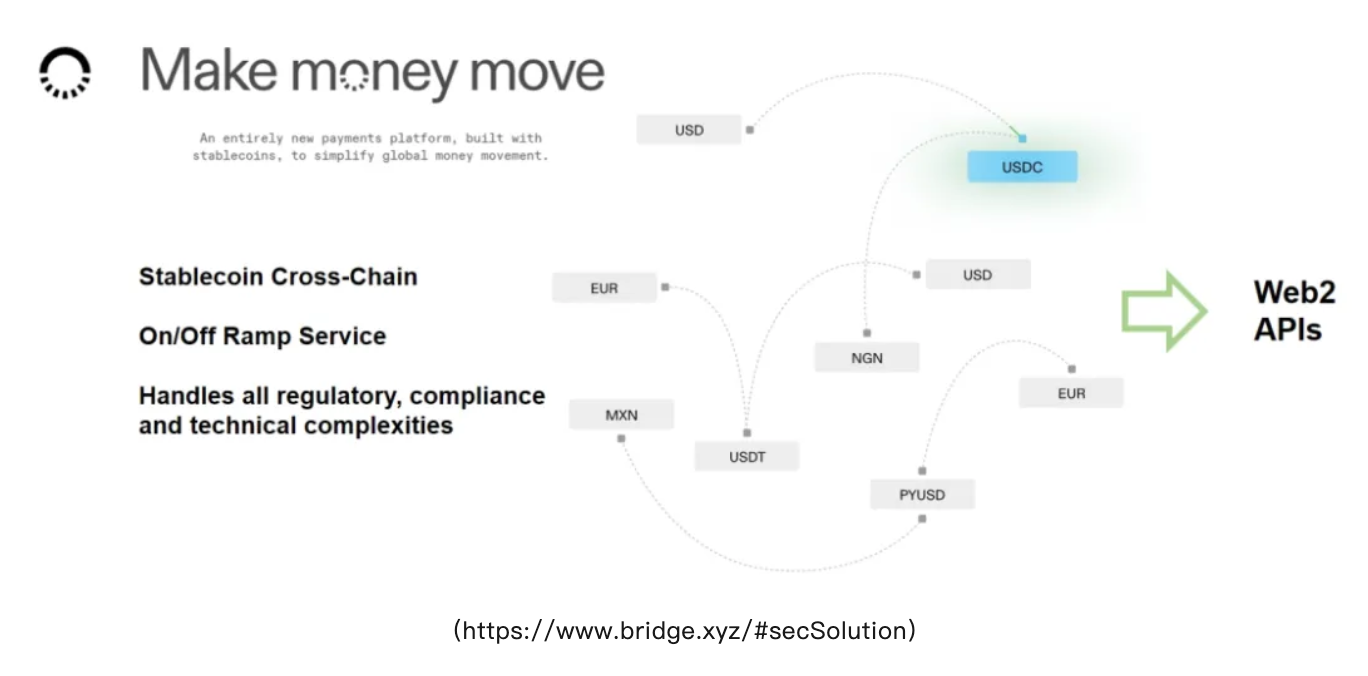

Bridge's Orchestration API is an API that integrates stablecoin payments into Web2 companies' existing businesses. Bridge handles all compliance, regulatory and technical complexities.

Bridge's Issuance API can help users issue their own stablecoins and provide an investment option of 5% of US Treasury bonds to improve capital utilization.

This set of APIs, combined with Bridge's own 1) stablecoin cross-chain transactions, 2) fiat currency/cryptocurrency deposit and withdrawal acceptance, and 3) virtual bank accounts (Virtual Bank Accounts) provided by Leed Bank, can help Web2 users use stablecoin payments more conveniently, and the user experience is smoother and more seamless.

Bridge said that using its API, funds can be transferred globally in minutes, stablecoin payments can be sent seamlessly, local fiat currencies can be converted into stablecoins, and US dollar and euro accounts can be provided to consumers and businesses around the world, allowing users to save and spend in US dollars and euros.

This is not a big innovation in essence, but the outstanding thing is that it makes the interaction process of Bridge's products more convenient for Web2 users.

According to the Foresight News article "What is Bridge, which Stripe spent $1.1 billion to acquire?" Bridge has attracted many customers, including SpaceX. According to Fortune magazine, SpaceX uses Bridge to collect payments in different currencies in different jurisdictions and transfer them to its global treasury through stablecoins.

Bridge has also established partnerships with crypto companies such as blockchain network Stellar and Bitcoin payment application Strike to provide infrastructure for their own stablecoin payment functions. In addition, Coinbase has also adopted Bridge's services to support transfers between Tether on Tron and USDC on Base. According to statistics, Bridge has processed more than $5 billion in annual payments.

According to Forbes, Bridge had previously raised $58 million from investors, including $40 million in Series A funding, when the company was valued at $200 million. Investors included Sequoia Capital, Ribbit Capital, Index Ventures, Haun Ventures, and 1 confirmation, etc. This time, the $1.1 billion acquisition price represents a 5.5x premium, the largest acquisition in Stripe's history, and the largest acquisition deal in the crypto industry to date.

The $1.1 billion acquisition price isn’t crazy, compared to the multi-billion dollar valuations of crypto protocols whose only exit liquidity is dumping useless governance tokens into the market.

3. Cooperation between Stripe and Bridge

The cooperation between Stripe and Bridge is essentially a continuation of the story of the rise of stablecoins. The integration of the two can further help the implementation of Stripe Pay With Crypto strategy. Stripe will be able to handle stablecoins more easily, making transactions more transparent and secure.

Let’s take a look at Bridge’s latest official announcement:

“Together, Bridge and Stripe will accelerate the adoption and utility of tokenized dollars, making it easier for everyone around the world to move, store, and spend money.

When we launched our API 18 months ago, the world was very different than it is now. Many were questioning the usefulness of the entire digital asset space, and stablecoins were affected. Regulators, banks, and fintechs were unable or unwilling to deeply engage with this new medium of exchange.

It is also since then that some of the largest global financial institutions, such as Visa and SWIFT, have begun to natively support stablecoins. Policymakers around the world are working to provide clarity and support for stablecoin infrastructure, recognizing the strategic importance of this technology to the current financial system.

Behind the scenes, the adoption and use of stablecoins is accelerating rapidly.

Soon after launch, several cross-border payment companies integrated our API, demonstrating that stablecoins can be used to make money move faster and cheaper around the world. We then worked with government agencies to distribute aid payments to support thousands of frontline workers in Latin America. Since then, we have built Virtual Accounts, enabling fintech companies like Dolar App and Chipper Cash to enable consumers and businesses around the world to hold and spend dollars.

With each use case, we have proven to ourselves and to those outside the company that stablecoins can become core global money flow infrastructure and that stablecoins represent an entirely new payment platform. This is not because consumers or businesses inherently want "cryptocurrency," but because stablecoins solve key financial problems. They make money easier to move, more economical to hold, and cheaper to remit.

Stripe and Bridge share a common vision that our increasingly global world needs better money. We need money that can flow across borders; that can be freely used by anyone in any country; and that can be sent at virtually no cost.

And, crucially, we all agree that major changes in financial services don’t happen overnight. Change takes years of evolution. Constant improvement of products and platforms, and ongoing trust with customers, regulators and partners.”

4. Stripe's Crypto Layout

Previously, Stripe announced on October 10 that it would reconnect US businesses to the encrypted payment gateway (Pay With Crypto), enabling US businesses to:

1. Accept USDC and USDP (Crypto Payin) from over 150 countries through Ethereum, Solana and Polygon;

2. Enterprises/merchants can receive US dollars (Crypto payouts);

3. Integration applies to checkout, element payment components, payment intent APIs, and will soon be applicable to the company's subscription function.

Stripe became the first major payments company to offer Bitcoin payments in 2014. However, the feature was phased out in 2018 as long confirmation times, high fees, and price volatility led to a drop in demand.

However, this is not the first time Stripe has integrated crypto services in recent months. In July, Stripe’s EU company allowed users to purchase cryptocurrencies such as BTC, ETH, and SOL.

In June this year, Stripe also signed a cooperation agreement with Coinbase. Stripe incorporated Coinbase's Base Layer 2 into its cryptocurrency payment products. At the same time, Coinbase allowed users to use Stripe's fiat-to-cryptocurrency onramp so that users can purchase cryptocurrencies in Coinbase wallets (Stripe Fiat-to-Crypto Onramp).

The essence of Stripe's businesses (whether acquiring or transferring money) is: 1) On/Off Ramp; 2) Cross-chain settlement of Crypto/stablecoins.

Therefore, regarding the acquisition of Bridge,

- Ability to quickly meet the functional requirements of this business;

- Better serve existing customers of the Stripe system;

- Expanding beyond the Stripe system. Bridge’s star client is the US government. Yes, you read that right. Uncle Sam has also joined the stablecoin party.

5. Response to Paypal PYUSD

Last October, when I was writing the "Ten Thousand Word Research Report on Web3 Payment: The all-out attack by industry giants is expected to change the existing crypto market landscape", I was still considering the specific utility and adoption of stablecoin payments. Now, several payment giants have already entered the market.

After Paypal first issued its stablecoin PYUSD on Ethereum in August last year, it launched PYUSD on Solana in June this year. In addition to Paypal's own system, it is also actively promoting the developer ecosystem of PYUSD.

According to DeFilama data, in August this year, PYUSD on Solana accounted for 64% of the market share, while Ethereum accounted for only 36%. PYUSD's overall Market Cap reached 1 billion US dollars in August.

Payapl previously published a document clarifying the evolution of stablecoin payments towards Mass Adoption:

- Awareness through Introduction

- Utility through Integration

- Ubiquity through Assimilation

Obviously, we are currently in the second stage and are moving towards the third stage.

Another payment giant, Block (Square) led by Jack Dorsy is also a loyal believer in Bitcoin. It holds 8,027 bitcoins and has many layouts in the Crypto field.

6. Final Thoughts

As Anna @gizmothegizzer said, in the land of the blind, the one-eyed man is the king. In crypto, the company with the most obscure API and the best connections may be the emperor. My first reaction is Tether, and Bridge may be one of them.

We are just getting started.

Future M&A transactions will be even crazier.