Chainlink, a provider of blockchain connectivity solutions, has launched its latest innovation, CCIP Private Transactions.

This feature is based on the Chainlink Cross-Chain Interoperability Protocol (CCIP). It facilitates financial institutions' interaction with blockchain technology without compromising regulatory compliance.

Chainlink Solves Blockchain's Privacy and Regulatory Issues

This new solution enhances blockchain interoperability while maintaining data integrity and confidentiality. It acts as a Chainlink blockchain privacy manager, enabling privacy features and addressing long-standing regulatory and confidentiality issues that have hindered institutional blockchain adoption.

The lack of sufficient privacy and security protocols for cross-chain transactions has been a major barrier for financial institutions to adopt blockchain. This is because regulations require financial institutions to maintain strict data privacy standards. Most blockchain platforms have struggled to meet these requirements.

However, Chainlink's new CCIP Private Transactions feature allows institutions to conduct inter-blockchain transactions while maintaining strict data privacy controls. The blockchain privacy manager enables financial institutions to perform private chain-to-chain transactions, ensuring that only the necessary data is disclosed.

Further reading: Explaining Real-World Asset (RWA) Backed Tokens

This functionality extends to transactions from private chains to public chains, providing a privacy layer that meets both operational and regulatory requirements.

"We expect increased institutional adoption of blockchain, CCIP, and Chainlink standards overall as private cross-chain transactions become possible," said Sergey Nazarov, co-founder of Chainlink, in a press release shared with BeInCrypto.

It is worth noting that the Australia and New Zealand Banking Group (ANZ) is one of the major financial institutions piloting this feature. ANZ will use it for cross-chain settlement of tokenized real-world assets (RWAs) under the Monetary Authority of Singapore's (MAS) Project Guardian initiative.

This collaboration highlights the growing interest of traditional finance (TradFi) institutions in leveraging blockchain for asset management and payments, particularly as they seek to harness the benefits of decentralized finance (DeFi).

Chainlink's CCIP Functionality Gaining Traction in Institutions

As reported by BeInCrypto, Chainlink has been working to enhance blockchain interoperability for institutions. The Project Guardian collaboration with ANZ is just one example of how the company enables financial institutions to leverage the power of blockchain without sacrificing regulation and security. The pilot program involving tokenized RWAs demonstrates the value of CCIP in facilitating secure cross-chain settlements.

In addition to ANZ, other organizations have already started integrating Chainlink CCIP into their operations. For instance, Mountain Protocol and Ronin Validators have recently adopted Chainlink CCIP to strengthen their respective blockchain ecosystems and facilitate secure cross-chain communication.

Similarly, IDA Finance integrated Chainlink CCIP to simplify asset management, and Swiss company Taurus partnered with Chainlink to enhance its tokenization services. These partnerships demonstrate Chainlink's recognition for its ability to address privacy and interoperability issues across various domains.

Further reading: What is Tokenization in Blockchain?

Additionally, 21.co's adoption of Chainlink's Proof of Reserve and the recent Bedrock exploit case highlight the broader scope of Chainlink solutions in improving the security and transparency of blockchain transactions.

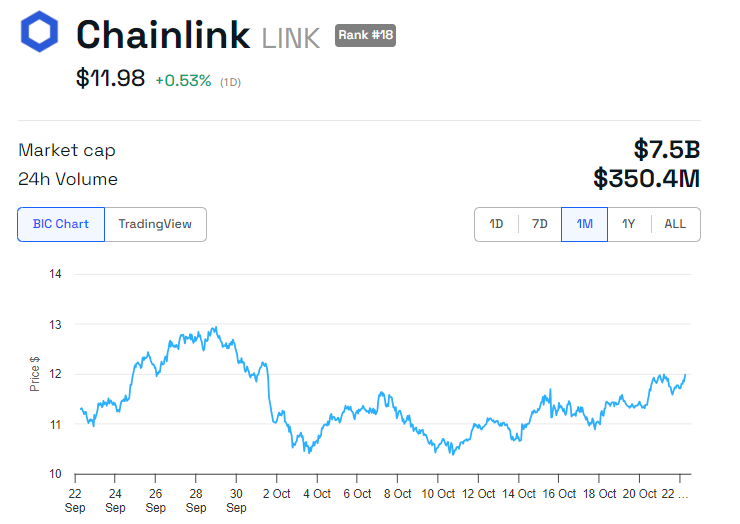

Despite the advancements in CCIP, the community often expresses disappointment with the lackluster performance of the LINK token. According to BeInCrypto data, Chainlink's LINK token has risen 0.53% on this news and is currently trading at $11.98.

Meanwhile, as Chainlink CCIP gains increasing attention, its position as a leading decentralized oracle network is being challenged. Specifically, it faces strong competition from blockchain oracles such as API3, Band Protocol, Nest Protocol, Pyth Labs, and GOracle.

Like Chainlink, these providers offer reliable data feeds to smart contracts across various blockchain platforms. They contribute to the oracle space by offering unique strengths, such as cross-chain capabilities, dAPIs, decentralized price oracles, and interoperable solutions.