According to observers, it appears that institutions are shifting from traditional cash and hedging arbitrage to pure directional trading.

- CF Benchmarks explains that the mismatch between spot ETF inflows and the surge in CME futures open interest indicates a tendency towards bullish directional bets.

- Bitwise also states that the rise in futures premium also indicates this.

If you are disappointed that Bitcoin (BTC) has not been able to break through $70,000, the following insights may cheer you up - the strong demand for spot ETFs recently listed in the US, which are generally seen as representing institutional activity, is mainly showing bullish directional bets, rather than arbitrage trades.

According to data tracking website SoSoValue, since October 14, the 11 spot Bitcoin ETFs have seen a cumulative net inflow of nearly $2.5 billion, the highest level since March. Meanwhile, data shows that the notional open interest value (or US dollar value) of active Bitcoin futures on the Chicago Mercantile Exchange (CME) has surged to a record over $12 billion, according to VeloData.

Experienced investors may view the synchronous rise of these two variables as a sign of institutions continuing to prefer cash and hedging arbitrage, a non-directional strategy aimed at profiting from the spread between spot and futures prices. This appears to have been the case at the beginning of the year, when institutions set up so-called basis trades, involving longing ETFs and shorting CME futures, keeping Bitcoin largely below $70,000.

However, Sui Chung, CEO of CF Benchmarks crypto index provider, says the latest ETF inflows indicate a tendency towards bullish trading through spot ETFs.

Chung told CoinDesk in an interview: "When spot ETF inflows and the growth in CME open interest correspond, the increase in basis trades is usually quite evident. But in this case, with $2.5 billion in spot ETF inflows and only a $1.6 billion increase in CME Bitcoin futures contracts, there is a clear mismatch."

He added: "This tells us that only a portion (we estimate around 40%) of the ETF inflows are for basis trades, with the remaining 60% or $1.4 billion being for directional holdings." Most Bitcoin spot ETFs reference the CF Benchmarks Bitcoin Reference Rate - New York (BRRNY).

Futures Premium Surges

The rising futures premium also undermines any view that ETF inflows are driven by cash and hedging trades. Widespread use of this strategy would typically "arbitrage away" the premium, limiting the price difference.

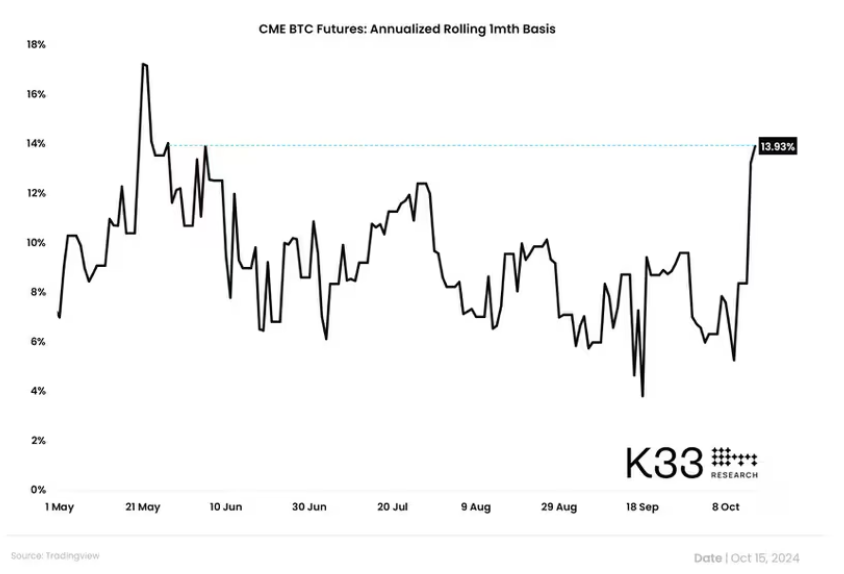

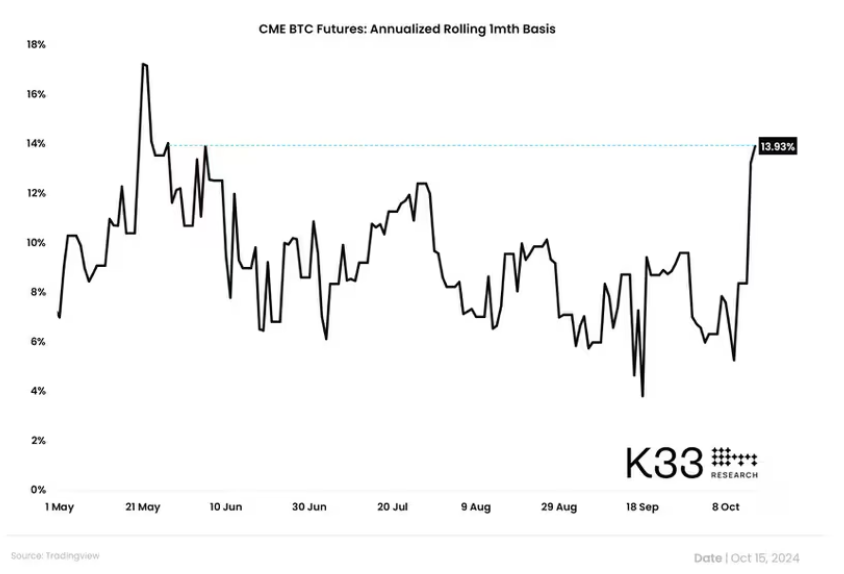

According to data from K33 Research, the annualized Bitcoin futures premium (basis) on CME rose from around 6% last week to 13.9%, the highest level since May. The funding rates in the perpetual contract market have also risen, suggesting a bullish long bias.

Bitwise's European research head André Dragosch told CoinDesk: "The Bitcoin basis rate (futures premium) has been rising, suggesting a long bias, which often makes the futures curve steeper and increases the forward market (contango). This is also reflected in the perpetual funding rates, which have risen to their highest level since July 2024."

Dragosch added: "Market makers like Jane Street tend to increase their Bitcoin short positions when Bitcoin ETF inventories increase; the latest evidence suggests a net increase in long positions through futures and perpetual contracts."

BTC CME Futures: Annual Rolling 1-Month Basis/Premium. (K33 Research)

BTC CME Futures: Annual Rolling 1-Month Basis/Premium. (K33 Research)

In other words, some market participants appear to be longing ETFs while shorting CME futures. According to data tracked by Tradingster, in the week ending October 15, non-commercial traders or large speculators held a net short position of 1,872 contracts, the highest level since March.

Dragosch pointed out: "The latest data on non-commercial net positions in CME Bitcoin futures suggests futures traders are net short on CME. However, looking at data across various futures exchanges paints the opposite picture."

BTC CME Futures: Annual Rolling 1-Month Basis/Premium. (K33 Research)

In other words, some market participants appear to be longing ETFs while shorting CME futures. According to data tracked by Tradingster, in the week ending October 15, non-commercial traders or large speculators held a net short position of 1,872 contracts, the highest level since March.

Dragosch pointed out: "The latest data on non-commercial net positions in CME Bitcoin futures suggests futures traders are net short on CME. However, looking at data across various futures exchanges paints the opposite picture."

BTC CME Futures: Annual Rolling 1-Month Basis/Premium. (K33 Research)

In other words, some market participants appear to be longing ETFs while shorting CME futures. According to data tracked by Tradingster, in the week ending October 15, non-commercial traders or large speculators held a net short position of 1,872 contracts, the highest level since March.

Dragosch pointed out: "The latest data on non-commercial net positions in CME Bitcoin futures suggests futures traders are net short on CME. However, looking at data across various futures exchanges paints the opposite picture."