The SUI price has risen 27.82% over the past 30 days, driven by a notable change in the Total Value Locked (TVL). After the TVL and price both surged, SUI appears to be entering a correction stage. This stabilization suggests a temporary pause in the upward momentum and could indicate market uncertainty.

The future direction may depend on whether SUI's TVL shows new growth or stagnation, and potential adjustments may occur.

SUI TVL: Correction Stage After Surge

The Total Value Locked (TVL) of SUI experienced an impressive rise, increasing from $308 million on August 4 to $1.096 billion on October 14, a remarkable 255% growth in around two months, which is particularly notable for a significant protocol like SUI.

This growth was accompanied by a substantial increase in SUI's own price, rising from $0.46 to $2.36, representing an incredible 391% growth over the same period.

However, after this surge, SUI's TVL has stabilized around the $1 billion mark, maintaining without further increases.

This stagnation suggests that SUI may be entering a correction stage or even preparing for an adjustment after the rapid growth in both TVL and price. The sharp rise has cooled down.

Read more: Top 10 Best Sui (SUI) Wallets in 2024 Guide

SUI ADX: Current Downtrend Not Yet Strong

SUI's ADX currently stands at 16.82, indicating the strength of the current trend. A value below 20 suggests the trend is still weak, meaning the market's directionality is limited.

ADX is an important indicator that helps measure the momentum of a trend, applicable to both upward and downward trends.

ADX (Average Directional Index) values are generally used to determine the strength of a trend, with readings between 20 and 40 indicating a medium-strength trend, and above 40 indicating a very strong trend. Just two days ago, SUI's ADX was 9, and it has shown a noticeable increase recently.

As SUI enters a downtrend, a continued rise in ADX could suggest strengthening downward momentum, which could lead to a significant correction in the coming days.

SUI Price Prediction: Will SUI Form a Death Cross Soon?

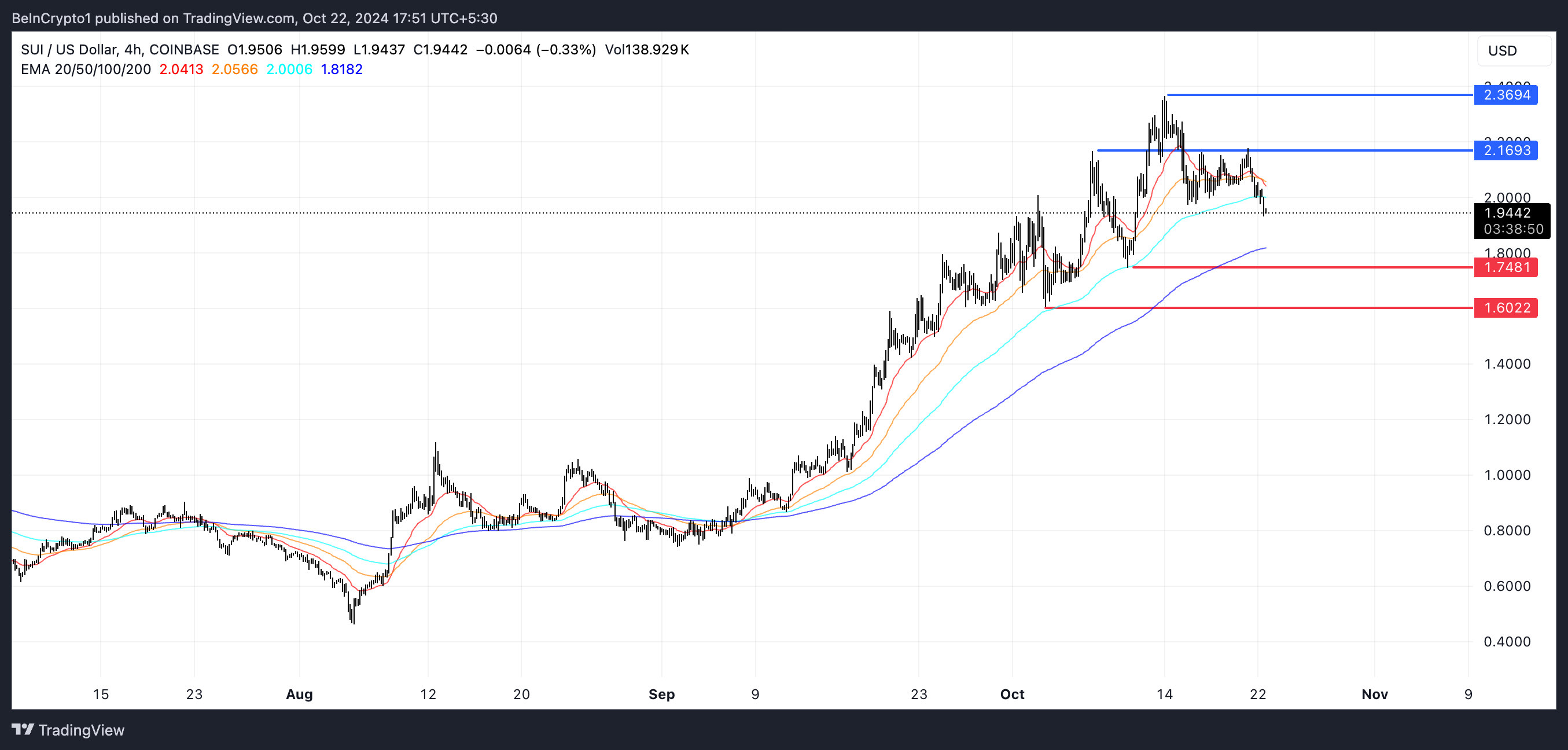

SUI's moving average (EMA) lines currently indicate that the short-term average is in a downtrend and may soon cross below the long-term average, which is often referred to as a "death cross." This could suggest that the downward momentum is gaining strength.

Such a crossover can signal the potential start of a downtrend, as the short-term price outlook weakens compared to the long-term outlook.

Read more: Everything You Need to Know About the Sui Blockchain

If this death cross occurs, SUI has support levels at $1.74 and $1.60, indicating a potential correction of up to 17%. However, if SUI's Total Value Locked (TVL) starts growing again and triggers a price increase, the price could test the $2.16 resistance level. If that level is breached, SUI could also test $2.36, representing a possible 21% price increase.