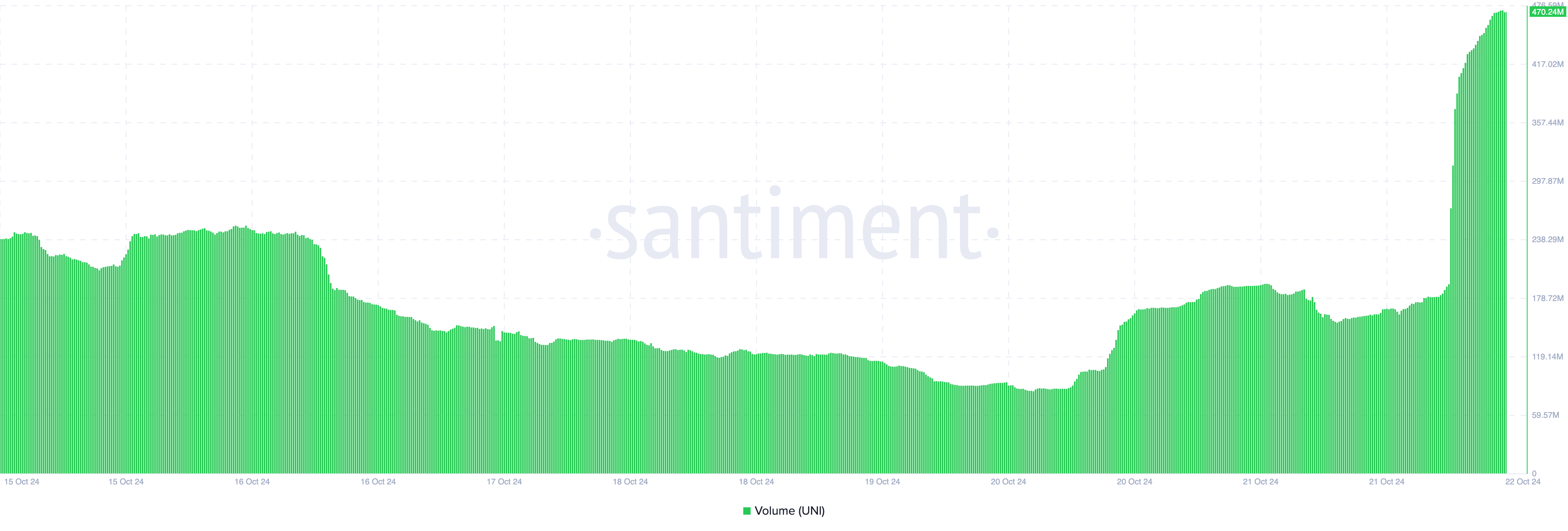

The trading volume of Uniswap (UNI) has increased by 150% in the last 24 hours, surpassing $400 million for the first time in nearly 10 days. This development occurred after the Korean exchange Upbit listed new trading pairs for the altcoin.

Not only the trading volume, but the price of UNI also reacted to this development, crossing $8. Here's how all of this happened and the next outlook for the token.

Uniswap, Surging Trading Volume and Network Activity

Upbit had previously listed Uniswap (UNI) on its spot market with only a BTC trading pair. However, today, the exchange announced that UNI has been listed with additional trading pairs including the Korean Won (KRW) and USDT stablecoin.

Before this announcement, Uniswap's trading volume was less than $200 million, and the price was holding at $7.40. After the news broke, the price spiked to $8.33, and the trading volume soared to $470 million.

This sharp rise emphasizes the increasing interest in UNI in the Asian market. Although it is not entirely unexpected, as similar Upbit listings have triggered similar reactions in the past. For instance, MEW recorded a new all-time high after its listing, and Injective (INJ) surged 10% after its Upbit listing last week.

Read more: How to Buy Uniswap (UNI) and Everything You Need to Know

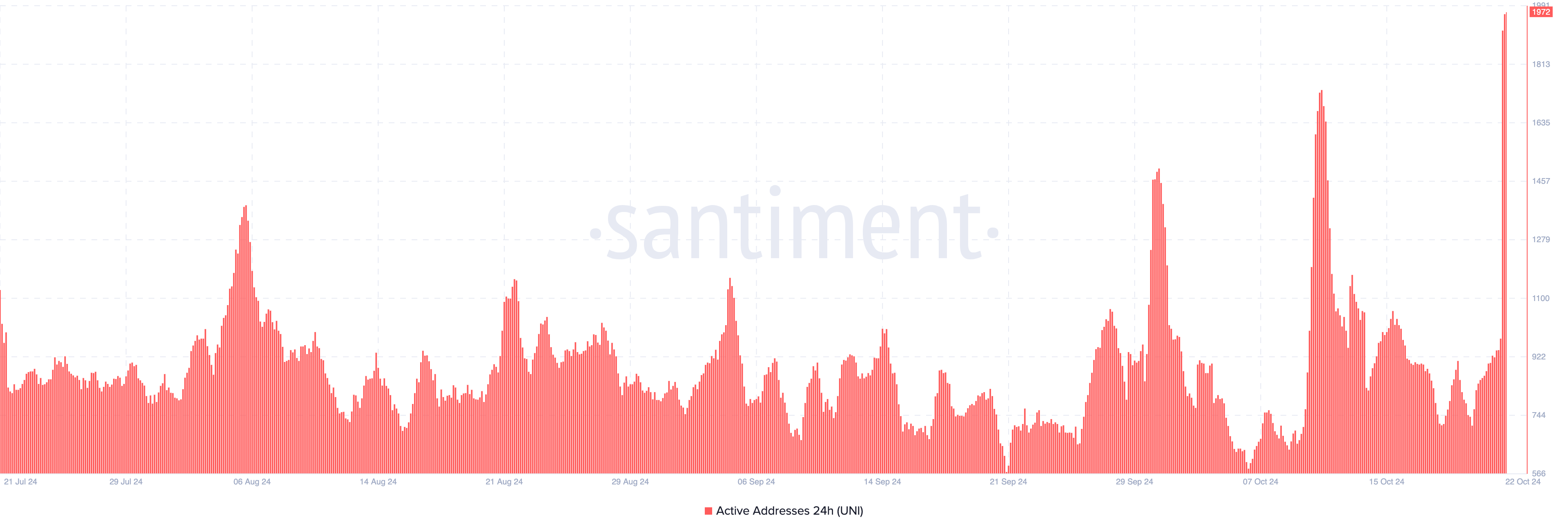

Along with the surge in trading volume, the number of active addresses on the Uniswap protocol has also increased. Active addresses measure the number of users successfully completing transactions on the blockchain. The increase in this metric indicates rising user engagement, which can further drive the price upward.

Conversely, a decrease in active addresses would signal lower user interaction and could potentially lead to notable price declines if sustained. Considering the current increase in network activity, if this trend continues, the price of UNI is likely to keep rising.

UNI Price Prediction: The Token Aims for Higher Targets

According to the daily chart, UNI's $8 surge has broken out of a descending triangle. A descending triangle is formed when the cryptocurrency price makes lower highs while forming a horizontal support line.

Falling below the support line could lead to further price declines. However, since UNI's price has broken out of the pattern, the altcoin can now move higher. If the token remains above the technical pattern, the price can rise to $9.04. In a very bullish case, it can even reach $11.51.

Read more: Uniswap (UNI) Price Prediction 2023/2025/2030

However, if Uniswap's trading volume decreases, this prediction could be invalidated. In such a scenario, the altcoin's value could drop to $5.62.