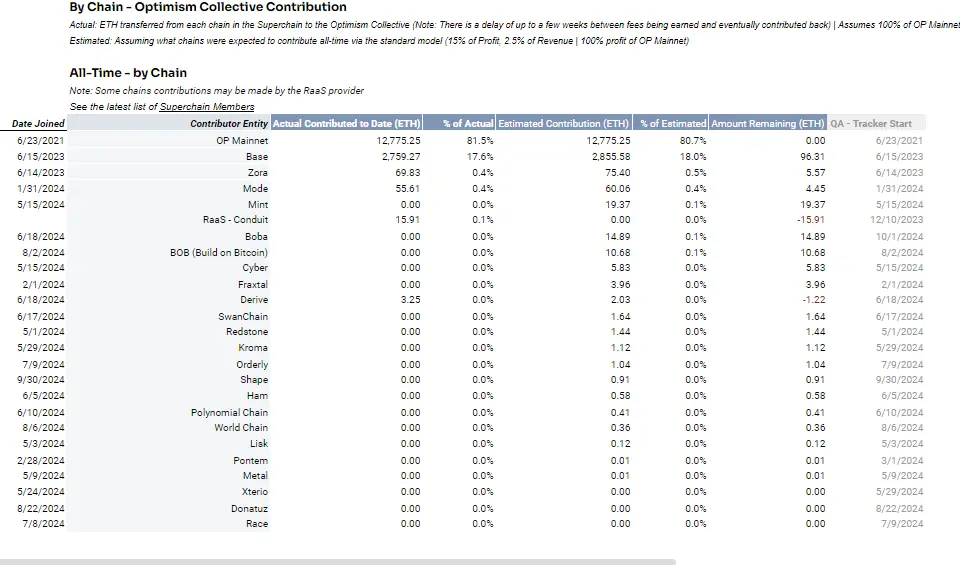

In terms of revenue, according to data compiled by Superchain, as of October 17, the Optimism Collective has generated revenue of 15,700ETH (worth approximately $40.82 million), of which the OP Mainnet has contributed the most revenue, accounting for 12,775.25ETH (approximately $33.21 million), or 81.5% of the total revenue; followed by the Base network, which contributed 2,759.27ETH (approximately $7.17 million), accounting for 17.6%, and then networks such as Zora, Mode, and the RaaS platform Conduit.

With the rise of Base and the growth in transaction volume on OP chain networks such as Mint and Orderly, the revenue share contributed to the Optimism Collective has also been growing. In the latest 244.9ETH revenue earned by the Optimism Collective in October, the Base chain alone contributed 44.8% of the revenue, while the other chains collectively contributed 13.8% of the revenue.

Optimismthe winner in Layer2?

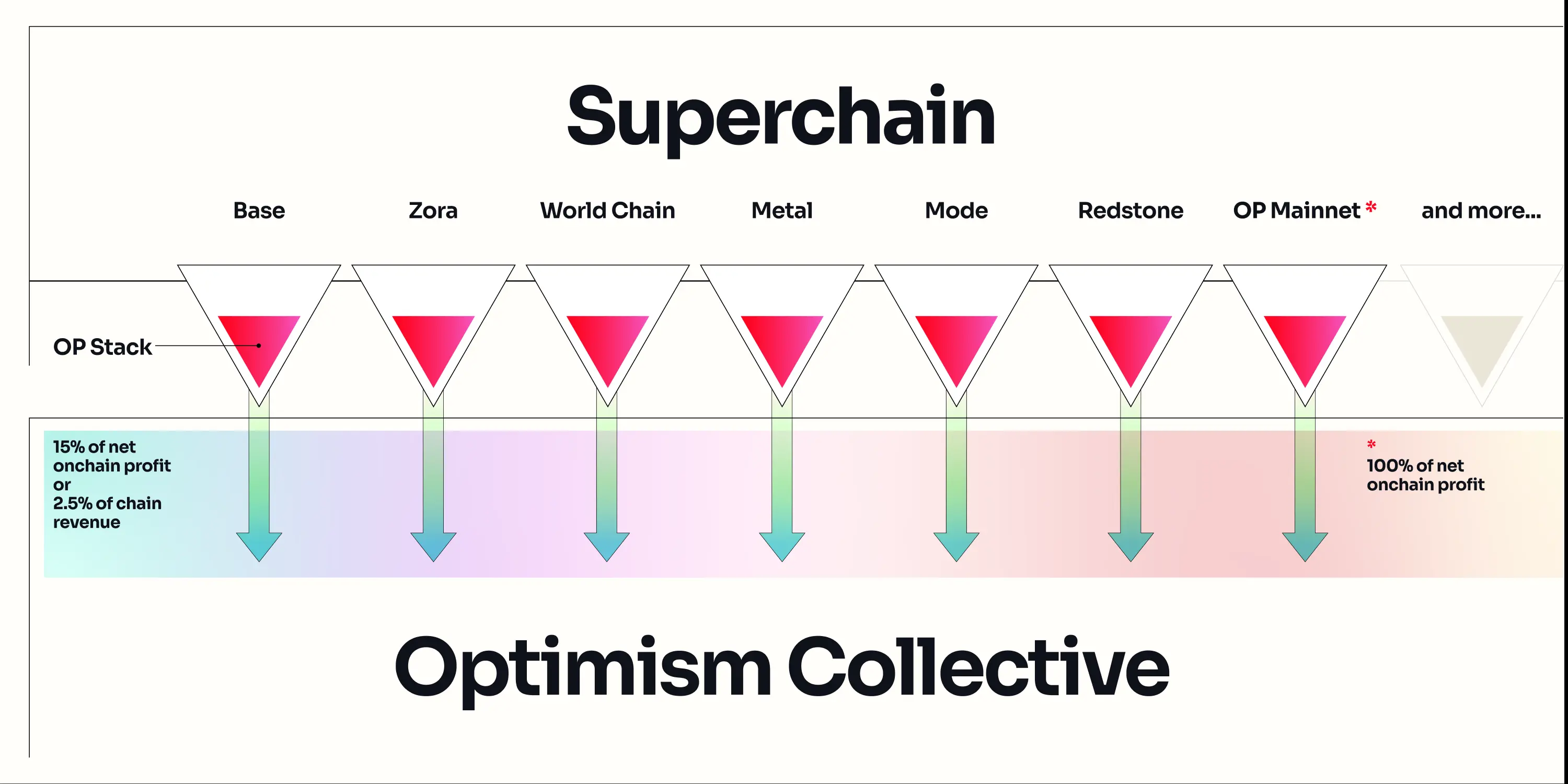

Through a standardized and open-source OP Stack toolkit, Optimism has successfully built the Superchain ecosystem, not only providing developers with efficient underlying tools and technical support for accessing Ethereum, but also unlocking a variety of complex application scenarios including gaming and social networking. This open and vibrant ecosystem has attracted a large number of developers and projects to join, forming a strong network effect. As more projects are built on the OP Stack, the ecosystem has entered a virtuous cycle, and the revenue generated by the Superchain ecosystem has also been growing rapidly, with significant economies of scale.

Moreover, through Superchain, Optimism has built its own unique business model, currently with two clear revenue streams: one is the direct on-chain revenue from its Layer2 mainnet OP Mainnet; the other is the revenue sharing from the Superchain ecosystem built on the OP chain.

These two paths together constitute Optimism's unique competitiveness in the L2 market, compared to competitors such as Arbitrum, StarkNet, and zkSync, forming its own unique business model, and its revenue performance is also more distinctive.

According to data from the Token Terminal platform, in the past six months, in the Layer2 market, Base has ranked first with a revenue of $23.51 million, while Optimism's OP Mainnet has ranked second with a revenue of $10.24 million. Although Arbitrum has long occupied the top position in the Layer2 market in terms of TVL, its revenue is only $9.49 million, less than OP Mainnet. The revenues of zkSync and StarkNet are more limited, at $1.84 million and $0.17 million respectively.

In addition, in addition to the revenue from the OP Mainnet, Optimism will also own 2.5% of the revenue or 15% of the profits from the Base chain. If calculated based on 2.5% of the revenue, i.e., Optimism's revenue: OP Mainnet + 2.5% of Base chain revenue, Optimism will need to receive an additional $587,000 in the past six months.

And in the future, every transaction occurring on the OP Stack chains will ultimately contribute a portion to Optimism's pocket, continuously generating revenue for it. With the continuous addition of heavyweight projects such as Uniswap, the revenue from the OP Stack is expected to continue to grow.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and are not related to the position of Web3Caff. The information in the articles is for reference only and does not constitute any investment advice or offer, and please comply with the relevant laws and regulations of your country or region.

Welcome to join the official Web3Caff community: X(Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram discussion group