Author: YB

Compiled by: Luffy, Foresight News

In May 2021, Byrne Hobart wrote an excellent article titled "Stripe and the Solid State Economy", in which he expounded on the view that:

Automobiles, Excel spreadsheets, vacuum tube computers, attempts to win real-time strategy games, and the implementation of terrible recursive programs, if they fail, it is almost always for the same reason: they have a large number of moving parts, and the more moving parts there are, the more likely they are to malfunction.

He pointed out that Stripe is a valuable company because it seamlessly combines the various business functions required for online payments.

However, the problem is that Stripe's sphere of influence is limited to e-commerce, and it is constrained by the institutional framework of the global financial system.

It turns out that there is not really 'one' global payment system. Some countries have multiple payment systems, some of which overlap in certain aspects, and participation in these systems requires government approval, bank permission, technical development, and ongoing compliance and maintenance costs.

In other words, the difficulty of global payments is due to the lack of strong network effects between currencies. Those in the cryptocurrency field know that this is the main value pillar of DeFi.

So why do I bring this up? Because now Twitter is flooded with the joy of Stripe's $1.1 billion acquisition of Bridge.

Celebration is understandable... this is a victory for cryptocurrency! The Collison brothers' bet on the crypto industry sends a signal to other participants in the fintech industry.

This is the largest acquisition in the history of cryptocurrency. Following closely are Coinbase (acquired Bison Trails for $475 million in 2021) and Binance (acquired Coinmarketcap for $400 million in 2020).

What caught me off guard about this news is not the acquisition itself, but that I was completely unaware of the scale of the stablecoin ecosystem, which far exceeds the usual suspects like Circle (USDC) and Bitfinex (USDT).

In most cases, Bridge is not even on people's radar. Over the past 2.5 years, they have been quietly exploring the stablecoin space, trying to find where they can play their best role.

Bridge's co-founders Zach and Sean eventually found Stablecoin Orchestration as the answer, which is just a fancy way of saying their API suite can easily convert between stablecoins and fiat currencies, and vice versa.

So why is this acquisition a natural fit for Stripe? Because Bridge enables them to shed excess moving parts and integrate their payment flow.

But what does this mean? What impact does this acquisition have on other traditional finance and stablecoin startups?

Traditional Finance Companies Enter the Fray

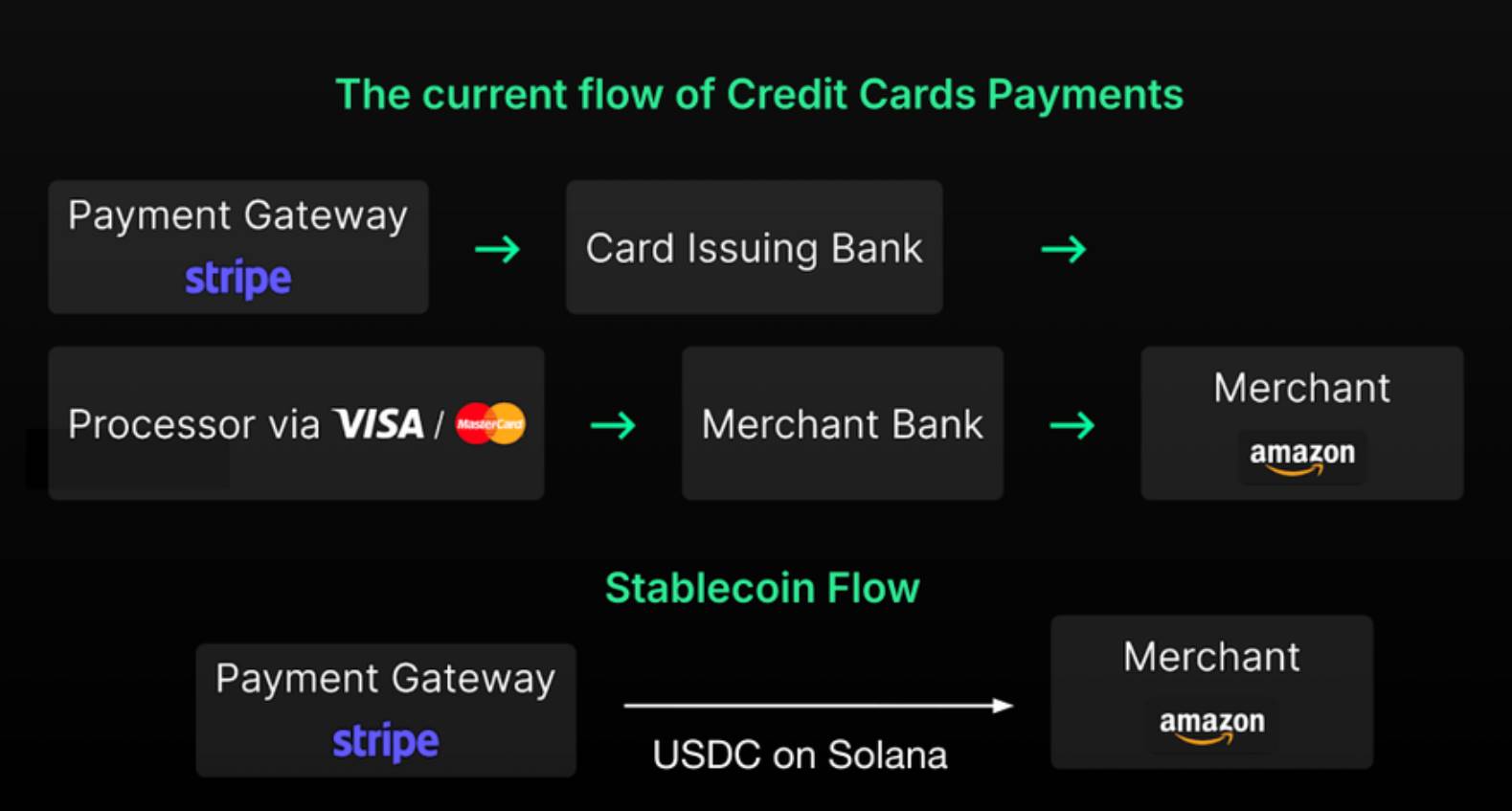

When using Stripe, most people are unaware that the product is processing flows between various stakeholders: banks, payment networks, and SWIFT for global transfers.

But as Byrne mentioned, Stripe only makes online payments viable.

Stripe is an interesting value-creating company that provides services to make certain processes run the way you imagine, even if you've never really tried it.

However, these intermediaries not only add transfer and settlement delays, making Stripe's processes inefficient, but also extract a portion of the value chain.

This is not unique to Stripe, PayPal also faces the same problem, which may be the main reason they launched their own stablecoin PYUSD last August.

By integrating stablecoins, these fintech companies are taking another step towards occupying the entire online payment value chain.

As I mentioned above, payment companies like PayPal and Stripe collaborate with existing banks to custody user funds. But by using stablecoins, they can have greater autonomy over the value of transactions on their networks.

This excerpt from Delphi Digital's report on crypto product moats explains the financial incentives:

...by allowing users to hold pyUSD through PayPal's payment front-end (e.g. Venmo), PayPal effectively becomes a bank. PayPal can then take in user funds and deposit them in the treasury to earn yield. This not only allows PayPal to compress payment fees to zero, but also gives them the ability to pay rebates or some yield on idle pyUSD balances to users. This is a crushing competitive advantage relative to other Web2 payment app competitors.

Making themselves a bank is the main motivation for fintech giants. From a business perspective, this may be more important than faster transactions and settlement speeds.

Now, the interesting thing to point out is that PayPal and Stripe have taken different approaches.

PayPal has decided to issue their own stablecoin, which means they are focused on fund management. Stripe has bet on the conversion layer, indicating they are focused on stablecoin infrastructure. They have chosen their respective paths because it fits their current technology stack.

From a higher dimension, Stripe is a payment API company, and Bridge directly integrates with this concept. Stripe only needs to integrate Bridge's stablecoin API into their own developer documentation.

PayPal has thrived through front-end services like Venmo, leveraging a large retail user base. So naturally, their crypto team has focused on optimizing how to manage user balances and leverage this capital. Issuing their own stablecoin PYUSD allows PayPal to more efficiently handle funds.

In my view, both companies are inevitably going to vertically integrate the entire stablecoin stack. Providing internal tools for stablecoin issuance, fund management, debit cards, crypto wallets, etc. is crucial. This seems like a no-brainer, as having a complete internal stack will allow the companies to provide the best user experience and capture a larger share of the payment value chain.

In other words, don't be surprised to see Stripe launch their own smart wallet and crypto debit card.

Additionally, it's worth noting that token issuance is the cash cow of stablecoins. For example, Tether generated more profit than BlackRock in Q4 2022. So as Stripe explores the maze of stablecoin concepts with their users, they will eventually launch a stablecoin to help their merchants onboard quickly and provide incentives for using their native stablecoin ecosystem.

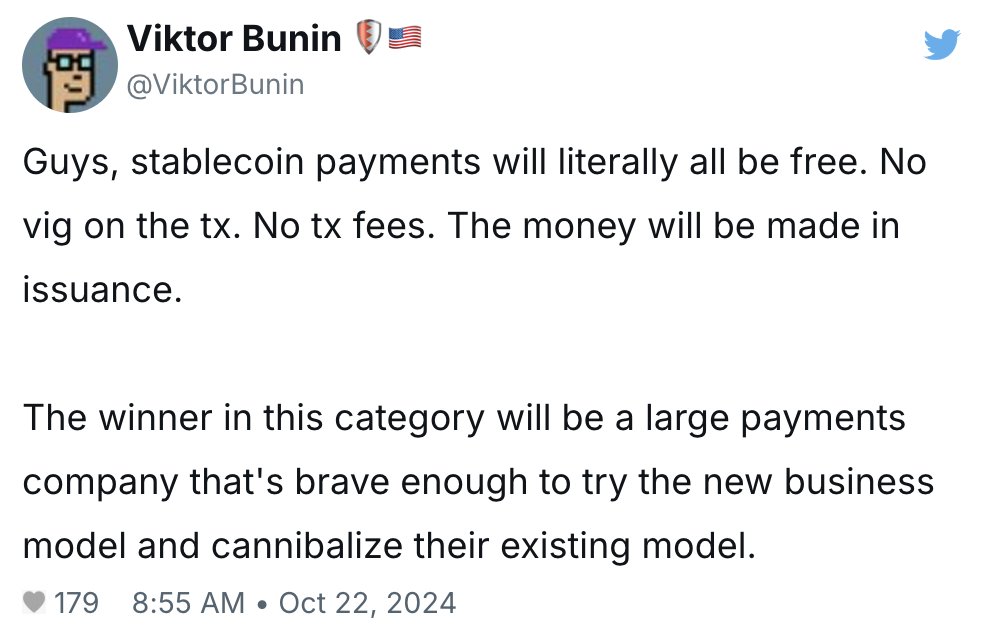

Both Stripe and PayPal have massive global reach and will seek to integrate stablecoin infrastructure into their existing networks. As Viktor mentioned above, the companies that "cannibalize existing models" before other market participants in the next 5 years will reap significant benefits.

Now, you might be wondering: if Stripe and PayPal fully commit to a stablecoin strategy, isn't this a huge threat to payment networks like Visa and Mastercard?

Indeed it is. This is why Visa and Mastercard have already started to script their own playbook to avoid missing the stablecoin revolution. For example, Visa became the first payment network to accept USDC in 2020, while Mastercard launched its own crypto credit card service.

But I suspect that Stripe's acquisition of Bridge has already accelerated the stablecoin strategies of the crypto teams at these large traditional finance/fintech companies.

As for banks? Honestly, I'm not sure what their response strategy will be. It's clear that stablecoins undermine their position as international payment facilitators and custodians of user deposits. But their advantage lies in regulatory compliance, so they may lean towards the rise of CBDCs?

For instance, the BRICS countries have just announced that they are currently launching their own digital currencies to reduce reliance on the US dollar. It's evident that banks will seize the opportunity to formulate their own CBDC strategies to compete for this new market share.

Regardless of what these different traditional finance stakeholders' answers are, the overall theme remains consistent: stablecoins have arrived in the financial realm.

The question now is, which large institutions will open their arms to embrace the new member of the financial system and quickly become friends with stablecoins.

To some extent, many different participants in traditional finance are starting to look very similar, as they all want to use stablecoins to provide full-stack financial services (payments, banking, card services, etc.).

So far, we have outlined the impact of stablecoins on all financial technology participants, but what will the new crypto-native stablecoin upstarts become?

If you had to choose one, would it be TradFi or DeFi?

Based on my previous research, stablecoin vertical founders need to choose the audience they cater to:

Traditional finance/Web3 tech companies

On-chain cryptocurrency adopters

The first is clearly the target of Stripe's acquisition of Bridge; the second hints at the long-tail effect of the upcoming DeFi-native stablecoin infrastructure. But what is the difference between the two?

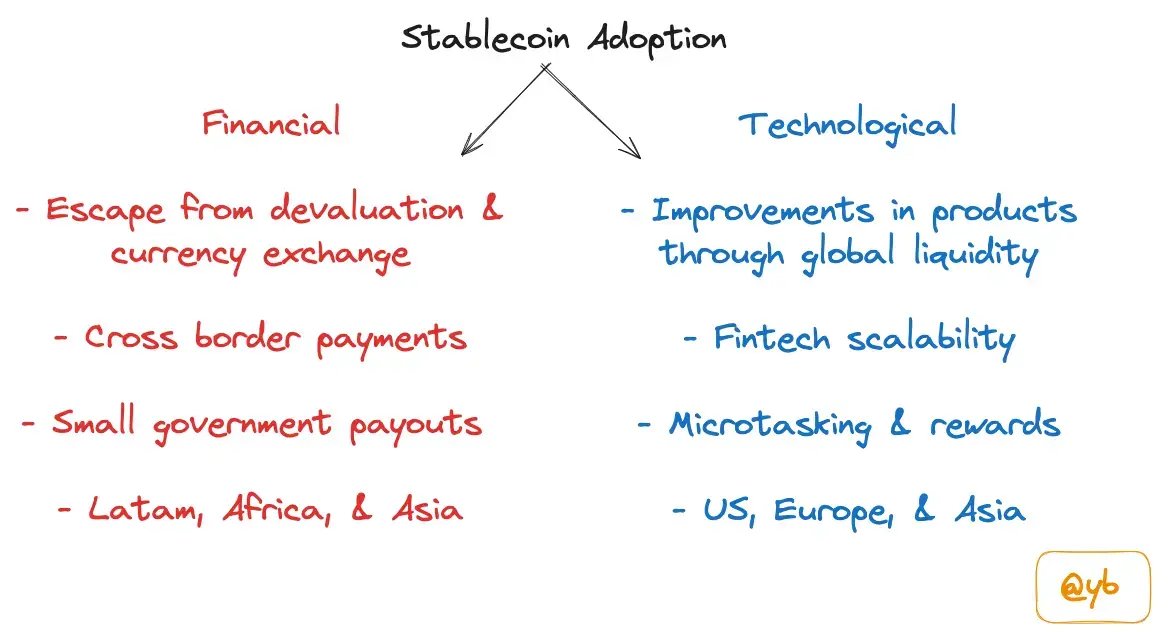

The scale of the stablecoin ecosystem goes far beyond just replacing fintech payment services. As I mentioned in my article on stablecoin adoption, this is a two-pronged approach. On one hand, it is dedicated to improving existing financial rails, and on the other, it uses stablecoins to enhance crypto products, such as Polymarket, Bountycaster, Uniswap, Aave, and others.

One group of startups aims to become plugins for traditional finance participants, seeking to find more powerful partners, such as Paxos, Ondo Finance, Brale, Agora, Coinflow, and Sphere.

Another group of startups tends towards a fully decentralized stablecoin infrastructure stack, including Prerna, Gnosis Pay, Based App, and Picnic. These companies aspire to be direct competitors to products like Stripe and PayPal. They cater to a more crypto-inclined audience and help enhance the on-chain experience through stablecoin-supporting applications.

That said, I believe founders should consider a barbell strategy for stablecoins. Are we catering to those traditional finance companies that will inevitably want to enter the stablecoin space? Or are we building stablecoin infrastructure for DeFi applications, experimenting with things that make no sense for Stripe and PayPal?

In my view, those companies trying to have it both ways will either be defeated by traditional finance players with distribution moats, or by DeFi players who optimize their products for unique on-chain functionality.

Today's post is to share some initial thoughts after hearing the news of the Bridge acquisition, but I haven't found meaningful answers to the following questions yet:

Where are the moats in the stablecoin stack?

How will other Web2 fintech participants get involved?

If another acquisition happens, who might it be?

In the coming months, the developments in the stablecoin space will become increasingly interesting.