Why delist USDT?

Markets in Crypto Assets - MiCA

The European Union's Regulation on Markets in Crypto Assets (MiCA), which will come into effect by the end of June 2024, imposes some restrictions on stablecoins, such as:

It is okay to invest in cryptocurrencies using stablecoins, but daily consumption payments must be made using euro-denominated stablecoins.

There are also regulations for stablecoin issuers, who must obtain relevant licenses. Only stablecoins issued by compliant institutions can be used in the EU.

USDT is issued by Tether, and although it is the oldest and largest stablecoin in the crypto market, its compliance has always been a potential risk. In a previous article, we analyzed the relevant risks of USDT:

MiCA stipulates that only licensed issuers can issue stablecoins in the EU. Obtaining a license in one EU member state allows the stablecoin to be used across the entire EU, without the need for licenses in all 27 countries. However, Tether has not obtained a regulatory license in any EU country, so it is not a compliant stablecoin issuer. If exchanges want to operate compliantly, they will have to delist USDT for EU customers, and not just USDT, but also other Tether-issued stablecoins like EURT.

How to delist USDT? Is our asset at risk?

The so-called delisting is actually just the deactivation of USDT for users in the European region. Registered exchange accounts usually require KYC, so exchanges know the location and nationality of each user. By disabling certain USDT trading pairs or only allowing USDT to be sold but not bought for European customers, users in that region will be forced to start using other stablecoins.

Are there compliant stablecoins in the EU?

The leading stablecoin USDT has always had potential compliance issues, while USDC, the second-largest stablecoin, has always touted compliance as one of its selling points. This time, USDC's issuer Circle has become the first compliant stablecoin issuer in the EU, having obtained the relevant licenses in both Europe and the US.

What is USDC? Why can it become the second-largest stablecoin? Is it safer than USDT?

Current stablecoin market share - USDT 70%, USDC 20%

Stablecoin market share in the overall crypto market

Source: CoinGecko

The stablecoin market share has not changed much over the past year, with Tether (USDT) still the leader, accounting for over 70% of the market, and USDC in second place with around 20%.

This is the overall market share, but the situation may be different in DeFi (on-chain), where in some chains USDC is the largest stablecoin, such as on the well-known Layer 2 chain Base, where USDC has a market share of over 90%, and on Solana, USDC accounts for nearly 70%.

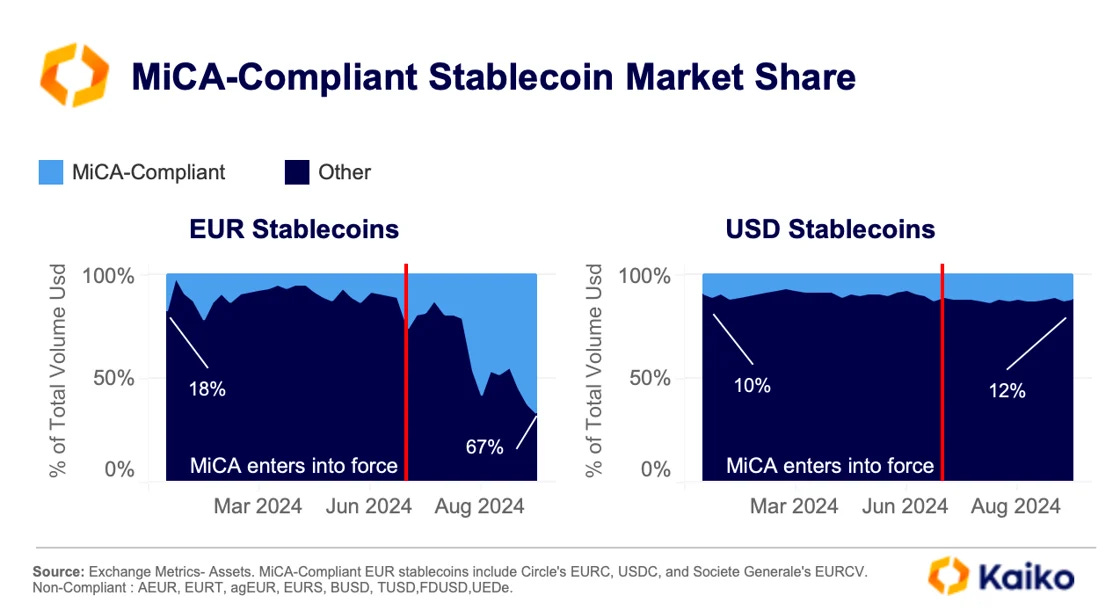

Stablecoin market share in the EU after MiCA implementation

According to a report by research firm Kaiko, the implementation of MiCA has led to significant fluctuations in the euro stablecoin market share, with the market share of compliant euro stablecoins surging from 18% a few months ago to 67%. The changes in US dollar stablecoins have been relatively small so far, but with Coinbase planning to delist USDT in December, a similar trend may emerge.

What will happen if USDT is delisted? Will stablecoins decouple? Will the crypto market collapse?

What impact will the delisting of USDT in Europe have on Asian investors who are not in Europe?

The delisting of USDT by exchanges in Europe will essentially only affect European users, who will no longer be able to use USDT on those exchanges. Some users may switch to using other stablecoins, but the main impact will be on the stablecoin market share, not on the underlying risk of the stablecoin mechanisms. Unless there are other unexpected events, such as issues with Tether's reserves or suspension of redemptions, there will likely be no price decoupling or crypto market collapse, and perhaps not even minor volatility.

Unless there are problems with Tether's reserves or it stops redeeming, where each stablecoin is fully backed by US dollars, being delisted only restricts the use in certain regions and does not affect the asset's safety.

In summary, the biggest impact of USDT delisting is the competition for stablecoin market share, and it does not have a significant impact on investors outside of Europe.

However, there will likely be some USDT holders who do not want to switch to other stablecoins, and in the face of regulatory restrictions on exchanges, they may turn to DeFi, as it is currently not affected by these regulations.

Two phenomena may be observed in the future:

Most people have no preference for stablecoins and will use whichever one the exchange provides, so more people will start using USDC, increasing its overall market share, including in DeFi.

Since exchanges do not allow the use of USDT, a minority of users who prefer USDT will turn to DeFi, driving capital inflows into DeFi and increasing the use of USDT in DeFi.

It is difficult to say which scenario will have a stronger impact, but regulation will inevitably bring some restrictions, and the relatively more free DeFi will certainly attract a group of people to switch, especially with the start of the rate cut cycle, which is generally more favorable for DeFi development.