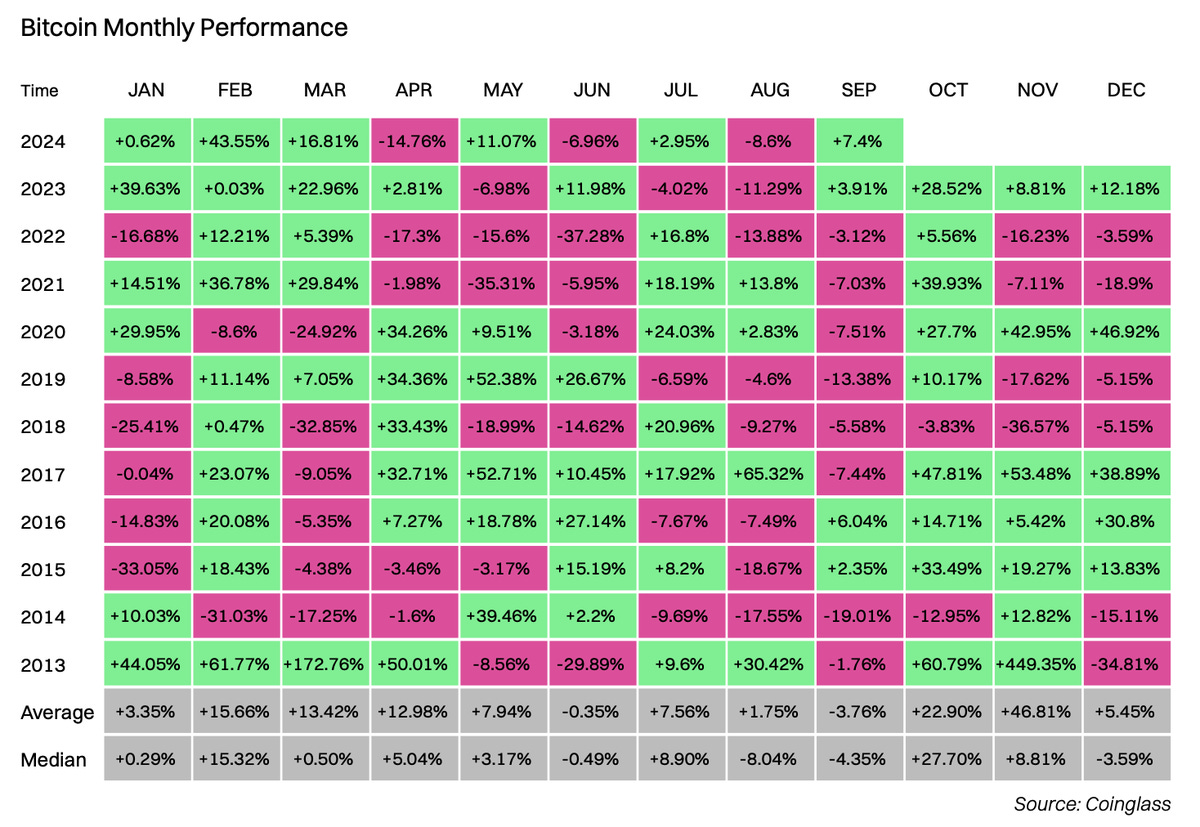

Bitcoin Price Performance - An Anticipated Fourth Quarter Ahead

We have experienced a bumpy third quarter, like riding a roller coaster, with the overall price fluctuating throughout Q3. The highly anticipated fourth quarter is just around the corner, and at least based on the data, Q4 has generally performed relatively well in the past.

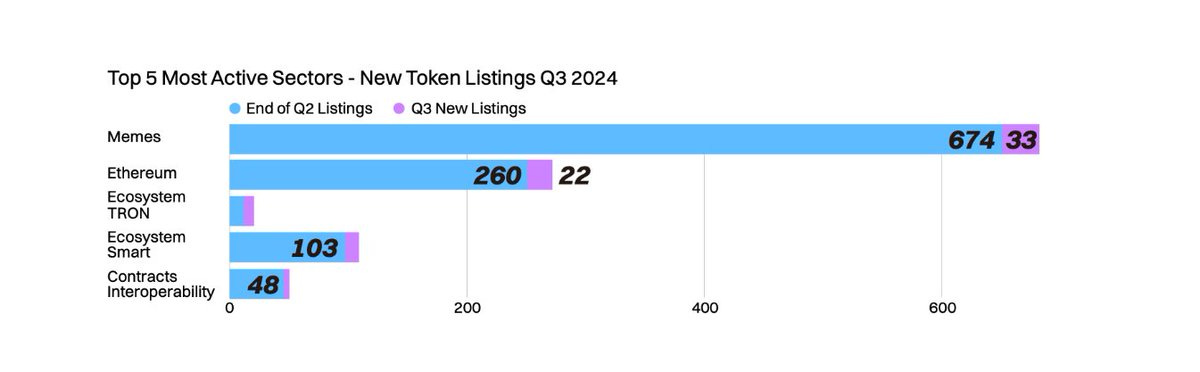

Despite the Uncertainty, the MEME Sector has Undoubtedly Been the Best Performer

Although Memecoins experienced a significant 70% pullback in the third quarter, the MEME sector has undoubtedly been the best performer year-to-date (YTD), outperforming other popular sectors such as AI, Layer 1 blockchains, and platform tokens.

Not Only Have Existing Memecoins Performed Well, But the Frequency of New Coin Listings Has Also Been Favored

The number of Memecoin listings has been more than any other sector.

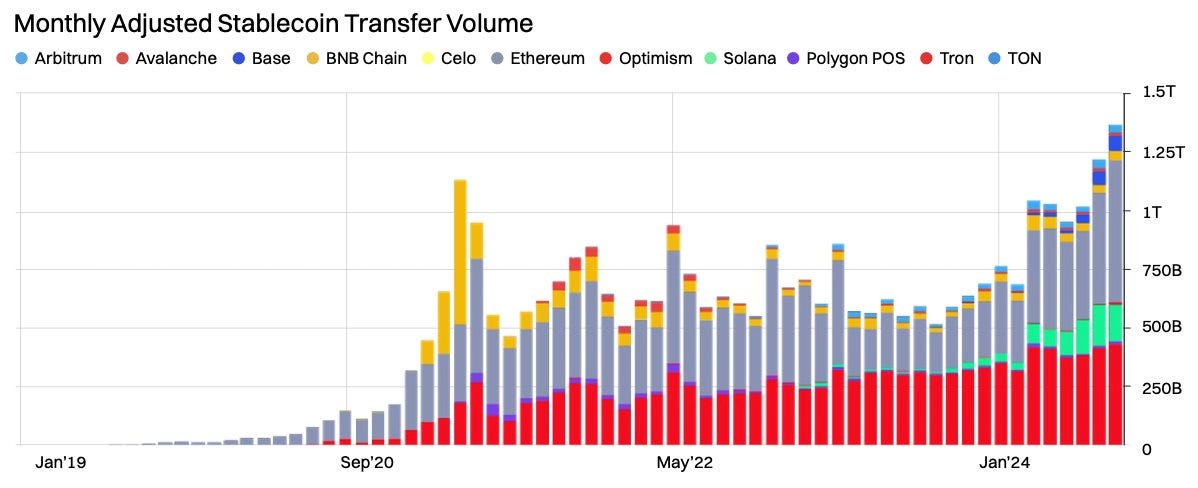

Another Closely Watched Area is Stablecoins

The overall Stablecoin market grew by 5.4% in the third quarter and is approaching new highs, with on-chain transfer volumes for Stablecoins also reaching new highs, exceeding $1.2 trillion.

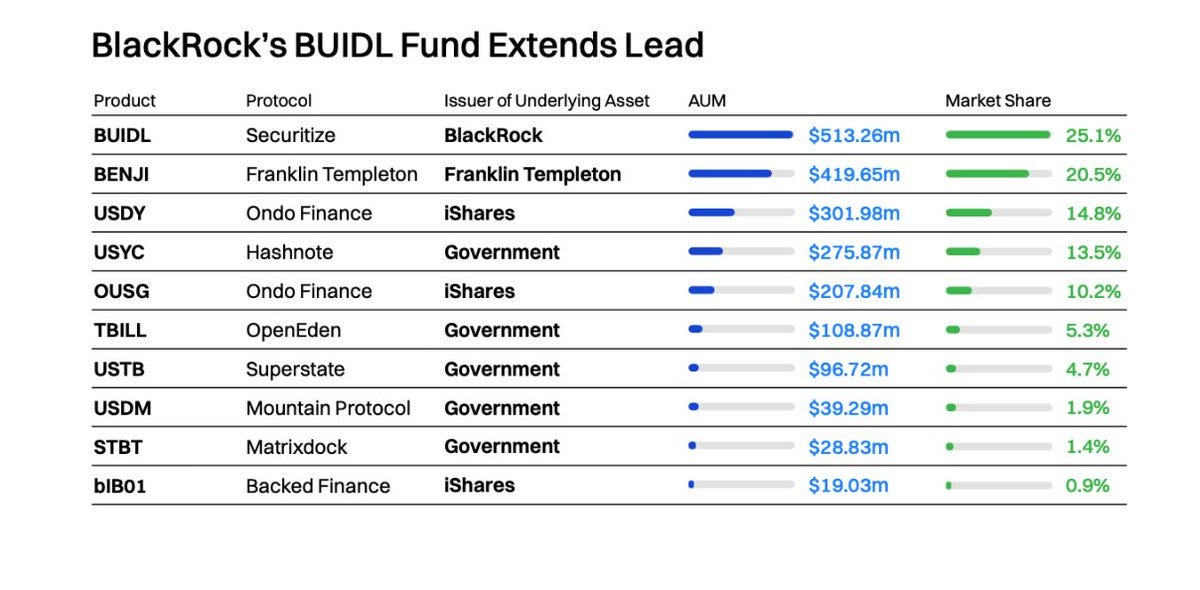

Speaking of RWA adoption, BlackRock is in a leading position in this area.

BlackRock's BUIDL fund manages over $500 million in assets, accounting for 25% of the market share. Closely following are Franklin Templeton and Ondo Finance, while OpenEden, supported by DWF, has also quickly captured 10.2% of the market share.

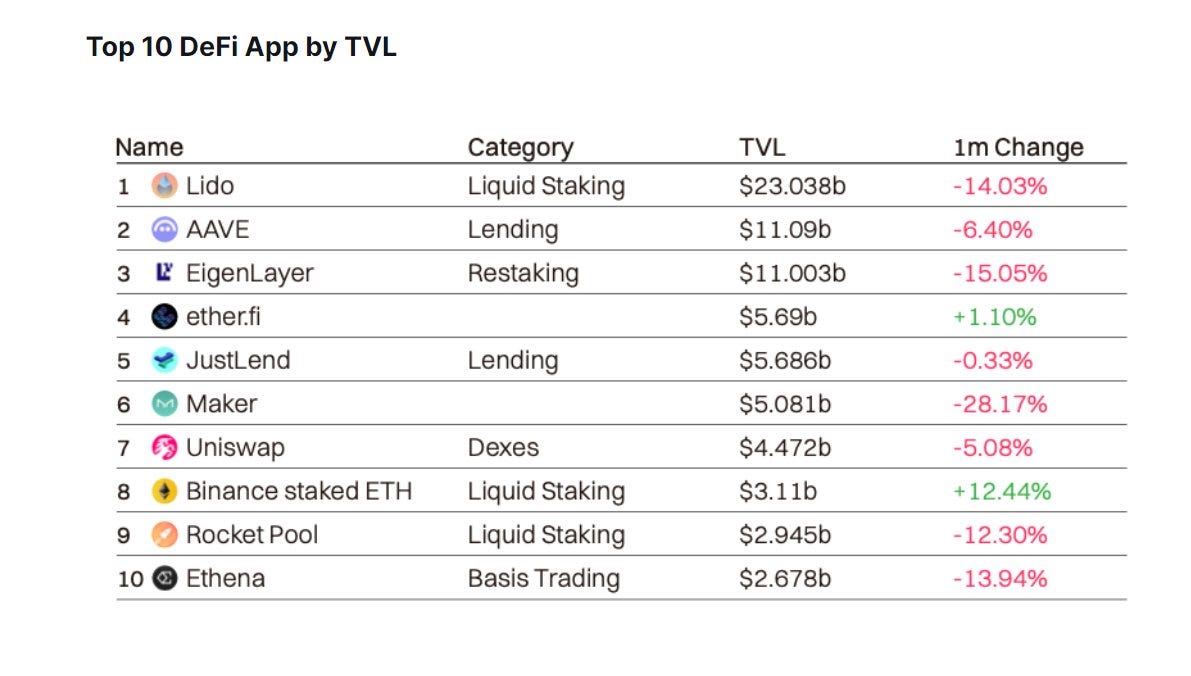

Regarding DeFi: Most Projects Saw a Decline in TVL in the Third Quarter, Partly Due to the Drop in Ethereum Price.

Lido remains in the lead, but Eigenlayer's on-chain funds have retreated, approaching AAVE, while Maker has seen the largest capital outflow (-28%), and Binance staked ETH has the most growing capital.

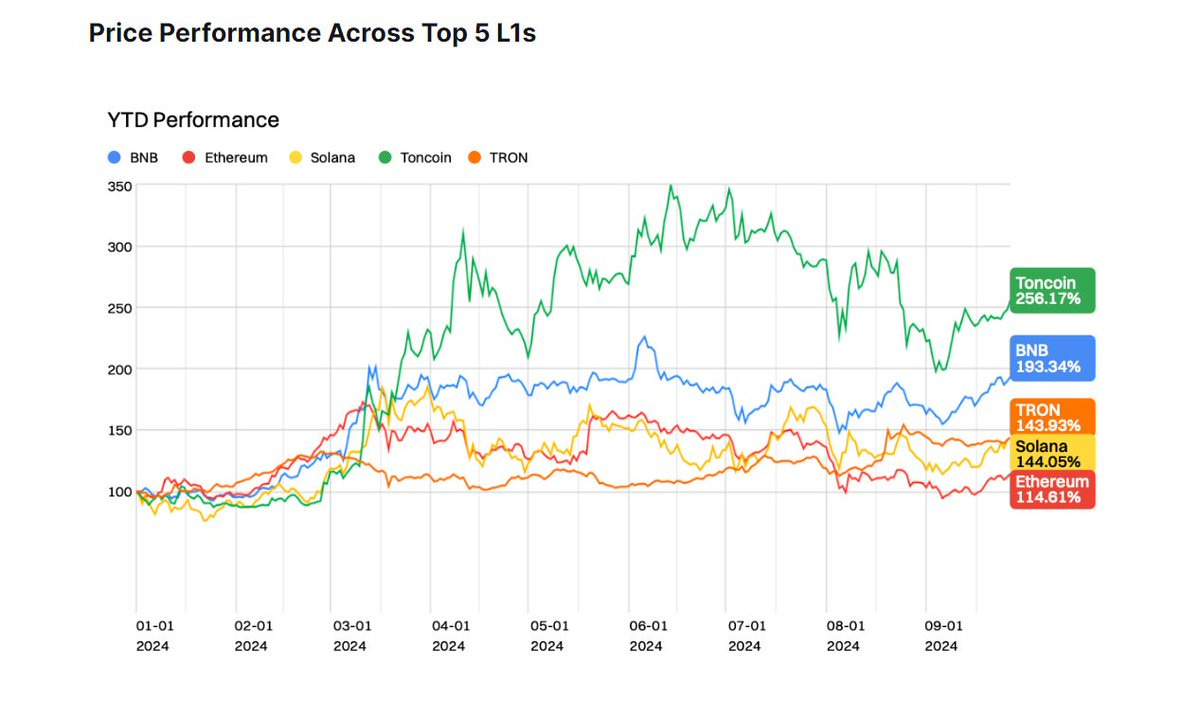

Ethereum's Price Not Only Retreated, But It Was Also the Worst Performing Layer 1.

Recently, $SOL has performed relatively strongly, and the SOL/ETH ratio has continued to hit new highs, while the ETH/BTC ratio has hit new lows, but we can see that $ETH has still achieved an amazing 114% growth from the beginning of the year to the end of the third quarter. TON has been the best performer this year, with a 256% price increase.

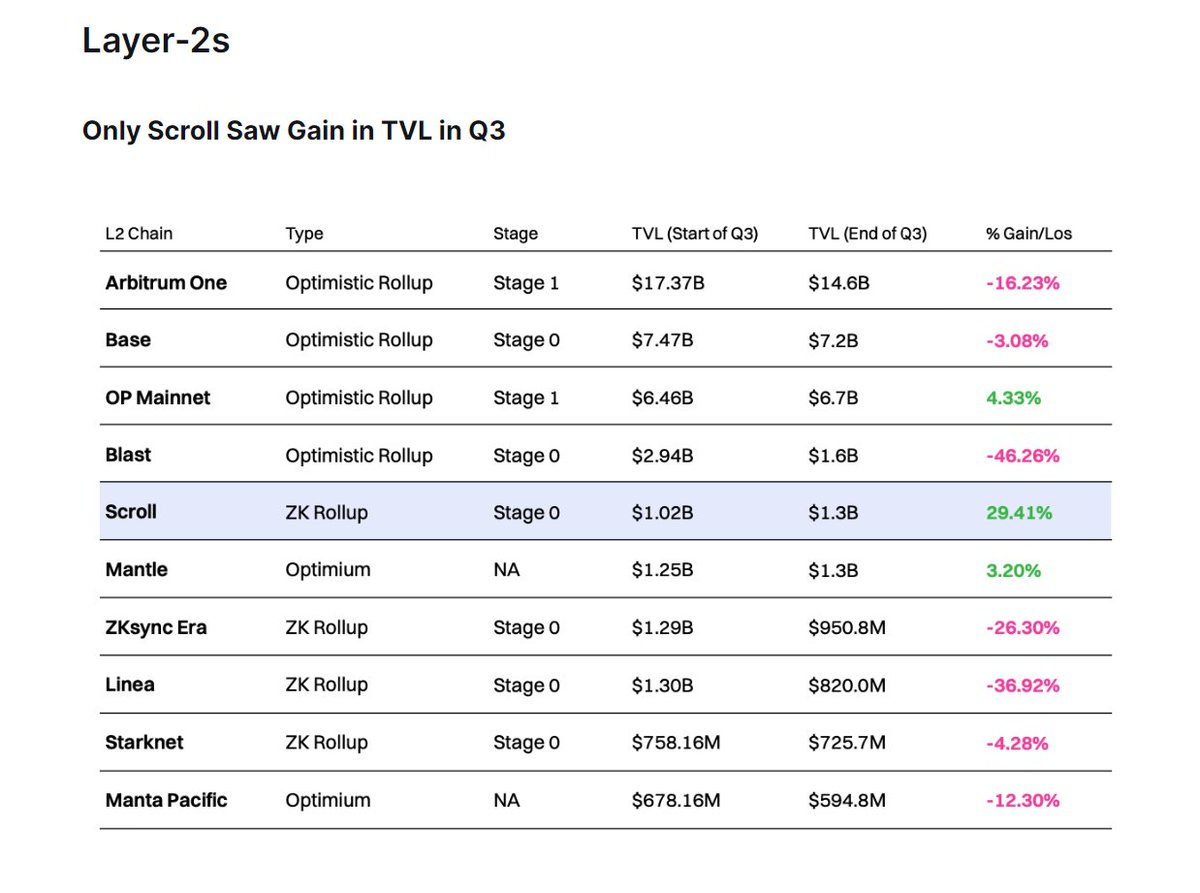

Underperforming: The Category Closely Related to Ethereum's Performance is Layer 2

Most Layer 2 solutions have experienced a sharp decline in TVL, with only Scroll, Mantle, and OP seeing positive growth, while Linea has had the highest capital outflow in the past quarter, which may be related to the withdrawal of airdrop participants.

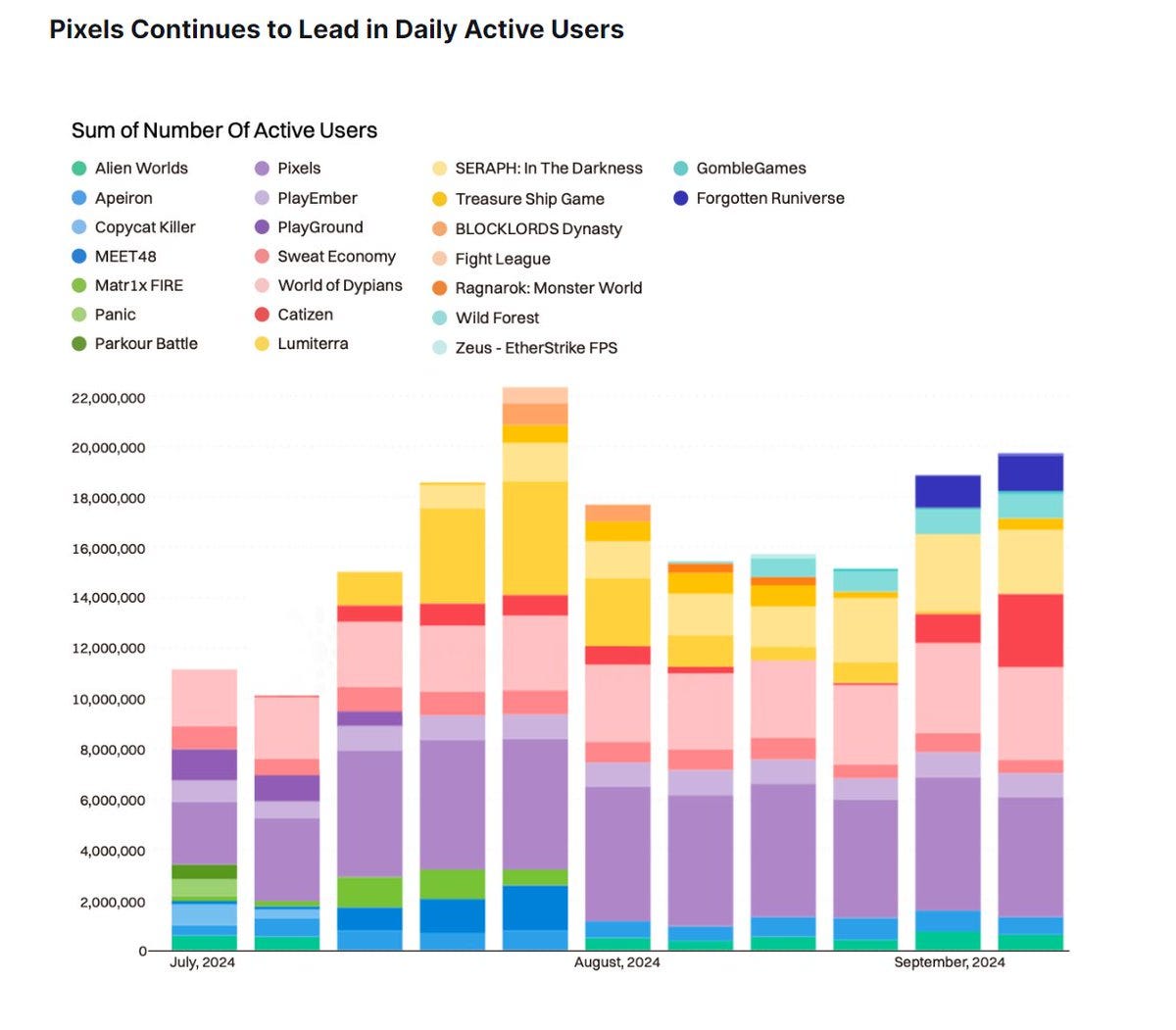

When it comes to games, Pixels is still the undisputed champion.

Often, the high-profile games we see on social media do not necessarily reflect player activity. In the past quarter, we can see that Pixels and World of Dypians have had relatively stable player numbers, while Forgoteen Runiverse and Seraph have emerged as popular games in the last two months.

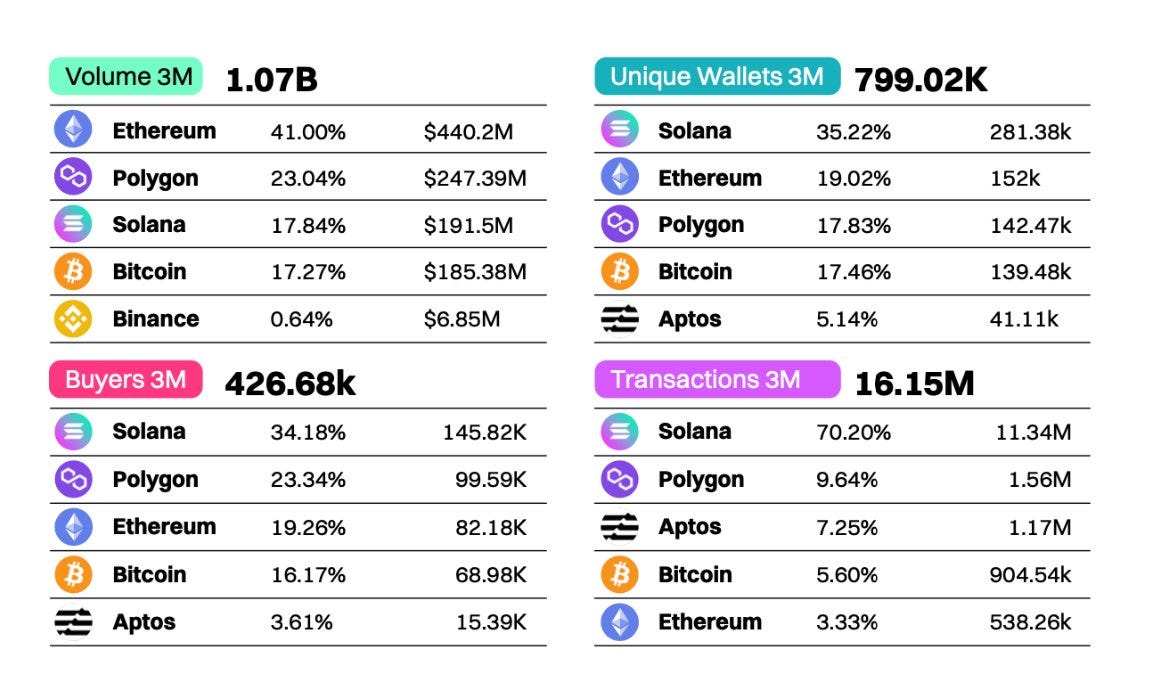

Is the Non-Fungible Token market recovering? Solana is leading in independent wallets, transaction volume, and buyer numbers.

Solana is leading in independent wallets, transaction volume, and buyers. In terms of transaction value, Ethereum is still the king, with a remarkable 41% market share. However, with the Solana meme regaining momentum, there is a possibility that the transaction volume and fees in the fourth quarter could continue to surpass Ethereum.

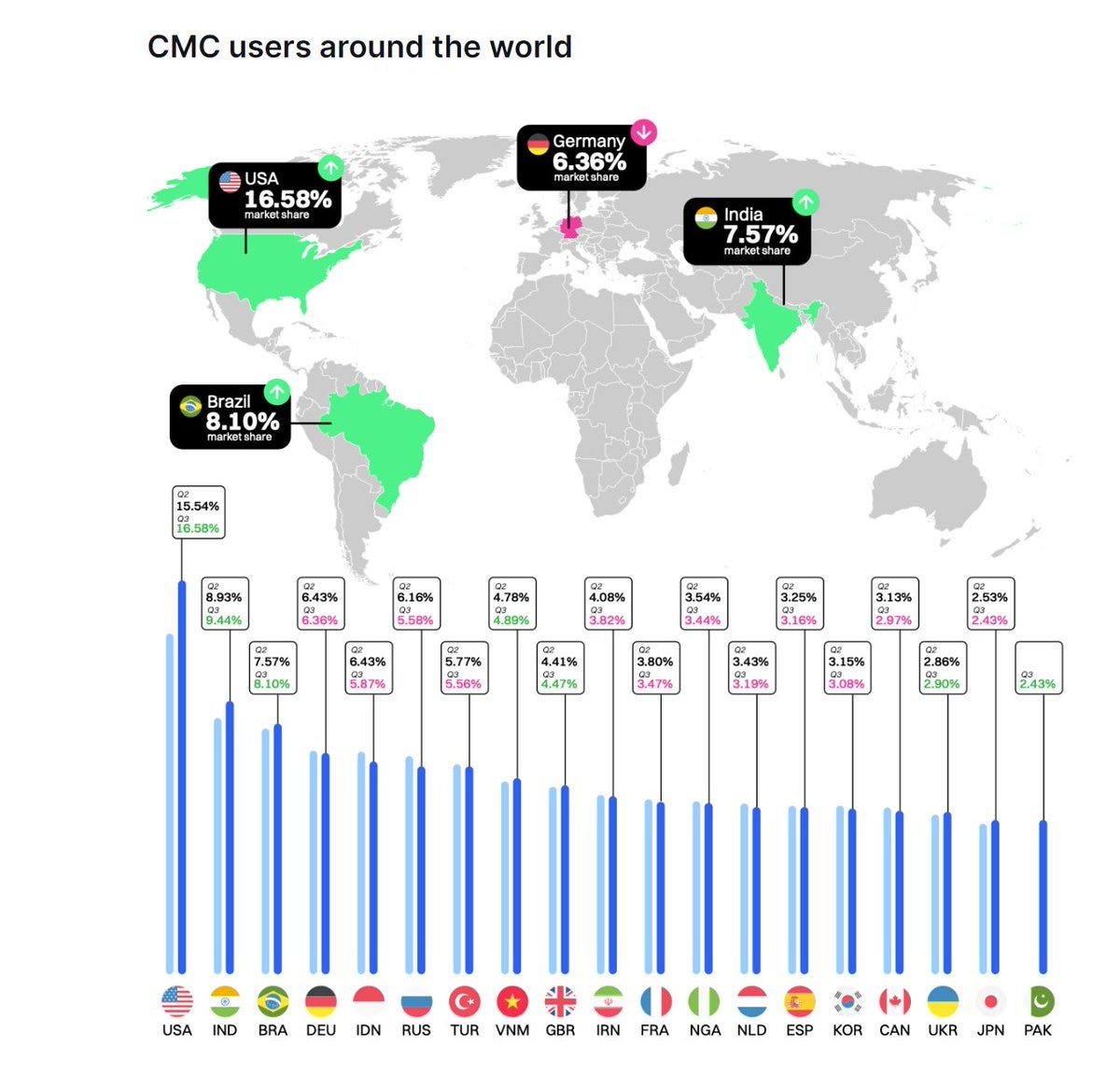

The global distribution of Coinmarketcap users is quite remarkable!

The United States has the most users, followed by India, Brazil, and Germany. This may provide an opportunity to gain a deeper understanding of the differences in the profiles of Altcoin users in different regions. Additionally, countries like Nigeria, Iran, and Pakistan are also on the list.

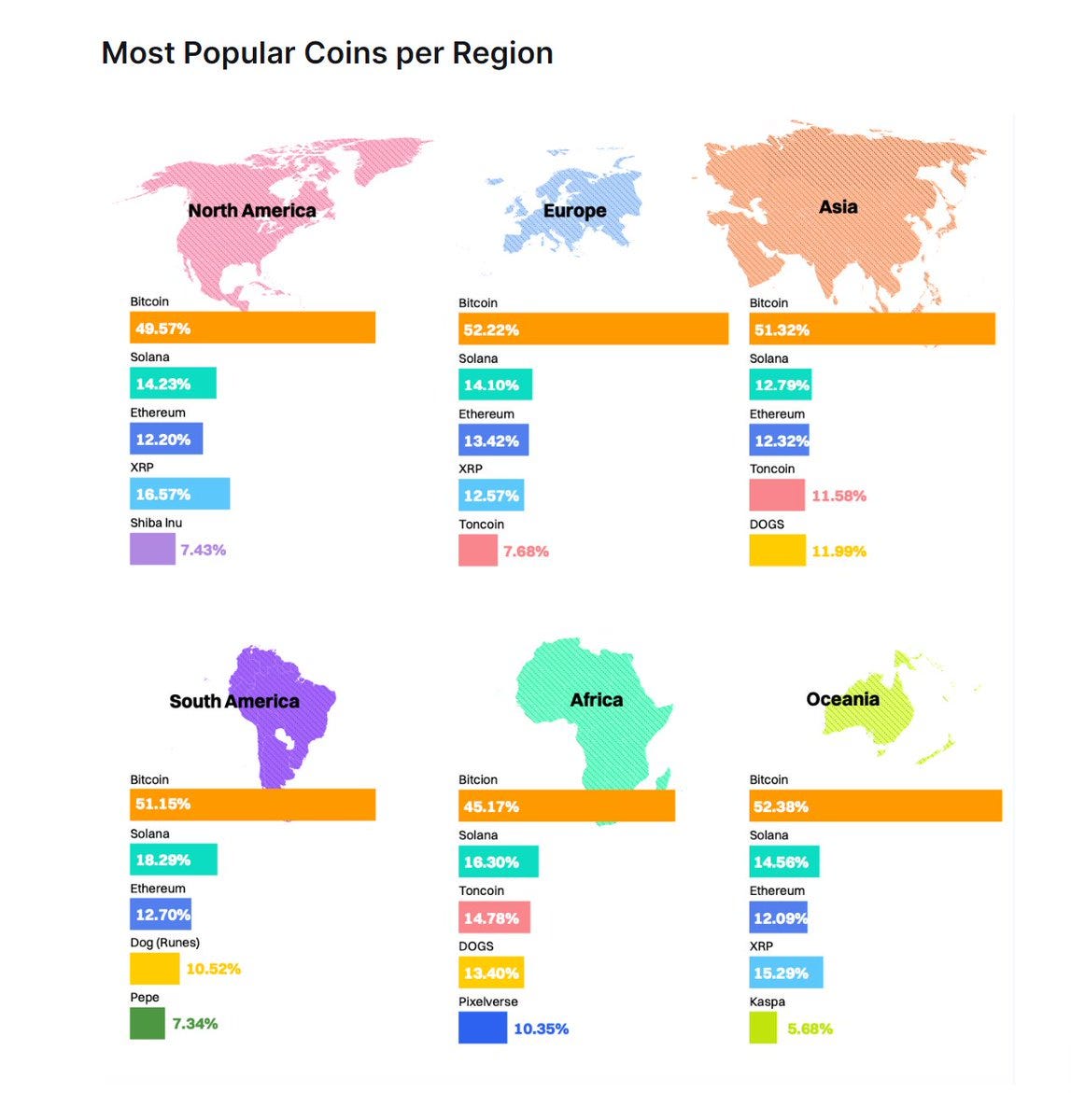

Bitcoin is still the asset with the most interest in almost every field worldwide

Solana is also in a leading position. Ethereum appears to be starting to show signs of fatigue. Surprisingly, a significant portion of investors in some markets are also interested in XRP, with as much as 16.5% of investors in the United States preferring $XRP, higher than $SOL and $ETH. We can also see that investors in different regions prefer different Altcoins, with $SHIB being popular in the United States, $TON having a significant share in Europe, Asia, and Africa, and $PEPE being more popular in North and South America. Game players in Africa also have a considerable proportion, and $KAS has a significant influence in Oceania.

source : https://coinmarketcap.com/academy/article/according-to-cmc-2024-q3