The US Department of Labor reported on Thursday (24th) that the number of initial jobless claims in the US for the week ending October 19 was 227,000, a decrease of 15,000 from the previous week and lower than the 242,000 expected by economists.

However, analysts believe that the hurricanes Helen and Milton that devastated the southern United States in the past two weeks have caused many people to lose their jobs, but many may not have been able to immediately apply for unemployment benefits, resulting in unexpected data.

However, the number of continuing jobless claims increased to nearly 1.9 million last week, the highest in nearly three years. The data on continuing jobless claims traditionally reflects the difficulty in finding jobs, suggesting that the job market has not continued to improve, providing support for the Fed's rate cut in November.

US bond yield rises to 4.2%

Meanwhile, the Fed's latest Beige Book survey revealed that economic conditions across the country remain weak, with 9 of the 12 regional Federal Reserve banks reporting stagnant or slightly declining economic activity, suggesting sluggish economic growth and also providing support for the next rate cut.

After the report was released, the falling US bond prices rebounded, and most institutions believe that the room for further declines in US bond prices is limited, and US bond investors are confident.

Why has the US bond yield continued to rise?

Why has the US bond yield continued to rise in the context of the Fed's rate cut cycle? Experts analyze the possible reasons:

- The US Treasury Department continues to issue debt to fill the government's fiscal deficit (plus some are concerned that if Trump returns to the White House, the US fiscal deficit may increase again)

- The Fed's attempt to shrink its balance sheet has eliminated a large amount of demand for government bonds

- Recent economic data shows that the fight against inflation is still stagnant

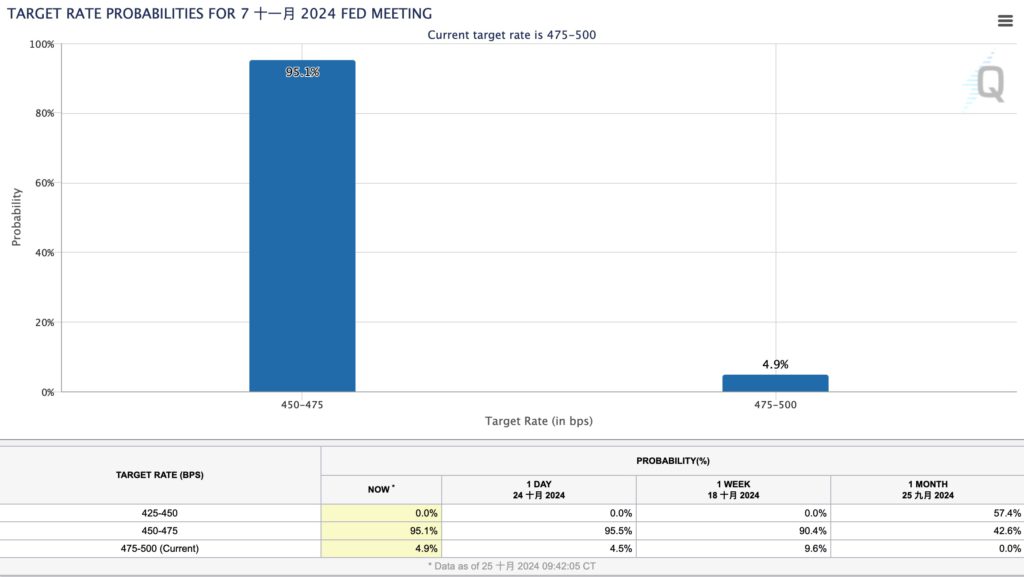

The latest data from the CME Group's Fed Watch tool shows that the market currently believes the probability of maintaining the current 4.75% to 5% interest rate in November has fallen to 4.9% from a week ago, while the probability of a 25 basis point cut to 4.5% to 4.75% has risen to 95.1%, and most are still betting that the Fed will continue to cut rates.

The four major US stock indices see mixed gains and losses

On the 25th, the four major US stock indices saw mixed gains and losses, with the Nasdaq rising more than 1% driven by tech stocks:

- The Dow Jones Industrial Average fell 259.96 points, or 0.61%, to close at 42,114.4 points.

- The Nasdaq Composite Index rose 103.12 points, or 0.56%, to close at 18,518.61 points.

- The S&P 500 Index fell 1.74 points, or 0.03%, to close at 5,808.12 points.

- The Philadelphia Semiconductor Index rose 55.22 points, or 1.07%, to close at 5,212.83 points.

China did not include fiscal stimulus measures in the agenda of the NPC Standing Committee meeting

On the other hand, in contrast to the US stock market, which does not seem to have any signs of slowing down its upward trend.

In order to cope with the continued sluggish economic situation, the Chinese authorities launched a historic large-scale easing policy at the end of September, which in the short term triggered a frenzy of gains in the Chinese stock market, but due to the lack of further economic stimulus measures, the market has recently been completely extinguished, and new investors have also been lamenting.

Yesterday (25th), Xinhua News Agency reported that the National People's Congress, China's highest legislative body, will hold a meeting from November 4 to 8, and the Standing Committee of the National People's Congress will deliberate on issues such as mineral resources, energy, and anti-money laundering legislation, and even consider the results of the US presidential election in early November, but did not mention the much-anticipated economic stimulus policy, which may once again disappoint the already lacking market confidence...