Stablecoins are emerging as the digital currencies that are reshaping global finance and commerce.

Original: Stablecoins | The Monetary Upgrade

Author: Peter Schroeder

Translator: LlamaC

Cover: Photo by vackground.com on Unsplash

"Recommended note: This article clearly explains the rise of stablecoins, their business models, their impact on the traditional financial system, and their potential and application prospects as digital currencies in global finance and commerce. It is an article that is easily harmonized, so enjoy and cherish it!"

Main Text

No innovation has captured the imagination and potential of the tech and finance worlds like stablecoins. These digital currencies, designed to maintain a stable value relative to a reference asset (typically a fiat currency like the US dollar), have become the bridge between the traditional financial system and blockchain technology. The news this week of Stripe's acquisition of Bridge has rippled through the tech world, making people aware of the potential for stablecoins to pave new monetary superhighways. Let's dive into the significance of stablecoins for the future of money.

The Rapid Rise of Stablecoins

There's a saying that ultimate complexity manifests as simplicity.

While cryptocurrencies can sometimes bring a lot of complexity, in principle stablecoins are the simplest form - they are digital currencies that combine the advantages of cryptocurrencies with the stability of traditional finance.

In hindsight, it all seems so obvious, but we are at a pivotal moment in the evolution of money. Stablecoins are not just an improvement on the existing system; they are laying the foundation for an entirely new internet-based financial system.

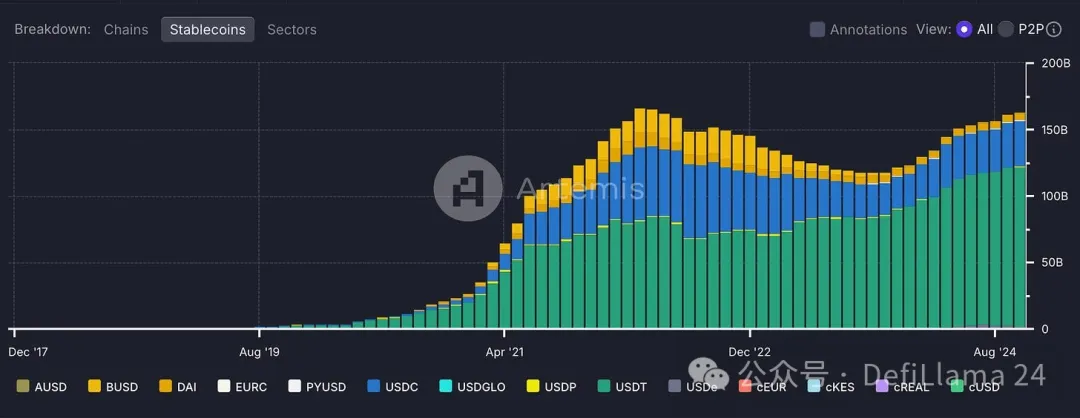

Accordingly, the market capitalization of fiat-backed stablecoins has exploded from the conceptual stage in 2018 to over $164 billion as of October 2024.

To put that in perspective, that's more than the GDP of over 100 countries.

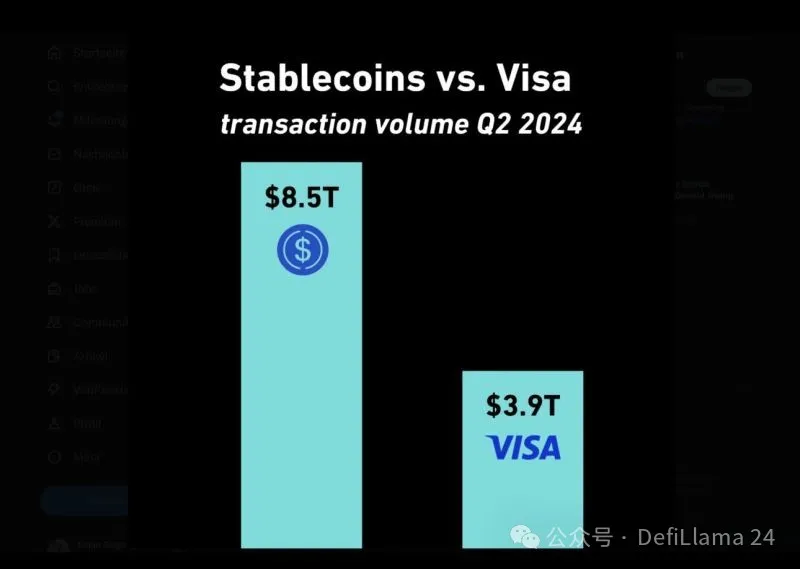

And these stablecoins are not idle. In just the second quarter, the transaction volume processed by stablecoins was nearly double that of Visa, often exceeding trillions of dollars per month.

For a technology that's only been around for 6 years, this level of growth is astounding.

The Business of Stablecoins

So why is the stablecoin business a good one, and how do they make money?

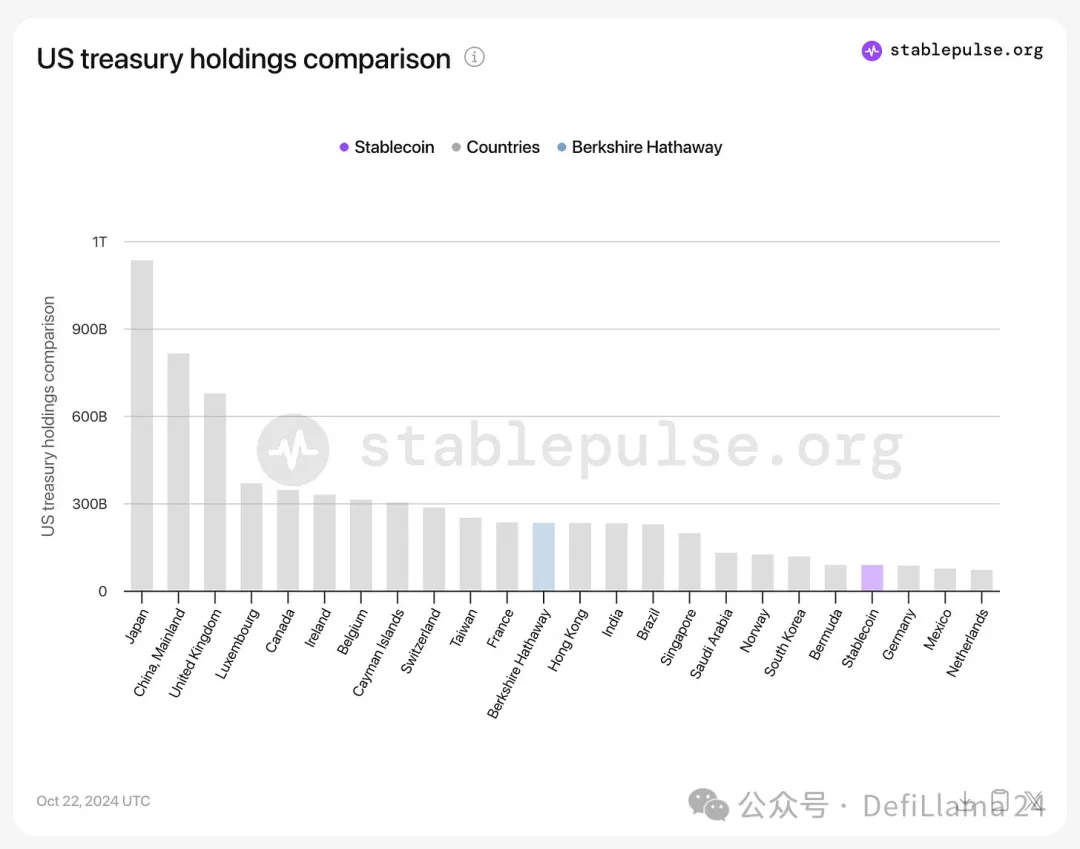

Stablecoins generate revenue by investing their reserve funds 1:1 into interest-bearing assets, such as Treasury bills and other short-term investment instruments. The interest earned on these investments provides a revenue stream for the stablecoin issuers.

This innovative investment strategy has made stablecoin issuers one of the largest holders of US Treasuries, surpassing the holdings of countries like Germany, Mexico, and the Netherlands.

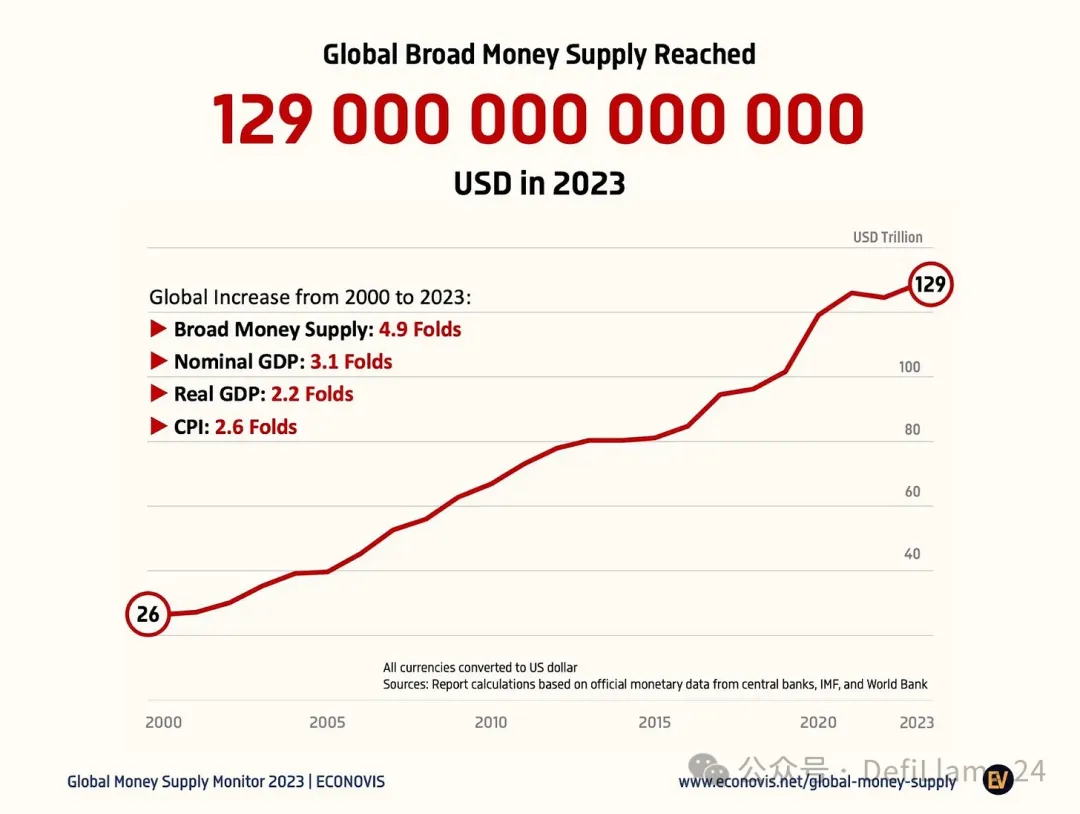

But stablecoins have only just begun to realize their potential. Consider this: the global money supply (M2) is estimated to be around $129 trillion.

We've only just begun to upgrade the financial system through stablecoins.

Beyond the M2 money supply, here are some other market sizes that stablecoins are poised to improve:

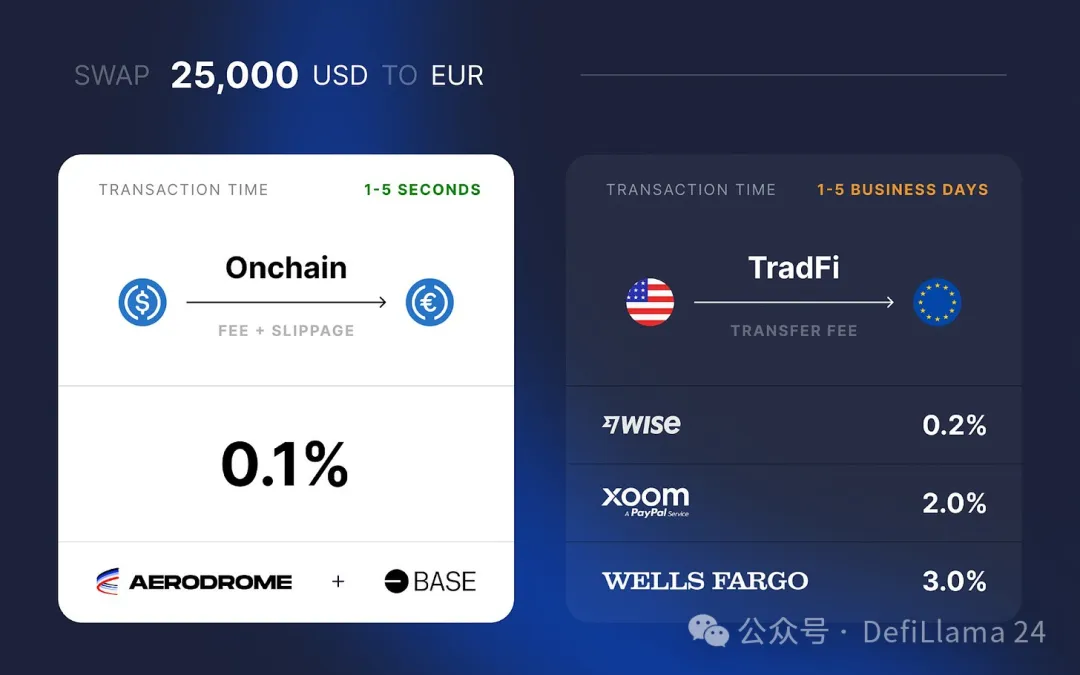

Foreign Exchange (Forex): $8 trillion moves between different currencies every day. This is the world's largest market, about 30 times the size of global daily GDP.

Once we have deeper liquidity in more currency-backed stablecoins globally, digital forex trading through stablecoin swaps will quickly start to change the way currency flows today.

Global Remittances: In 2023, global remittances were estimated to be worth $883 billion, and are projected to reach $913 billion by 2025.

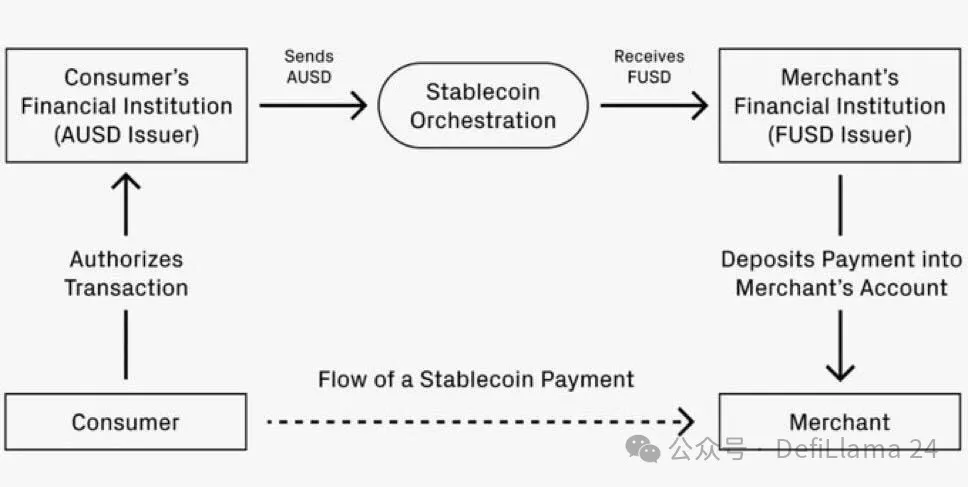

Stablecoins make cross-border payments as simple as sending a text or email, providing faster, cheaper, and more seamless transactions.

The Miracle of Money

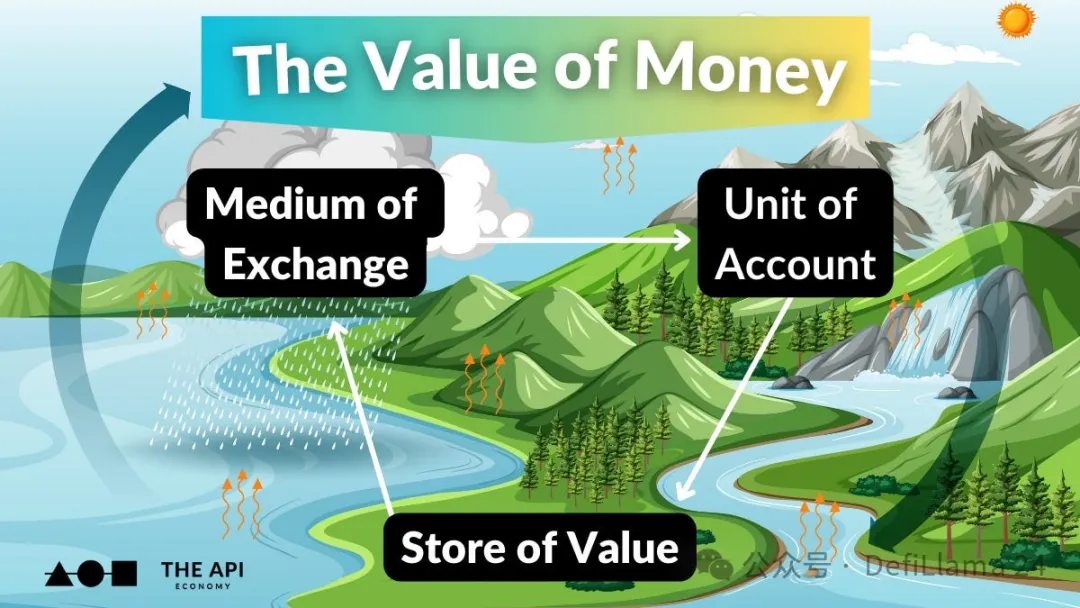

Why are internet-based currencies so important? Similar to water, money permeates our society, nourishing economic activity. It seeks the path of least resistance, just as water flows downward. Just as water is vital to life, money is the lifeblood of commerce, facilitating transactions and storing value.

Medium of Exchange

As a medium of exchange, stablecoins have the opportunity to replace existing processes through their efficiency and programmability. In every workflow where there are intermediaries facilitating and participating in transactions, stablecoins have the opportunity to abstract and simplify the payment process. According to McKinsey, the global payments industry processed 34 billion transactions worth $180 trillion in 2023, with a revenue pool of $2.4 trillion. By simplifying these payments, stablecoins are eating into this $2.4 trillion global payments tax, making payments more efficient for everyone.

Unit of Account

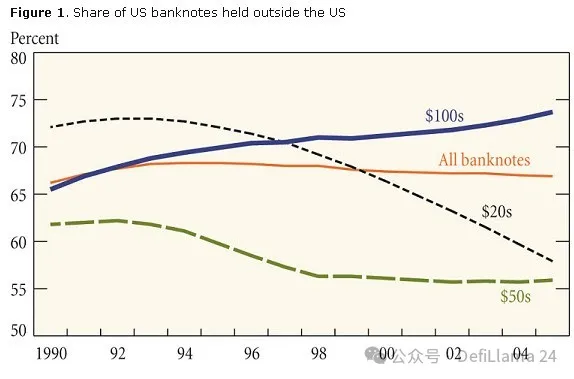

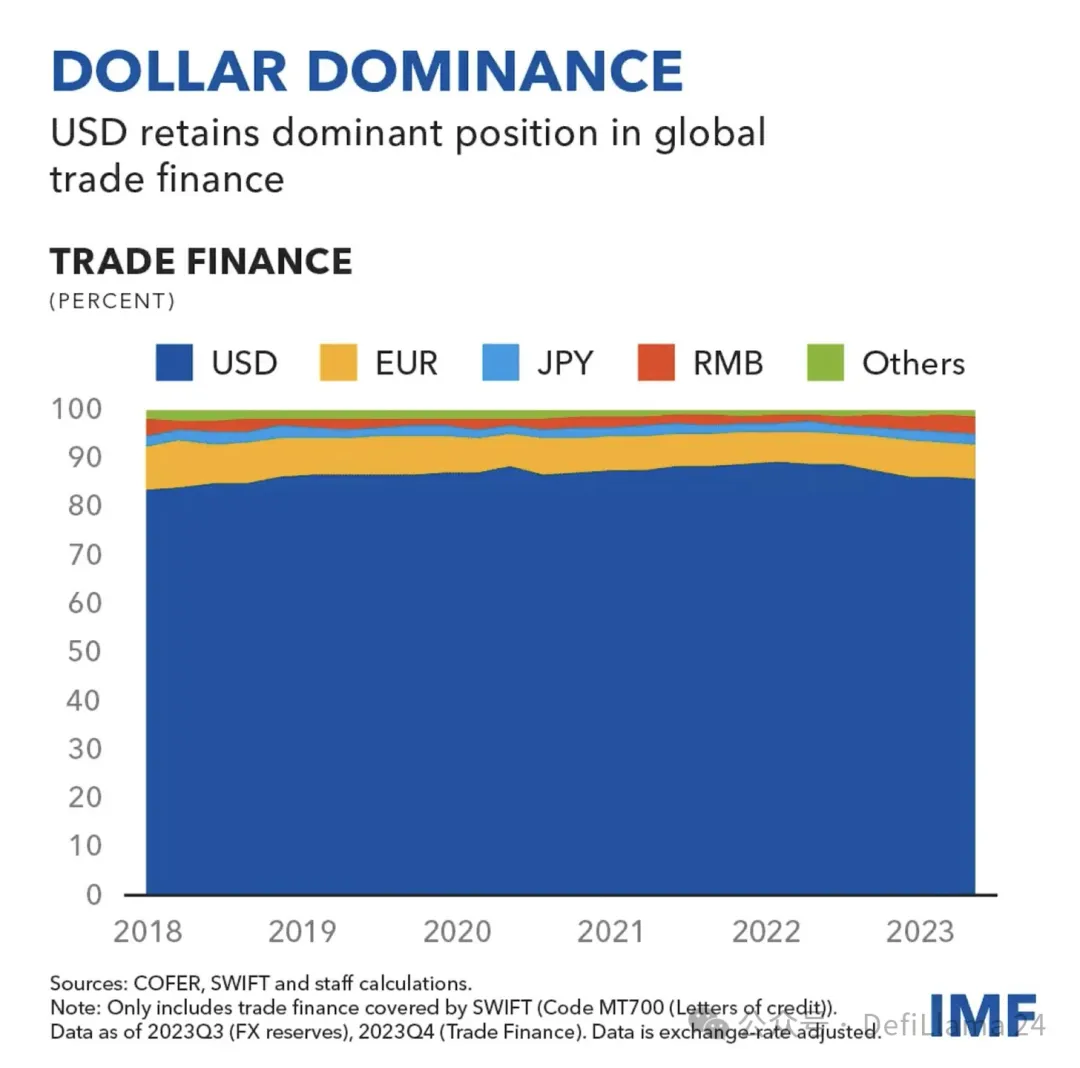

While stablecoins are already useful as a store of value and medium of exchange, their potential as a unit of account remains largely untapped. As more businesses and individuals become comfortable with stablecoins, we may see them used to price goods and services, especially in an international context. According to SWIFT data, the US dollar accounts for over 80% of trade finance due to the fact that most commodity trade continues to be priced and settled in US dollars.

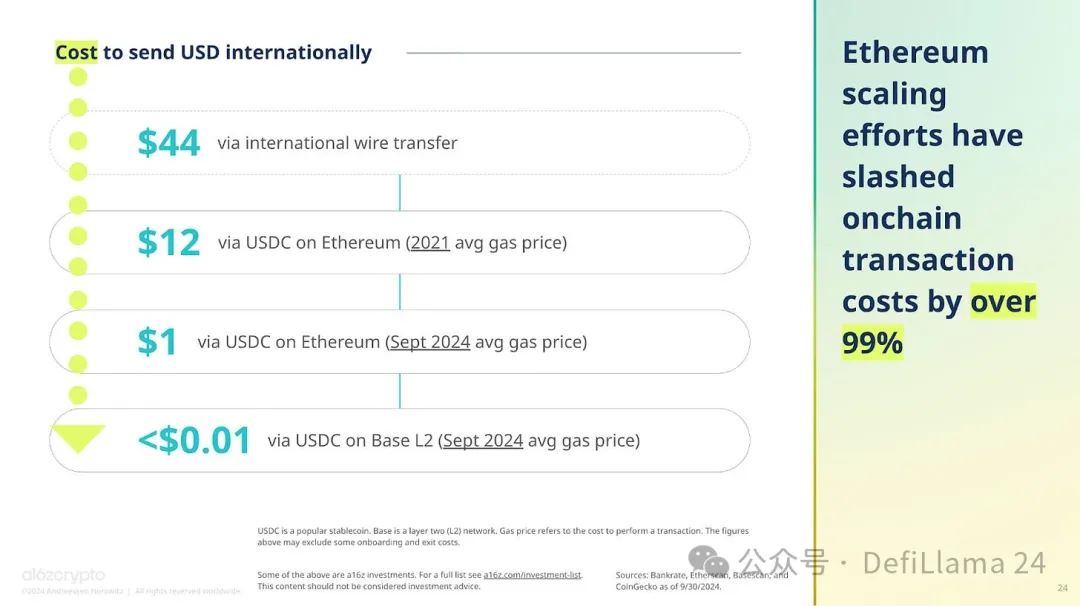

A Better Internet Money

Apps like Venmo and Cash App have revolutionized peer-to-peer payments within the US, making it simple to split dinner bills or pay rent. However, these solutions are primarily limited to domestic use. There is currently no "global Venmo" that can enable fast, convenient, low-cost international remittances. This is where stablecoins shine. They provide an inherently global solution, operating 24/7, unconstrained by borders or banking hours. Using stablecoins like USDC, sending money to anywhere in the world becomes as simple as sending a text message, and the cost is typically just a fraction of traditional international wire transfers. After the Ethereum Dencun upgrade in March, the average transaction cost on L2 networks like Base is now below $0.01. It's nearly instant and available anywhere in the world.

In other words, stablecoins like USDC on Layer 2 networks have already become the most efficient payments rail in the world. Just think about that...I'm pleased to report that we've now reduced transaction times to under one second anywhere in the world, and fees down to $0.01.

This makes crypto the best global payments rail that exists today. There are some payment rails in the traditional financial system. Some are very fast, like credit cards, but they're very expensive, charging 2% fees. Some are very cheap, like ACH, but they're very slow. Two to three business days. Right? Some are very fast and cheap, like WeChat Pay, but they only work in one country, which is China. Crypto, the crypto payments rails, like on Layer 2 networks like Base, are now the only ones I'm aware of that check all three boxes. They're fast, they're cheap, and they're global.

And that's part of why I think we're seeing 200% to 300% year-over-year growth in stablecoin transaction volumes. It's really powerful. It's not just unlocking payments, it's actually starting to unlock a whole new class of applications.

So for example, if you have fast, cheap, global payments, what might that enable? Maybe sometimes on social media, people click the like button or give some content a thumbs up. You know, why can't that be a micro-transaction? Right? In the US today, people get paid every two weeks. Why can't you get paid every hour?

Maybe the whole concept of payday loans could go away. Right? Or minute-by-minute. So if the world has a fast, cheap, global, decentralized financial system that's not controlled by any one country, I think a lot of the frictions in the economy will be eliminated, and you'll see massive adoption. Even just by eliminating a little bit of friction, you can see an order of magnitude increase in activity. Like with text messages, it used to cost $0.25.

At the peak of text messaging, there were about 250 billion messages per year. Now, with free apps like WhatsApp and iMessage, it's billions of messages per day. So just by eliminating a little bit of friction, you can see activity increase by an order of magnitude. And that's going to happen in payments as well.

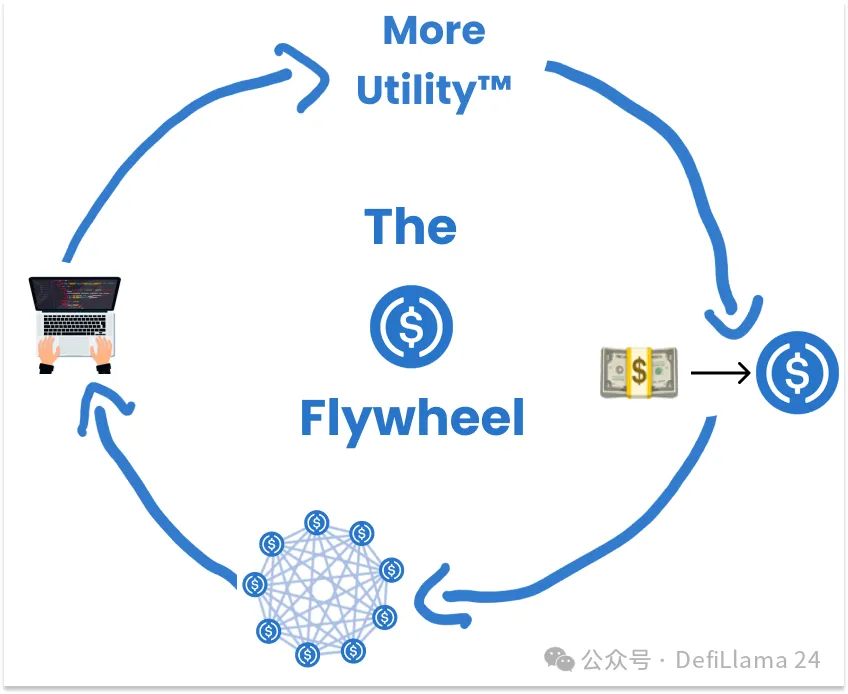

As more applications integrate stablecoin functionality, we may see network effects. Each new application that adopts a stablecoin increases the utility of the entire ecosystem, thereby incentivizing further adoption and innovation. Network effects refer to the phenomenon where the value of a product or service increases as more people use it. Think of social networks like Facebook or messaging tools like WhatsApp - their value grows exponentially with each new user. Stablecoins have the potential to generate extremely powerful network effects.

As more people start using stablecoins, more businesses will accept them, and as more businesses accept them, more people will want to use them. This virtuous cycle could lead to rapid, widespread adoption and exponential growth.

Out with the old, in with the new

When we look at the landscape of stablecoins, people often draw comparisons to the early days of the internet. Back then, many struggled to understand the transformative potential of the technology. We are in a similar stage with stablecoins now. In the "The Money Movement" podcast hosted by Jeremy Allaire, Chris Dixon said:

All new technologies tend to do two things. They tend to do old things better, and they tend to do new things that were previously impossible. Blockchain is actually a new way of building internet services, where the architecture is such that there's no gatekeeper or toll collector. Stablecoins represent a huge opportunity for entrepreneurs, developers, and innovators. The companies and protocols that successfully navigate this space could become the financial giants of the future. Here are some of the companies currently innovating in the stablecoin ecosystem:

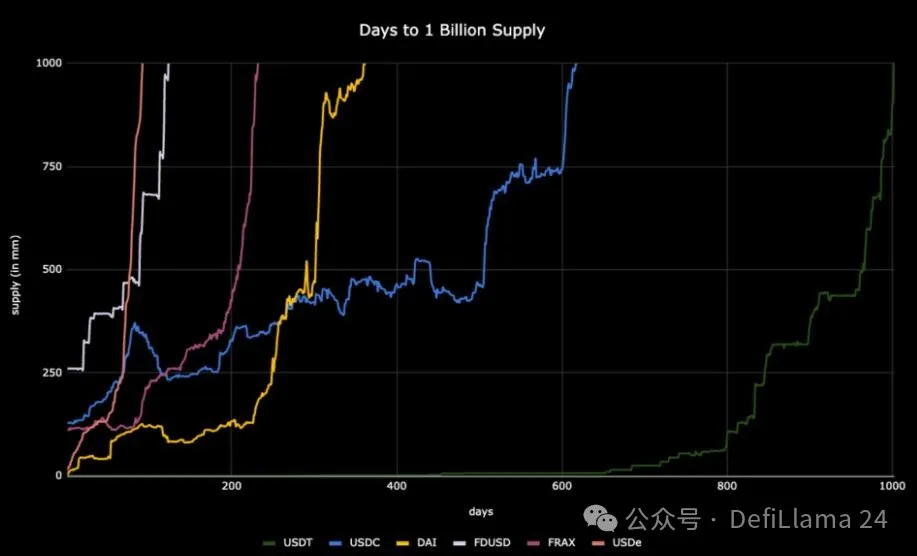

The potential is enormous. Stablecoins have the ability to reshape the financial system in a more open, efficient, and inclusive way. They may be the key to unlocking global financial inclusion, enabling new business models, and creating a more interconnected global economy. Don't blink, as this growth is happening rapidly, with several stablecoins growing their supply to over $1 billion in less than a year.

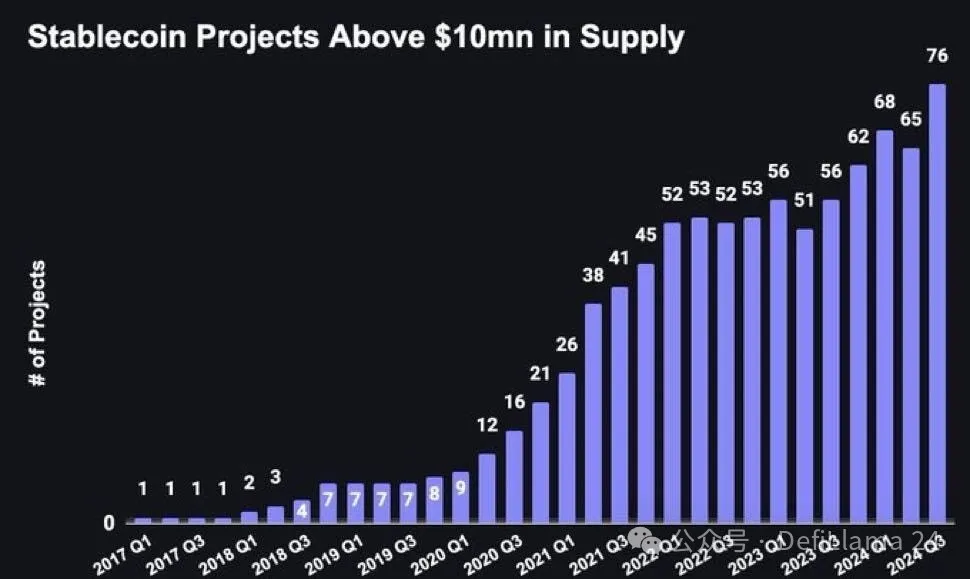

There are now over 76 stablecoin projects with a supply of over $10 million.

The potential for growth is not only massive; it is transformative on a global economic scale. And we are just getting started. We are on the threshold of a new financial era. The stablecoin revolution has only just begun, and I, for one, am eager to see where it takes us.

Until our next adventure.

Disclaimer: As a blockchain information platform, the articles published on this site represent the views of the authors and guests only, and are not related to the position of Web3Caff. The information in the articles is for reference only and does not constitute any investment advice or offer, and please comply with the relevant laws and regulations of your country or region.

Welcome to join the official Web3Caff community: X(Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram discussion group