A New Framework for Evaluating Application Defensive Capabilities

The legendary businessman Warren Buffett is well known as the king of defense, with a simple but effective heuristic for identifying defensive companies. He asks himself, "If I had $1 billion and I built a competitor to this company, could I take significant market share?"

By slightly adjusting this framework, we can apply the same logic to the crypto market, considering the structural differences mentioned above:

"If I forked this application and had a $50 million token subsidy, could I steal and maintain market share?"

By answering this question, we can naturally simulate the dynamics of competition. If the answer is yes, then it's likely just a matter of time before an emerging fork or undifferentiated competitor erodes the application's market share.

Conversely, if the answer is no, then the application possesses what I believe are the elements that every defensible crypto application should have:

Non-forkable assets

Non-subsidizable assets

To illustrate what I mean, let's use Aave as an example. If I were to fork Aave today, perhaps no one would use my forked protocol because it would lack the liquidity for users to borrow, and it would lack the users to utilize that liquidity. Thus, the TVL and the two-sided network effects supporting Aave's money markets are a "non-forkable" asset.

However, while TVL does provide a degree of defensiveness for money markets, the nuance is in asking whether these assets are also non-subsidizable. Imagine a well-capitalized team comes along, not only forking Aave but also designing a carefully crafted $50 million incentive program to acquire Aave's users.

Assuming the competitor can achieve a competitive liquidity threshold, given the inherent fungibility of money markets, there may not be much incentive to switch back to Aave.

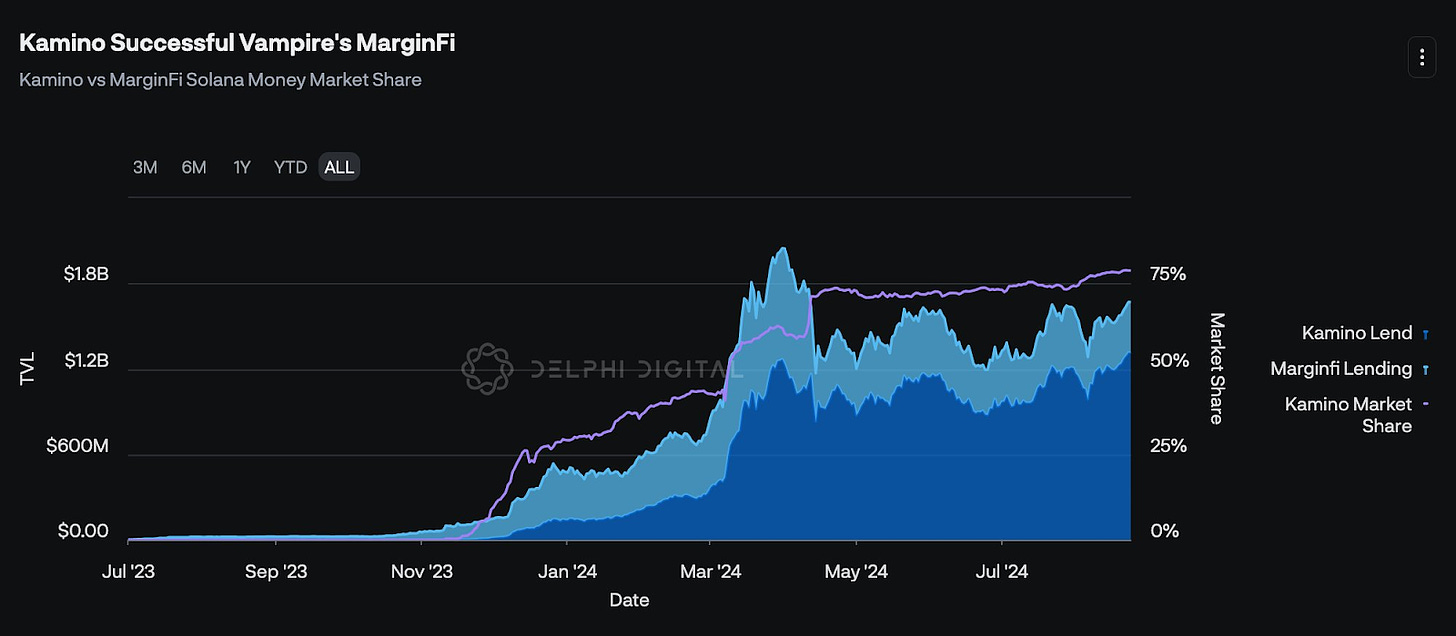

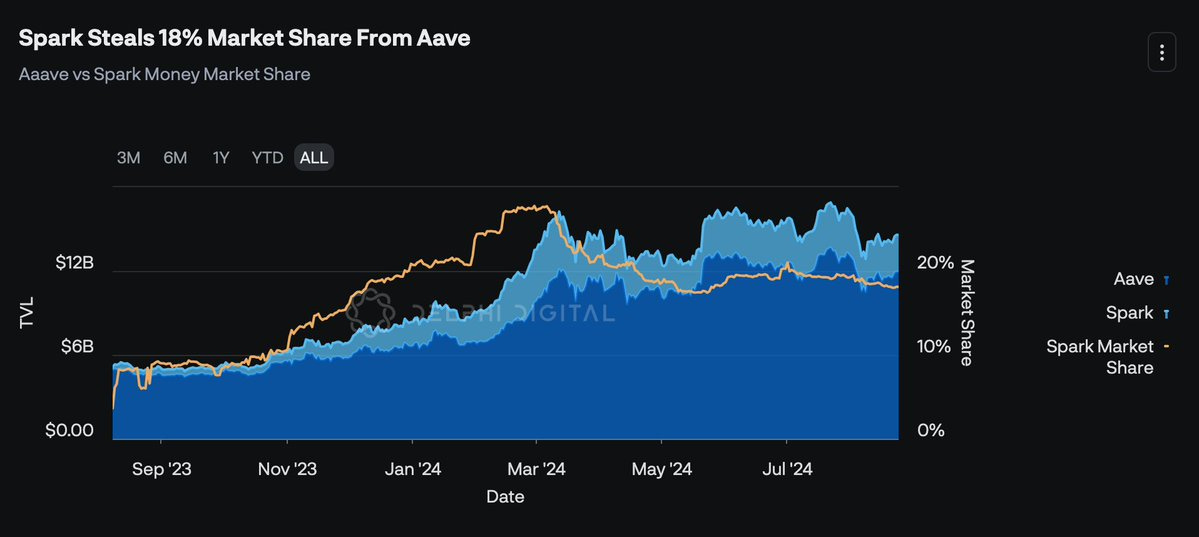

What needs to be determined is that I don't think anyone will successfully vampire Aave in the near term. Subsidizing a $12 billion TVL is a herculean task. However, I believe other money markets that haven't yet reached this scale face the risk of losing meaningful market share. Kamino provides us with the latest precedent from the Solana ecosystem.

Additionally, it's worth noting that while larger money markets like Aave may be immune to emerging competitors, they may not be entirely immune to applications seeking horizontal integration. Spark, a lending protocol for MakerDAO, has already captured over 18% of Aave's market share since launching its own Aave fork in August 2023, which can be considered a good move by MakerDAO.

Therefore, in the absence of some other non-subsidizable assets (such as CDPs embedded in the DeFi market structure), lending protocols may not be as structurally defensive as one might imagine.

Again, I ask myself - If I forked this application and had a $50 million token subsidy, could I steal and maintain market share? - I believe the answer is actually yes for most money markets.

DEXs - Decentralized Exchanges

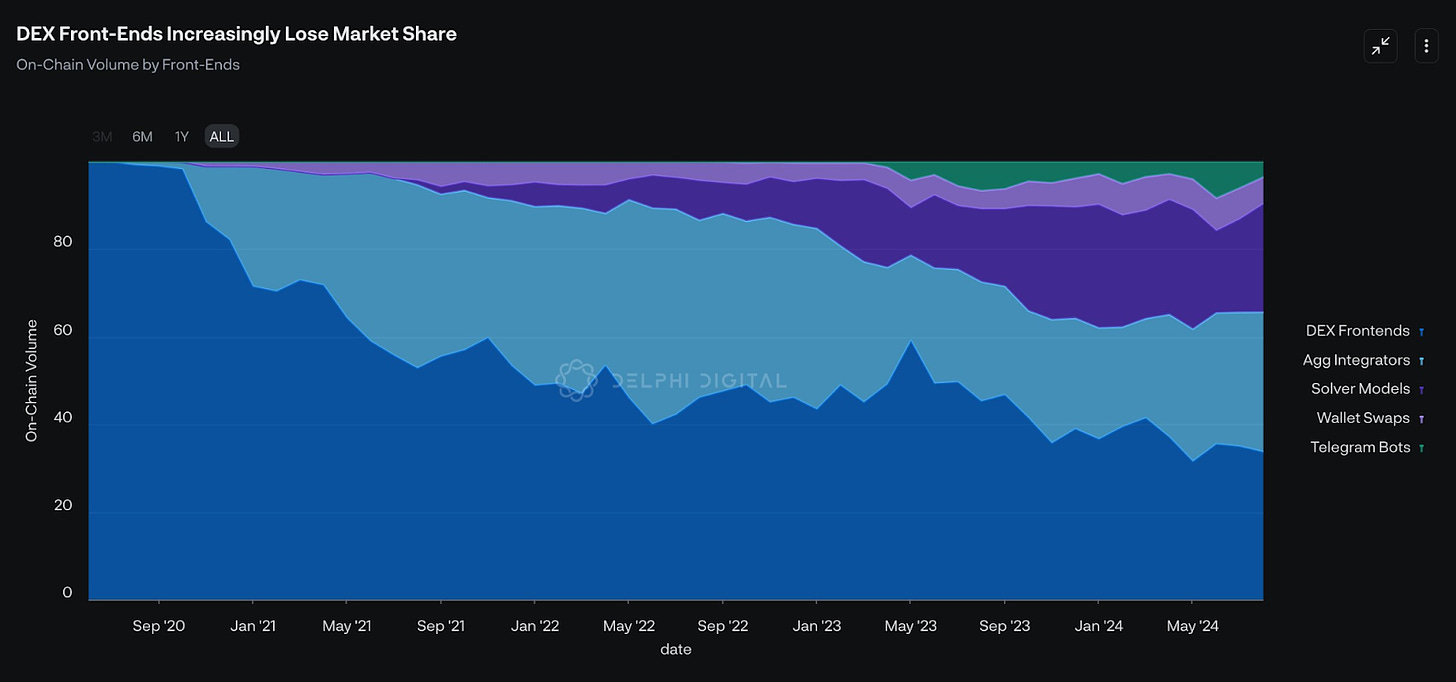

The rise of aggregators and interchangeable frontends has made the defensibility of the DEX market more nuanced. Historically, if you asked me which model is more defensible - a DEX or an aggregator - my answer would clearly be the DEX.

Fundamentally, given that the frontend is essentially just a wrapper, the switching costs between aggregators are inherently lower.

In contrast, given that DEXs have a liquidity layer, using a DEX with lower liquidity would incur higher switching costs for users in the form of slippage losses. Thus, since liquidity is non-forkable and harder to subsidize at scale, I believe DEXs are actually more defensible.

While I expect this to still hold true in the long run, I believe the ultimate equilibrium may tilt towards the frontend capturing more of the value.

My reasoning can be summarized in four points:

Liquidity is more of a commodity than you think

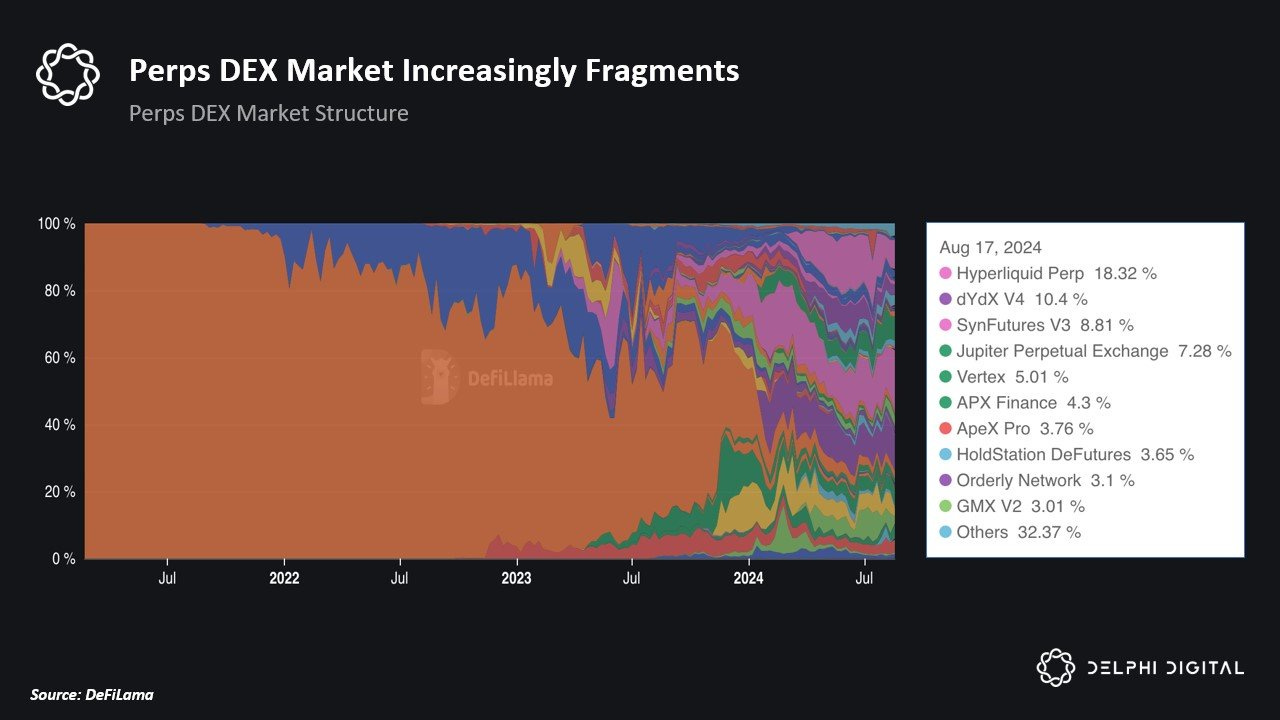

Similar to TVL, while liquidity is inherently "non-forkable", it is also not immune to subsidies. There are many historical precedents in DeFi that seem to emphasize this logic (e.g., the SushiSwap vampire attack). The unstable structure of the derivatives market also reflects that liquidity alone cannot serve as a sustainable moat.

Given the low threshold for directing liquidity, countless new derivative trading platforms have been able to quickly capture market share.

In less than 10 months, we can estimate that Hyperliquid has already become the most popular derivatives trading platform by volume, surpassing dYdX and GMX, which once each held over 50% of the entire Perps market.

Frontends are evolving

The most popular "aggregators" today are intent-based frontend interfaces. These frontends outsource to "solvers" networks that compete to provide users with the best execution.

Importantly, some intent-based DEXs also leverage off-chain liquidity sources (i.e., CEXs, market makers) to achieve this. This allows the frontend to bypass the liquidity bootstrapping stage and immediately provide competitive and often better execution. Intuitively, this also undermines on-chain liquidity as a moat for existing DEXs.

The front-end has the voice of the end-user

In the part of attracting user attention, the front-end has extremely high bargaining power. This can enable the front-end to achieve exclusive deals or vertical integration.

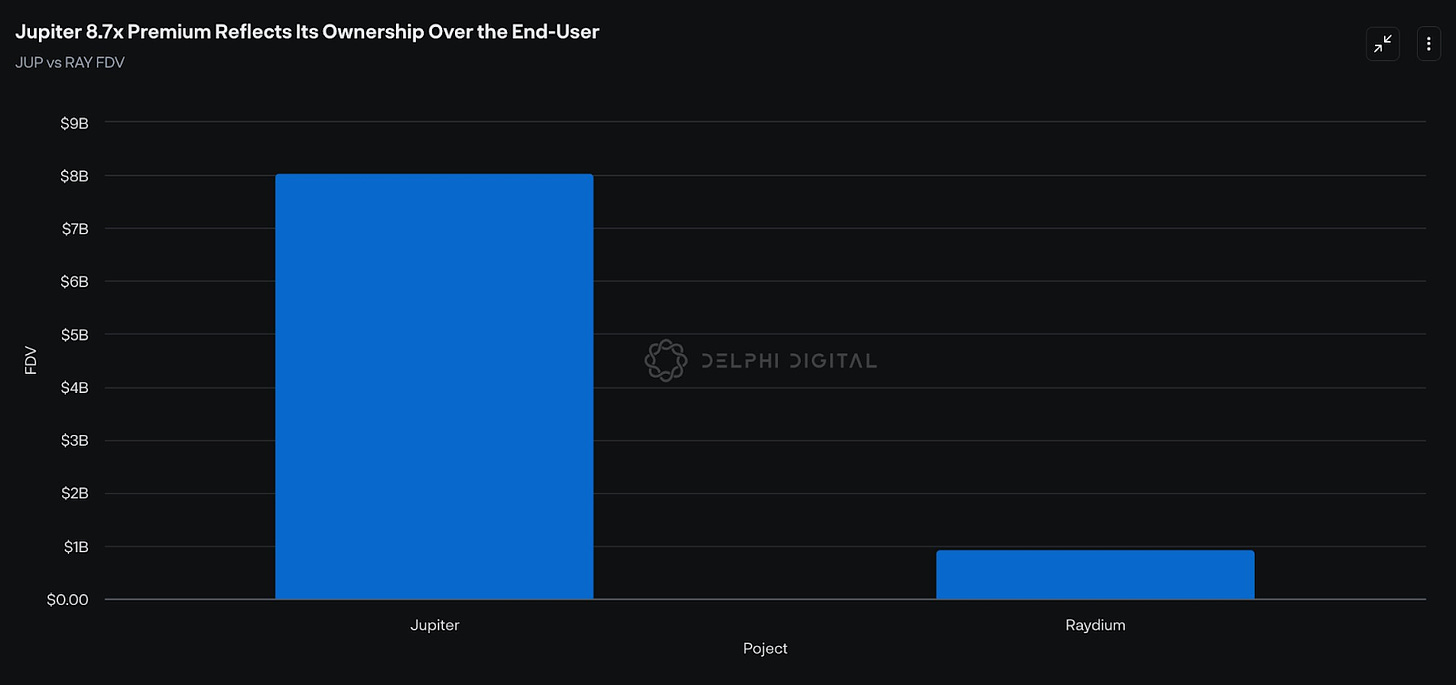

By leveraging its intuitive front-end and ownership of the end-user, Jupiter is now one of the derivative trading platforms across the chain. In addition, Jupiter has successfully integrated its own launchpad and SOL LST, and plans to build its own RFQ/solver model.

Given Jupiter's proximity to users, the premium of JUP is at least to some extent reasonable, although I expect this premium to eventually disappear one day.

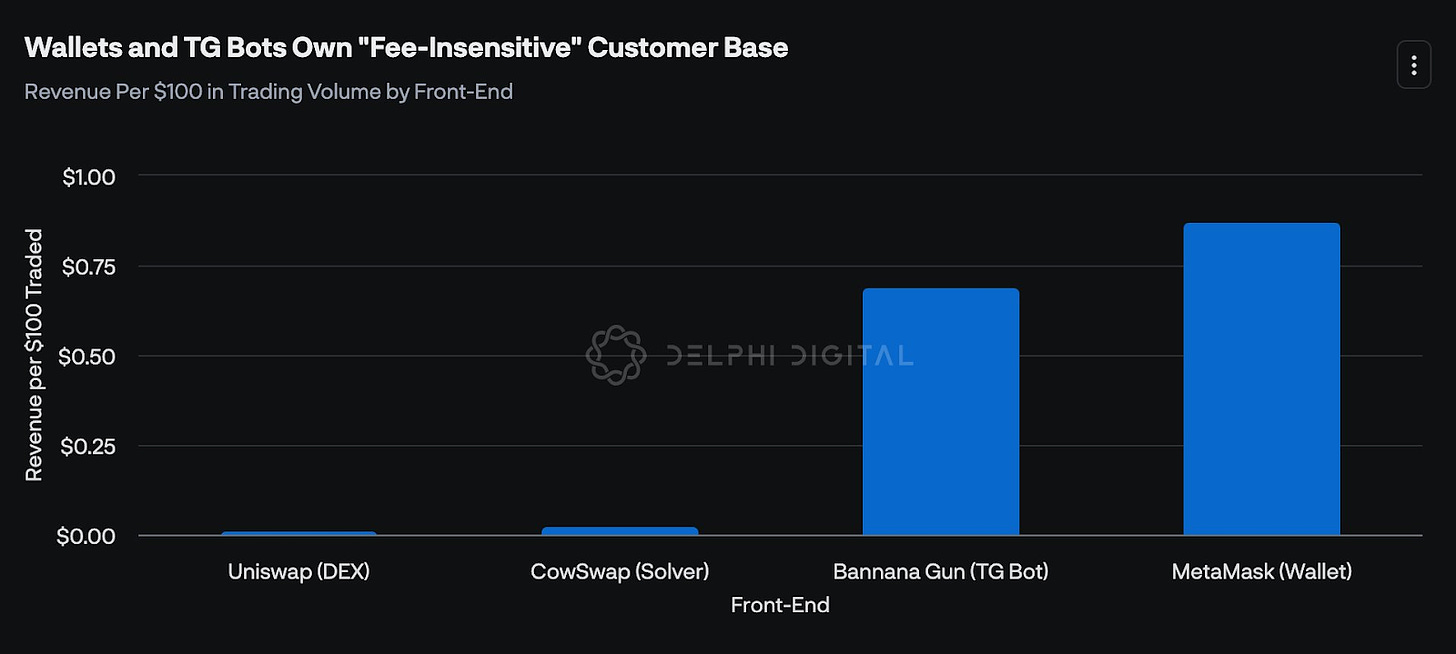

Furthermore, as the ultimate front-end, no one is closer to the user than the wallet. With the huge advantage of having retail-scale traffic on the mobile end, wallets can access the most valuable order flow - "the fee-insensitive elements". Given the relatively high switching cost of wallets, this allows wallet providers like MetaMask to earn over $290 million in fees by strategically playing the convenience card to retail, rather than fine-tuning execution cost considerations.

Furthermore, while the MEV supply chain will continue to evolve, one thing will be proven - whoever has the most unique access to order flow will see disproportionate value accretion.

In other words, all the ongoing efforts to redistribute MEV - whether at the application layer (e.g. LVR-aware DEXes) or closer to the core layer (e.g. crypto mempool, TEE, etc.) - will disproportionately benefit those closest to it.

This means protocols and applications will become increasingly "thin", while wallets and other front-ends will become "thicker" due to their proximity to the end-user.

I will elaborate on this idea in a future report titled "The Fat Wallet Thesis".

Notes:

LVR: Loss-Versus-Rebalancing

TEE: Trusted Execution Environment

Conceptualizing Application Moats

One thing that needs to be made clear is that I expect the winner-take-all network effects to continue to manifest. But I believe we are still far from that future. Therefore, in the medium to short term, isolated liquidity may continue to prove to be an ineffective moat.

Instead, I believe liquidity and TVL are more of a prerequisite, and real defensibility may come from intangible assets like brand, differentiated by better user experience, and most importantly, continuous innovation of new features and products.

This means Uniswap's ability to overcome Sushi's vampire attack is their key to "outinnovating" Sushi. Similarly, Hyperliquid's rapid rise is due to the team's ability to build what may be the most intuitive DEX ever, while continuously rolling out new features.

In short, while things like liquidity and TVL can certainly be subsidized by emerging competitors, an unstoppable team cannot. Therefore, I expect there to be a high correlation between applications that can sustainably capture value and those built by teams that never stop innovating.

In an industry where it is almost impossible to achieve a moat, this can be said to be the most powerful source of defensibility.