Comparison of USDT and USDC

Similarities and Differences between USDT and USDC

Similarities

Both are US dollar stablecoins, with prices pegged to the US dollar at 1:1

Both are issued by centralized organizations

The underlying reserve assets of both are predominantly US Treasuries

Both publicly disclose their reserve asset data and release audit reports periodically

Both are currently the mainstream and widely used stablecoins in the crypto space

Differences

The issuing entities are different, with USDT issued by Tether and USDC issued by Circle

The compliance levels of the issuing entities differ, with Circle being more compliance-focused and obtaining relevant licenses in many regions, while Tether has been more passive on compliance, facing government investigations and lawsuits, and currently facing the risk of being delisted in the EU region

Market share differs, with USDT being the largest stablecoin and USDC being the second largest

Adoption levels differ, with the two stablecoins having different numbers of trading pairs supported on various exchanges

Interest rates differ, as they are separate tokens, the deposit and lending rates vary based on market conditions

Circle has a venture capital arm, Circle Ventures, with a diverse investment portfolio including Aptos, Centrifuge, Maple Finance, LayerZero, Sui, Near, Xion, Hyperlande, Spectral, and Term Finance, covering Layer 1, DeFi protocols, infrastructure, and RWA sectors, with investments in over 90 projects

Tether and the CEO of the long-established crypto exchange Bitfinex, Jean-Louis van der Velde, are reported to have shared high-level executives, leading to past scandals of market manipulation, which have since been resolved

Summary of USDT vs USDC Differences:

Both are well-known stablecoins, with prices pegged to the US dollar at 1:1, and backed by over-collateralized real asset reserves. There is little difference in usage, but the main differences lie in the issuing companies, risk profiles, and adoption levels.

What is a Stablecoin? What are its Uses?

Cryptocurrencies typically have highly volatile prices, but stablecoins are different. Stablecoin prices are stable, with US dollar stablecoins pegged to the US dollar, always maintaining a 1:1 ratio. In usage, they can be considered the crypto version of the US dollar.

Common Stablecoin Q&A

Q: Why is there a need for price-stable stablecoins?

A: Because of their price stability, they can be used as a medium of exchange, a store of value, and for payments, allowing traders to avoid frequently converting between crypto and fiat currency to maintain value.

Q: How do stablecoins maintain price stability?

A: USDT/USDC are centralized stablecoins, issued and backed by central entities. Each issued stablecoin is fully collateralized by real assets, and users can redeem them 1:1 from the issuing entities. This full collateralization and redemption mechanism helps maintain the 1:1 peg to the US dollar.

The USDC/USDT exchange rate has remained largely stable around $1, occasionally seeing premiums of up to 0.3%, at which point large-scale arbitrage opportunities arise.

Q: So are stablecoins completely risk-free?

A: There are still risks. If the market has doubts about the collateral assets, such as suspecting asset misrepresentation by the issuing institution, or if the redemption mechanism malfunctions, such as the issuer suspending redemptions during a bank run, these could lead to the stablecoin's price depegging. However, as long as the collateral assets and redemption mechanism are functioning normally, stablecoin risk is relatively low.

Depeg: When a stablecoin's price significantly deviates from its intended peg, losing its price stability.

In the past, $USDC briefly depgged to as low as $0.88 due to the consecutive failures of Silvergate and Silicon Valley Bank in the US, leading to large-scale USDC redemptions. The price later recovered.

Source: https://afrenb.com/usdc-unanchored/

Further reading:

What to do when a stablecoin depggs? 5 strategies to earn more | Analysis of depeg, investment opportunities

Q: If the price doesn't fluctuate, how do the issuers make money? Why are they willing to issue stablecoins?

A: They earn from transaction fees + yield on the reserve assets (interest). Users pay fees when minting and redeeming stablecoins, and the reserve assets, such as US Treasuries, generate interest income for the issuers.

Further reading:

Is issuing stablecoins a good business? Tether, the USDT issuer, earned $5.2 billion in the first half of 2024, a new high

What is USDT?

USDT was first issued by Tether Limited in 2014, and is the world's first stablecoin. It is currently the third largest cryptocurrency by market cap (over $120 billion). USDT has been issued on over 70 different blockchains, with the token symbol Tether.

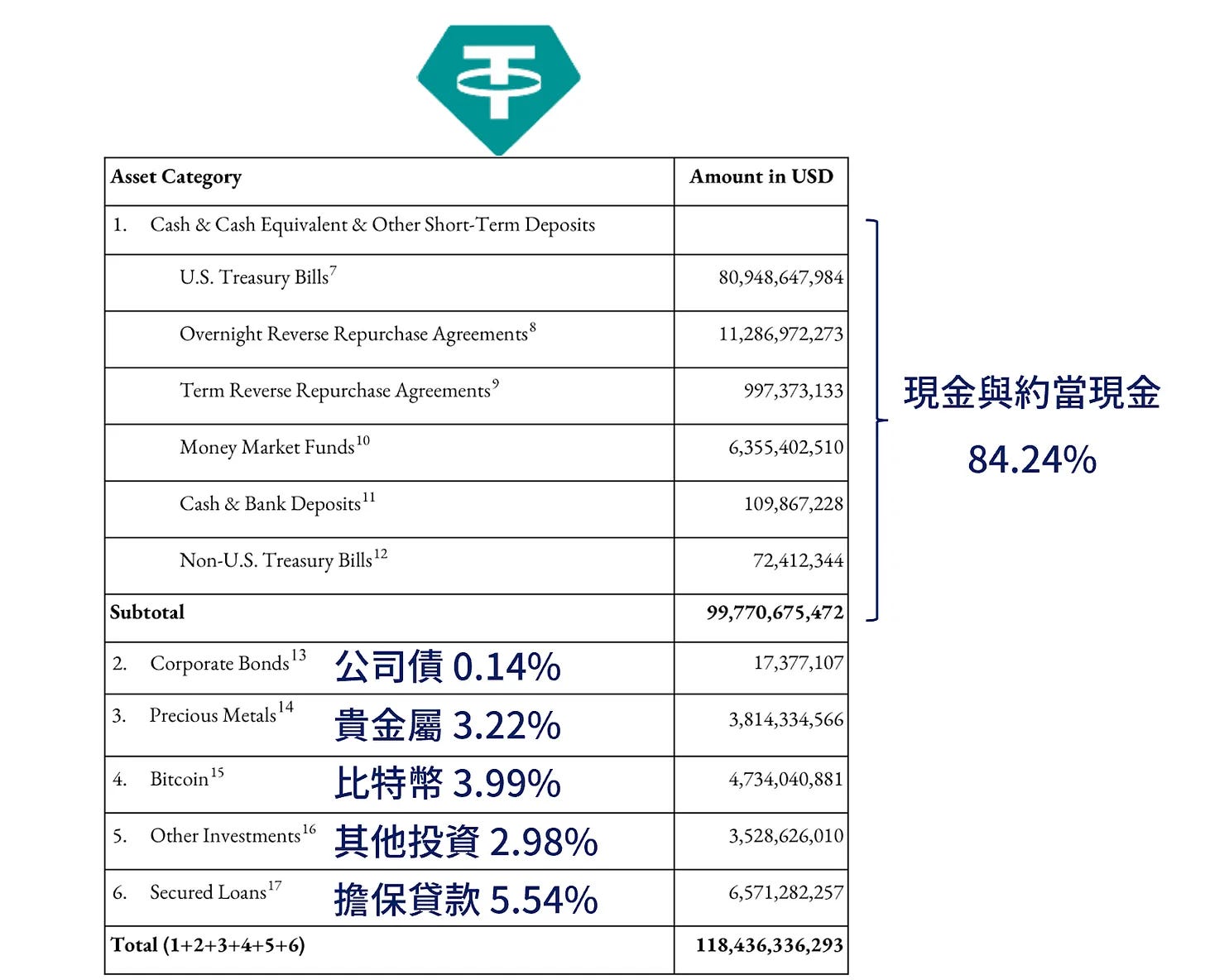

The asset reserve composition disclosed in Tether's 2024 H1 financial report:

The latest attestation reports can be found here (updated quarterly).

The USDT reserve assets are predominantly composed of highly liquid cash and cash equivalents, with US Treasuries being the largest component. In terms of the safety and liquidity of the reserve assets, the risks are not significant.

The main risk of USDT lies in Tether not being a fully compliant stablecoin issuer, carrying regulatory risks, and the company has not undergone a comprehensive audit, leaving lingering concerns about transparency.

But USDT is also the oldest and most stable stablecoin in the crypto history, having weathered several depegging risks successfully, and even survived the largest-scale bank run in the crypto world, with over $20 billion redeemed within three days, but still managed to redeem stably without any issues.

Further reading:

What is USDT? How to Safely Buy USDT Tether? Six Fraud Tactics, Risk Analysis

What is USDC

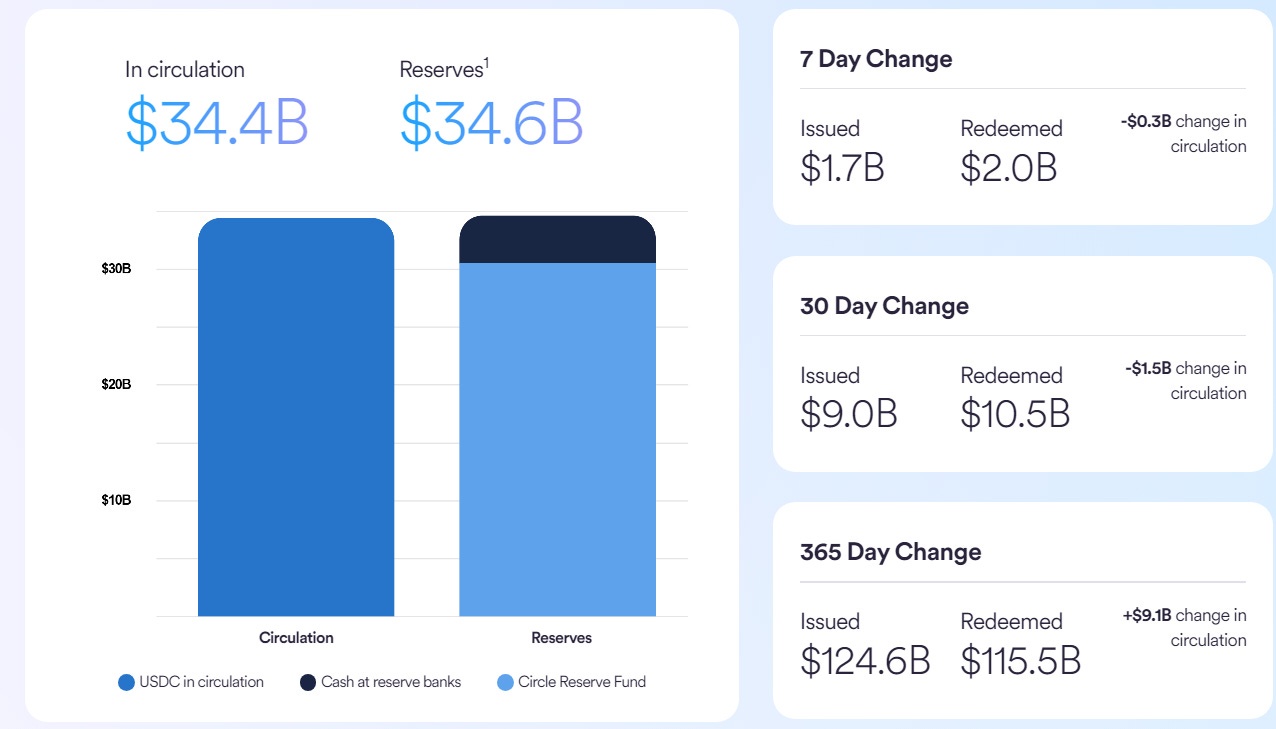

USDC is the second-largest stablecoin after USDT. If USDT is the oldest and first stablecoin, then USDC is the first "compliant" stablecoin. "Compliant" means that the issuer of USDC, Circle, is regulated by the government, meets relevant regulations, and its asset reserves are verified by the Big Four accounting firms, with monthly reserve proof reports provided.

Some common criticisms of USDT, such as non-compliance, never having undergone a comprehensive audit, and lack of transparency in the face of regulation, do not exist with USDC, although both are centralized stablecoins and have centralization risks.

View the latest published reserve reports (updated weekly) here

Compliance is the biggest feature of USDC. Recently, after the EU began implementing the MiCA (Markets in Crypto-Assets) regulation, there are clear rules for stablecoin issuers within the EU, and Circle is the first EU-compliant stablecoin issuer.

Further reading:

What is USDC? Why can it become the second-largest stablecoin? Is it safer than USDT?

USDT / USDC Stablecoin Comparison, What Are the Key Differences?

USDT | USDC | |

Price | Crypto stablecoin = 1 USD | Crypto stablecoin = 1 USD |

Market Cap | Wins with $120.2 billion (CMC) | $34.6 billion (CMC) |

Circulating on How Many Chains | Wins with 80 chains (defillama) | 79 chains (defillama) |

Number of Trading Pairs on Exchanges | Wins with 383 trading pairs on Binance | 80 trading pairs on Binance |

Issuer | Tether | Circle |

Is the Issuer Compliant | Somewhat gray, previously faced charges from the New York Attorney General, settled for $18.5 million, and also does not comply with the EU's MiCA regulation | Wins, is (licensed in multiple countries), the first European stablecoin issuer to meet MiCA standards |

Provides Reserve Proof | Yes | Yes |

Has Undergone Audit | No | Wins, Yes |

Is Fully Backed | Yes | Yes |

Are the Reserve Assets Highly Liquid | Yes, mainly composed of US Treasury bills and reverse repurchase agreements | Yes, mainly composed of short-term US Treasuries and reverse repurchase agreements |

Depegging History | Last major depegging was in 2017, dropping to around 0.92 | Last major depegging was in early 2023, dropping to 0.87 |

Similarities: Prices are mostly stable, both have experienced short-term depegging, both provide periodic reserve reports, both are fully backed, both have highly liquid reserve assets, both have wide distribution on chains

Differences: USDT has a larger market cap and more trading pairs on exchanges; USDC issuer Circle holds licenses in multiple countries, is a compliant stablecoin issuer, and has undergone audits

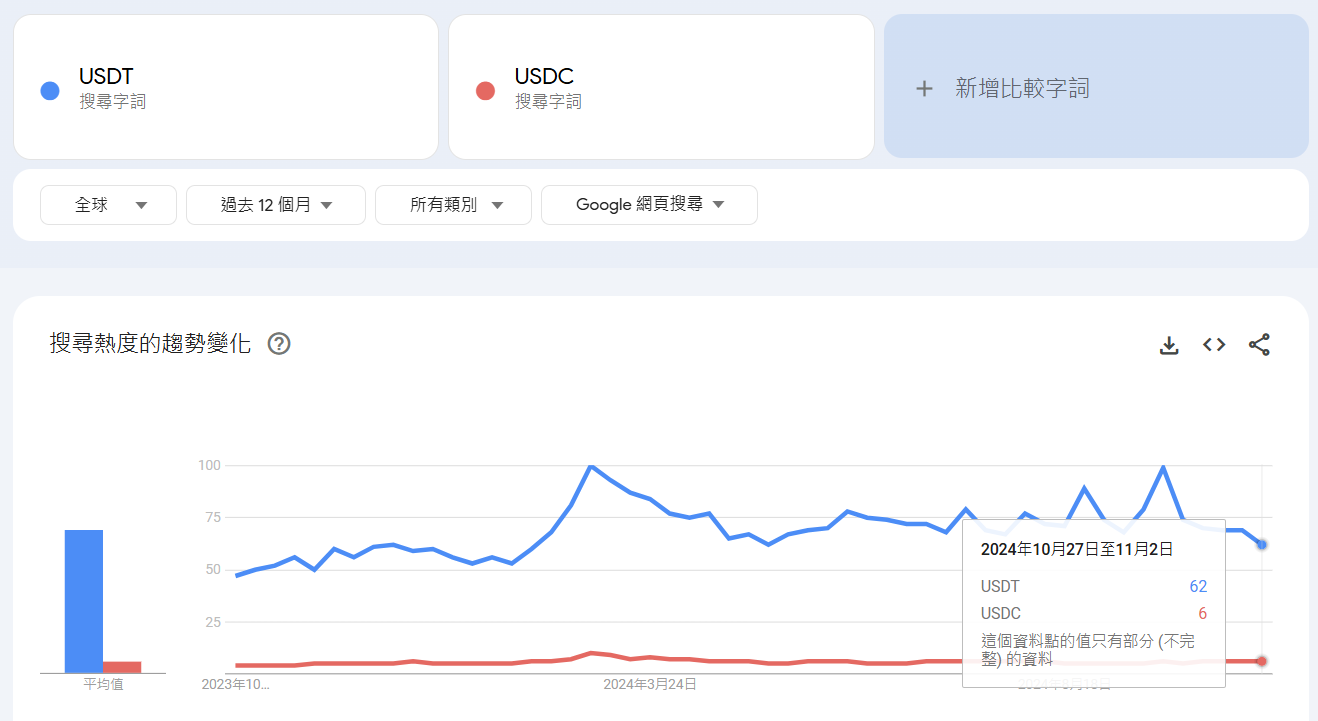

USDT / USDC Brand Awareness Gap

Comparing Google trend search trends, the search volume difference between the two is over 10 times.

USDT / USDC Pros and Cons Comparison and Usage Recommendations

USDT

Pros: Largest and most well-known, with the most use cases

Cons: Fraudsters also use it the most frequently, in a gray area when it comes to regulationUSDC

Pros: Compliant, with sufficient ubiquity and convenience in general

Cons: Lower brand awareness, fewer trading pair support

As a medium of exchange for buying other cryptocurrencies, USDT has more trading pair support on exchanges, making transactions more convenient.

For short-term capital parking, there is not much difference, you can look at which one has a higher current yield.

In terms of long-term holding risk considerations, the future development is uncertain, but based on current information, Circle is a more compliant issuer, has also undergone audits, and faces lower regulatory and centralization risks.

Key point: Risks are all relative, absolute risks are never zero, the ideal situation is to diversify holdings, don't put all your eggs in one basket.

Are there other stablecoins?

There are actually many stablecoins, in addition to centralized stablecoins like USDT and USDC (issued by central institutions), there are also decentralized stablecoins issued by smart contracts; and in addition to stablecoins pegged to the US dollar, there are also stablecoins pegged to other fiat currencies, such as EURC pegged to the Euro.

Further reading:

What is a stablecoin? Introduction to 10 mainstream stablecoins | Analysis of fraud, de-pegging, and collapse risks

The most important key to stablecoins is price stability, so when evaluating stablecoins, the most important thing is to first check their price anchoring mechanism. Currently, the most stable approach is through collateralized asset backing, so the focus should be on the asset reserve status and redemption mechanism. If there are any doubts or you are not very clear, it is recommended not to use it, or only for very short-term parking. For long-term holding of stablecoins, you must find safer and more stable ones.

Stablecoin application scenarios

In addition to use in trading, the potential future scenarios for stablecoins: settlement and payment

Stablecoins + blockchain can greatly accelerate cross-border settlement speed and reduce costs, some payment giants have also started to research this track, and even started to launch their own stablecoins, such as PayPal's PYUSD:

PayPal Stablecoin PYUSD: Best Use Cases, Purchase Channels and Security Concerns Analyzed