Author: Ares, Jinse Finance

On October 29, BTC returned above $71,500, hitting a new high since June 7 this year, and is poised to surpass the previous all-time high of $73,777.

At the same time, the total crypto market cap has also rebounded and exceeded $2.5 trillion. Many analysis institutions believe that the hot market is mainly driven by Trump's victory, but there is still about a week left before the final result of the US election is announced, and it is still uncertain who will win. From the current financial market reaction, the "Trump trade" is very obvious, but investors still need to be wary of potential market risks.

I. The US election is approaching, who will have the last laugh?

The Bitfinex Alpha report shows that Bitcoin volatility has risen, with election factors becoming a key influence. Bitcoin rebounded after fluctuating 6.2% last week, driven by geopolitics and the Trump election trade. The election expectations have led to active options trading, and the implied volatility after the election day may reach 100 per day. However, despite the increase in short-term volatility, Bitcoin has risen 30% since the September low, reaching a high of over $71,500 as of the writing.

On the data level, Deribit data shows that the number of Bitcoin call options expiring on November 8 is twice the number of put options.

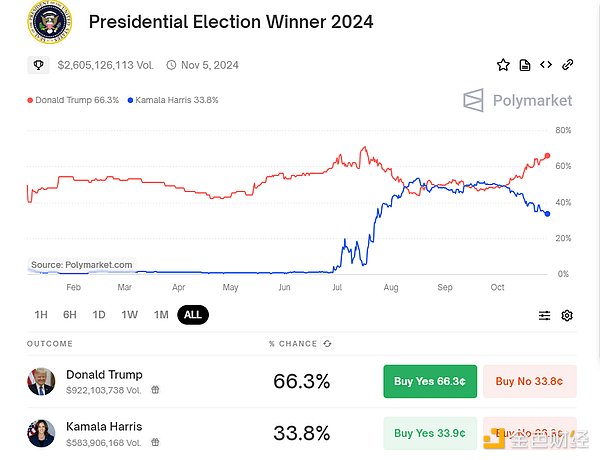

Currently, the prediction market Polymarket shows that the probability of Trump winning the US presidential election has risen to 66.3%, while the probability of Harris winning has dropped to 33.7%, with Trump leading by 32.6 percentage points.

And Trump's recent poll support rate has also surpassed Harris for the first time since early August.

The RealClearPolitcs platform's average poll as of October 28 shows that Trump has a slight 0.2 percentage point advantage over Harris. Their support rates are 48.6% and 48.4% respectively. As of October 23, Harris was still leading Trump 49.1% to 48.5%.

In addition, according to the calculation results published on the website of Florida State University, more than 43.3 million American citizens have voted early for the presidential election to be held on November 5. In the few remaining pre-election days, if there is no major "October surprise", the main tone of the final stage of the election will remain deadlocked.

However, the "Trump trade" in the financial market is already very obvious, especially in the crypto market, with BTC first reaching $71,500.

On October 29, the three major US stock indexes collectively closed higher, with crypto concept stocks generally rising, among which MARA Holdings rose 11%, Riot Platforms rose nearly 10%, and MicroStrategy rose nearly 9%. In addition, the Trump Media & Technology Group (DJT.O) rose 21.6%.

In the crypto field, Trump-themed meme coins have seen a general rise. The Trump family crypto project World Liberty Financial (WLFI) has also announced a stablecoin issuance plan.

Meanwhile, legendary analyst Martin Armstrong predicts that Trump will win the election by a landslide, and that Harris's real support rate has actually dropped to 6.5% to 7.5%. The Democratic Party's "deep state" has entered a panic mode.

On the trading side, large funds are also choosing to bet on Trump. On October 29, a whale invested another 1 million USDC to bet on Trump winning the US election. Over the past 4 days, this whale has spent 5 million USDC to purchase 7.54 million "shares" of Trump winning the US election.

II. A historic week: the battle between bulls and bears rages on

Currently, Bitcoin has returned above $70,000, just $2,000 away from its all-time high. Many investors generally expect that it will break the previous high and refresh the historical record before the US election. However, there are also some opposing institutional views that the current market still faces many uncertainties, especially the possibility of a correction after the election.

1. Bullish

Bloomberg ETF analyst: The SOL and XRP ETF listing applications are "call options on a Trump victory". Furthermore, if Trump wins... he will certainly appoint a more libertarian SEC chairman.

Arthur Hayes: The family office Maelstrom has invested 5% of its funds in USDe, maintaining a large long position in cryptocurrencies. They are using the USDe stablecoin from Ethena Lab to hedge against uncertainty, while maintaining large bullish bets on Bitcoin, Ethereum and other cryptocurrencies.

Matrixport: The US election may become a key catalyst for the crypto market. South Korea is known for its active altcoin trading, but the current trading volume is still sluggish, and the possibility of a significant altcoin rebound is not high. Bitcoin's funding rate has always been consistent with the trading volume trend in South Korea, and a higher funding rate usually attracts hedge funds to buy ETFs to earn the spread.

However, the current Bitcoin funding rate, South Korean trading volume, and Bitcoin spot ETF buying volume are all lower than the levels in March 2024. The US presidential election next week may become a key catalyst to ignite new momentum in the market.

Trader Eugene: The market will continue to rise after the election, and he is bullish on Solana, with the speculative long positions in October basically wiped out.

DWF Labs co-founder: The next two quarters will be a bullish cycle, the market is still unstable but the overall direction is positive. October (Uptober) is the first month of the bullish cycle from Q4 2024 to Q1 2025. The market is still very unstable, but the direction is positive.

As an activist, BlackRock has bought an additional 34,085 Bitcoins worth about $2.3 billion in the past two weeks. The company currently holds over 400,000 Bitcoins worth nearly $26.98 billion.

2. Bearish: A sell-off may occur after the election

Temasek International's Chief Investment Officer: If Trump returns to the White House, it may not have a positive impact on the global economy and financial markets. He pointed out that the policies of the Trump administration will lead to a slowdown in global economic growth, which will ultimately affect US companies as well. He also warned that higher interest rates and a stronger US dollar will have an adverse impact on emerging markets.

Nomura: In the event of a "Harris election deadlock/Congress split" scenario, all asset classes will face reversal risks, with some upside room for US Treasuries and short-term interest rates, as well as the risk of unwinding bets on Trump sweeping the "overheated economy" and deregulation theme stocks; the gold/crypto trade under the "Harris deadlock" will be squeezed; if the Democrats sweep Congress in a "blue wave", the stock market may fall 7-10% in the next one to three months.

Columbia Business School professor: Trump becoming US president may have a "negative" impact on Memecoins, as they are a form of "economic populism and a statement against unfairness". "US regulation will be unfavorable to Memecoins, and most people have lost money on Memecoins.

Greeks.live macro researcher: Market attention to this US election is lower than expected, Friday's non-farm data and unemployment rate data are worth watching, the last important economic data before the election, and Fed officials have almost no speaking engagements scheduled. As the election approaches, market attention to this election is lower than expected, but there is still a high degree of uncertainty.

"Fed mouthpiece": The US election may face new inflation risks. The Fed's two-and-a-half-year battle to curb inflation seems to have been successful, but the US election could change this situation. Both candidates support policies that promote economic growth, and these policies may prevent inflation from falling further. However, economists, and even conservative advisers, are concerned that Trump's views in particular are likely to ignite the flames of inflation. This includes his proposals to impose across-the-board tariffs on imported goods, expel workers, and rely on the Fed to lower interest rates.

In summary, these policies all point towards inflation. Trump's proposals may put him in a new conflict with the Fed, whose task is to maintain low inflation. Any factors that could reignite inflation could lead officials to slow down or even halt their rate cut plans.

Economist Peter Schiff: Bitcoin may fall due to the "Trump sell-off wave". As Trump's approval rating rises, Bitcoin has not followed the rise of other Trump-related assets, possibly because speculators have already bought in advance, leading to weaker demand. He predicts that Bitcoin may face a "Trump sell-off wave" and believes that under inflationary pressure, gold's hedging advantage is more prominent and is entering a bull market. Tyr Capital Chief Investment Officer: Bitcoin may face selling pressure after the US election. Bitcoin prices may surge significantly before the November 5th US election, but after the election results are announced, there may be selling pressure due to profit-taking. International Monetary Fund (IMF): The world faces the risk of low growth and high debt. The world is in danger of falling into a path of low growth and high debt, which will reduce the resources that governments can use to improve opportunities for their people, address climate change and other challenges. The upcoming US presidential election on November 5th has raised concerns that Americans facing high inflation during the Democratic President Biden's tenure may allow Republican candidate Trump to return to the White House, ushering in a new era of protectionist policies and further increasing US debt by trillions of dollars.