Author: bitsCrunch

Recently, BTC has broken through the $70,000 mark again, and the market's greed index has reached 80 again. Meme coins are often the bugle call for each bull market surge, such as $GOAT, which rose more than 10,000 times in price within 5 days. Through the analysis of the trading data of the current market TOP 25 Meme coins, we have found several noteworthy market characteristics and evolutionary trends.

Meme Market Characteristics

Layered Holding Addresses

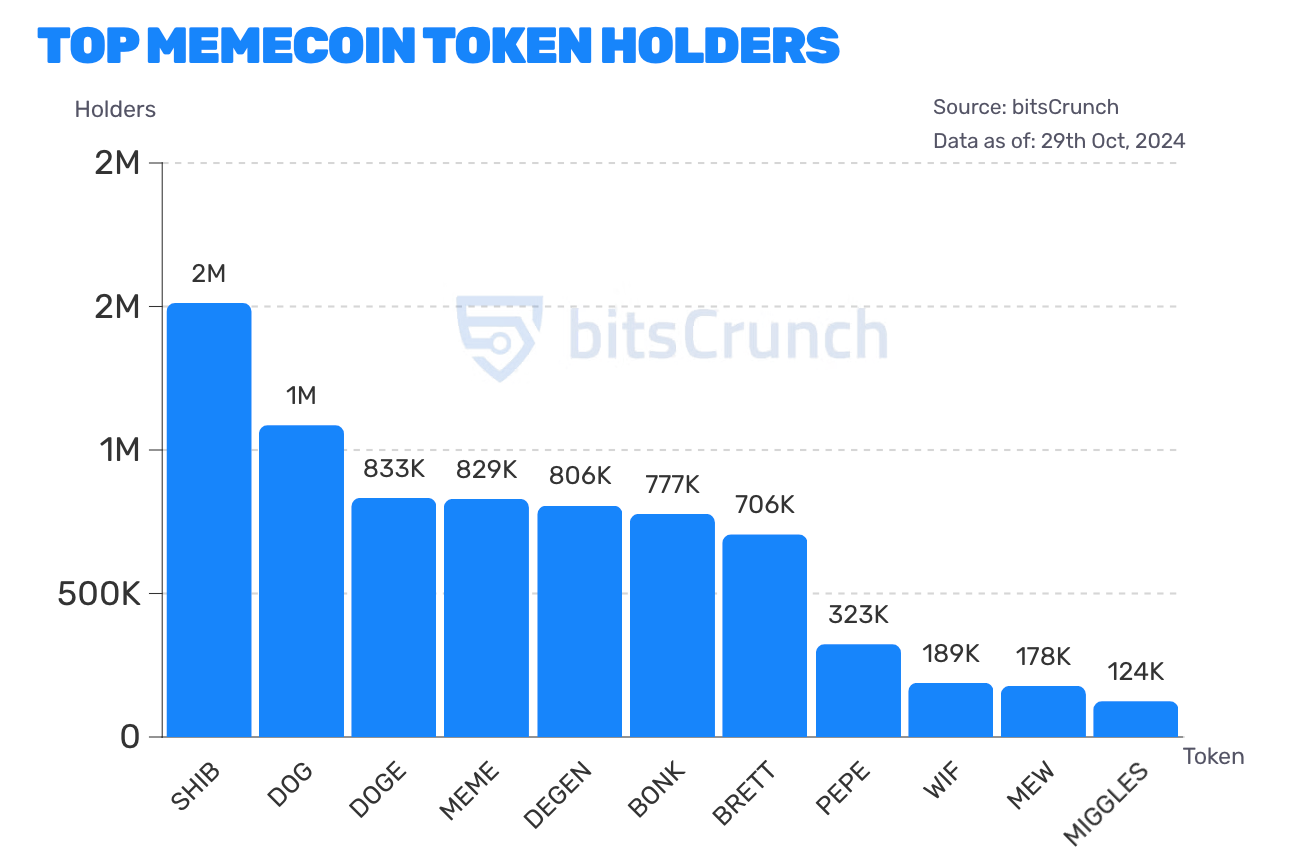

In terms of the number of holders, SHIB, DOG, DOGE, MEME, and DEGEN have more than 800,000 holding addresses, with SHIB taking the lead with 1.51 million addresses, about 400,000 more than the second-place DOG. At the same time, these projects also occupy a relatively high trading volume in the overall market.

The number of holding addresses for BONK and BRETT is over 700,000, while the number for projects like PEPE and WIF is 320,000 and 180,000 respectively. However, it is worth noting that the 30-day growth in the number of holding addresses for these two projects is 3.02% and 4.86% respectively, which is higher than the growth of all the Meme coins with the most holders.

It is worth noting that according to bitsCrunch data, MEW and MIGGLES are the only two remaining Meme coins with holding addresses over 100,000, and MIGGLES' growth in the last 30 days has reached 26.55%. Tokens such as HIGHER, FLOKI, POPCAT, MOCHI, PONKE, MOODENG, and MYRO make up the projects in the 50,000-100,000 holding address range, but their liquidity is relatively limited.

Liquidity Layering

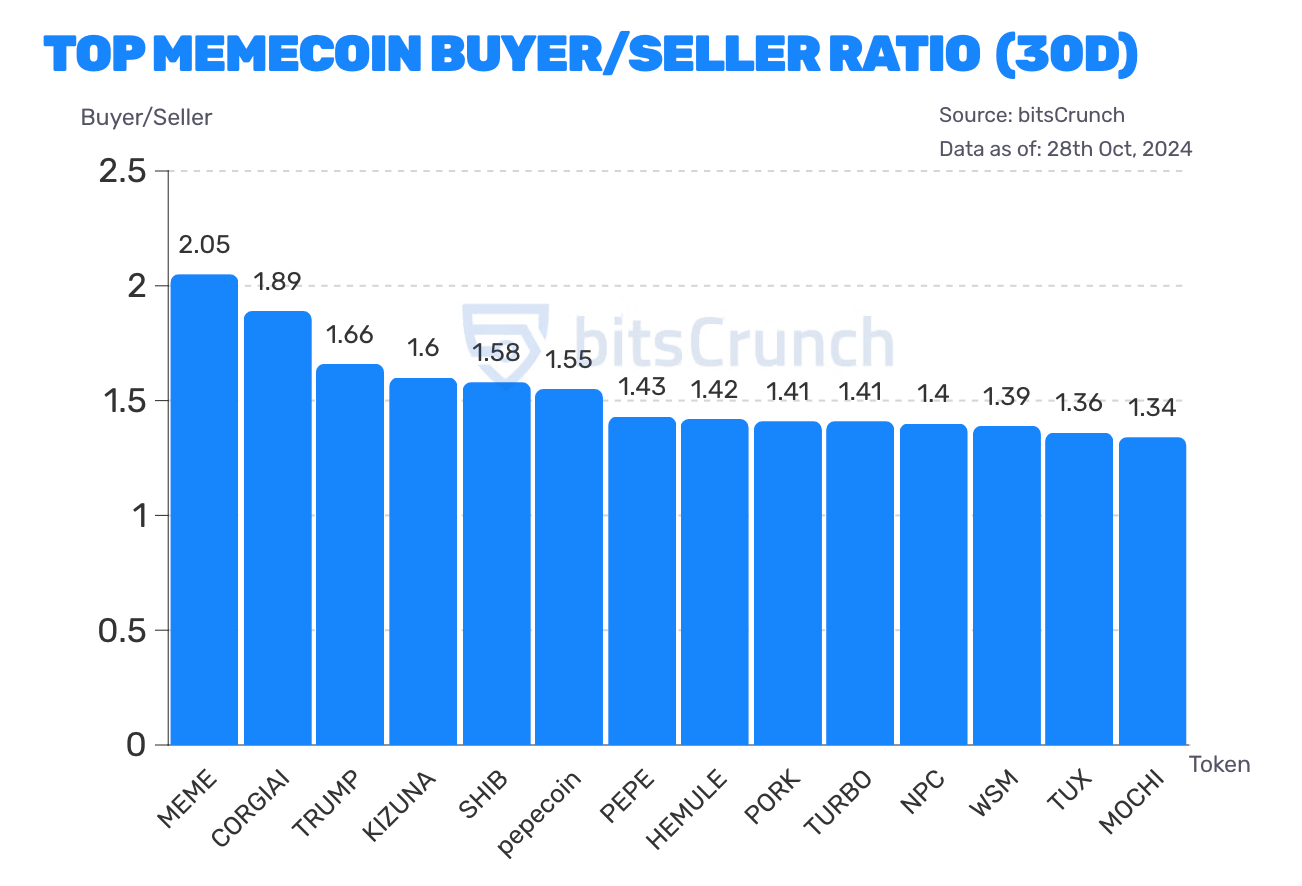

Meme coin prices are strongly correlated with social hot spots. According to the buy-sell ratio index, we found that TRUMP's index is 1.66, with a price increase of 15.9%. This is highly related to the recent US political election event.

SHIB and WIF had the largest trading volumes in the past 7 days, at 70.2 billion and 67.3 billion respectively, ranking first and far exceeding the third and fourth places. By comparing trading volume and price volatility, we found that the projects with high trading volume rankings (such as SHIB and DOGE) have relatively moderate price volatility, while the projects with smaller trading volumes often have greater volatility.

It can be seen that large-cap Meme coins are gradually acquiring the attribute of "value storage", and investors have a stronger tendency to hold them. Many investors have adopted a "buy-the-dip" strategy, and the head effect will be further strengthened. Small-cap Meme coins, on the other hand, play more of a speculative tool role, with stronger short-term speculative characteristics. Liquidity layering will become more pronounced, which may lead to further polarization of the market.

The rate of address and price changes reflects the instant changes in liquidity. According to bitsCrunch data, HIGHER and MOODENG have experienced a short-term liquidity increase of 2.32% and 1.98% respectively, and this abnormal influx of liquidity often signals potential price volatility.

In contrast, TURBO and PONKE have experienced liquidity outflows of -0.31% and -0.13% respectively. This slow but persistent liquidity outflow may indicate a gradual weakening of market confidence.

For investors, this means that they need to assess the liquidity risk of projects more carefully, rather than just focusing on price fluctuations. In this rapidly evolving market, the importance of risk management may exceed the pursuit of returns.

Ecological Analysis Framework

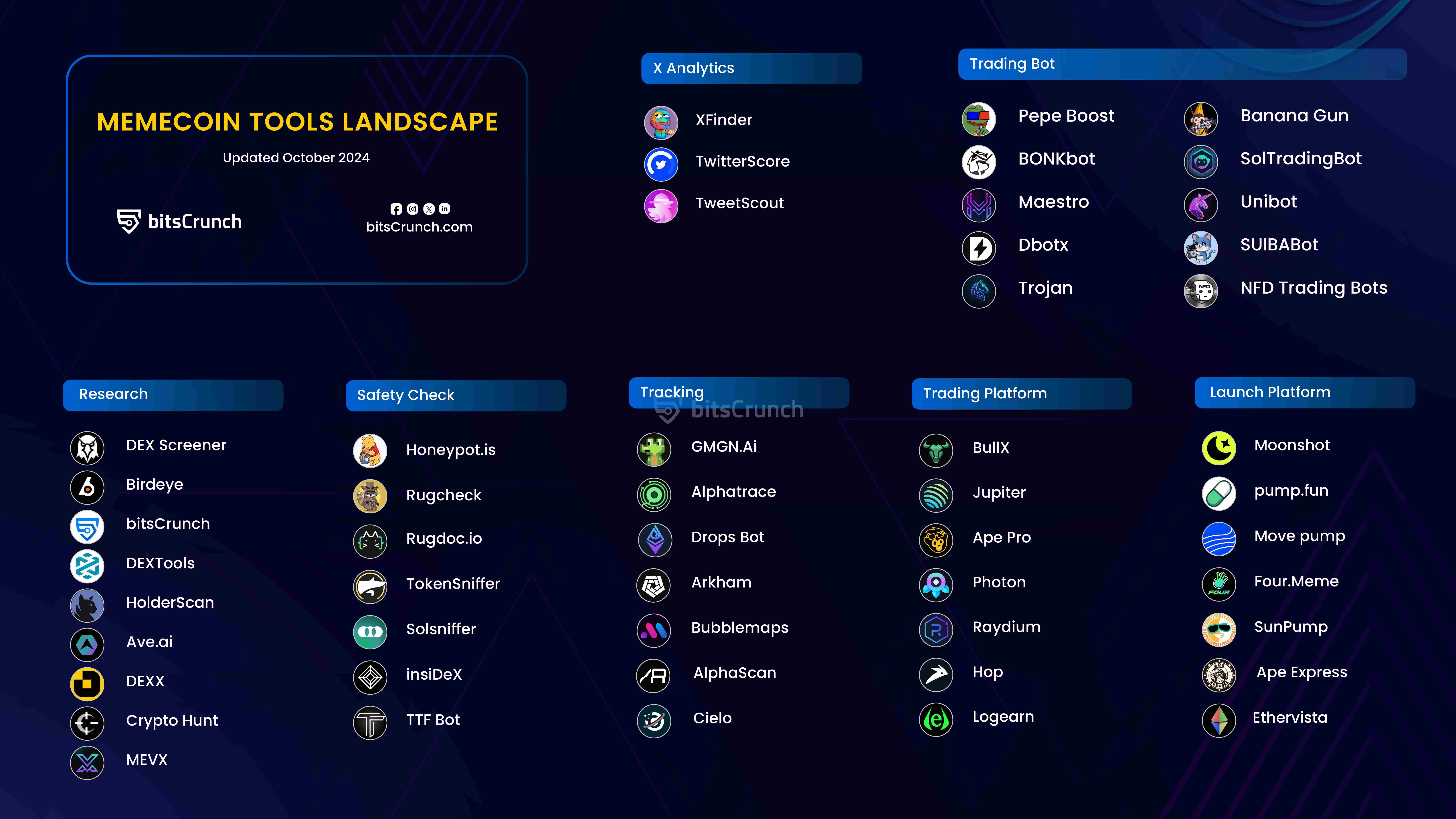

The Meme Tool Ecosystem Panorama presents the five core modules of the entire industry: research tools, security checks, tracking systems, trading platforms, and issuance platforms.

Trading Security Data Analysis

From the current market data, authenticity verification and contract security assessment have become the primary steps in investment decision-making. The rampant market manipulation in the Meme coin trading market often hides two possibilities: one is that the project party tries to boost trading activity to get on the trend list of DEX Screener; the other is that bots are manipulating the market. Therefore, it is necessary to identify real community interactions before trading.

Through the contract analysis of the holding addresses of Meme coin projects, several risk issues have been found, one is the excessively high concentration of permissions, the second is the lack of liquidity locking, and the third is the large overlap of holding addresses.

Specifically, one core address has frequent interactions with multiple dispersed addresses. This pattern is particularly common in some emerging projects with abnormal 24-hour price increases, often indicating the risk of centralized market manipulation. Secondly, it is necessary to monitor whether there are complex fund flows between multiple large holding addresses, which may be due to the operation of a large speculative group in the background.

Therefore, for Meme coin newcomers, it is necessary to focus on observing the degree of decentralized holdings, which is more common in mature projects like SHIB or PEPE. However, it is worth noting that even for these projects, the TOP100 addresses still control the vast majority of the supply.

Social Impact Analysis

Generally speaking, a successful Meme coin project needs to be endorsed by at least 3-5 KOLs with over 100,000 followers on average. But this indicator is changing.

Currently, a large number of followers is no longer a decisive factor. For example, HIGHER, although only supported by medium-sized KOLs, has a stronger upward ability. This reflects that the market is shifting towards de-KOLization. The time distribution of KOL endorsements has an important impact on the project's trend. Projects that obtain multiple KOL endorsements in a concentrated period of time often perform worse than those with endorsements scattered over different periods.

Key Indicator System

Based on statistical analysis of successful cases, we have summarized the following key indicator system:

Trading volume indicator: Stable projects should have organic trading volume (excluding bot trading) of $500-1,000 within the first hour of launch. This threshold is lower than the industry's usual $1,000-2,000, but we found that a lower initial threshold is more conducive to the project's sustained development.

Market cap threshold: $100,000 is a critical psychological barrier. Data shows that 87% of successful projects only started to achieve substantial growth after breaking through this market cap. However, it is worth noting that this threshold varies in different tracks. For example, Meme coins with an AI theme often require a higher starting market cap.

Supply distribution: The founder's holding ratio is an important indicator. Statistics show that when the founder's holding is less than 5%, the project's survival rate is significantly higher. This may be because lower team holdings reduce the risk of sell-offs and increase community confidence.

Risk Warning Mechanism

First, basic indicator monitoring. Tracking trading volume, holding distribution, price fluctuations and other basic data in real-time, and setting abnormal volatility alarm thresholds.

Second, on-chain behavior analysis. Monitor the abnormal movements of large addresses, especially the interactions with known risky addresses. At the same time, track the changes in liquidity pools and warn of potential sell-off behavior. Also, establish a dynamic stop-loss system based on the different development stages of the project.

Third, social signal monitoring, establish a KOL library, and identify possible market manipulation signals. Pay special attention to abnormal activity on social media, look for opportunities on new public chains, and diversify the investment portfolio.

Through a large amount of data and market observation, we hope to provide investors entering the Meme market with a comprehensive market overview and systematic analysis framework. However, it needs to be emphasized that this article does not constitute investment advice, and any framework needs to be constantly adjusted and improved according to market changes. Since Meme is a high-risk, high-return market model, risk monitoring should be emphasized before trading.