Recently, Castle Island Ventures general partner Nic Carter retweeted a tweet by Columbia Business School adjunct professor Omid Malekan, suggesting that the meme coin frenzy may begin to subside after Donald Trump wins the US presidential election.

Table of Contents

ToggleWill meme coins face a bear market after Trump's victory?

The theoretical basis is that meme coins are essentially a product of a harsh regulatory environment, as the strict regulatory policies of the US Securities and Exchange Commission (SEC) have limited the financing and issuance models of cryptocurrencies, and many functions that could give tokens value (such as fee switches, token dividends, airdrops, etc.) are also difficult to implement, so investors prefer to invest in the speculation of meme coins.

However, if the Republican Party takes power, it will create a favorable regulatory environment for the cryptocurrency market, and once the US regulatory environment becomes more rational, the focus of the cryptocurrency market will shift back to dApps and other truly meaningful applications, leading to a significant reduction in the trading demand for meme coins.

Cobie: Regulation is not the problem, the financing structure is the key

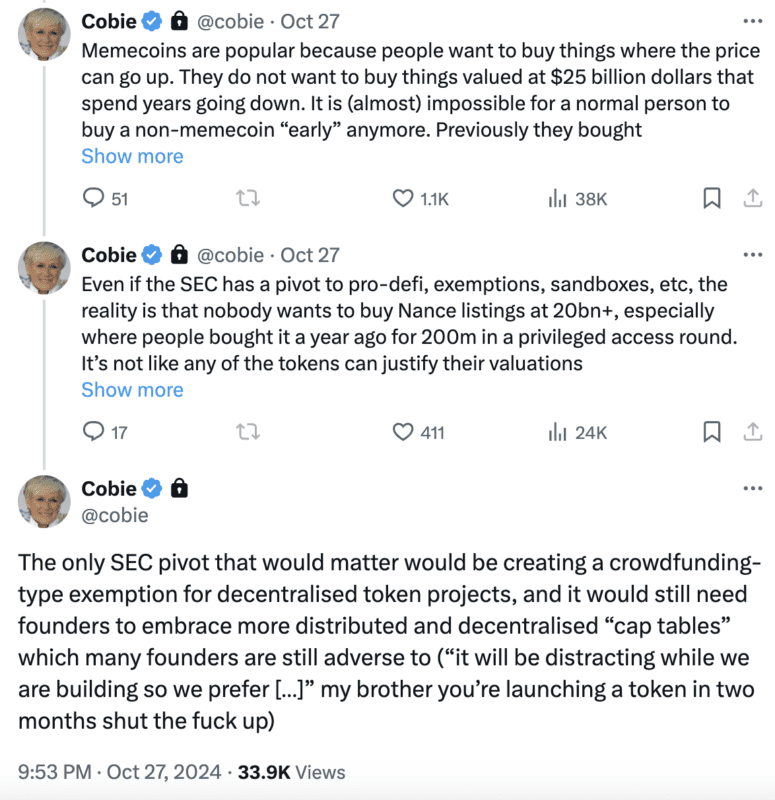

However, many people disagree with the views of Nic Carter and Omid Malekan. The well-known KOL Cobie pointed out that meme coins are popular because people want to buy things that have the potential to rise in price, rather than things with a market capitalization of hundreds of billions of dollars that have been declining for years. Therefore, the key is not whether the regulatory environment is friendly, but whether the current market financing structure can be changed.

"I don't think the SEC's stance has much impact on this trend - the SEC has repeatedly classified Solana as a security and forced Robinhood to delist SOL, but it has had almost no impact on the market's optimism about SOL. If you want non-meme tokens to be attractive to meme coin traders, you may need a different fundraising model, and founders also need to adopt these models."

Even if the US party rotation leads the SEC to support DeFi, introduce exemption rules or sandbox policies, no one wants to buy tokens on Binance with a valuation of over $20 billion, especially when they bought them at a $2 billion valuation a year ago. In any case, these tokens cannot prove their valuation by paying direct returns to holders, because they simply don't make enough money.

Furthermore, Cobie further pointed out that the only SEC policy change that could have an impact is the creation of a crowdfunding-like exemption for decentralized token projects, and founders would also need to accept a more decentralized, decentralized "capital structure".

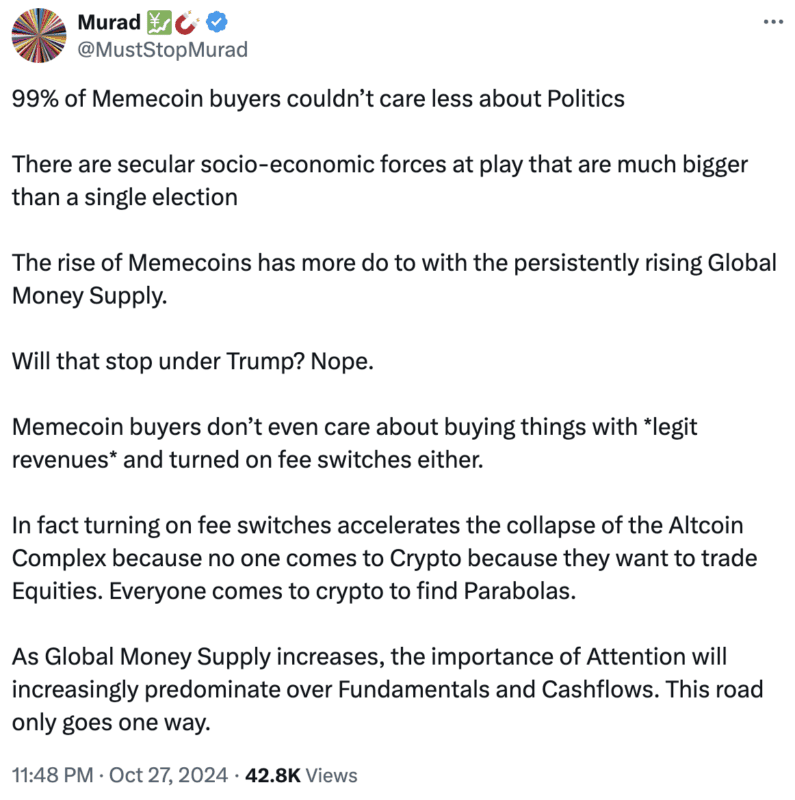

Murad: 99% of meme coin buyers don't care about politics

On the other hand, Murad, a KOL who has recently become popular due to the meme coin craze, also commented in the comments that the rise of meme coins is more driven by the continuous growth of the global money supply, and even if Trump is elected, it will not change this trend.

"Meme coin buyers don't care whether these tokens have 'legal earnings' or whether they have opened fee mechanisms. In fact, opening fee mechanisms has actually accelerated the collapse of altcoins, because no one comes to the cryptocurrency market to trade stocks. People come to the crypto market to find 'parabolic growth'."

As the global money supply increases, the importance of attention will increasingly surpass fundamentals and cash flow. This path will only go in one direction.