The new ETF partnership between China and Saudi Arabia raises concerns about its impact on the liquidity of the US Bitcoin ETF market.

According to recent reports, China and Saudi Arabia have promised to cooperate on ETFs after Chinese President Xi Jinping's visit to Riyadh.

Bitcoin ETF, boosting the US market...Seeking a shift to China and Saudi Arabia

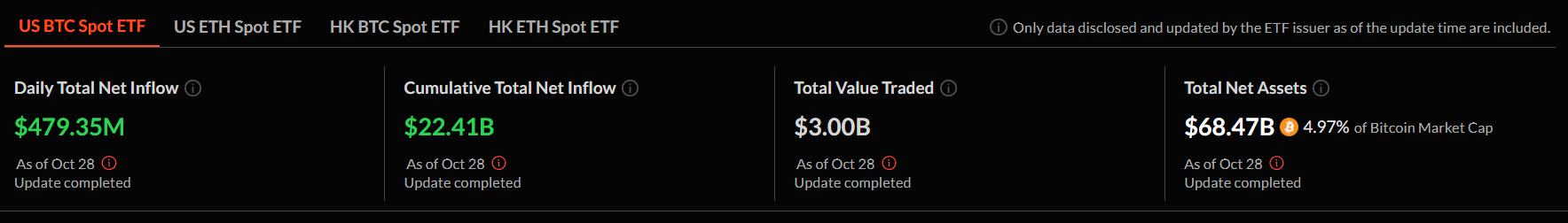

Currently, Bitcoin ETFs in the US hold $684.7 billion in net assets, which is a significant portion of the US's $9 trillion ETF market. As a result, the US is leading global ETF activity.

In fact, the iShares Bitcoin Trust ETF (IBIT) is currently one of the top 100 ETFs by asset size.

Read more: What is a Bitcoin ETF?

However, the new financial agreement between China and Saudi Arabia could change the situation. According to a report by Bloomberg analyst Eric Balchunas, the countries have promised to invest $1 billion in each other's ETF markets.

For example, Saudi Arabia will invest in a Hong Kong ETF that includes Saudi-listed companies. China will also invest in a Saudi ETF that tracks Chinese stocks.

Balchunas explained that this strategy, called the "liquidity sharing" initiative, aims to make each country's ETFs more attractive to local investors, potentially drawing back investors who may have chosen more liquid US-based ETFs.

Saudi Arabia, a new Middle East ETF initiative

After President Xi's visit, Saudi Arabia announced the first China-focused ETF, the Al-Bilad CSOP MSCI Hong Kong China Stocks ETF, which will be launched with over $1.2 billion in initial funding, making it the largest ETF in the Middle East.

Listed on the Saudi Stock Exchange, this ETF provides Saudi investors with seamless access to Hong Kong-listed stocks. The significant size of the Saudi ETF even surpasses the largest Islamic ETFs currently listed on the Qatar Exchange.

This initiative raises concerns that the two countries may be jointly pursuing efforts to weaken the appeal of the US Bitcoin ETF.

Read more: How to Trade Bitcoin ETFs - A Step-by-Step Approach

"While this may seem somewhat unnatural, we can't blame everyone who sees the US as a 'liquidity vampire' constantly siphoning off local investors. It holds a quarter of global ETFs, but accounts for 70% of global AUM and 84% of all trading volume. We have to fight for liquidity," Eric Balchunas recently wrote in a post on X (formerly Twitter).

As US ETFs take up an increasingly larger share of global investors, many non-US markets feel they are losing out. The new ETF alliance between China and Saudi Arabia appears to be a counter to this trend.

Bitcoin ETFs recorded over $3 billion in net inflows in October, significantly contributing to the continued rise of Bitcoin, the largest cryptocurrency currently trading around $72,500.

There is growing optimism that BTC could set a new all-time high from the current uptrend.