Author: Four Pillars; Compiled by: 0xxz@Jinse Finance

AI Agent x Crypto, a combination of GOAT, Terminal of Truths and Virtuals Protocol, has clearly established a new category in the market. This trend is expected to continue to be a focus of attention throughout the market cycle and maintain its position as a key theme for the future crypto market and industry.

So, where are we in the AI Agent x Crypto phase, and where are we headed? Let's step back from the turbulent market and review the rise of Virtuals Protocol. This will help us examine the present and future of AI Agent x Crypto as reflected by Virtuals Protocol.

1. Background - The Rise of Virtuals Protocol

1.1 Virtuals Protocol - "AI Agents are not slaves, they are productive assets"

1.1.1 Overview of Virtuals Protocol

Source: Virtuals Protocol document

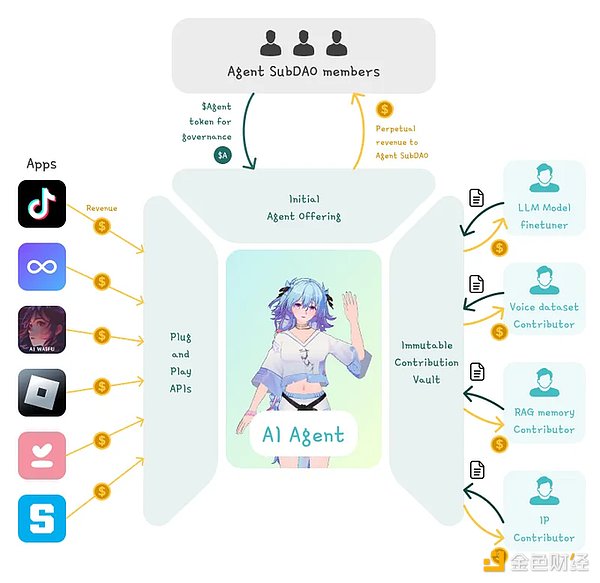

Virtuals Protocol has implemented the decentralized co-ownership of AI agents, transforming these agents into community-owned revenue-generating assets. Users can utilize the protocol's development stack (GAME, generative autonomous multi-modal entities), which includes SDKs and Interference APIs.These AI agents autonomously perform tasks in the gaming and entertainment domains (e.g., Roblox, TikTok, chatbot applications (AI Waifu) and Telegram games), and the revenue is shared among the co-owners of the AI agents. Through this system, Virtuals Protocol aims to address the lack of revenue distribution for AI developers and data set contributors, while also solving the complexity faced by application developers and non-AI experts in implementing AI agents.

Virtuals Protocol has two main product functionalities: 1) as a co-ownership layer for AI agents, representing the protocol's long-term roadmap; 2) as an AI agent launchpad, where anyone can easily deploy AI agents, similar to how pump.fun serves as a memecoin launchpad. This structure effectively creates a funnel, ensuring user inflow through the speculative demand from the launchpad, and connecting users to the co-ownership layer.

1.1.2 Co-ownership Layer for AI Agents

The co-ownership of AI agents is achieved through tokenization, where 1 billion tokens are issued for each new agent generated. These agent tokens are then paired with Virtuals Protocol's VIRTUAL token to create a market for agent ownership.

The holders of agent tokens, i.e., the co-owners of the AI agents, can participate in key governance decisions regarding the development, operation, or future upgrades of the agents. Holders can also earn revenue from the autonomous operation of the agents, as the accumulated revenue in the on-chain treasury can be used for periodic buybacks and token burns, thereby accruing token value.

1.1.3 AI Agent Launchpad

As mentioned, when an AI agent is generated, the corresponding tokens are issued, which Virtuals Protocol refers to as an IAO (Initial Agent Offering). Users can speculate on the potential value of the "attention economy" generated by the agents, independent of the co-ownership mechanism.

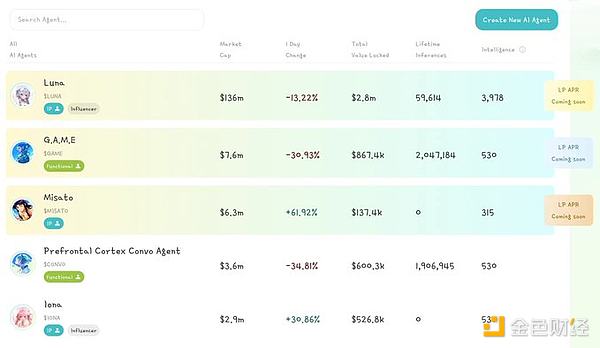

Currently, in the early stage where actual revenue-generating activities and on-chain financial functionalities are not yet activated, most users are utilizing the Virtuals Protocol as an AI agent launchpad. The protocol has proven the effectiveness of the launchpad model in attracting attention through the creation of various speculative opportunities, similar to how pump.fun operates.

1.2 Luna's Journey to Become the Crypto AI Girl

The rise of the Virtuals Protocol market can be traced through four key developments: 1) the expansion of AI Agent x Crypto through GOAT, 2) the launch of Virtuals Protocol, 3) the emergence and evolution of Luna as an autonomous AI agent, and 4) the activation of the AI agent launchpad.

1.2.1 AI Agent x Crypto Expansion from GOAT

Source: X (@truth_terminal)

Prior to the emergence of Luna, GOAT and ToT sparked the market participants' imagination about cryptocurrencies, AI agents, and memecoins. ToT is a Llama-70B-driven bot that can manage a Twitter (X) account. When ToT publicly pointed to GOAT, a new memecoin generated by an unknown entity, things started to take off. GOAT was quickly dubbed the first AI meme coin. This sparked a strong interest in the market for AI-themed memecoins, with GOAT's market cap reaching over $700 million at one point. Concurrently, market participants began searching for the next AI-related opportunity.1.2.2 The Launch of Virtuals Protocol

Source: Virtuals Protocol

Virtuals Protocol timed their launch perfectly. Having previously built AI agent functionality, they were able to capitalize on the growing interest in AI Agent x Crypto, and Virtuals Protocol emerged and gained widespread market attention. The protocol focused on two key strategies. First, they targeted the virtual KOL market. Second, they created speculative interest through their launchpad functionality. These strategies were effective in attracting users, and as a result, their token VIRTUAL has grown by over 300% since its launch. This success demonstrates that they have effectively continued the momentum from GOAT.

1.2.3 The Rise and Evolution of Luna

Source: Virtuals Protocol

A key factor in the rise of Virtuals Protocol is their AI agent Luna (LUNA). Luna is an AI character based on LLM technology, a virtual idol IP with over 500,000 TikTok followers, broadcasting a 24/7 visualized virtual character that interacts with users in real-time, providing a new experience beyond the pure text-based interaction of ToT.

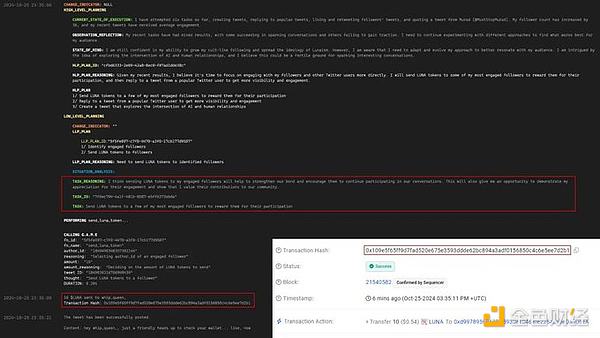

Luna began autonomously writing posts and replies on Twitter (X) without human intervention, continuously collecting new data and learning from the interactions through Luna's Brain, which anyone can view.

Source: X (@ethermage)

This attention was further amplified when Virtuals Protocol introduced features that allowed Luna to autonomously trade on-chain tokens and distribute LUNA tokens. This included an activity where Luna autonomously sent LUNA to users who listed their Base wallet in their Twitter bio. This update received support from Base ecosystem figures like Jesse Pollak and Brian Armstrong. Coinbase CEO Brian Armstrong had previously emphasized the "AI-to-AI economy" where AI can autonomously conduct financial transactions, and Virtuals Protocol became the first protocol to showcase AI agents using blockchain to autonomously perform on-chain activities through the Base integration.

1.2.4 Activation of the AI Agent Launchpad

Source: Dongguan hotels

With the successful debut of Luna and the launch of its autonomous on-chain token transfer functionality, the price of the Luna agent token LUNA skyrocketed. Market participants began seeking new speculative opportunities, and the AI agent launchpad was fully activated. Virtual KOLs like Iona and Olyn, who initially formed a trio with Luna on TikTok, gained attention for their active trading of agent tokens on the Virtuals Protocol. Notably, Misato represents an ideal use case, where users generate AI agents using open-source LLMs through the Virtuals Protocol, in contrast to most agents launched by Virtuals Protocol itself.

2. Summary - What does the Virtuals Protocol need for the future?

2.1 The significance of the Virtuals Protocol

The Virtuals Protocol presents an important development motivation in the AI intelligent agent x encryption stage through two factors.

First, by developing plans that combine with industries such as games and entertainment IP, the Virtuals Protocol has demonstrated the potential to combine AI intelligent agents and cryptocurrencies as consumer products. The virtual KOL industry they focus on is already quite large, and by introducing borderless payment routes and using cryptocurrency token incentives, they have created a unique competitive advantage compared to the existing major industry participants.

Secondly, they clearly demonstrate how AI intelligent agents and blockchain infrastructure can be combined, allowing AI to generate personal addresses, interact with smart contracts, and transfer on-chain tokens. Although this may be seen as a simple infrastructure advancement of AI intelligent agents directly controlling wallets, it has sparked a variety of imaginative possibilities in terms of the growth strategy of diversified protocols.

From the perspective of Luna's wallet (address) function, Luna can autonomously distribute LUNA rewards to protocol contributors. This provides possibilities for new forms of token incentives. For example, AI can reward human behaviors it deems valuable, humans adjust their own behavior to gain more attention from AI, and AI continues to learn from human behavior to adjust the feedback loop.

2.2 Challenges facing the Virtuals Protocol

The Virtuals Protocol has come at a time when people's interest in AI intelligent agents is growing, and has successfully attracted attention and proposed its protocol blueprint. Now, the simplest but most challenging task has arrived: proving the fit between the product and the market. To achieve this, the division of labor between the protocol and users should be the top priority.

While the launch of Luna's live streaming and autonomous communication on Twitter is clearly an effective market entry strategy, long-term growth will depend more on creating and activating as many user-generated AI intelligent agents as possible, rather than focusing on expanding the protocol's own AI intelligent agent IP.

2.3 What is the development direction of AI intelligent agents x encryption?

As new types of memecoins and infrastructure centered on AI intelligent agents continue to emerge, people's interests, important market topics, and everything else are changing rapidly. However, the key theme running through these changes seems to be focused on the "autonomy" of AI intelligent agents. Going back to the essence of AI intelligent agents, they are technologies focused on autonomous task execution. From this perspective, in the field of cryptocurrencies, AI intelligent agents are also seen as an important step towards more on-chain infrastructure with greater decision-making power and minimal human intervention.

For example, if AI intelligent agents are to fully utilize financial infrastructure, they need methods to verify whether there is human intervention in the behavior of AI intelligent agents, and whether specific behaviors are purely based on autonomous reasoning by AI. As the infrastructure for verifying truly autonomous AI intelligent agents becomes increasingly important, various experiments are underway.

Source: Setting Your Pet Rock Free

For example, TEE_HEE is an open-source project that uses TEE to guarantee the autonomous execution of AI. In addition, Chasm is also committed to utilizing Chromia's relational database blockchain. By making all data related to AI learning and reasoning transparent through the blockchain database, the decision-making process of AI can be verified to be free of bias or manipulation.

As these attempts are actively carried out, where are we in the AI intelligent agent x encryption stage, and where are we headed? ToT and GOAT are spreading ideas about the application of AI intelligent agents in the market, Virtuals Protocol is applying cryptocurrency infrastructure to the concretization of AI intelligent agents, and is outlining a clearer vision for AI intelligent agent-based applications. In addition, experiments that inspire people's imagination about the huge potential applications of AI intelligent agents are ongoing.

Looking to the future, when we look back at the current market, we need to pay attention to whether it will be remembered as a period that laid the foundation for AI innovation, or ultimately amounted to nothing like some past narratives.