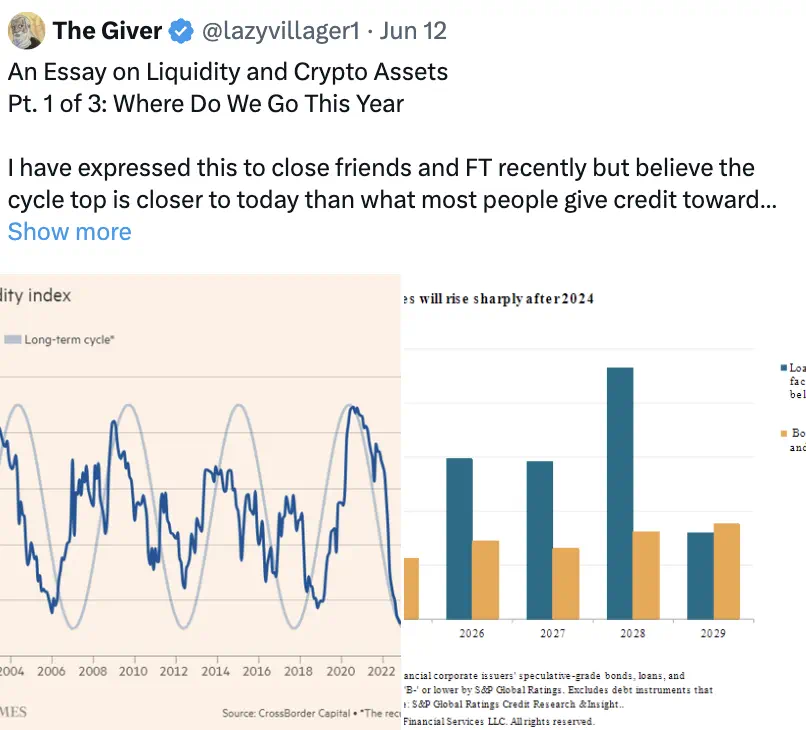

This is a very long thread intended to record the process of the rise in the price of Bitcoin since October 15th. I will reiterate the original points I made when I was a guest on the @1000xPod.

Before we begin, I want to make it clear that this is not a recommendation to long or short any coins, especially given the extremely crowded nature of open contracts and positions over the next week. We have a very high probability of challenging the all-time high (ATH), if not an outright likelihood. This could bring about significant right-tail effects. Specifically, I think managing a new short position here could be very difficult. That said, here goes -

Today, I hope to define the nature and intensity of the capital flows into Bitcoin since mid-October. I will discuss how BTC has added $2.5 trillion since the Bitcoin low of $59,000, and the total crypto market cap has added $4 trillion, and describe what I see as constrained capacity in Q4 2024 that I don't believe will be substantially breached.

I have two main views: 1) new capital is still constrained, which is a necessary premise; the strong inflows we've seen over the past two weeks have been speculative capital; 2) the excess liquidity required to generate the kind of parabolic move we saw in 2021 does not exist.

However, I believe the following principles have been severely overlooked and under-discussed, largely because the price rise analysis has been very superficial, only getting attention when prices fall.

You need to believe:

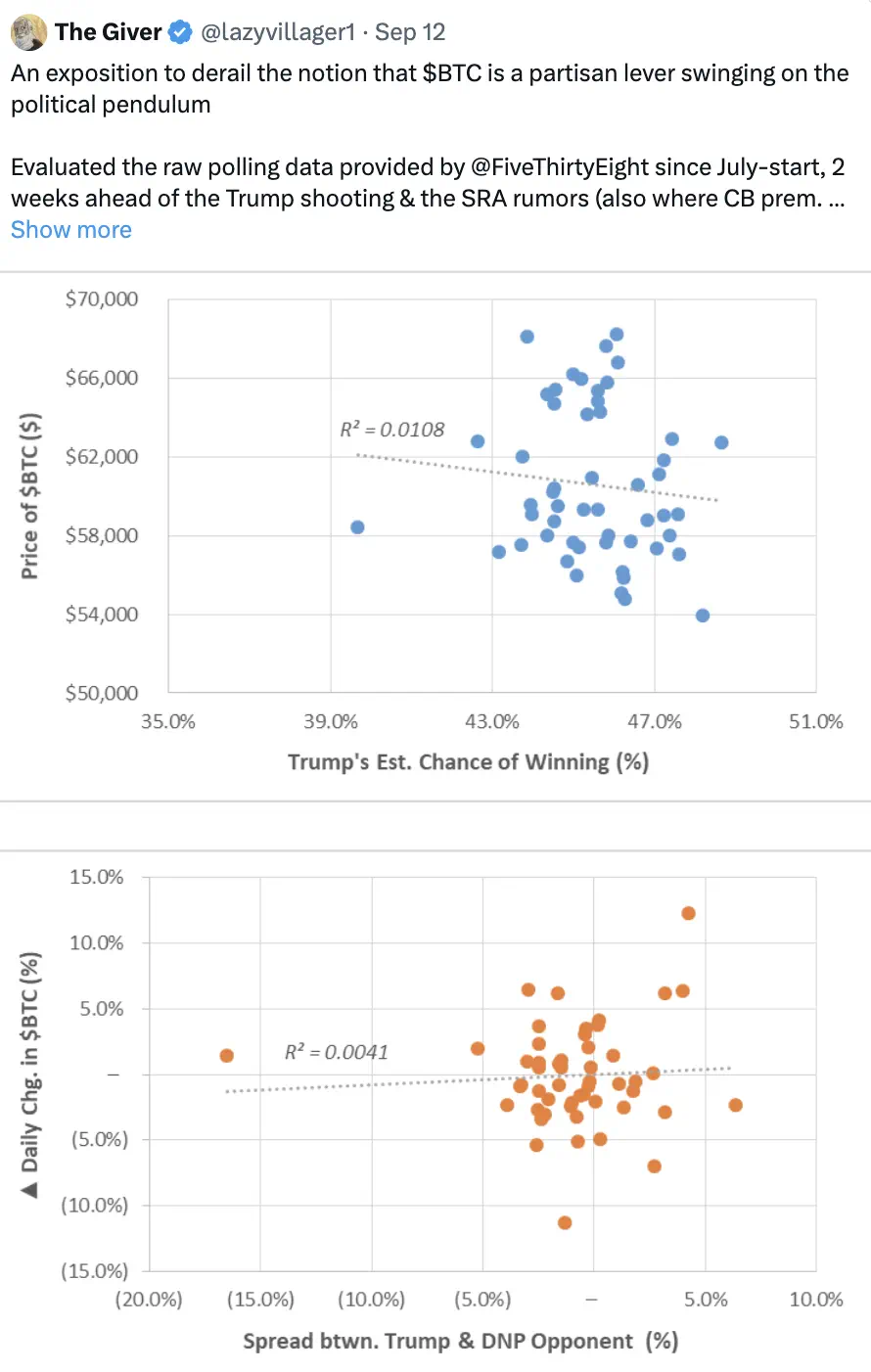

1) The direction of the election does not drive price-dependent outcomes; rather, Bitcoin is currently being used as a liquidity tool to hedge a Trump victory.

2) The "relaxed conditions" required to make new all-time highs today are not yet in place. Interest rates and other popular heuristics have far less correlation with faction liquidity than popular narratives suggest, suggesting prices are ultimately being suppressed, not price discovery.

Reiterating Previous Points

When Bitcoin broke above around $61,000/62,000 during the Columbus Day holiday, it prompted me to revisit the events at the time. So starting from that week (to be presented later on @1000xPod), I predicted the following, which I'll summarize here:

- BTC.D would increase (while BTC itself may challenge $70,000 before the election results)

- At the same time, mainstream coins and altcoins would generally decline relative to BTC - because the speculative capital in point 1 is only focused on BTC as a hedge against a Trump victory

- The initial inflows (with a cost basis between $61,000 and $64,000) would be sold off before the actual election, leaving new directional capital (and speculative capital)

- Through the effects of 1 to 3, Bitcoin would decline in the medium term, regardless of who wins

So I recommended going long BTC, and short "everything else".

Why are the Capital Flows Mercenary in Nature?

My understanding of this positioning has three main aspects:

1) Microstrategy is the preferred vehicle for making large-scale investments and risk exposures: rapid expansion is often accompanied by local tops.

2) The market consensus view on the "Trump trade" is wrong; its impact is not causal, i.e. an increase in Trump's odds does not linearly create opportunities for BTC's performance, but rather the basket of assets that rallied this month reflects a low estimate of a Trump victory.

3) A new participant has emerged in this cycle - this capital is different from previous participants - it has no intention of recycling capital within the ecosystem; native crypto capital has already been fully deployed, and the likelihood of spot follow-through is low.

A Case Study on Microstrategy

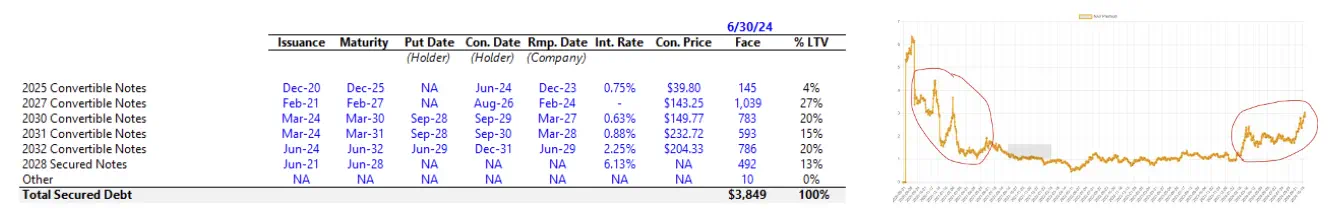

I believe Microstrategy is one of the most misunderstood investment vehicles currently: it is not just a simple BTC holding company, but more like a FIG (where NOLs are covered by new capital raises), with a core business centered around generating non-liquid net interest income (NIM).

NIM is a concept that can be most easily understood through insurance companies seeking returns on long-term deposits, often in the form of liquidity premiums (such as bonds), where ROE exceeds ROA.

In the case of MSTR or any other stock, the two aspects to compare are:

- The expected BTC price appreciation (which can be defined as the BTC yield)

- The weighted average cost of capital (WACC)

Microstrategy can be said to be an under-leveraged enterprise with a relatively light asset burden - the company's obligations are largely covered before BTC reaches $10-15K, so its capital efficiency is very high:

It is able to access the credit markets efficiently, having arranged over $3 billion in convertible bonds, typically with a structure of <1% coupon and 1.3x conversion premium cap, callable if the price exceeds the actual price at some future point. However, looking at its 2028 secured notes, we can see MSTR's fixed debt cost is around 6% (paid down).

So we can visualize MSTR's overall cost of capital from a credit perspective, using the implied probability allocated to achieving a 1.3x MOIC with the hybrid convertible debt instrument.

If you collect $1 per year (no redemption) for 5 years, then for the lender, to balance providing the convertible bond and paying the $6/year coupon, this means a $5 gap per year for the first 5 years must be filled by a one-time $30 payment in year 5.

So we can derive the formula: 5 + 5/(1+x)^1 + 5 + 5/(1+x)^2 + 5 + 5/(1+x)^3 + 5 + 5/(1+x)^4 must equal 30/(1+x)^4. This works out to around a 9% cost of capital, while the current debt/market value ratio implies an equity cost of around 10%.

In simple terms: if the BTC yield, i.e. the expected annual growth rate of BTC, can exceed 10%, then MSTR's premium should expand relative to net asset value (NAV).

Through this framework, we can derive an understanding that the premium reflects overly eager sentiment, or expectations of imminent BTC expansion - so the premium itself is reflexive and patient, not lagging.

So when we overlay the premium onto the BTC price, we see two periods where the premium exceeded 1 - the first half of 2021 (when BTC first approached $60,000), and the peak in 2024, when we previously approached $70,000+.

I believe, as the stagnant premium ends tomorrow, the stock market understands this and expects the earnings to be used to buy BTC, expressing this expectation in two ways:

- Buying MSTR in advance, anticipating the premium will re-calibrate to ~1-2x, as Saylor is likely to buy more BTC;

- Buying BTC directly, not only to capitalize on a Trump victory, but also Saylor's buying intent (through IBIT inflows).

This theory aligns with the options market (biased towards the short-term), which has seen increasing activity, anticipating BTC reaching $80,000 by year-end, which matches the implied BTC yield created by MSTR's purchases (1.10x $73,000 ≈ $80,000).

However, the question is: what type of buyer is this? Are they here to discover prices of $80,000+?

How did this new capital impact the price action in October?

While there was initially some correlation with algorithms and perpetual contracts, apart from BTC, almost all assets lacked sustained follow-through, suggesting the current bidding is merely through inflows to MSTR and BTC ETFs.

We can draw a few conclusions from this:

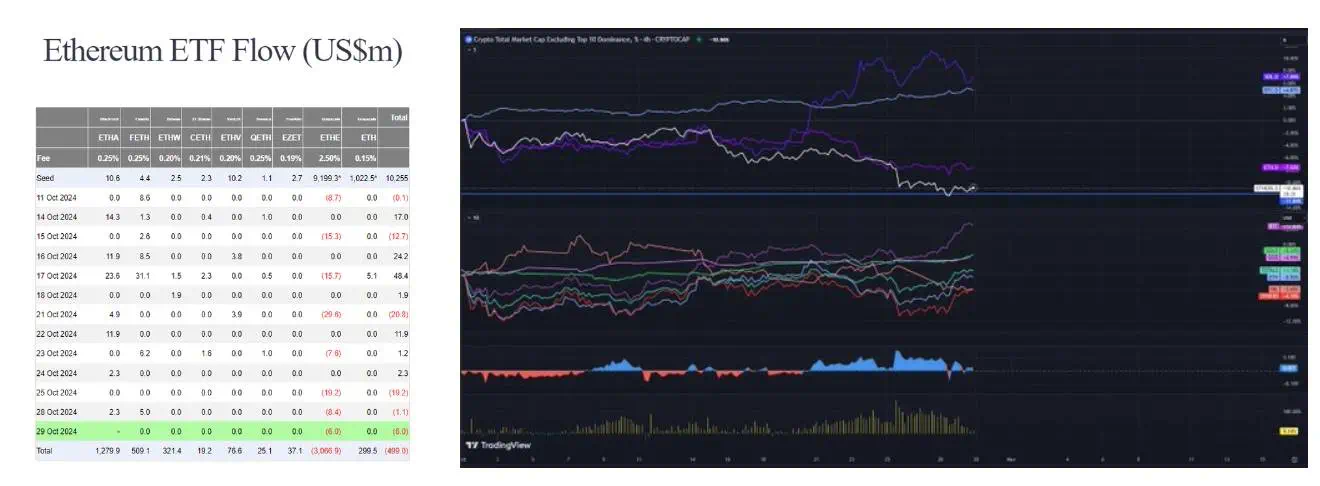

- ETH ETF: Although ETH ETF has seen inflows of over $3 billion since mid-October, there has been virtually no net inflow. Similarly, the open interest (OI) of ETH CME also appears unusually subdued, leading us to conclude that these buyers are not inclined to diversify and are only interested in BTC.

- BTC exchange and CME open interest are also at or near all-time highs. Futures open interest in the currency reached a peak this year, reaching 215,000 units, up 30,000 units from mid-October, and has increased by 20,000 units since last weekend. This behavior is reminiscent of the desperation for exposure we saw before the BTC ETF launch.

- Prior to mid-October, the strength of Altcoins against BTC had been gradually waning, with Solana's strength following ETH and other Altcoins, performing flat and lacking appeal. In absolute terms, other Altcoins have actually declined this month, to around $220 billion, from $230 billion on October 1.

What changed for Solana on October 20? I believe the growth of SOL (+$10 billion) primarily reflects an unexpected repricing of meme assets (observing the GOAT charts and the underlying AI space, these phenomena are abundant on Solana). Users entering the ecosystem must purchase Solana, and when they profit, they exchange it for Solana, consistent with the L1 fat tail theory, reflecting a broader trend we've seen this year in APE and DEGEN. During this period, I believe around $1 billion in wealth was created and passively held SOL during the election.

- This year, we have seen the first instance of stablecoin contraction, leading to a lack of self-generated dollar demand (deceleration) beyond what is created today.

In traditional markets, we have also seen similar repricing phenomena - we can observe how this demand has emerged through the case study of Trump Media & Technology: the stock is priced at $50 today, compared to around $12 on September 23, with no new earnings or news releases. For better context, Trump Media's current market cap is comparable to Twitter - an $8 billion increase in a month.

Therefore, two possible conclusions can be drawn:

- The use of BTC as a liquidity proxy merely reflects election betting capital and does not reflect the sustainable long-term holdings implied by other narratives (e.g., rate cuts, easing policies, and a productive labor market). If the latter, the market's performance should be more consistent, with other risk proxies (gold when the dollar depreciates, otherwise SPX/NDX) exhibiting more uniform strength this month.

- The market has fully priced in a Trump victory; this capital is not stable and unwilling to engage in a broader ecosystem, although today's holdings suggest it should/will participate. This fractal is not what crypto natives are prepared for, as this type of buyer did not exist in the past.

Who is this new buyer?

When analyzing the composition of participants, history typically includes the following categories:

- Speculators (short-term/medium-term, often causing deep capital troughs and peaks, very sensitive to prices and rates)

- Passive bidders (through ETFs or Saylor, though he is in large-scale purchases) insensitive to prices, willing to support pricing, as they have formed entrenched HODL behavior in a typical 60/40 portfolio construction.

- Arbitrage bidders (insensitive to prices but sensitive to rates) - employ capital, but overall have no impact on prices, may have been the initial drivers of the early-year momentum.

- Event-driven bidders (expand open interest in a specific time frame), such as the ETH ETF and the Trump summer activity, which we believe we are now seeing.

The 4th category of bidders has a summer playbook, which can be expressed through my previous tweet about BTC as a partisan lever (next tweet).

This suggests that the buying behavior is indeed impulsive and jumpy, but this buyer is not concerned with the election outcome (which can be interpreted as a lack of linear correlation between Trump's odds and BTC price). They may engage in de-risking, involving closed-end funds of BTC/ETH, similar to the Greyscale bidders when the ETF went live.

BTC as a Partisan Lever

How do interest rates affect the price of Bitcoin?

In June/July (next tweet), I hypothesized that it is difficult to view rate cuts as a simple aspect of easing policy. In this tweet and subsequent content, I will debunk this theory and discuss what I believe is a key missing variable that has led us to overestimate BTC demand: excess liquidity.

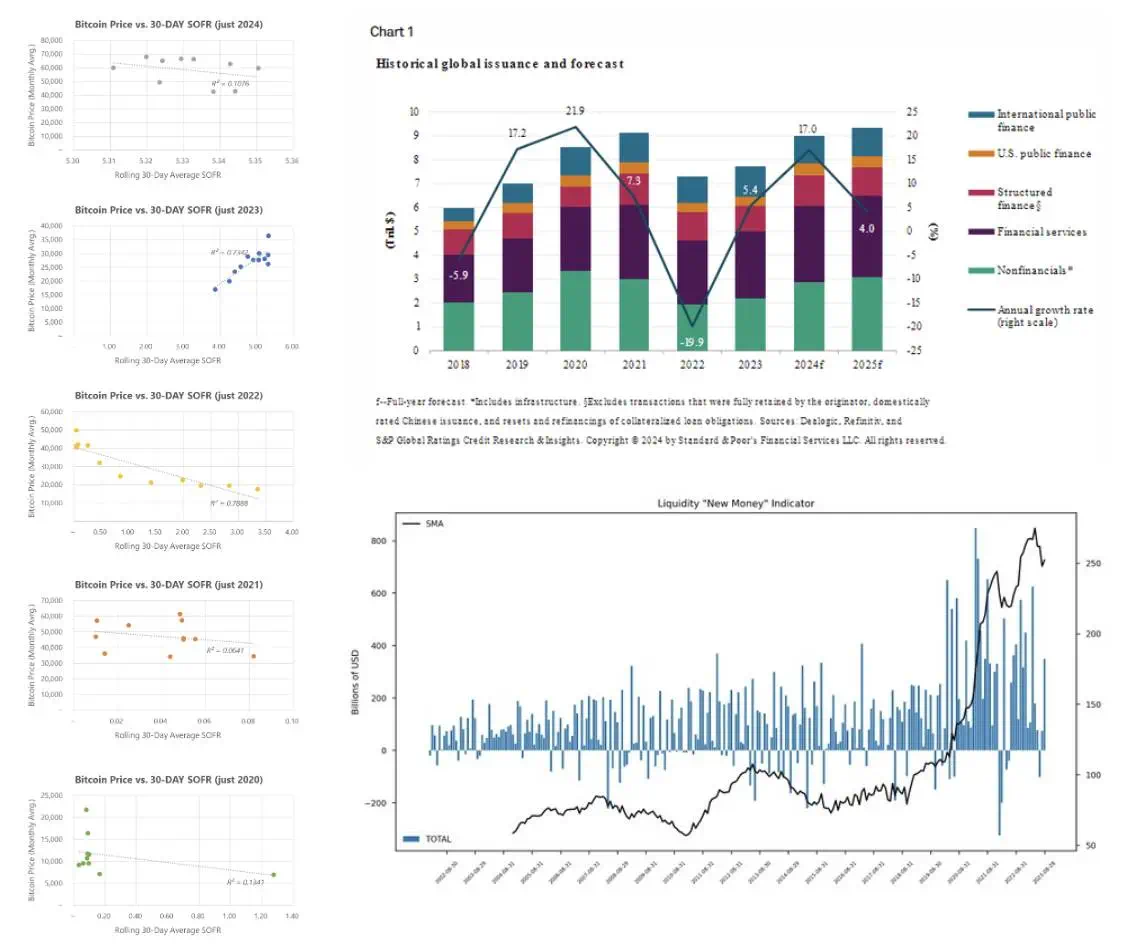

First, let's independently compare BTC's price over the past 5 years with historical SOFR (rates). This shows a very strong correlation in 2022 and 2023, while in 2020, 2021, and 2024, it appears to exhibit a more dispersed trend. Why is that? Shouldn't lower rates make borrowing easier?

The issue is that, unlike those special years, the lending market in 2024 is already quite robust, presaging an impending rate cut. A unique mechanism is that lower-grade average debt has shorter maturities (thus maturing in 2025-2027), which can be traced back to the "high for long" years.

You can also check out the debt index created by @countdraghula (ignoring quantitative easing) to outline actual debt growth.

Similarly, the stock market's performance has been exceptionally strong: "The S&P 500 has exceeded any consecutive rally over the past decade, totaling 117 weeks" (without a -5% return). The previous longest rally was 203 weeks, when the economy was recovering from the depths of the Global Financial Crisis.

In other words, credit and equity markets have created a massive restorative rally without a recession occurring.

My reasoning is: We experienced unique mechanisms in 2021 and 2023 (COVID and SVB failure) that led to liquidity injections. Leveraging the power of the Fed's balance sheet to build new facilities.

The Business/Liquidity Cycle Has Been Broken

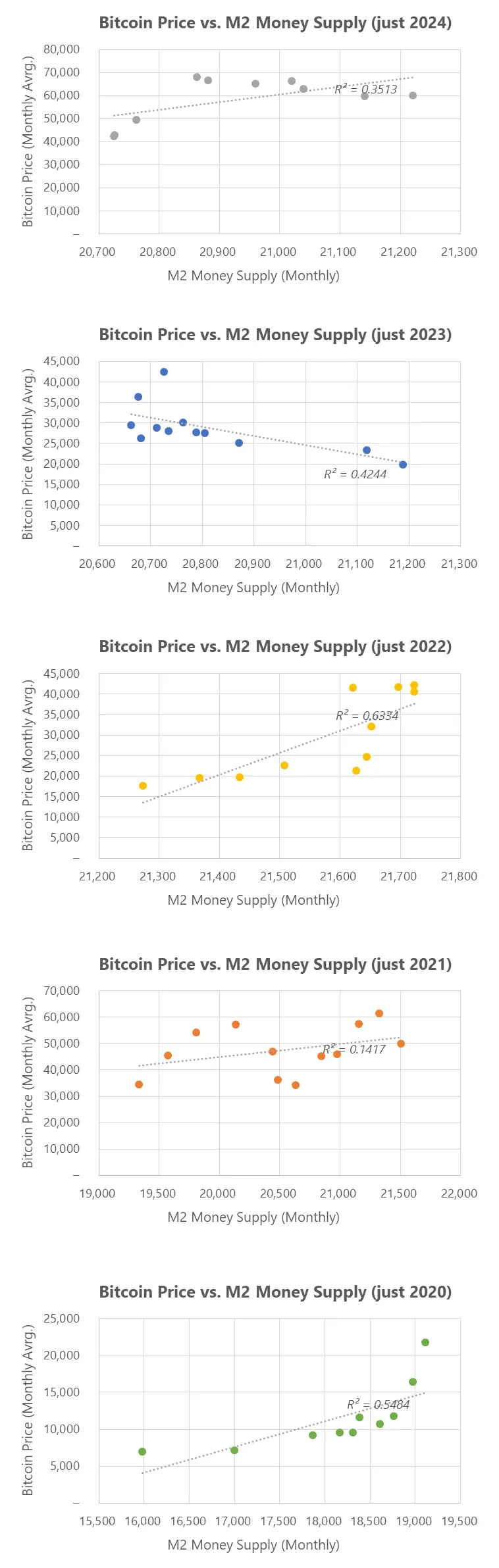

Bitcoin and M2 Correlation: Arguing How Emergency Measures Create Growth and Volatility

Bitcoin's growth is often viewed as the primary driver, however, since 2022, the correlation between Bitcoin and M2 has been weakening (and is starting to resemble the 2021 peak again). I believe this is closely related to the current government's willingness to open up the use of its balance sheet to achieve financial stability. This is a no-holds-barred approach.

So the key question is - what is Bitcoin exactly? Is it a leveraged stock? Is it a chaotic asset? With the underlying market (around $2 trillion) already so large, almost matching the TOTAL1 high we saw in 2021, what conditions must arise for price discovery to occur?

I don't think these questions are likely to be answered during this year's office transition.

How Emergency Measures Supported Bitcoin: The Quantitative Easing Triggered by COVID in 2021

I believe using the 2021 fractal to visualize future price action is flawed. In 2021, at least around $2 trillion was injected through various projects. The maturity of these projects is very interestingly aligned with Bitcoin's price action (PA).

On March 15, 2020, the Federal Reserve announced a plan to purchase $500 billion in Treasuries and $200 billion in mortgage-backed securities. This ratio doubled in June and began to slow down in November 2021 (the speed doubled again by December 2021). The PDCF and MMLF (providing loans to high-quality money markets through stabilization funds) expired in March 2021. Direct lending fell from 2.25% to 0.2% in March 2020. Direct lending to companies through the PMCCF and SMCCF was introduced, ultimately supporting $100 billion in new financing (increased to $750 billion to support corporate debt), and bond and loan purchases were made. This will gradually slow down between June and December 2021. Through the Cares Act, the Federal Reserve is preparing to provide $600 billion in 5-year loans to consumers, while the PPP program will end in July 2021. According to a report in December 2023, about 64% of the 1,800 loans at the time were still outstanding. As of August, 8% of these loans were delinquent. The speed of this monetary injection and creation is very unique. This is also clearly reflected in the price trend of 2021 - reaching a peak in the first and second quarters, declining in the summer (when many programs ended). Finally, when these programs completely stopped, Bitcoin experienced a huge downward swing.