Bitcoin (BTC) has fallen below the realized price, which is an important indicator representing the average purchase cost of all circulating coins. This decline has weakened hopes for a rapid rebound to the $72,000 level, and falling below the realized price generally indicates that selling pressure is increasing.

The current price of Bitcoin is $68,608, and if it continues to trade below this critical threshold, it could suggest a long-term downward trend. However, how much further can BTC decline?

Weakening on-chain support for Bitcoin, whales selling

On October 20, the spot price of BTC fell below the realized price, and over the next 3 days, the value of the cryptocurrency dropped from $69,022 to $66,611. Then, on October 28, the realized price of Bitcoin fell below the spot price. The next day, BTC rose to $72,708, sparking speculation that the coin could soon set a new all-time high.

However, that did not happen. According to data from CryptoQuant, the realized price of Bitcoin is currently $69,352, which is higher than the current value.

Generally, when the realized price is below the market price, it indicates on-chain support and suggests upside potential. But the current situation is the opposite. In the short term, the likelihood of Bitcoin price quickly recovering to the $72,000 level appears low.

Read more: The 7 Best Cryptocurrency Exchanges for Trading Bitcoin (BTC) in the USA

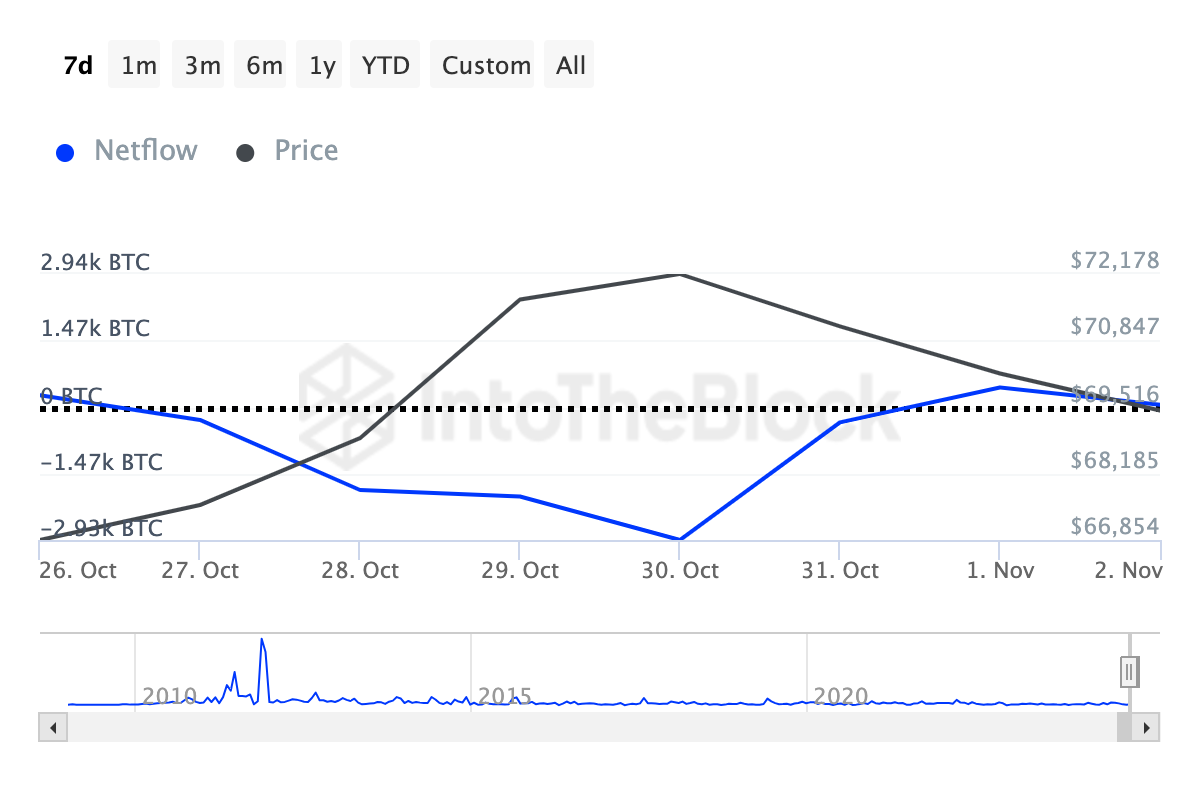

Another indicator that Bitcoin may have difficulty rebounding is the net inflow of large holders. This metric looks at the activity of addresses holding between 0.1% and 1% of the total circulating supply.

When the net inflow of large holders is positive, it suggests that crypto whales are accumulating coins and the price can rise. However, according to data from IntoTheBlock, the net inflow has decreased, indicating that whales have sold more coins in the past week than they have purchased.

If this continues, the positioning of Bitcoin's realized price could align with further downside potential.

BTC Price Forecast: Expected to Correct to $66,000

The current price of Bitcoin has fallen 6% from its recent local high and is in danger of breaking below the upward channel on the daily chart.

This pattern is formed by two uptrend lines, providing resistance at the top and support at the bottom. Currently, Bitcoin is moving around the $67,941 support line.

If BTC falls below this support, it could slide to $66,575, and in a more bearish scenario, it could drop to $62,826.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Conversely, if Bitcoin's realized price falls below the current value, it could signal a trend reversal. In that case, BTC could rise to $72,770 and set the stage for a new all-time high.