Author:0xPain.sui

Compiled by: TechFlow

Conclusion: The DeFi market is recovering and remaining active.

What happened to DeFi?

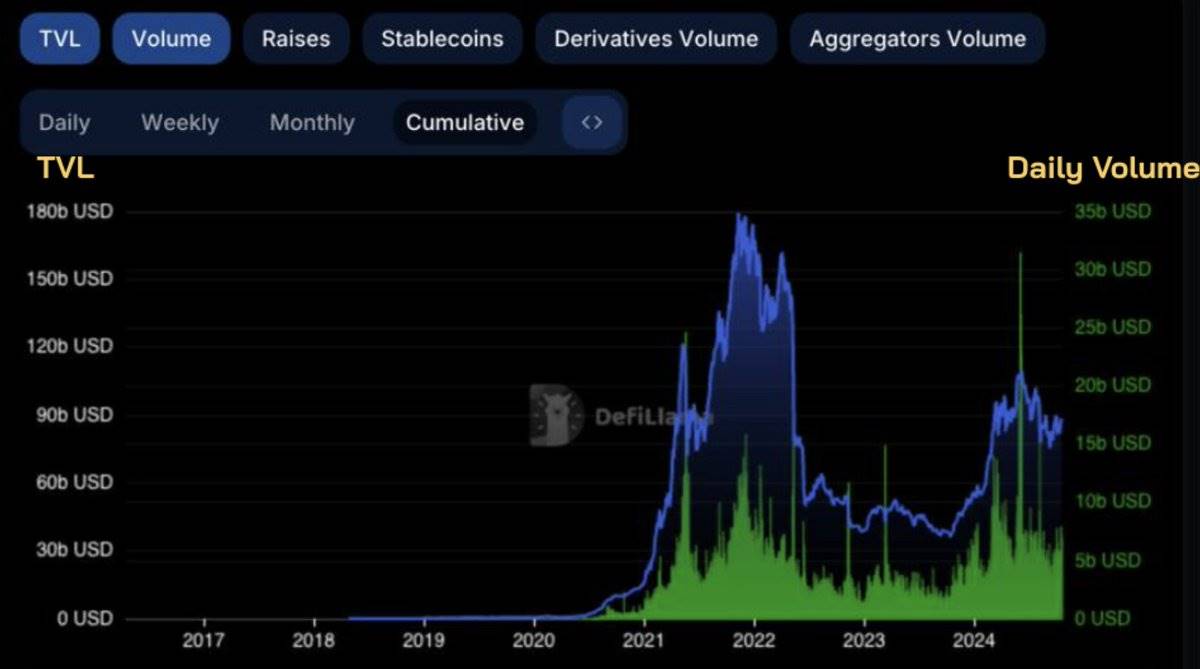

Although affected by Token price fluctuations, the DeFi Total Value Locked (TVL) is currently around 60% of its historical high, but its daily trading volume has recovered to its previous peak, ranging from around $5 billion to $15 billion. This shows that DeFi market activity is warming up.

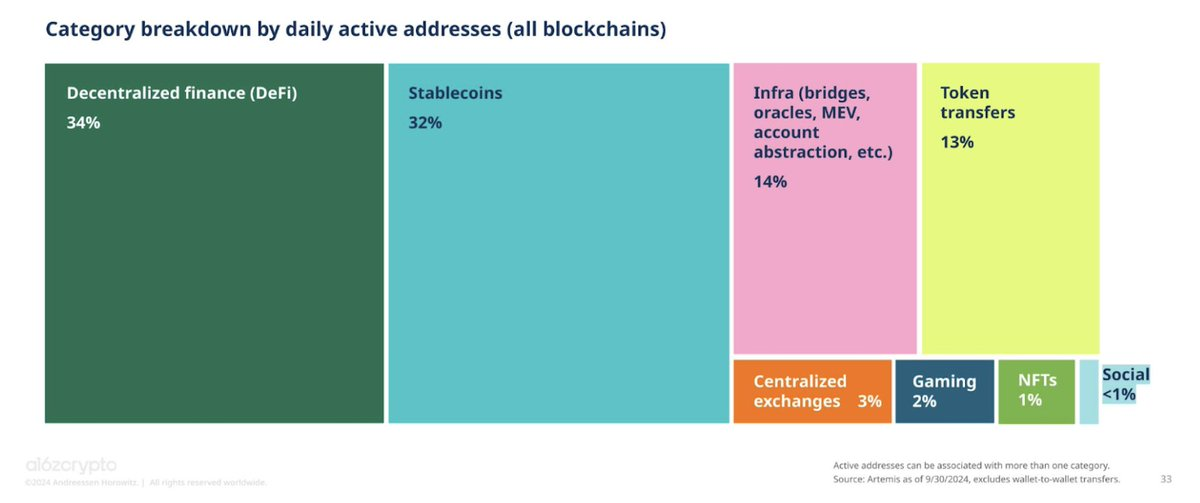

According to the data on daily active addresses, as of the end of September 2024, DeFi occupies an important position in the entire crypto market. It should be noted that these data may be affected by bot activity.

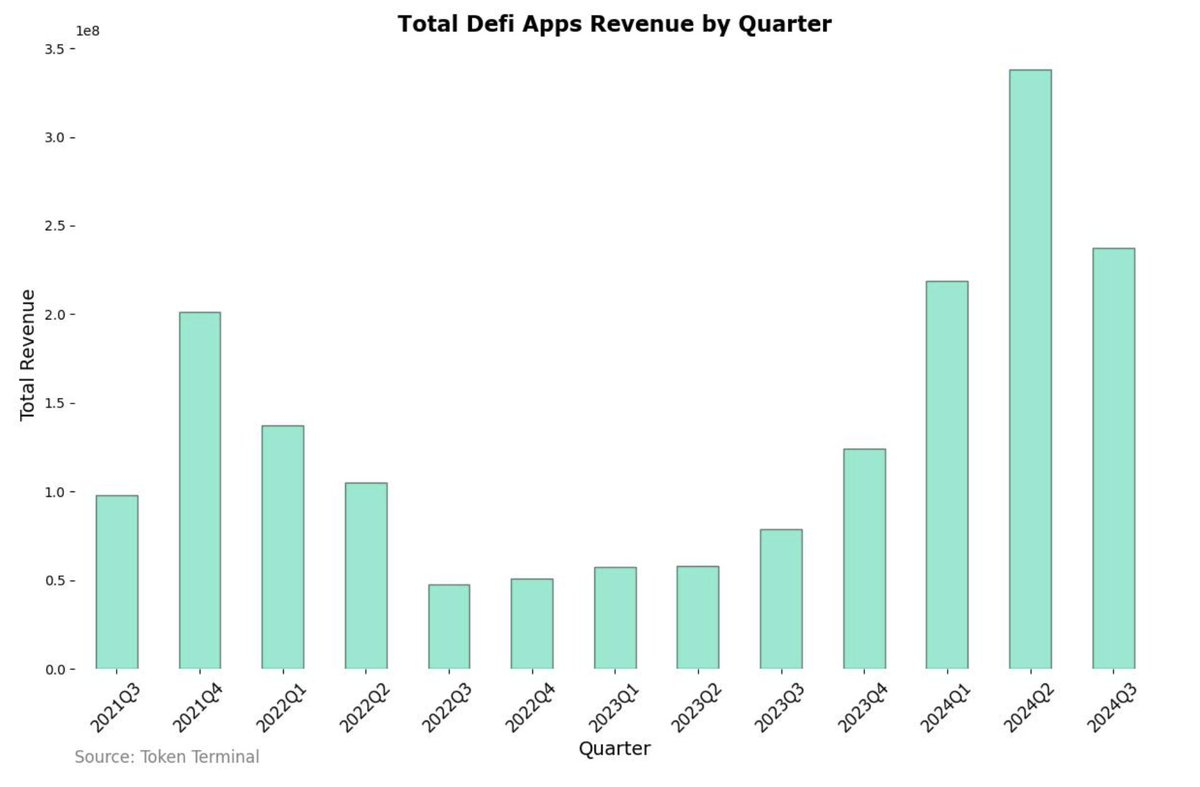

Looking at the revenue data, the earnings of DeFi projects reached new highs in the second and third quarters of 2024, far exceeding the level of the DeFi summer of 2021.

Therefore, it can be concluded that DeFi has always been an important part of the crypto market. However, the market's focus is currently shifting to other areas, such as MEME coins and AI, leading to a recent decrease in attention on DeFi.

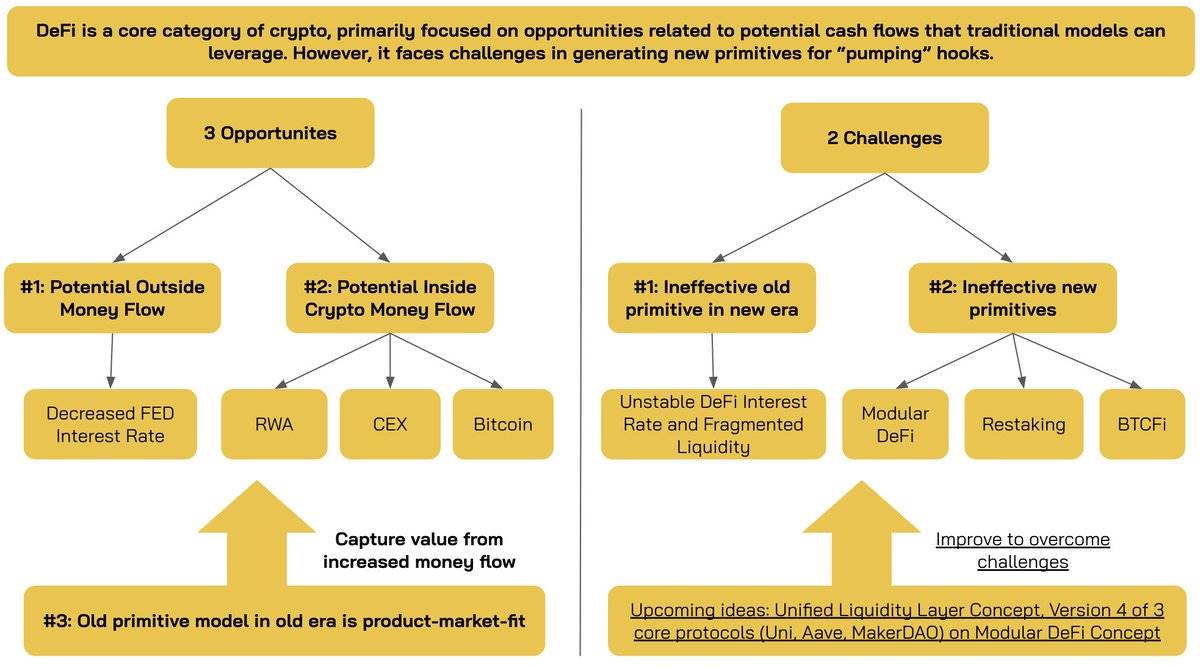

Three major opportunities for a potential DeFi explosion

1: Declining interest rates

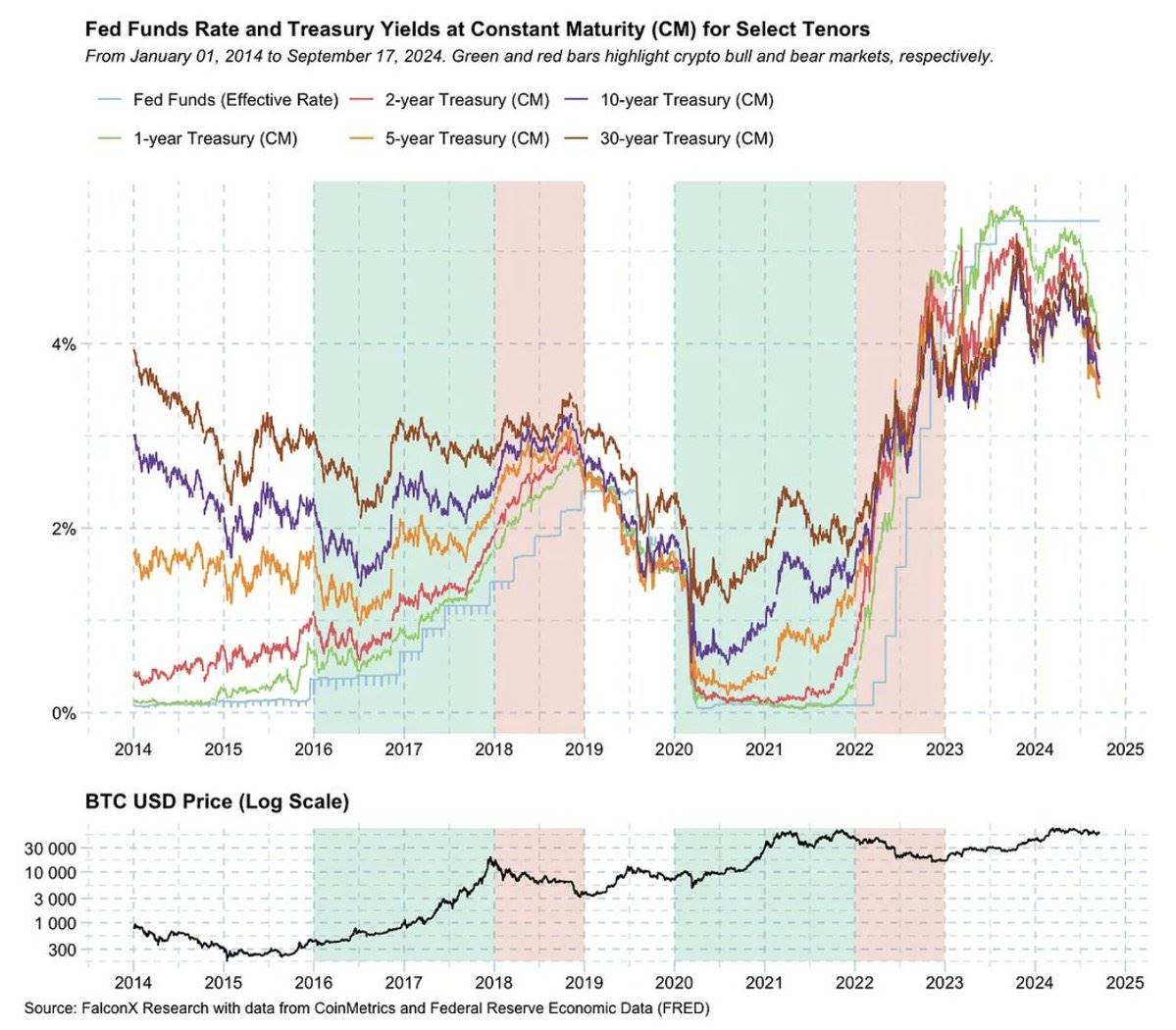

During the bull market cycles of 2016-2018 and 2020-2022, DeFi experienced a golden period, coinciding with the Federal Reserve's significant interest rate cuts (close to zero). DeFi benefited in two ways:

When traditional investment tools (such as Treasury bonds) become less attractive, capital usually flows to high-yield investments like DeFi.

The influx of external capital will drive investment in risky assets such as crypto Tokens, increasing the demand for yield on holding these assets.

By the end of 2023, DeFi maintained growth even in a high-interest-rate environment. Therefore, with the decline in interest rates, DeFi is expected to experience explosive growth.

2: Inflow of capital from Real-World Assets (RWA), Centralized Exchanges (CEX), and Bitcoin

2.1 RWA

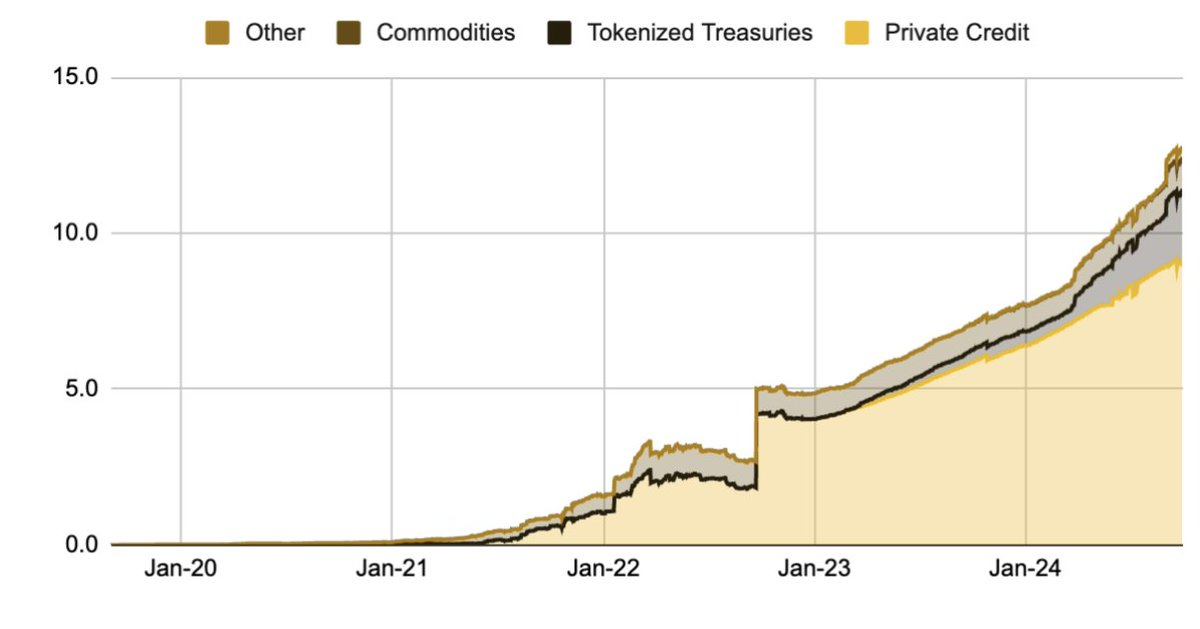

RWA market cap data source: Binance Research

As of the end of August 2024, the market cap of the RWA sector has exceeded $12 billion, more than doubling compared to the same period in 2023. Among them:

Private credit accounts for about 75%, or $9 billion. This figure is only 0.9% of the traditional private credit market, indicating a huge market potential. Platforms supporting this area include @centrifuge, @maplefinance, and @goldfinch_fi.

Tokenized government bonds account for 17%, with a market value of over $2.2 billion, with related platforms including Ondo, @Securitize (collaborating with BlackRock's BUIDL fund), @FTI_Global, @Hashnote_Labs, and @OpenEden_Labs.

Private credit refers to loans provided by non-bank financial institutions to small and medium-sized enterprises.

Recognizing the potential of this market, @MorphoLabs has taken steps to support the lending pairs of Centrifuge Anemoy's Liquid Treasury Fund (LTF), Midas short-term US Treasuries (mTBILL), and Hashnote US Yield Coin (USYC) by integrating with Coinbase's KYC verification system. Therefore, the integration of these asset types into DeFi seems to be a trend in the near future.

2.2: Centralized Exchanges (CEX)

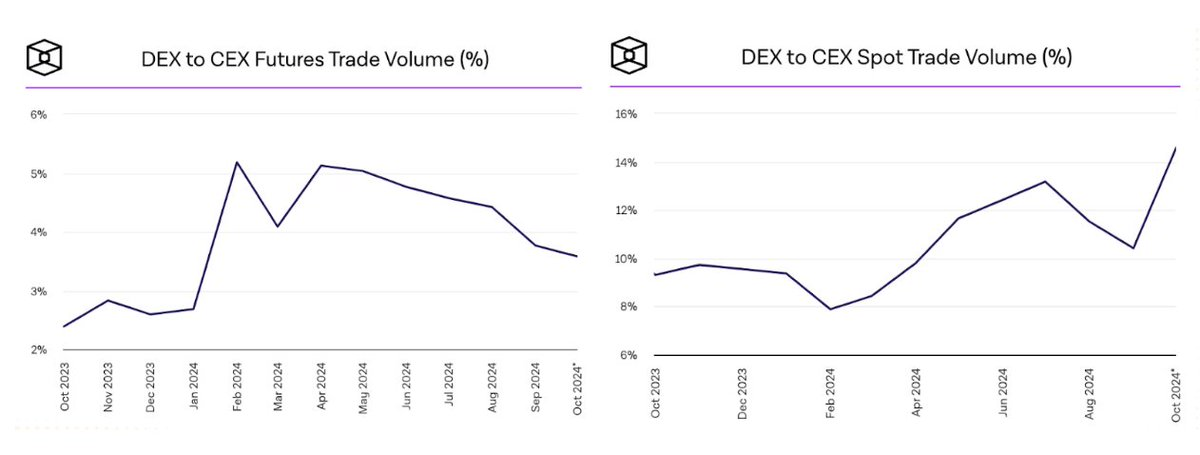

Capital flows are also shifting from centralized exchanges (CEX) to decentralized exchanges (DEX) through derivatives and spot trading. According to data from The Block, since the end of 2023, DEX's market share in these two areas has grown significantly, reaching new highs in spot trading, exceeding 15%.

From a broader perspective, centralized exchanges are also bringing off-chain users onto the chain through initiatives such as Appchain L2, for example, Coinbase's launch of Base and Kraken's Ink...

2.3: Bitcoin

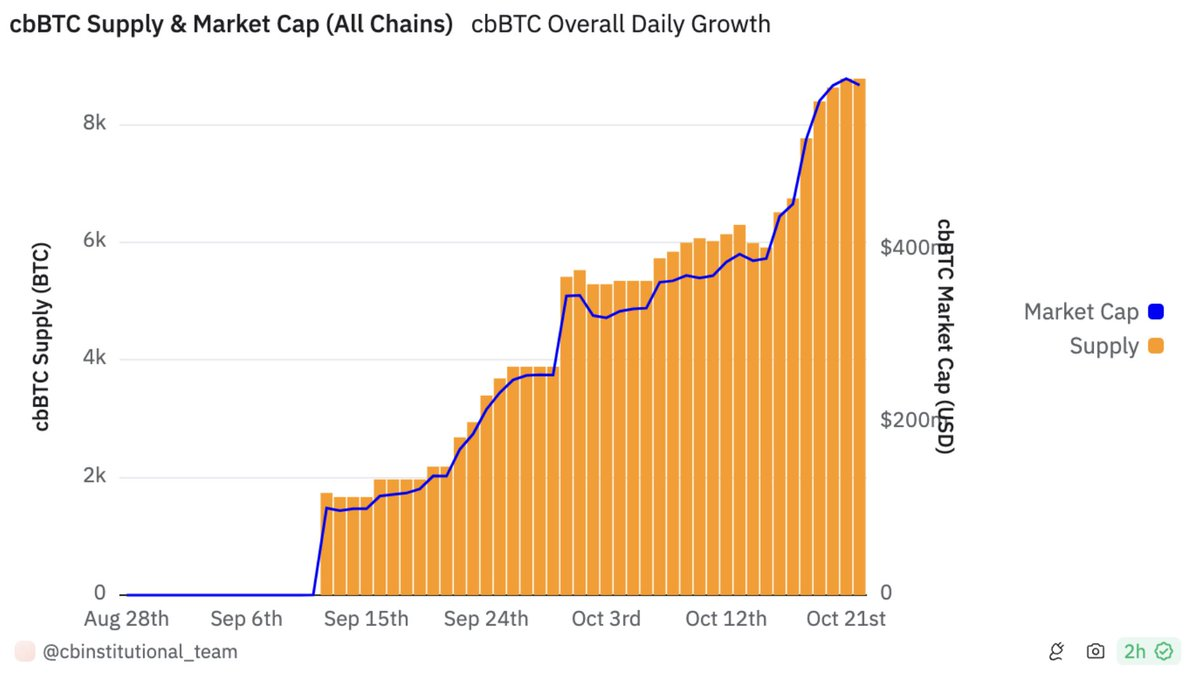

The integration of BTC with DeFi is receiving high attention from major institutions, especially after the launch of cbBTC by @coinbase, due to concerns over the security of WBTC. Within just one month, the market cap of cbBTC reached $500 million, primarily used in DeFi protocols on Ethereum and Base. If this trend continues, there could be tens of billions of dollars of BTC flowing into DeFi in the future.

As of the end of October 2024, the total market cap of WBTC and cbBTC only accounts for about 1/1300 of the total Bitcoin market cap, indicating that this largest crypto asset still has a large amount of untapped capital.

3: The old-fashioned DeFi model has almost proven its market fit

Fees and incentive mechanisms. Data source: Artemis

DeFi has always been an important area of the crypto market, and over time, its model has gradually shown a fit with the market. This can be seen from the sustained demand for use, even as incentives such as Token rewards have been decreasing. This is particularly evident in some major projects, such as Aave (lending), Uniswap (decentralized exchange), and Lido (liquid staking), where fees remain at relatively high levels, while the price and quantity of Tokens used for user incentives have been steadily declining since 2021.

Compared to other trends in the crypto market, we can observe:

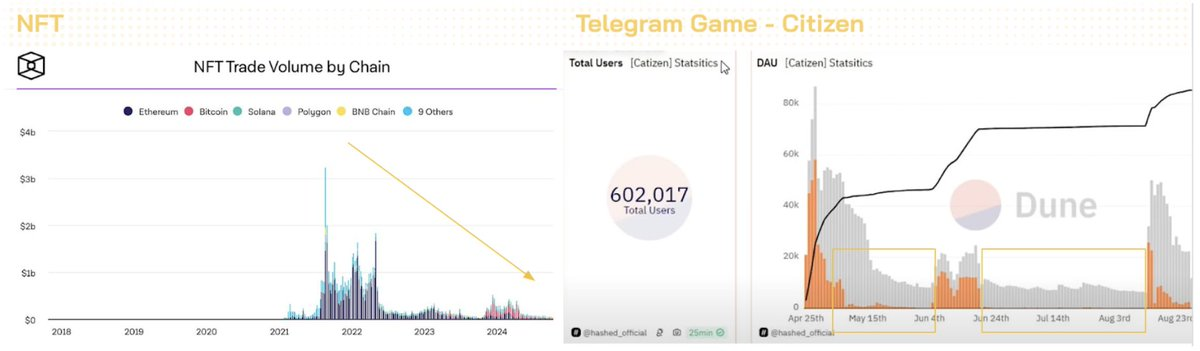

Non-Fungible Tokens (NFTs): Trading volume is currently at a low, with no signs of recovery after the hype of 2021-2022 (a period that coincided with the growth of DeFi).

Telegram games (e.g., projects under Binance Launchpool like Citizen): Daily active users (DAU) only increase on important dates related to airdrops, and the projects have been unable to maintain a stable active user base over a longer period.

SocialFi: Friendtech has officially abandoned control of the protocol after facing development difficulties, and the user count and NFT prices of Lens Protocol have seen significant declines...

Two major challenges for DeFi

1: Unstable interest rates and liquidity fragmentation

As mentioned earlier, lowering the Federal Reserve's interest rates is a necessary condition to attract traditional capital (including individuals and institutions) to flow into DeFi in search of yield. However, DeFi's yields are not stable, often influenced by market conditions. For example:

MakerDAO's mechanism depends on whether the price of USDS is above or below $1 to adjust the savings rate.

The interest rate when providing liquidity on Uniswap or other decentralized exchanges depends on the level of trading activity.

The interest rates on platforms like Aave are affected by the curves and pool utilization rates set by the DAO governance system.

Additionally, DeFi protocols also face the problem of liquidity fragmentation across different blockchains, which exacerbates interest rate volatility and reduces capital efficiency, especially as hundreds or even thousands of chains are expected to launch in the future.

The concept of a unified liquidity layer in Aave V4. Source: Aave

To solve this problem, well-known DeFi projects have proposed some unified liquidity solutions, such as the cross-chain liquidity layer developed by Aave and the Superchain plan participated by Uniswap. However, these solutions have not yet been implemented.

2: The new model has not yet shown its effectiveness

2.1: Modular DeFi

DeFi may return in a modular form, rather than relying on liquidity mining. This transformation may be led by the three giants Uniswap, Aave and MakerDAO (now called Sky). @SkyEcosystem has recently been renamed to Sky Money and continues to advance its endgame strategy. @Uniswap's V4 plan will be launched in the fourth quarter of this year, using a new model called Hooks, which allows users to develop their own automated market maker (AMM) on the Uniswap platform. @aave's V4 is also planned to be released in the early second quarter of 2025.

Recently, only some smaller protocols have completed the development of new models, such as Morpho and Euler. Morpho allows curators to design lending markets using the liquidity of Morpho Vaults. @eulerfinance has launched v2 with the Ethereum Vault Connector (EVC), establishing connections between lending pools on Euler.

In this stage of DeFi development, a common trend is the expansion of collateral asset types, which opens up new application scenarios for reaching and serving new user groups.

However, based on the activity of Morpho Labs, the company that initiated this trend, we have not seen an increase in lending. → Therefore, DeFi may shift towards a modular model, but the effectiveness of this approach remains to be validated over time.

2.2: Re-pledging

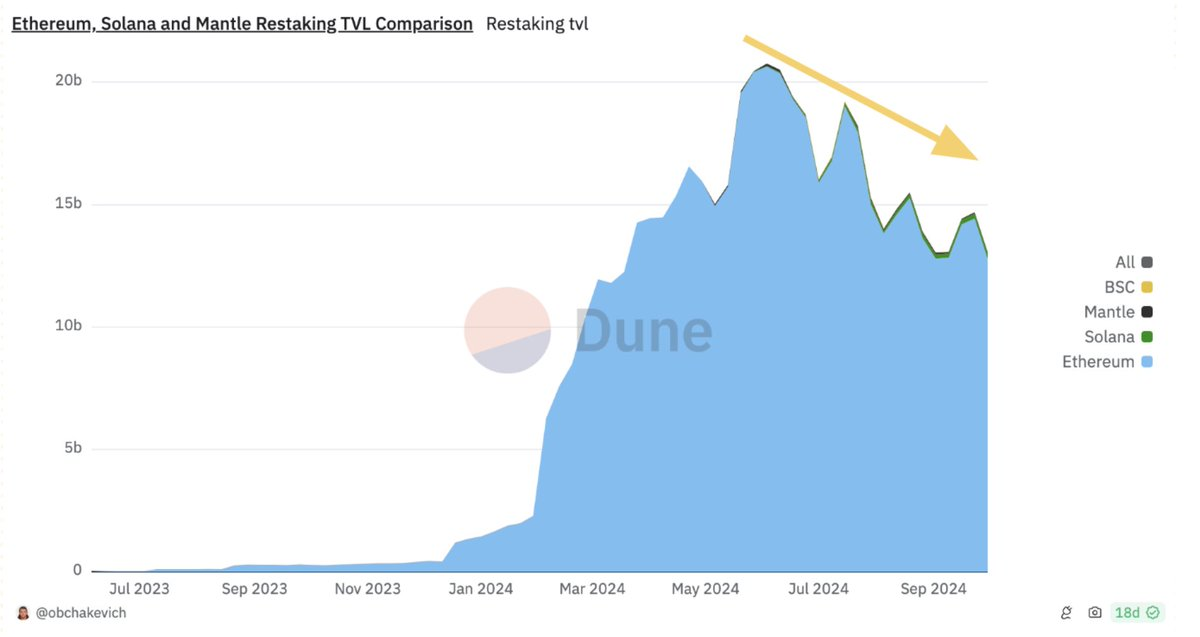

Although re-pledging was only launched in early 2024, its total locked value (TVL) has reached $15 billion, accounting for 5% of the ETH market capitalization, with about $10 billion concentrated on @eigenlayer on Ethereum. However, the use of re-pledging as a security economic layer, AVS, is almost zero. This poses long-term challenges, as stakers have no stable source of income other than project Tokens, and if this situation continues, the TVL may decline significantly.

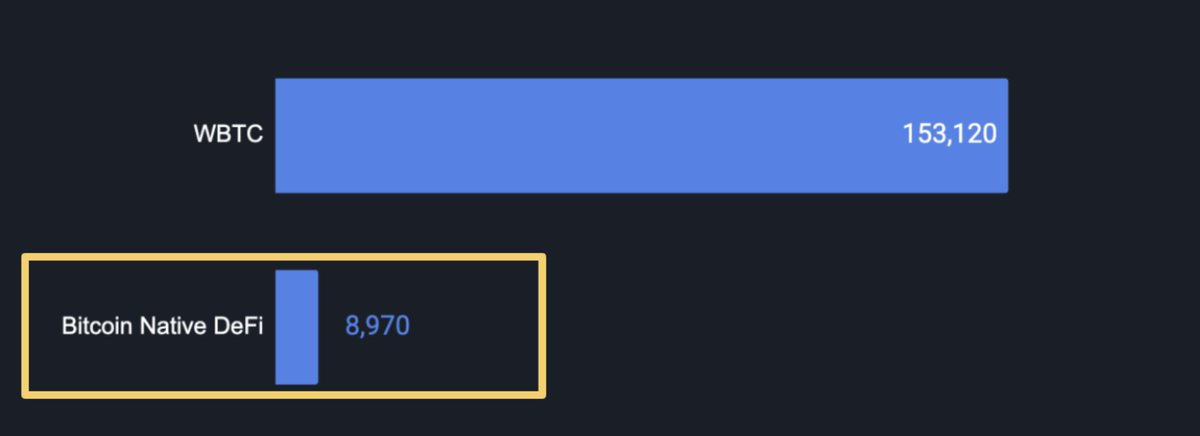

2.3: BTCFi

BTCFi TVL. Source: Coinmarketcap BTCFi Report

In addition to introducing BTC into the DeFi ecosystem through WBTC or cbBTC, the idea of creating an independent ecosystem for Bitcoin has also taken shape, mainly developing on sidechains such as Stacks and Merlin. Although this concept has existed since 2021 (with the launch of the Stacks mainnet), its TVL is still relatively small, at around $1 billion. This may be because these projects:

Do not reflect the unique features of the Bitcoin L1, such as Ordinals or Runes, but are more like copies of Ethereum.

Are not fully regarded as "native" projects, as they only use BTC as an asset, lacking a close connection with the Bitcoin L1.

DeFi has been an important growth area in the crypto market. Over time, the old DeFi model has proven its market adaptability. In the near future, capital from traditional markets, real-world assets (RWA), centralized exchanges (CEX), and Bitcoin may flow into DeFi, which could further drive the development of this field.

Currently, the development of new DeFi models is still not clear enough and has limited effects, mainly relying on the old model, which to some extent inhibits the momentum of growth. However, we can still look forward to the solutions in the next stage, such as modular DeFi, cross-chain liquidity, and even the fee switching mechanism of the major DeFi protocols. Once the flow of funds is activated and the new models show market demand, DeFi is expected to usher in unprecedented growth.