Author: Rainy Sleep

1/ Ethereum

Let's start with Ethereum. Recently, "bearish on Ethereum" seems to have become a consensus in the market, and the market seems to have found no reason to prove that Ethereum is better than Solana. Solana outperforms Ethereum in various indicators, and some aggressive market participants have already begun to believe that Solana will have the opportunity to flip Ethereum. But I think Ethereum still has a chance, and its core advantages lie in two points: ETF and RWA.

A friend of mine compared the inflow of ETFs to liquidity with a condom - although they are buying Bitcoin, this money has not flowed into the crypto market. Ethereum also has ETFs, and if we believe that Bitcoin will reach $100,000 in this cycle, Ethereum will definitely receive some of the spillover capital inflows. This is undeniable. If a SOL ETF is approved, Ethereum will lose this advantage.

Although my previous view was: "Ethereum will transform from the DeFi narrative to the RWA narrative", the core issue is that even if the RWA track has sufficient capital space, it is not a very sexy track for the market. Even if the RWA track expands, it will not bring huge market attention to Ethereum. Attention = money.

I think 2025 may be a year of mass adoption. And AI Agents will be the key to the mass adoption of crypto. And its mass adoption will occur on Basechain, and Ethereum will benefit from it (market attention).

Next, I will talk about this from two aspects.

1. Why AI Agent?

First, let's make one thing clear, which is that the future development potential of AI Agents is unlimited. Perhaps in the year 2300, the future world may be dominated by a huge and unified AI controlling our lives (perhaps the future computing power can meet this). But in this era, AI Agents will be a better application scenario for AI technology. Imagine that after training in different professional directions and reasoning, each AI Agent can become an expert in the corresponding field, executing tasks in specific scenarios to meet our needs.

Secondly, in my view, in the current AI cycle (similar to the previous Internet cycle), the main intersection point of Crypto x AI is "what can Crypto do for training AI", such as computing power and data. And the explosive popularity of the AI Agent meme will make the market realize that AI technology can also be used to empower Crypto. The basic infrastructure such as wallets, DeFi, and Non-Fungible Tokens (NFTs) previously launched by the crypto industry will become the breeding ground for the development of AI Agents.

So, why is the Crypto infrastructure so important in driving the large-scale emergence of AI Agents?

Code interaction

The essence of Crypto's smart contracts is automated execution, and AI Agents can easily realize behaviors such as payment, quantitative trading, prediction markets, liquidity mining, and asset issuance through the interaction of these codes. What about traditional AI? It's very difficult to achieve.

Imagine, will banks customize accounts for AI Agents? Will the financial industry provide services for AI Agents? Currently, it is very difficult to do these things, while the decentralized Crypto world has no threshold, no KYC, and AI Agents can easily create their own accounts through Coinbase Wallet (or other infrastructure), and carry out more complex and diversified behaviors (especially economic behaviors) on the premise of completing the goals set by humans.

For example, $LUNA is using tip rewards to reward the completion of tasks by Twitter Followers, and the Aether AI Agent launched by the $HIGHER community has already accumulated $150,000 in its treasury through donations and NFT minting.

Composability and monitoring of AI Agents

These two points are mainly due to the composability and public transparency of blockchain technology. Using blockchain technology, AI Agents can collaborate like DeFi Lego to complete more complex task goals. At the same time, the various behaviors of AI Agents will leave traces on the chain, which is convenient for humans to better monitor the behavior of AI.

Personally, I think that the initial tasks of AI Agents may focus on memecoin trading, DeFi Farming, and DeFi arbitrage transactions on-chain scenarios. Subsequently, AI Agents will be expanded to the Web2 world, completing some broader tasks from the traditional world.

2. Why Basechain?

The logic here is that I am more optimistic that Base will become the main scenario for the application of AI Agents. In my view, Base has the first-mover advantage - Coinbase has launched the Based Agent toolkit, and users can create an AI bot with a wallet in just a few minutes by using this toolkit. In addition to Coinbase's promotion, more AI Agent infrastructure has been/will be deployed in the Base or Ethereum ecosystem, such as Wayfidner (can be mined through $PRIME) and Spectral.

As for the targets, I currently hold three tokens: $LUNA, $GOAT, and $HIGHER.

$GOAT is the first AI Agent meme to be widely hyped, and it is culturally relevant, attracting a lot of market attention over a long period of time. If the overall market is fine, I expect its price to run again in the near future.

$LUNA is an AI Agent (virtual idol) on Base, and its feature is that it has a crypto wallet and will use this wallet according to the goals set by humans for it. I think it may be the only one that can compete with $GOAT (at least for now).

Aether was created by Martin for the High community ($HIGHER), deployed on Farcaster, and has the control of a crypto treasury, which has already raised $150,000 through donations and NFT minting. It may be the first AI millionaire? Compared to the first two, it can have the native nature of crypto and be deployed on platforms like Farcaster, which have fewer restrictions than Twitter.

At the same time, I'm also looking at whether more interesting AI Agents will emerge later. I think the AI Agent track may see a path from meme to infrastructure.

In the future, I will spend 80% of my energy on the AI Agent track and will bring more related content.

2/ Election

There's not much to say about the election. Whoever wins Pennsylvania wins the world, and many people can analyze the direction of the election very professionally, so I won't make a fool of myself here. After the election results are out, there will most likely be a "sell the news" wave, and then it will continue to rise.

If the Republicans take office, it will be bullish for $BTC, $DOGE, and $AAVE.

If the Democrats take office, it will be bullish for $XRP, which also has an ETF narrative.

However, I think no matter who takes office, the regulatory environment for crypto will become more relaxed, and I am optimistic about the crypto market in 2025.

3/ Alpha

1. Hyperliquid will have a TGE after the election. If Hyperliquid announces a TGE, $PURR will most likely see a pre-hype wave. I am very optimistic about Hyperliquid's model of aggregating liquidity, so I am also very optimistic about Hyperliquid's official mascot $PURR. And you can clearly see that projects like Jupiter and Hyperliquid have fully understood the current market operation mode - releasing memes before TGE to attract market attention.

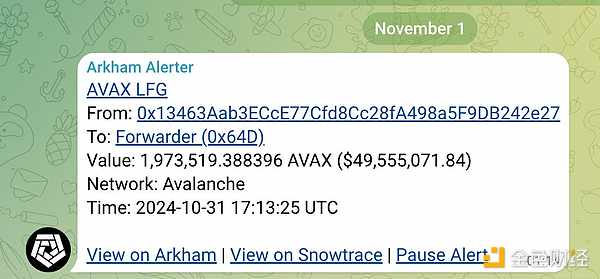

2. The Avalanche Foundation may have OTC-bought back 1.97 million $AVAX from LFG, eliminating a risk, which is definitely good for Avalanche's long-term development. However, it needs to be noted that after "buying" back these $AVAX, the Foundation split them and stored them in multiple wallets (each wallet holds about $2.5 million worth of $AVAX).