Author: shaofaye123, Foresight News

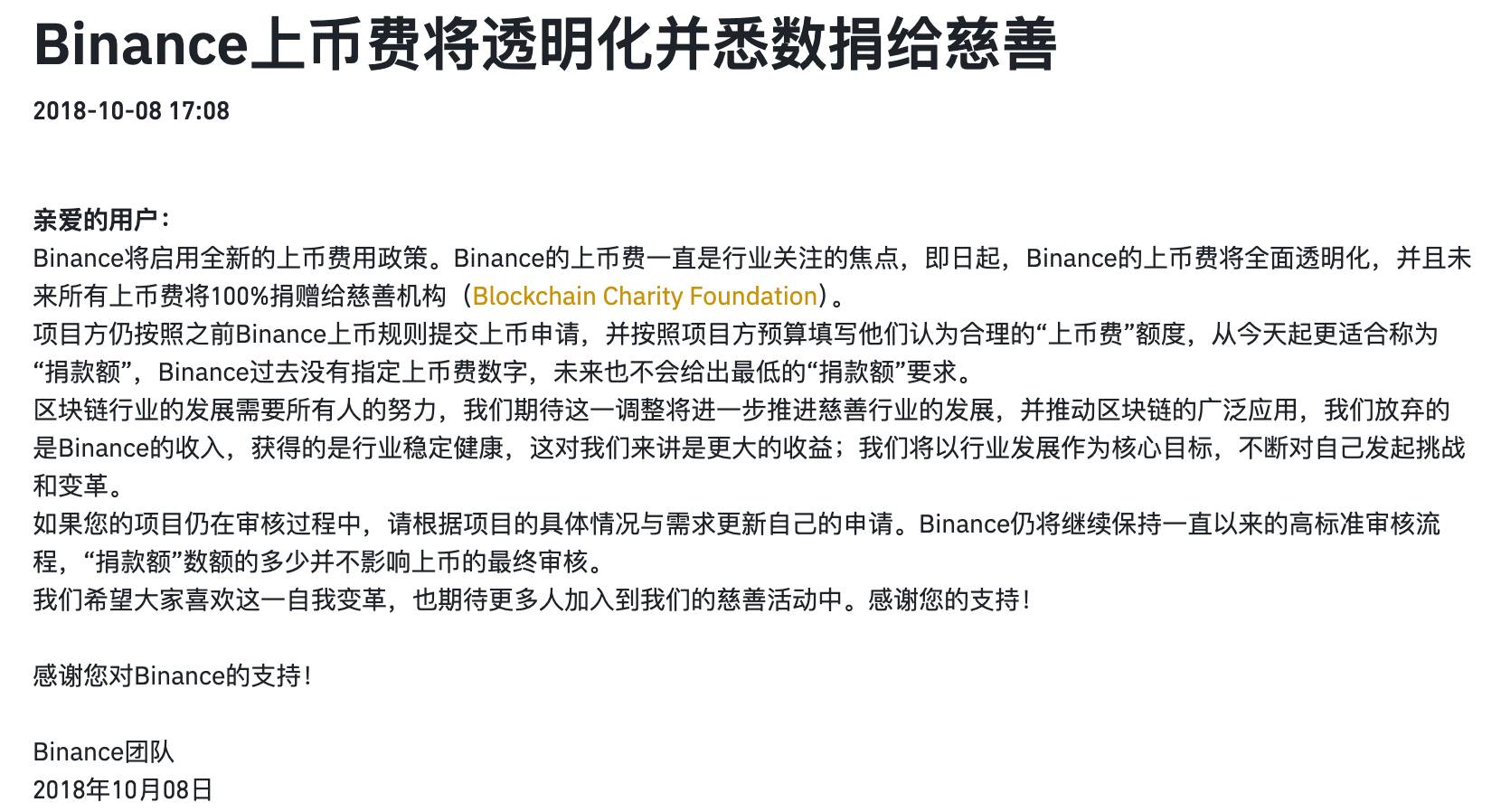

The listing fee of exchanges has always been a focus of the industry. The discussion on whether there are really astronomical listing fees is not the first time. In 2018, Binance was accused of charging a $1 million listing fee to list tokens. Other exchanges have also been involved in the topic, with fees ranging from 10 ETH, 20 BTC, to 500,000 Tokens, making it difficult to determine the truth. In October 2018, Binance also issued an announcement stating that it would make the listing fee transparent and donate it to charity. In 2022, due to the MITH incident requesting a refund of the deposit, Binance's listing fee was once again caught in the public opinion vortex. Recently, with the CEO of Moonrock Capital exposing a $100 million listing fee on Twitter, the rumors and criticisms of Binance's astronomical listing fees have once again become the focus of attention.

The Incident

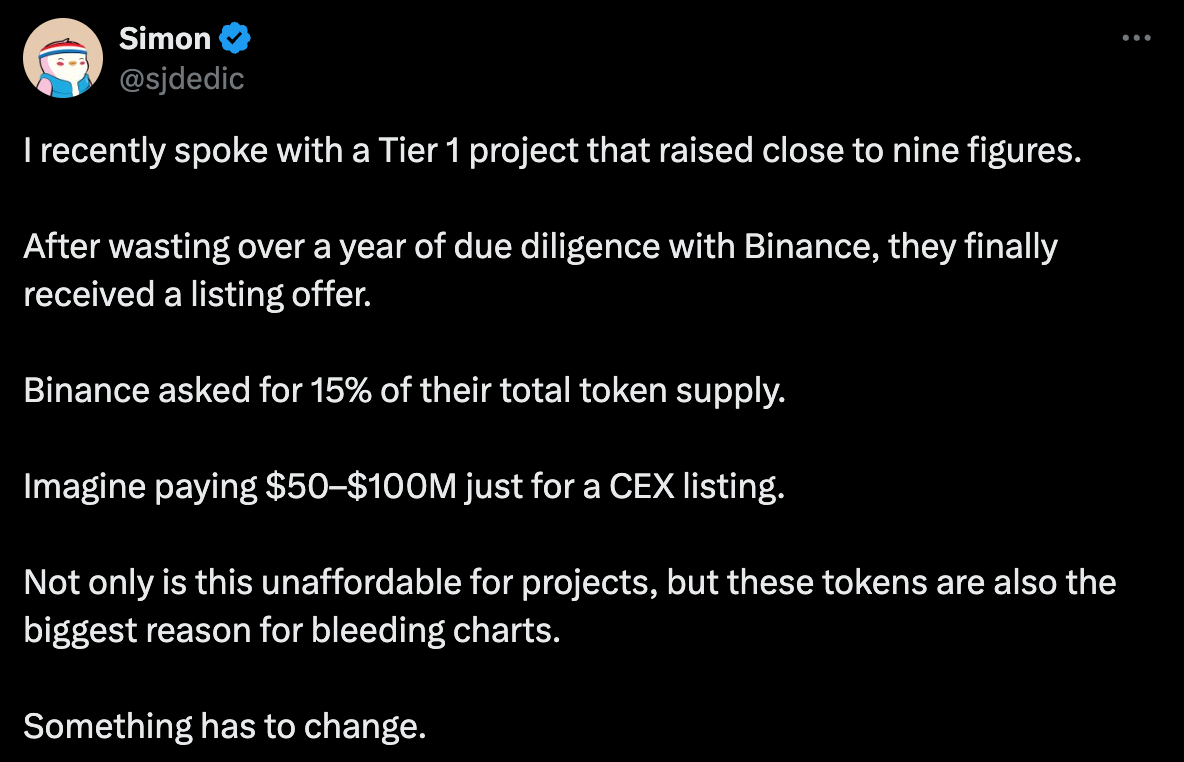

On November 1, the CEO of Moonrock Capital, a crypto-native advisory and investment firm, spoke out on Twitter. He claimed that Binance required a potential project to provide 15% of its total token supply to ensure its listing on the centralized exchange, which accounted for 15% of the total token supply, worth about $50 million to $100 million.

Subsequently, the incident began to ferment, with the post receiving over a million views, and more and more KOLs began to participate in the discussion or support it.

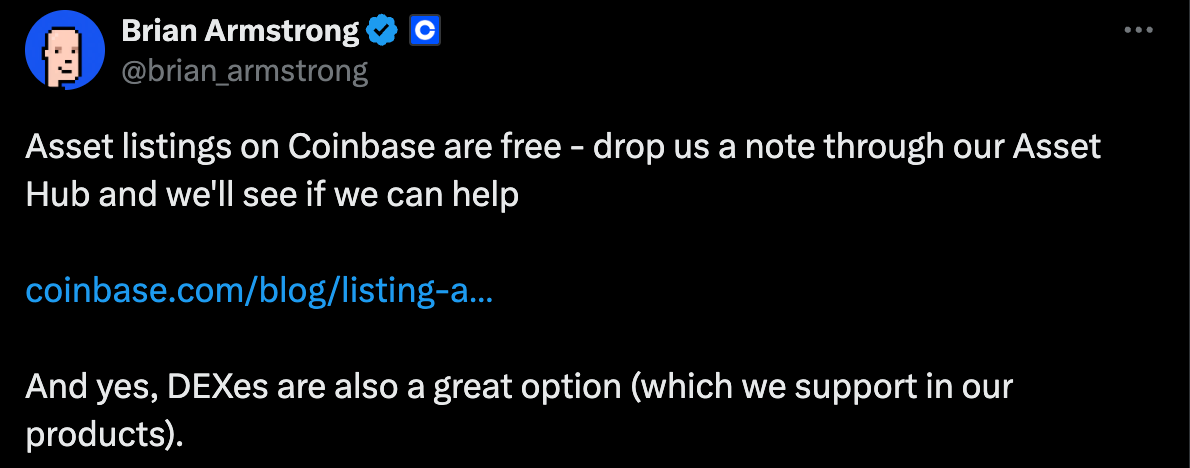

Coinbase co-founder Brian Armstrong also issued a statement on this matter, stating: "Coinbase's listing is free."

However, Coinbase, which wanted to use this incident to demonstrate the spirit of decentralization and fairness, was quickly exposed. Not only did it charge a listing fee, but the amount was not small.

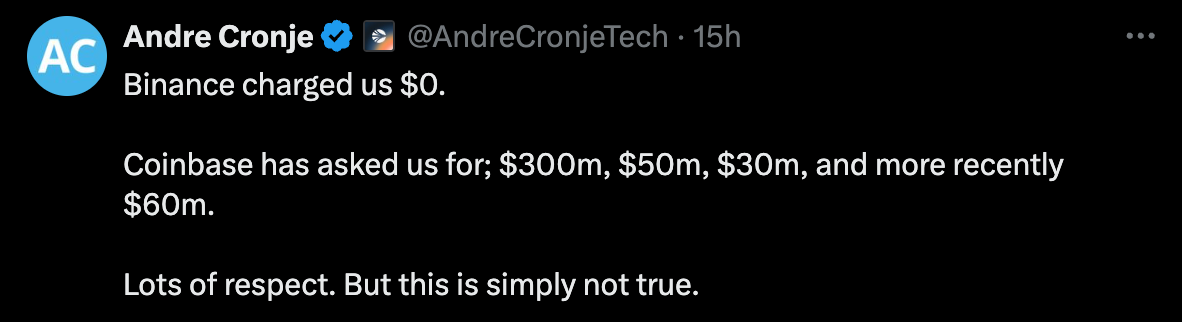

Sonic Labs co-founder Andre Cronje tweeted that "Binance does not charge a listing fee, but Coinbase has repeatedly requested fees, quoting $300 million, $50 million, $30 million, and the most recent quote was $60 million." This response sparked widespread discussion, and the incident escalated further. Some questioned whether Andre might have contacted a fake Coinbase listing employee, and Andre said he was willing to provide all the evidence for the public to verify. "I have not signed a non-disclosure agreement, so I am very happy to provide the relevant proof (the quotes came from multiple Coinbase employees/departments, communicated via email, Telegram, and Slack over the years). Coinbase can argue that this is not a listing fee, but an Earn Fee, but this will still be converted into the project's listing cost."

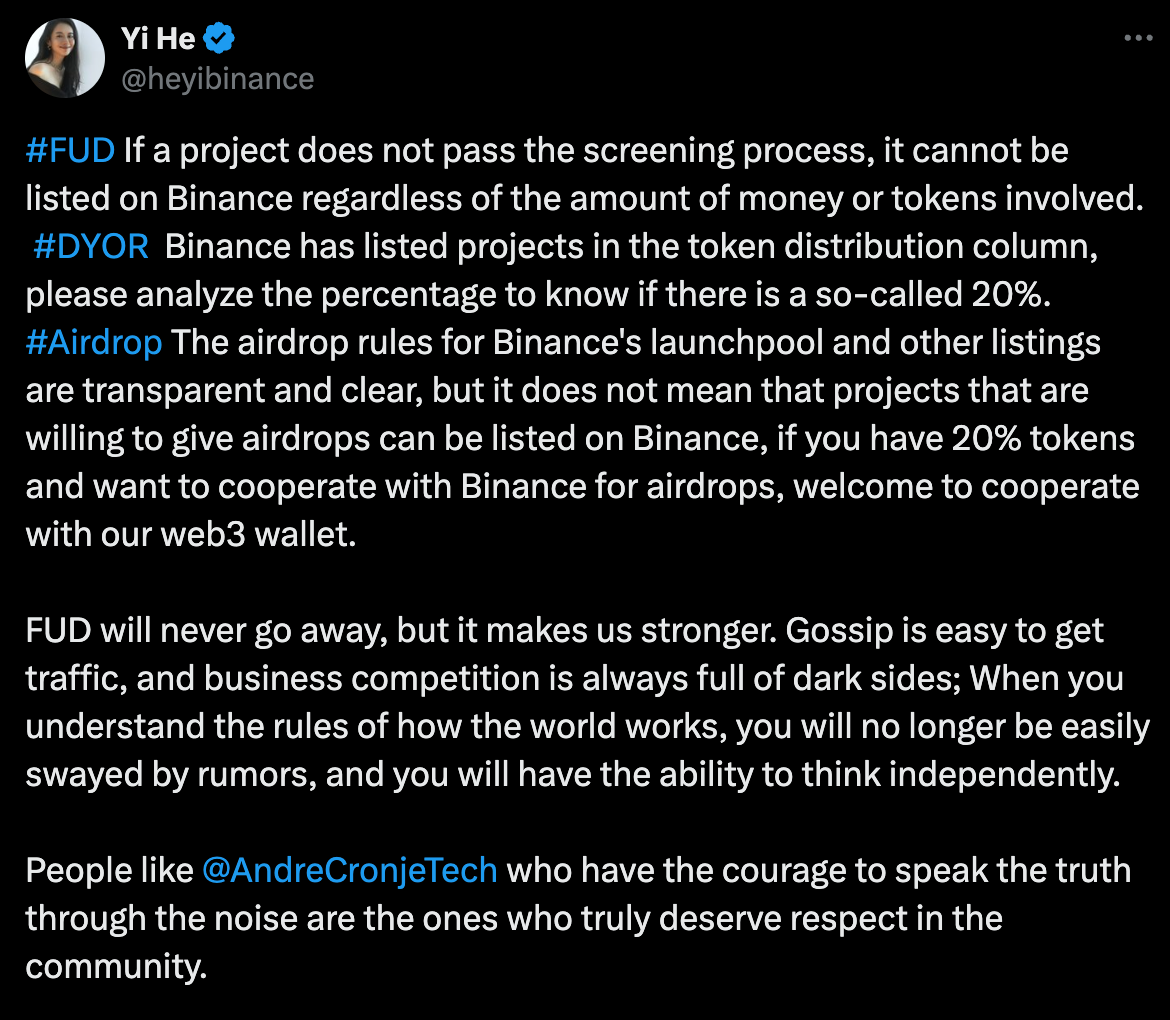

He Yi's Response

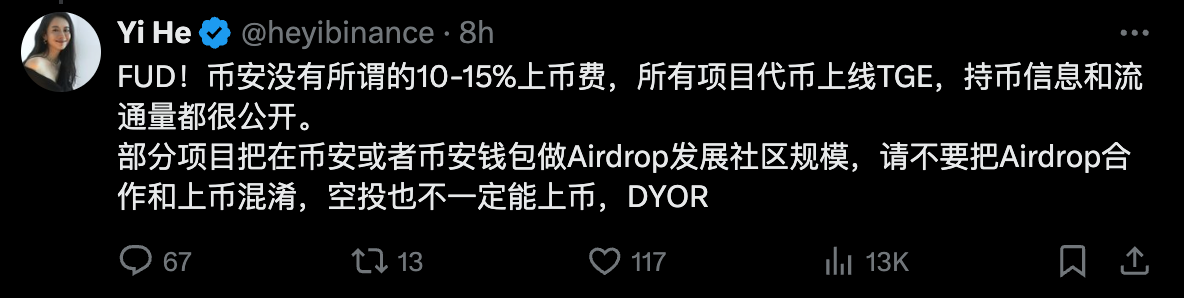

With the discussion reaching a high fever pitch, Binance co-founder He Yi also gave a response, stating that there was no such thing as a listing fee, and that the airdrop ratio and rules for cooperation with projects were clear and transparent, and that the listing qualification was not determined by whether the project provided tokens. In addition, Binance has a strict listing screening mechanism.

He Yi stated on Twitter:

FUD If the project does not pass the screening process, no matter how much money or what percentage of the tokens, it cannot be listed on Binance.

DYOR The projects listed on Binance all have clear introductions in the token distribution column, so you can analyze the percentage yourself to see if there is a so-called 20%, 15%, or anything like that.

Airdrop The airdrop rules for Binance's launchpool and other listings are transparent and clear, but that does not mean that all projects willing to do airdrops can be listed on Binance. If you have 20% of the tokens and want to cooperate with Binance on airdrops, you are welcome to work with our Web3 wallet.

FUD will never disappear, but let's get stronger. Gossip is easy to gain traffic, and business competition is always full of dark sides; when you understand the rules of how the world works, you will no longer be easily swayed by rumors and will have the ability to think independently.

People like AC, who dare to tell the truth in the midst of the noise, are the ones truly worthy of respect in the community.

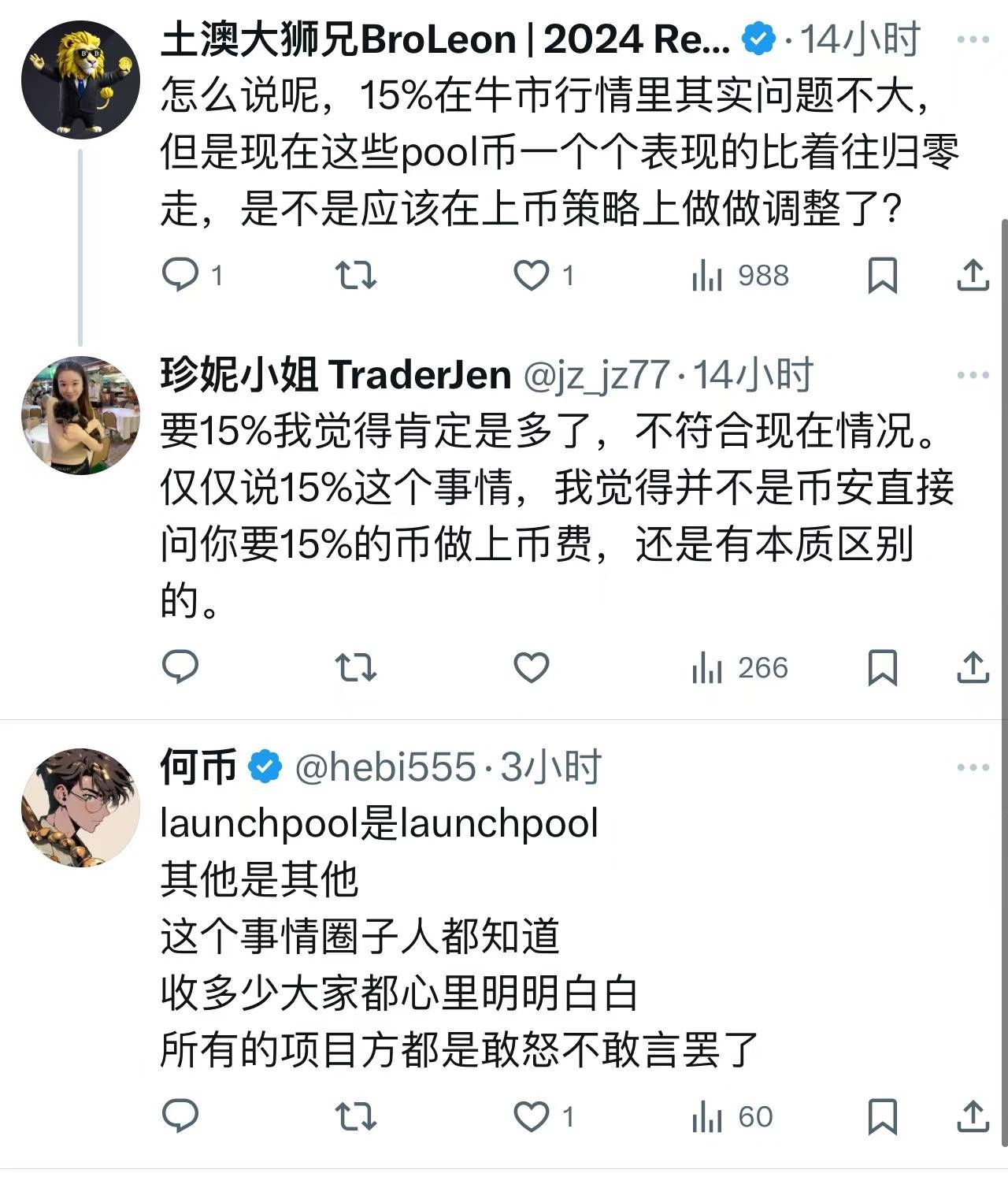

As for the listing fee, KOLs and the public also have different views. Some believe that the listing fee is part of the exchange's operations and can be used as a way to screen the quality of projects. Others believe that the listing fee may hinder the listing of some potentially promising but underfunded projects, thereby affecting the diversity and competitiveness of the market.

Seeing Industry Development from Listing Fees

In 2018, 2022, and 2024, it seems that the controversy over listing fees is brought up every so often. Cryptocurrencies are based on the core principle of decentralization, yet the listing fees of centralized exchanges have always been shrouded in a veil of mystery. From a business perspective, it may be reasonable for exchanges to charge a certain listing fee, as they need to invest resources to evaluate projects, ensure compliance, and maintain platform operations. However, the charging of fees should be transparent and fair, and high fees should not become an obstacle to innovation.

The ongoing controversy over listing fees shows a strong demand from industry practitioners for transparency and fairness. Binance's proactive response has to some extent alleviated market doubts, further highlighting the necessity for exchanges to be more transparent and fair in their listing policies. But the development of the industry should not be limited to just listing, and project parties should focus more on the quality and sustainability of their projects. The focus on listing fees at each stage reflects the demand for a fairer and more transparent market environment. And this often means the emergence of a new turning point, where the industry needs truly valuable projects to stand out.