Trump Elected! The First Crypto President of the White House is Born!

On November 6th Beijing time, the most dramatic presidential election in US history has finally come to an end. According to real-time election data from Fox News, Trump defeated Harris, who received 62.14 million votes, with an advantage of 67.12 million votes, successfully obtaining 277 electoral votes, exceeding the 270 threshold for victory, and winning the 2024 US presidential election.

Trump's continued lead and successful election have helped push BTC to a new all-time high of over $75,000, and the entire crypto sector is experiencing a bull market.

The 2024 US election is destined to leave the most indelible mark in crypto history. Since the birth of Bitcoin, the crypto industry has gone through three election cycles in 16 years, and has finally truly entered the arena of the US presidential election.

The growing strength of BTC and other crypto assets, as well as the rising influence of crypto voters, are the driving forces behind politicians like Trump playing the "crypto card".

Whether Trump's crypto promises will be fulfilled after taking office remains to be seen, but the gears of crypto's destiny may have already started turning.

Trump's Crypto Promises

Compared to Harris' unclear stance on crypto, Trump's continuous crypto promises have made him the most anticipated president for the crypto community.

The crypto community has bet billions of dollars on Trump's victory on Polymarket. Trump's multiple statements on crypto have also helped drive significant BTC rallies and volatility.

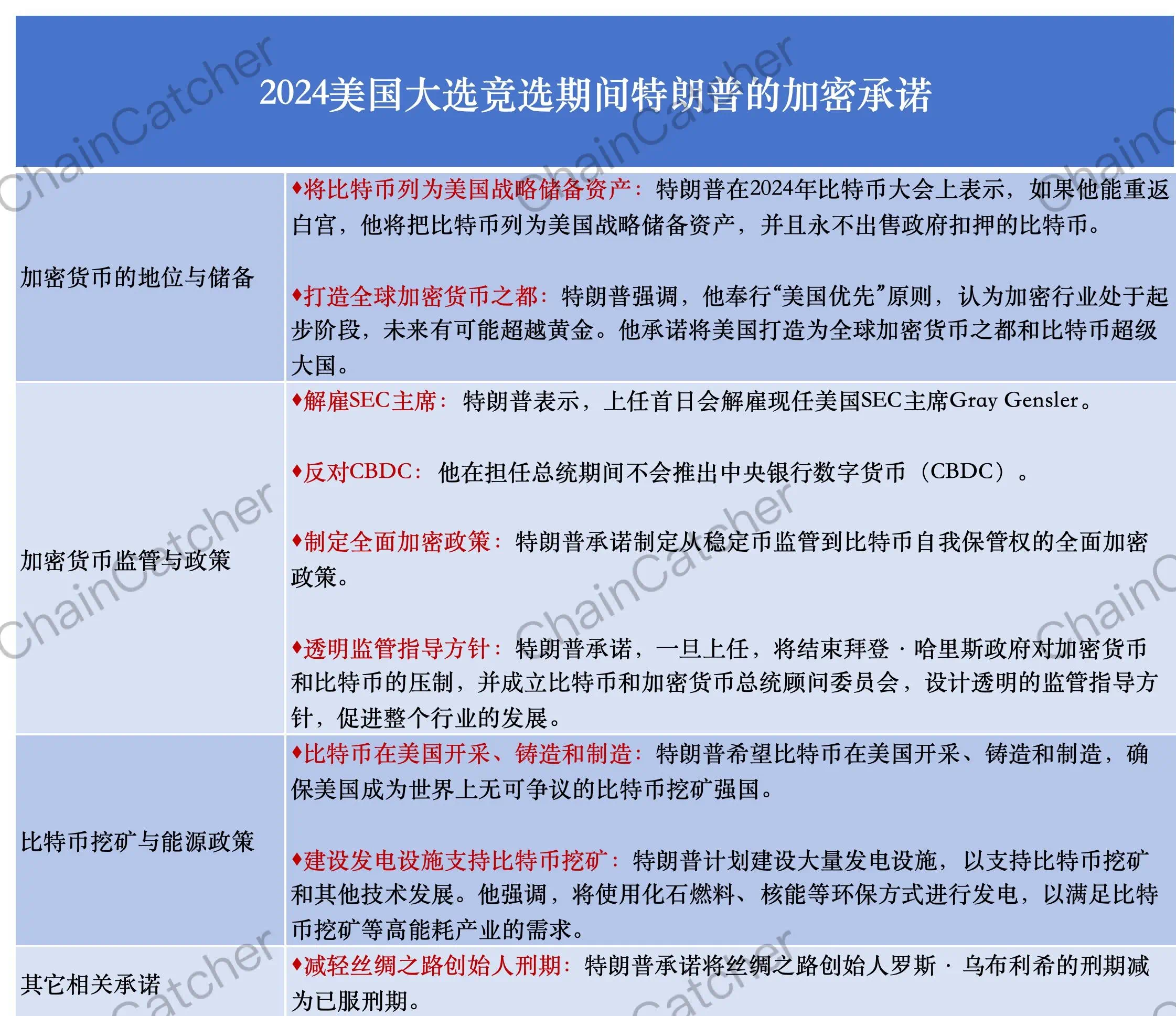

Reviewing his campaign platform, Trump's key crypto policy promises include:

Trump has repeatedly emphasized the status of cryptocurrencies and BTC. Trump vowed to build a global crypto capital. He adheres to the "America First" principle and believes that the crypto industry is in its infancy and may surpass gold in the future. He has promised to make the US the global crypto capital and a BTC superpower.

At the 2024 BTC Conference, Trump also stated that if he returns to the White House, he will list BTC as a strategic reserve asset for the US and never sell the BTC seized by the government.

Regarding the $35 trillion US national debt issue that could trigger a long-term economic crisis, Trump has also suggested that it could be solved by repaying with cryptocurrencies.

Regarding BTC mining and energy policy. Trump wants "all remaining BTC to be produced in the US", ensuring that BTC is mined, minted and manufactured in the US, making the US the world's undisputed BTC mining powerhouse, and claims this will help the US become an "energy leader".

Trump plans to build a large number of power generation facilities to support BTC mining and other technological developments. He emphasizes that fossil fuels, nuclear power and other environmentally friendly methods will be used for power generation to meet the high energy demands of industries like BTC mining.

On crypto regulation and policy, Trump has also mentioned several targeted solutions.

Under the oppressive regulation of the Democratic-led SEC, the contradictions between crypto companies, community users and US crypto regulation are also intensifying.

Trump's series of regulatory proposals have undoubtedly won the favor of crypto voters.

Trump said that on his first day in office, he will fire the current SEC Chairman, Gary Gensler. Trump also opposes CBDC, stating that he will not introduce a central bank digital currency (CBDC) during his presidency.

Regarding the lack of clarity and transparency in crypto regulation that the crypto community has repeatedly criticized, Trump said that within the first 100 days of his term, there will be corresponding regulations.

He will formulate comprehensive crypto policies from stablecoin regulation to BTC self-custody rights. He also said he will end the Biden-Harris administration's suppression of cryptocurrencies and BTC, establish a Bitcoin and Cryptocurrency Presidential Advisory Council, and design transparent regulatory guidelines to promote the development of the entire industry.

In addition, Trump also promised to reduce the sentence of Silk Road founder Ross Ulbricht.

Trump's "light regulation, heavy innovation" crypto promises have instilled a lot of confidence in the crypto community, at least the crypto community generally believes it will get a more relaxed regulatory environment.

Among the many promises, anonymous crypto market analyst and trader Crypto Rand believes that ensuring a solid regulatory framework for cryptocurrencies and making it legally binding is one of Trump's most important promises. He believes that Congress and the US Securities and Exchange Commission have repeatedly shown a lack of understanding of the crypto industry and its development.

Furthermore, Trump's promise to grant crypto users the right to self-custody is essentially enshrining "not your keys, not your coins" into US federal law.

Many politicians or crypto companies also believe that Trump's inauguration will also accelerate the end of the term of Gary Gensler, who is known as the "crypto extinction diva". US Senator Cynthia Lummis of Wyoming said that SEC Chairman Gary Gensler may step down as the head of the regulatory agency next year.

Regarding the vision of establishing a BTC strategic reserve, asset manager Bryan Courchesne also believes that although it is challenging, it is not impossible. He said the Department of Justice could transfer the approximately 200,000 BTC it has seized to the Treasury Department as a reserve asset, and continue to accumulate digital currencies to establish a BTC strategic reserve, although this process may face cumbersome administrative procedures.

However, there are also many crypto figures like former BitMEX CEO Arthur Hayes who believe that Trump's crypto promises are just election campaign rhetoric and have little hope of being fulfilled. Arthur Hayes believes that until the relevant legislation is formally implemented, these crypto declarations may remain empty promises.

Especially in Trump's political career, he has repeatedly broken his own promises, such as failing to fulfill his promises on healthcare plans and border walls.

Trump's crypto promises also face challenges in terms of fulfillment.

Regarding the BTC reserve strategy, Ric Edelam, founder of the Digital Assets Council of Financial Professionals, believes that in theory, cryptocurrencies could help solve the long-standing US national debt problem, and a BTC reserve could significantly reduce or even eliminate the US national debt.

But the reality may be that Trump may not be able to successfully establish a reserve fund. Or even if he succeeds, his successor may cancel it. Ric Edelam believes that Trump's "using cryptocurrencies to solve the US debt problem" should just be an interesting statement during the campaign, nothing more.

The vision of making the US the world's BTC mining powerhouse has also been questioned as too idealistic.

Currently, the BTC supply cap is 21 million, and 90% have already been mined. Bitfarms CEO Ben Gagnon said that if Trump reduces red tape and increases support and investment in energy and power infrastructure, the US will consolidate its position as the most competitive place for global BTC mining, and making the US the world's number one BTC mining country is absolutely possible and desirable.

However, due to the decentralized nature of BTC's infrastructure, the remaining BTC mining cannot be concentrated in a single country, and it is impossible for 100% of BTC to be mined in the US or any other country, which would also fundamentally go against the core principles of BTC's creator Satoshi Nakamoto.

Furthermore, quickly firing Gary Gensler on day one is not as easy as Trump claims. The dismissal process may involve multiple steps and legal procedures, requiring reasonable grounds for dismissal, which may require a series of legal reviews and administrative transitions. Trump may still face a situation of co-governing with Gary Gensler.

Outlook for the Crypto Market

Although Trump's crypto promises remain to be tested by time, the market is generally optimistic about the crypto market under a Trump presidency.

Many analysts believe that BTC will continue to set new historical highs, and may even break through $100,000 by the end of the year.

Geoff Kendrick, an analyst at Standard Chartered Bank, said that BTC will rise another 10% in the next few days and reach $125,000 by the end of this year.

Bernstein analysts have previously stated that the Bitcoin price may reach $80,000-$90,000. Jeff Park, head of alpha strategy at crypto asset management firm Bitwise, predicted that the price of Bitcoin could rise to $92,000.

Early Bitcoin investor Erik Finman said that Trump's policies will ignite the crypto market and drive significant growth across the industry. He believes that Trump's victory could push the Bitcoin price up to $100,000.

By the end of 2025, Bernstein Research Company stated in a report on Bitcoin prices that the Bitcoin price could reach as high as $200,000. PlanB, the creator of the Bitcoin Stock-to-Flow (S2F) model, even boldly predicted that BTC could reach $1 million.

In addition to the BTC trend, Trump's tenure after taking office will also have an important impact on Federal Reserve rate cuts, the progress of crypto currency ETFs, meme coins, and other areas.

Trump had promised to significantly lower interest rates if elected, but David Kelly, chief global strategist at JPMorgan Asset Management, said that if Trump is elected, the Federal Reserve is most likely to pause its easing cycle as early as December. This is because Trump's expansionary fiscal policy plans will drive up inflation and prevent interest rates from falling.

Kelly also pointed out that if the Republican Party achieves a major victory in Trump's victory, there will be more expansionary fiscal policies, which may trigger trade wars, widen deficits, and lead to higher interest rates.

Maya MacGuineas, chairman of CRFB, also believes that if Trump is elected, especially if the Republicans control Congress, future interest rates may be higher than expected.

In terms of crypto currency ETFs, Nate Geraci, president of The ETF Store, believes that if Trump is elected, it will accelerate the approval of an Ethereum ETF backed by collateral, and Nate Geraci also said that the net inflow of Ethereum ETFs is just a matter of time.

In terms of the progress of crypto currency ETFs other than BTC and ETH, Bloomberg senior ETF analyst Eric Balchunas said that after Trump's election, regardless of whether BlackRock joins Bitwise, VanEck and other companies hoping to expand crypto currency ETFs beyond BTC and ETH (such as XRP and SOL), there will be a "fairly good chance" of more crypto currency ETFs appearing.

However, Trump's inauguration may have a negative impact on meme coins. Nic Carter, co-founder of Castle Island Ventures, said on his social platform that the meme coin hype is largely a reaction to the SEC's oppressive regulation. If the SEC regulates rationally, the market demand for trading meme coins will decrease.

Therefore, if Trump is elected, the situation may change. Overseas crypto KOL @malekanoms judged that Trump's victory will have a negative impact on meme coins.

@malekanoms believes that because a Republican landslide will overturn all this, restore initial coin offerings (ICOs), implement universal airdrops, and other forms of token rationalization. In addition, they may also make fee conversion and token dividends possible. And the rationalized regulation in the United States will refocus the attention of crypto currencies on dApps and other truly important things, but may also lead to a long-term bear market.

Although many views believe that Trump's election will be a turning point for crypto to rise again, some crypto enthusiasts also believe that the impact of the election is limited.

Looking at the past two cycles, whether it was a Republican or Democratic presidential candidate taking office, it did not affect the upward trend of the crypto market. The real long-term factors affecting the crypto market are still the industry's own technological development, Federal Reserve policy decisions, and other key factors.

Crypto Supporters Behind Trump

Trump's election may bring better development opportunities for his crypto supporters behind him. Several leaders in the crypto industry have donated to Trump's super political action committee, the Trump 47 Committee, and the America PAC.

According to incomplete statistics, a16z co-founders Marc Andreessen and Ben Horowitz have each donated $25 million to Trump's super action committee.

The founders of the crypto exchange Gemini and Winklevoss Capital Management have also donated a total of over $20 million.

In addition, Sequoia Capital partners Douglas Leone and Shaun Maguire donated $10 million and $5 million respectively.

Kraken co-founder Jesse Powell also donated $5 million. BTC Inc. CEO David Bailey donated over $498,000 in Bitcoin.

Ripple's Chief Legal Officer Stuart Alderoty donated $300,000 in XRP.

Crypto's Fate Gears Have Quietly Turned as It Takes the Stage of the US Presidential Election for the First Time

Trump's heavy use of the "crypto card" has also allowed crypto, since the birth of Bitcoin 16 years ago, to truly take the stage of the US presidential election for the first time, after going through three election cycles.

And this is due to the right time, place and people, inseparable from the continuous expansion of the Bitcoin and crypto market capitalization, the "accumulation of sand into a tower" of crypto users, and the collision of election cycles and crypto bull market cycles.

The last election year was 2020, when crypto was in a bear market and Bitcoin was around $8,000. But in 2024, crypto entered a bull market, with Bitcoin breaking through $70,000 multiple times, surpassing the silver market value at one point, and has long since transformed from a fringe asset to a mainstream asset globally.

The young crypto voters and the ever-rising crypto donations have also become a force that crypto politicians cannot ignore.

A Triple-A report shows that the global digital currency user base will reach 562 million (6.8% of the global population) by 2024. Among them, 34% of crypto currency holders are between the ages of 24-35. The young and diverse crypto user base has also played a crucial role in the key battlegrounds of the US election.

According to a report by security.org, the number of crypto currency holders in the US is estimated to reach 93 million, meaning that more than 30% of Americans hold crypto currencies. Coinbase's research has shown that one-sixth of crypto currency holders live in key states. And 90% of crypto currency voters said they would vote on November 5, four times the enthusiasm of non-voters.

The 2024 election cycle is also the beginning of the SEC's oppressive regulation of crypto. The crypto settlement reached a new high of nearly $20 billion in 2024, and crypto leaders have also become targets of crypto crackdowns. This has also prompted many crypto companies or investment firms such as Ripple, Coinbase, Kraken, and a16z to try to obtain a better living environment through political donations.

In 2024, the crypto donation capability of participants in the election has also reached a new high, far exceeding the previous election cycle.

Regardless of whether Trump subsequently fulfills his crypto promises as scheduled, it does not affect the 2024 US election becoming an important milestone in the history of crypto development.

As a super "sales king", Trump's flamboyant use of the crypto card during the campaign has also attracted a larger global audience to pay attention to and even participate in crypto.

In addition to making crypto promises to solicit votes, Trump and his family have also accepted crypto donations, continued to engage in NFTs, opened the "Trump DeFi Official Channel", and even launched the crypto project World Liberty Financial, to some extent bringing crypto into the mainstream.

In addition, the crypto prediction platform Polymarket has also become one of the most popular crypto products under Trump's multiple reposts, with its election prediction data being cited by Bloomberg, CNBC and other media, and even added to the Bloomberg terminal service.

With the joint efforts of various forces to bring crypto onto the stage of the 2024 US presidential election and into the mainstream, crypto is expected to become an indispensable force in US elections from now on, and the gears of crypto's fate may have quietly turned.