Written by:Scott Matherson

Compiled by: Bai Hua Blockchain

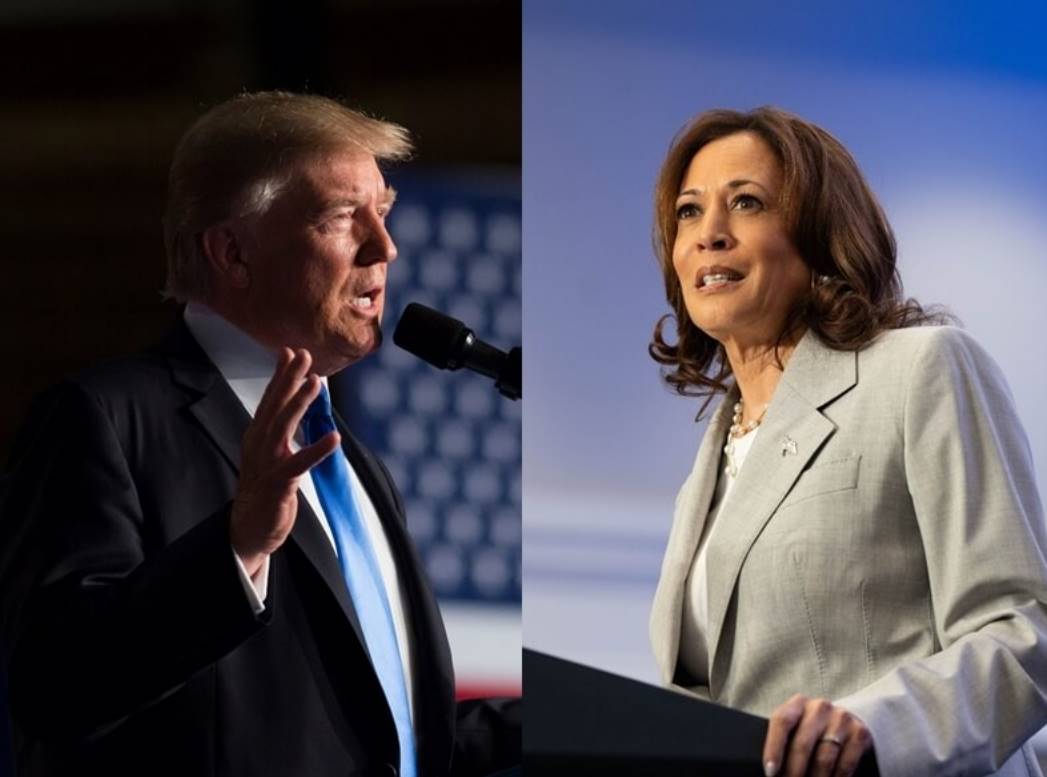

The US presidential election is approaching, and voters will cast their final ballots in the next 48 hours. A unique focus of this election season is the cryptocurrency industry, with the two major candidates - Kamala Harris and Donald Trump - making the future of digital assets an important campaign issue.

As the election approaches, market analysts and investors are closely watching Bitcoin and other cryptocurrencies, observing their reaction after the election results are announced. This is because the performance of cryptocurrencies may determine whether the bullish momentum can continue in November and December.

Interestingly, history shows that Bitcoin's price on US election day has consistently served as the price floor for parabolic rallies. Bitcoin's US election day price may lay the foundation for a parabolic rally.

The election outcome may play a crucial role in driving or hindering the expected bullish momentum that is expected to continue through November and December. Specifically, the candidates have outlined their views on cryptocurrency regulation and the potential role of blockchain technology in the US economy.

This resurgence of political interest indicates that cryptocurrencies have firmly entered mainstream policy discussions, and regulatory changes may occur depending on who wins the presidential election.

However, history suggests that Bitcoin is poised for a rally after the election. Interestingly, Bitcoin's price has never fallen below its election day price, and has exhibited parabolic rallies after every US election. This positive Bitcoin price trend has been disclosed through cryptocurrency media accounts on the social platform X.

According to the Bitcoin price chart below, in the past three election days, Bitcoin's price has served as the price floor, followed by parabolic rallies. For example, in the previous election in 2020, Bitcoin's price was $13,569.

Currently, Bitcoin is trading at $69,155. Chart source: TradingView

After the election, Bitcoin saw a rally in the following months, ultimately breaking the $69,000 high in 2021. Notably, the $13,569 price point during the 2020 election even served as a support level during the 2022 bear market, further highlighting the significance of Bitcoin's election day price.

What's next for Bitcoin?

If history repeats itself, Bitcoin's price trajectory on election day may see a parabolic rally in the remaining two months of 2024 and early 2025. Interestingly, it can be argued that Bitcoin's current state is more likely to see a parabolic rally compared to the past three elections.

At the time of writing, Bitcoin is trading at $68,700. Recent price action has shown Bitcoin breaking above $73,000 and retesting the $73,737 all-time high set in March 2024. Considering the election day trend, we may see Bitcoin break this level before the end of November. Breaking the all-time high will open up room for Bitcoin's rally, potentially reaching as high as $300,000 before the next election cycle.