Author: UkuriaOC, CryptoVizArt, glassnode; Compiled by Bai Shui, Jinse Finance

Driven by the high possibility of President Trump winning the US election, Bitcoin has hit a new high of $754,000.

The inflow of capital into Bitcoin assets continues to grow, indicating that new demand is constantly flowing in.

There has been a significant increase in profit-taking activity, while actual losses remain negligible. However, both of these values are relatively small compared to the trading volume during the extreme market periods.

Due to investors hedging positions in both directions, the options market is pricing in higher volatility expectations.

New High

After months of consolidation and sideways trading, Bitcoin has broken through new highs, thanks to the high possibility of President Trump winning the US election. The price successfully broke through the $73,700 level and rebounded to above $75,300, entering the price discovery phase and pushing investor sentiment closer to euphoria.

Liquidity Continues to Grow, Profits Continue to Rise

Since early September, the net capital inflow into Bitcoin has increased significantly. This indicates that investors' interest in allocating capital is constantly increasing, and traders are also profiting from the market's strength.

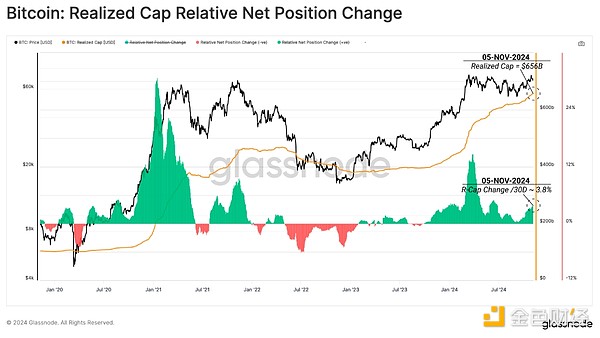

The actual market capitalization of Bitcoin has grown by 3.8% in the past 30 days, which is one of the highest inflow levels since January 2023. The actual market capitalization is currently trading at a historical high of $656 billion, with a 30-day net capital inflow of $2.5 billion.

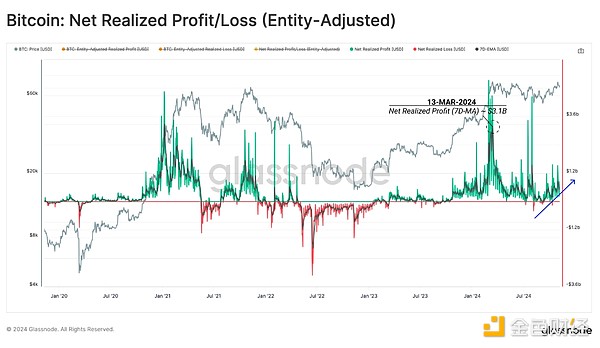

The wave of profit-taking that hit a historical high in March peaked at $3.1 billion in realized profits.

As the market has digested this trend over the past seven months, both realized profits and losses have declined to a balanced position. This indicates that the supply and demand forces have been fully reset.

At the same time, we can see a structural increase in profit-taking, a phenomenon that is starting to reappear, indicating that a new wave of demand is entering the market.

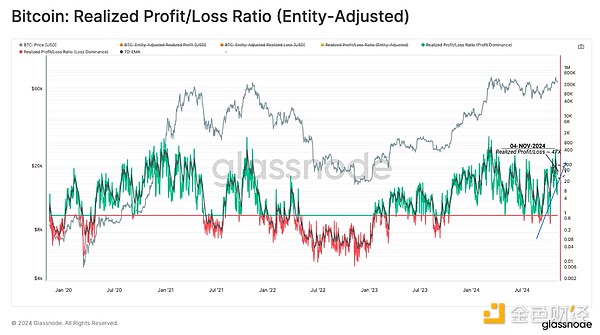

We can also observe the changing market dynamics through the ratio of realized profits to losses.

The market is currently in a profit-dominant situation, with realized profits remarkably 47 times higher than losses. This reflects that as the market continues to rise and set new highs, the supply of losses is becoming increasingly scarce.

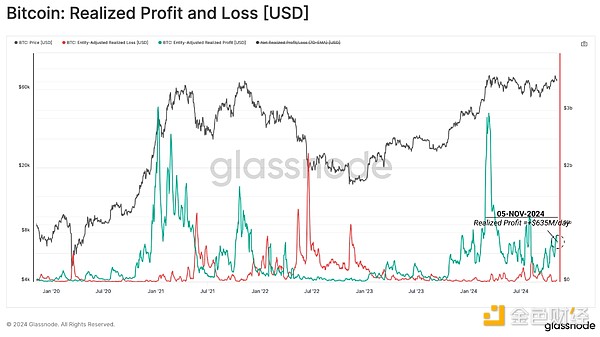

We can also see a significant increase in the amount of profit-taking, adding $635 million per day.

Although this is a quite substantial dollar value compared to the euphoria of previous bull market cycles, the number is still relatively moderate.

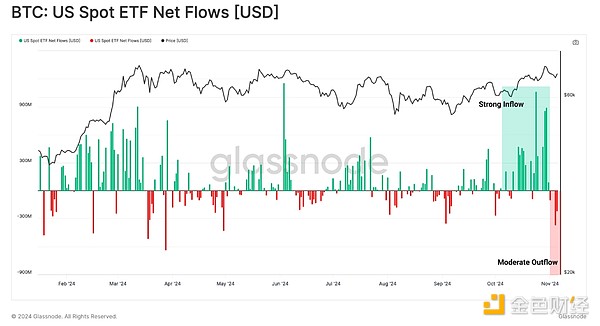

ETF Experiences Capital Outflows

This month, demand for US Bitcoin ETFs has been significant, with inflows surging, comparable to the success of the product's initial launch.

However, investors appear to be reducing risk on the eve of the US presidential election, with capital outflows particularly evident over the past 3 days. However, with the formation of a new ATH, the ETF may see new demand and momentum chasers.

Volatility Expectations Intensify

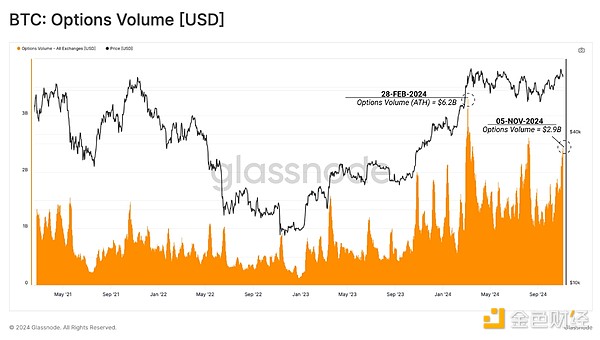

The US presidential election has been a focus of investor attention, and expectations of increased volatility have persisted for several weeks. Since 2023, the options market has become an important component of the BTC market structure, allowing investors to express their increasingly mature views on the market.

The number of open interest in option contracts has soared to $25.2 billion, with a record high of $30.2 billion recorded in March alone.

Options trading volume has also been steadily rising, currently reaching $2.9 billion, second only to the record high in March and the trading volume during the JPY arbitrage unwind on August 5th. This further highlights the growing presence of institutional-level investors, who are using sophisticated tools to express their market views.

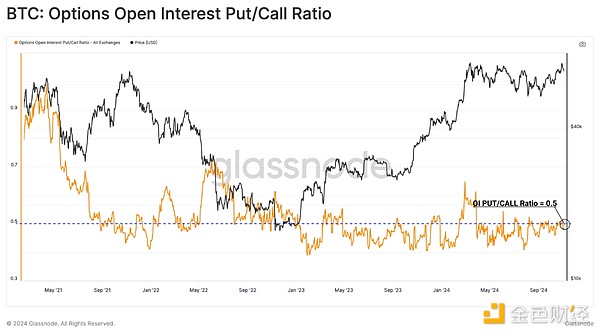

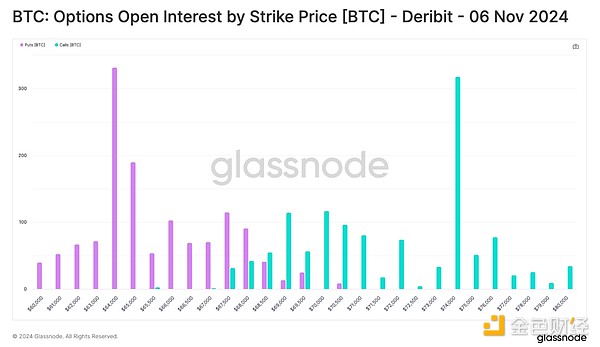

Evaluating the ratio of open interest in put and call options, the two sides are evenly balanced. This indicates that investors and speculators have hedged and bet on significant volatility in both market directions.

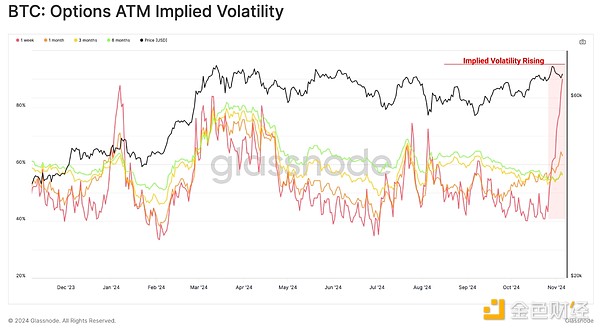

The view that investors expect future volatility to rise is also reflected in the options implied volatility (IV).

Currently, we see IV surging across all contract expiration dates, most notably in the short-term 1-week expiry. This suggests that investors are anticipating and betting on increased volatility around the announcement of the US election results.

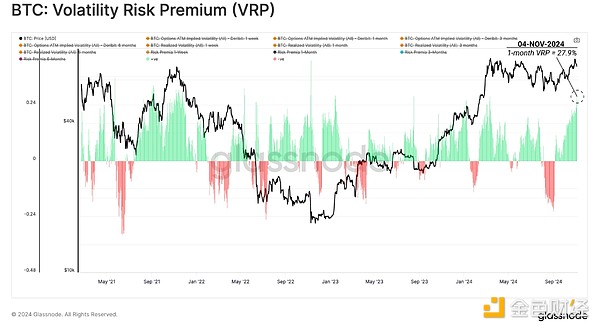

By comparing the difference between options implied volatility and actual volatility over the same time period, we can calculate the volatility risk premium (VRP). This metric represents the compensation required by option sellers to bear the volatility risk.

Currently, the 1-month VRP value is 27.9%, with only 1.4% of trading days recording a higher value. This highlights how extreme the volatility pricing in the options market has become.

Evaluating the distribution of put and call options expiring shortly after November 6th (the US election day), we can see that the two sides are almost evenly split. The total open interest in put options is 1,348 BTC, while the total open interest in call options is 1,271 BTC.

This indicates that investors have hedged against downside protection and upside risk, highlighting the degree of uncertainty about the final market direction.

Summary

After the US presidential election, Bitcoin has hit a new all-time high, breaking through $75,000 for the first time this week. This trend is supported by a moderate $2.5 billion monthly capital inflow, indicating that Bitcoin still has the potential for further growth as new demand continues to flow in.

With increasing demand and growing volatility expectations from options tools, the market appears poised to welcome further volatility.