Author: Vince Quill, CoinTelegraph; Compiled by Wu Zhu, Jinse Finance

Stablecoin issuer Tether announced that it will conduct a large-scale cross-chain transfer on November 6, 2024, moving over 2 billion Tether-USD from various blockchain networks to the Ethereum network.

According to Tether, 1 billion USD will be transferred from the TRON network, 600 million USD from the Avalanche C-Chain, another 300 million USD from the NEAR Protocol, and finally 60 million USD from the EOS network to the Ethereum network.

The stablecoin company explained that this cross-chain swap is being carried out on behalf of a large unnamed exchange that wishes to transfer its USDT holdings from various cold wallets to the Ethereum blockchain.

Tether also assured investors that the large-scale cross-chain transfer will not affect the total supply of USDT.

Tether CEO Clarifies Reserves Supporting USDT

The large-scale cross-chain transfer of USDT comes amid an unverified report by The Wall Street Journal that the U.S. government is investigating the stablecoin company for alleged money laundering and sanctions violations.

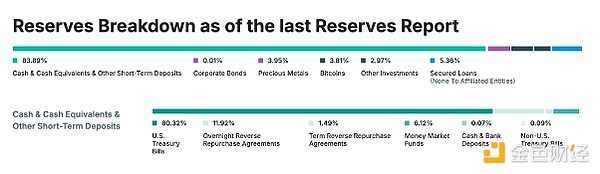

Affected by this news, the cryptocurrency market briefly declined, leaving investors in a state of fear, uncertainty, and doubt. The market uncertainty surrounding the largest fiat currency outflow in the digital asset market prompted Tether CEO Paolo Ardoino to disclose the details of the company's reserve assets supporting its dollar-pegged stablecoin at the PlanB event in Lugano, Switzerland.

Tether's reserve breakdown. Source: Tether

These reserve assets include approximately $100 billion in U.S. Treasury bills, 82,000 Bitcoin (valued at around $62 billion at current market prices), and 48 tons of gold (recently hitting a historic high of $2,790 per ounce against the U.S. dollar).

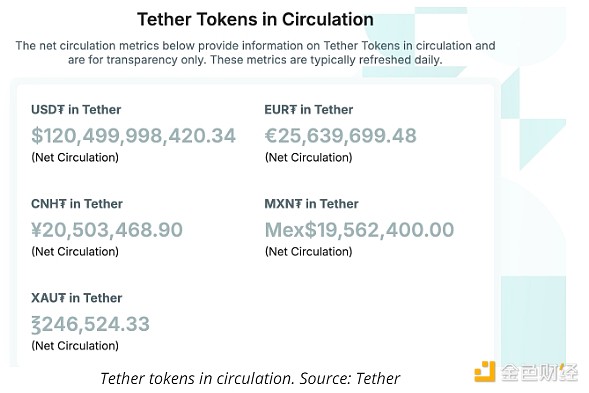

In October 2024, the market capitalization of Tether's USDT also reached $120 billion. This high market cap is seen by many traders as a representation of increased trading activity in the digital asset market, which is often viewed as a bullish signal for asset prices.

However, data from Chainalysis shows that stablecoins are increasingly being used as a store of value in economies with rapidly depreciating local currencies, rather than for market speculation.