Author:hitesh.eth

Compiled by: TechFlow

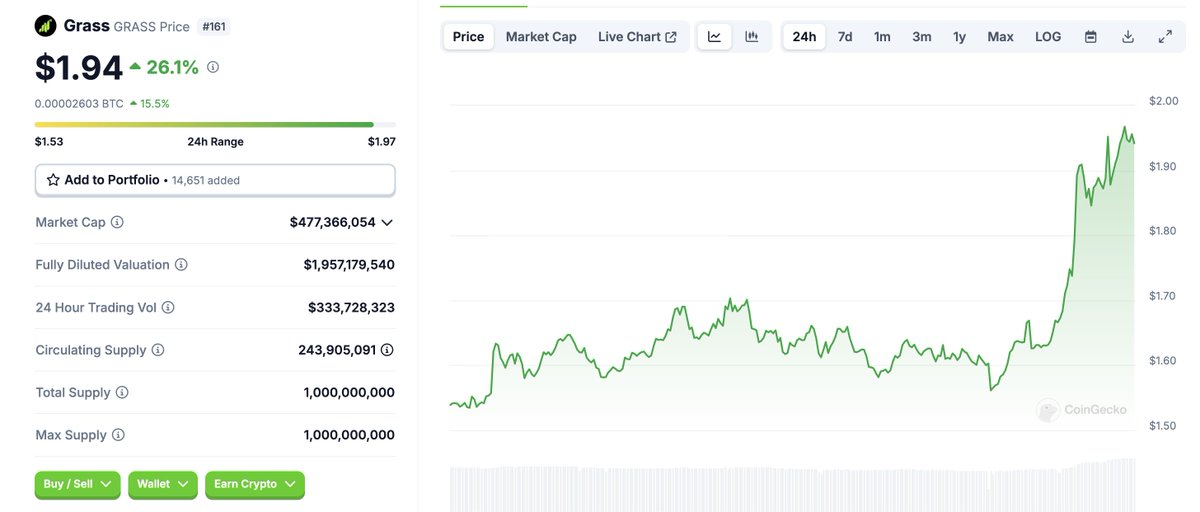

Are you curious about why the price of $GRASS is rising?

Grass has allocated 10% of its total supply for Airdrop One, distributing it to 2 million users. Approximately 100,000 users have received over 100 $GRASS, worth around $200, by running the app and sharing public data with the Grass network. These public data were previously being shared with many websites without the users' knowledge.

This Airdrop is just the beginning. Next is staking, with currently around 35% of the circulating $GRASS being used for staking. The current annualized yield is around 50%, which is quite attractive. Additionally, venture capitalists cannot immediately unlock their staking rewards, giving regular investors more confidence, especially after being disappointed by the past performance of tokens like $TIA, $SUI.

Now, your shared public data is transmitted through TLS encryption, ensuring user privacy. Those running nodes will be rewarded as the demand for Grass grows.

The founders of Grass revealed a few weeks ago that their daily data retrieval volume reached 80TB. Even after the Airdrop activity, if this data retrieval volume reduces to 10%, we can still expect around 10TB of daily data retrieval, or about 300TB per month.

So, what is the average cost of data retrieval in a low to medium scenario? Approximately between $0.1 to $100 per GB. We can conservatively estimate that companies may be willing to pay $1 per GB to use the Grass network for data retrieval. Based on this estimate, Grass could generate around $300,000 in monthly revenue, and if the daily data retrieval volume reaches 80TB, the monthly revenue could exceed $3,000,000 - which is quite feasible in the near future.

You might be wondering why I wrote this article, and it's because I find it interesting. I do not hold $GRASS, run any nodes, or receive any compensation - this is a purely independent research out of interest, and I'm not providing any investment advice here.