Four years after failing to be re-elected, in his last public speech during his term, Trump stated that he would return in some way. Today, Trump has secured victory, fulfilling his pledge, meaning that the United States will enter the "Trump 2.0 era" starting from January 20, 2025.

Since announcing his candidacy, Trump's "Make America Great Again" campaign platform has focused on key areas such as manufacturing, taxation, trade, immigration, and the environment, with policy changes often becoming a watershed for market trends. From the potential of the stock market to the volatility of cryptocurrencies, and the trajectory of the US dollar, the future performance of various assets is widely debated, as investors seek to capture opportunities in the new political cycle.

Cryptocurrencies Witness a New Round of Upswing

Since late October, Trump's winning probability on major prediction platforms has been constantly fluctuating, and Bitcoin, the most direct asset of the "Trump trade," has also been on a rollercoaster ride. The fate of Bitcoin and the US election have never been so closely intertwined.

During the campaign, Trump's heartfelt promises and deep-rooted interests have injected a strong stimulus into the further growth of the cryptocurrency market. First, Trump has promised to take measures to ensure the United States' leadership in the cryptocurrency field, planning to include Bitcoin in the national reserves and fire the SEC chairman, who is known as the "Crypto Killer." Secondly, Trump himself is deeply involved in the cryptocurrency market, not only issuing Non-Fungible Tokens (NFTs) multiple times, but also frequently promoting the tokens issued by his family on social media.

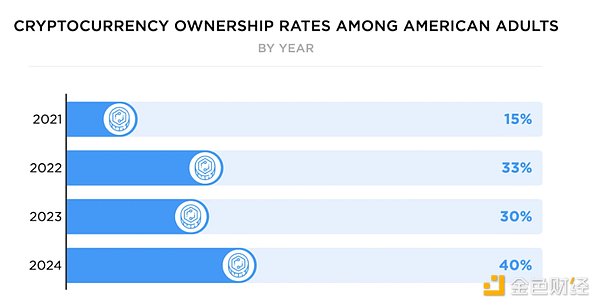

According to security.org data, currently 40% of American adults own cryptocurrencies

Furthermore, Musk, who is considered the "number one contributor" to Trump's victory and was mentioned 11 times in the victory speech, is also a supporter of Bitcoin and Dogecoin. During the critical stage of the election, Musk repeatedly mentioned Dogecoin, causing it to soar, and it has now doubled in value. Therefore, it can be foreseen that whether it is to fulfill campaign promises, expand family benefits, or reward supporters, Trump will have sufficient motivation to implement policies to boost the cryptocurrency market after taking office.

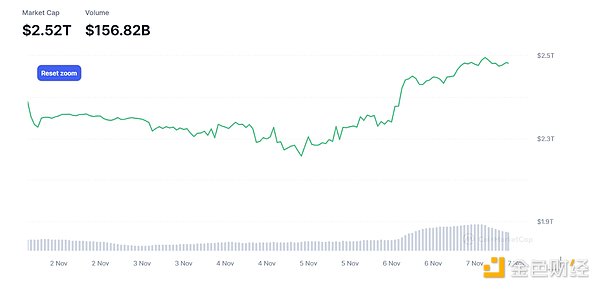

The market is actively responding to the potential growth of the cryptocurrency market. Within two days of Trump's election, the total cryptocurrency market capitalization grew by 14.5% from $2.2 trillion to $2.52 trillion, and cryptocurrency-related stocks and ETFs in the US stock market were also heavily bought, reflecting the impact of Trump's policies.

Tax Cut Policies Support US Stock Earnings

In Trump's policy blueprint, the US stock market is seen as one of the biggest winners. On the day after Trump's victory, the three major US stock indices hit new highs, with the S&P 500 index rising 2.5%, the largest post-election day gain on record, the Dow Jones Industrial Average rising 3.57%, the largest gain in two years, and the Nasdaq closing up 2.95%, with most tech stocks rising. Tesla's stock price soared nearly 15% in one night, reaching the highest level since July 2023. Trump-related media, technology, prison, cryptocurrency concept, banking, and energy stocks all saw significant gains.

Trump's proposed domestic tax cuts, emphasis on technology, and encouragement of fossil energy, have all positively impacted the US stock market to a certain extent. Particularly, the tax cut policies are expected to provide long-term support for the profitability of US stock companies and the sustained economic growth. In terms of sectors, areas like finance and traditional energy, where Trump's policies tend to reduce regulation and support domestic extraction and fossil fuel use, are likely to see positive effects and outperform the broader market. Considering Trump's active support for the development of artificial intelligence and his lax regulatory approach, this also provides some support for the technology stock market.

Data shows that October 2023 was one of the least volatile months for the US stock market during the election year, reflecting that investors generally reduced their positions and avoided risks before the election. Now that the outcome has been decided, the subsequent increase in positions may help the US stock market experience a year-end rally. The US stock small-cap sectors that have underperformed this year may perform better than the broader market under the expectation of tax cuts, and cyclical stocks in the US should also see some performance, driven by the hope of Trump supporting the return of manufacturing.

However, it is necessary to be wary of the potentially negative impact of Trump's significant tariff hikes on the economy and inflation. It is expected that the volatility of the US stock market may increase going forward.

The US Dollar Continues to Strengthen

Driven by Trump's victory, the US dollar index surged nearly 2% intraday on Wednesday, marking the largest single-day gain in nearly two years and hitting a three-month high. Other currencies came under pressure, with the Japanese yen falling more than 1.9% to a three-month low, the offshore Chinese yuan falling above 7.2 for the first time in over three months, and the euro falling more than 1.8% to its worst day in over four years, reaching a four-month low.

With Trump's return to the White House, the US dollar is expected to continue strengthening. Trump's trade protectionism and tax cut policies are likely to be actively implemented after he takes office. These measures may drive up US inflation, prompting the Federal Reserve to maintain high interest rates to prevent the economy from overheating, further pushing the US dollar into a new upward cycle and hurting global currencies, especially emerging market currencies. At the same time, Trump's plan to withdraw from multilateral institutions may suppress growth in other parts of the world, further enhancing the appeal of the US dollar.

Gold Favored in the Medium to Long Term

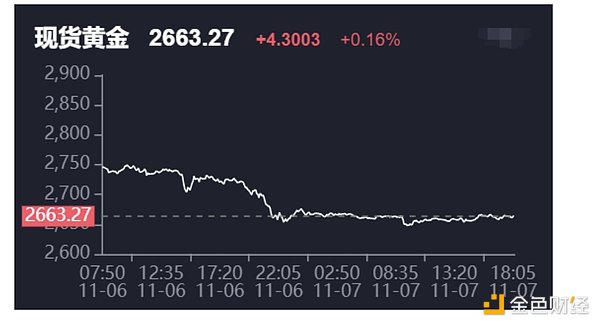

After Trump's victory, the gold market experienced a short-term correction, with spot gold recording its largest single-day decline in five months on the day after the election. Trump's economic policies have raised market concerns about potentially inflationary policies, while also pushing up US bond yields. Additionally, the resolution of the US election uncertainty has led to a resurgence in risk-on trading, suppressing the short-term safe-haven demand for gold.

Although gold is under pressure in the short term, the market still remains bullish on gold's medium to long-term outlook due to the frequent geopolitical conflicts and its inflation-hedging characteristics. Gold prices are influenced by two pricing logics at the macroeconomic level: US inflation and fiscal policy. Rising US inflation will drive gold to appreciate relative to the US dollar, while the fiscal logic is reflected in the synchronization of gold prices and the US federal deficit rate. Persistent fiscal expansion that undermines the US dollar's creditworthiness will increase the allocation value of gold. Additionally, Trump's foreign policy may further the fragmentation of the global monetary system and economic cycles, stimulating the "de-dollarization" process and increasing the demand for gold.

From the rise of cryptocurrencies to the prosperity of the US stock market, and the strength of the US dollar, investors will face numerous opportunities in the new political cycle of the incoming administration. However, Trump's trade policies and tax cut measures also come with certain risks, reflecting the complexity of policymaking.

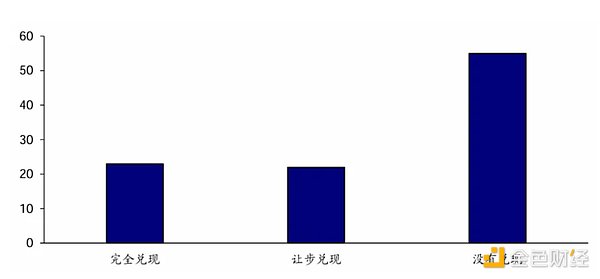

At the same time, the market remains cautious about whether Trump's policies can be effectively implemented, as according to PolitiFact statistics, 23% of Trump's policies were fully implemented during his first term, such as raising tariffs on imports to the US, restricting illegal immigration, and withdrawing from the Paris climate agreement. 22% of the policies were compromised, and 55% were not implemented, such as investing in US infrastructure and reviving US manufacturing.

Fulfillment rate of Trump's first term promises

The US election ended with the victory of the Trump camp, and the global market is now engaged in a battle over the "Trump 2.0 era". eeee.com, as the official partner of the Argentine national team, provides trading services covering more than 600 assets including cryptocurrencies, commodities, stocks, and indices, and also supports financial products with an annualized yield of up to 5.5%, where users can invest with USDT at any time with one click. In addition, the 4E platform has a $100 million risk protection fund to further safeguard the security of users' funds. With the help of 4E, investors can closely follow market dynamics, flexibly adjust their strategies, and seize every potential opportunity.