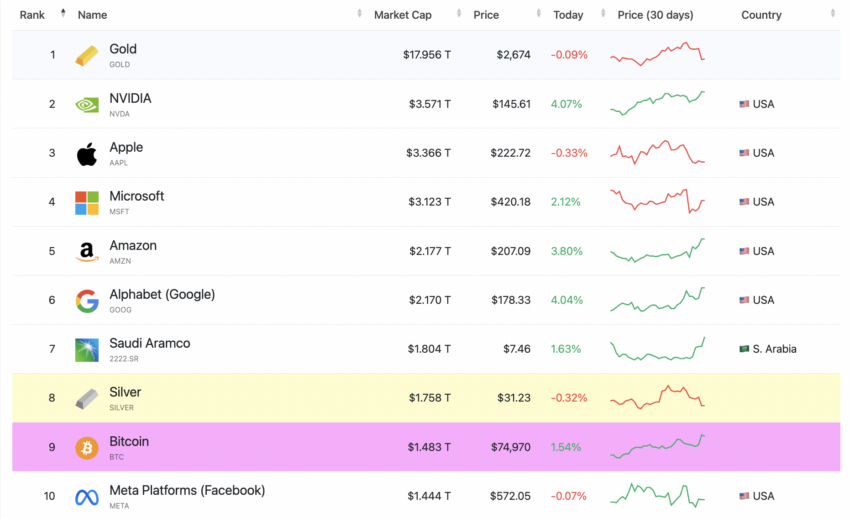

Bitcoin has reached a milestone by surpassing Meta to rank 9th in the global market capitalization rankings.

Buoyed by investors' optimistic outlook on Donald Trump's victory in the 2024 U.S. presidential election, Bitcoin's market capitalization has reached $1.48 trillion, surpassing Meta's $1.44 trillion.

Bitcoin, the 9th Largest Asset in the World

Bitcoin's current value is around $74,900, exceeding Meta's market capitalization.

This is the second time Bitcoin has overtaken Meta, following a brief period in March when it briefly exceeded $73,000. This milestone underscores Bitcoin's growing importance and its competitive position against other major technology companies.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The list is led by gold, with a market capitalization of $17.95 trillion, followed by Nvidia at $3.57 trillion and Apple at $3.36 trillion.

The ranking includes companies such as Microsoft, Amazon, and Alphabet (Google). Bitcoin's latest valuation places it right behind silver in 9th position. This development shows that Bitcoin has evolved from a niche digital asset to a globally significant store of value.

Its All-Time High Briefly Surpassed Silver in March This Year

As Bitcoin has risen in the global market capitalization rankings, many are curious if it will soon overtake silver. Currently, silver's market capitalization is around $1.75 trillion, slightly higher than Bitcoin's $1.48 trillion.

In March 2024, Bitcoin briefly surpassed silver to become the 8th largest asset in the world.

"We can see the potential for Bitcoin to become the digital gold of the 21st century. We should not forget that gold has also historically been volatile. But Bitcoin is risky: it is too volatile to be a reliable store of value today, and it is expected to remain highly volatile going forward," said Marion Laboure, an analyst at Deutsche Bank Research, as reported.

At the time, its value soared to $1.42 trillion, surpassing silver's $1.387 trillion, and it rose 4% to a new all-time high of $72,000. Given Bitcoin's recent momentum and the continued interest from institutional investors, this event is likely to be repeated.

Surpassing silver would further cement Bitcoin's position as digital gold and strengthen its reputation as a valuable asset in the financial realm. If Bitcoin continues on this trajectory, overtaking silver could be the next milestone in its journey.

Bitcoin's Mainstream Adoption Accelerating

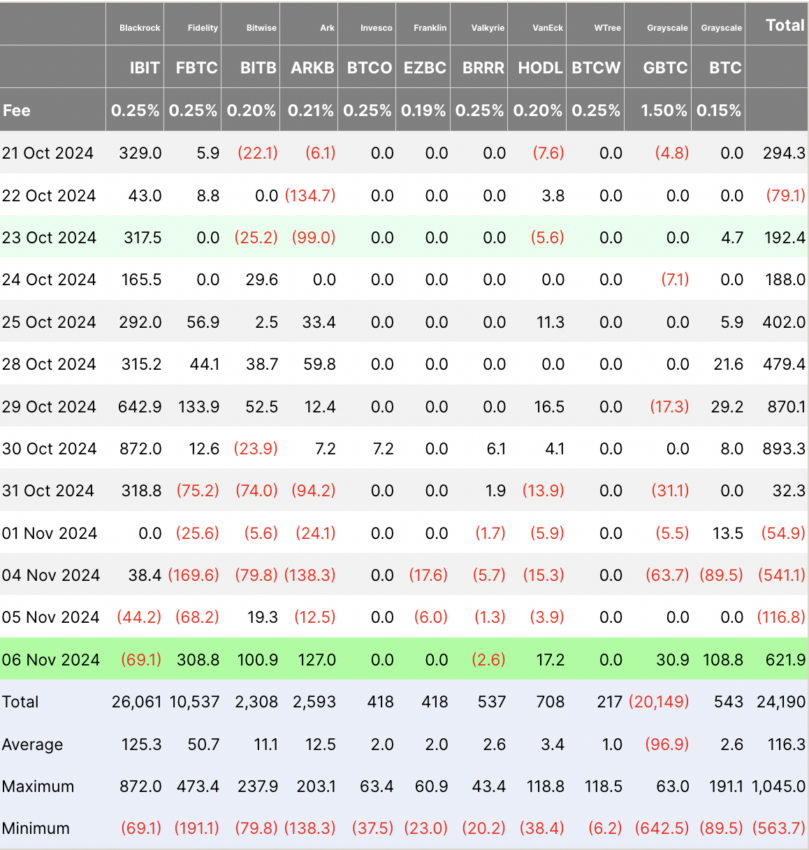

As Bitcoin establishes itself as one of the world's largest assets, there has been an increase in investment inflows into various exchange-traded funds (ETFs).

For example, on November 6th, most Bitcoin products saw positive inflows. Fidelity's FBTC recorded a significant inflow of $308.8 million, indicating strong investor interest. Bitwise's BITB and ARK's ARKB also received $109 million and $127 million, respectively.

Grayscale's GBTC managed a slight $30.9 million inflow despite previous outflows. The inflows on this day highlight the general increase in interest across various ETFs, contrasting with the volatility and outflows seen in other funds. The total inflow amounted to $621.9 million, reflecting the demand for Bitcoin products.

Read more: What is a Bitcoin ETF?

As Bitcoin solidifies its position as one of the world's largest assets, these investment patterns suggest that mainstream adoption is drawing closer. With increasing institutional support and infrastructure facilitating broader access, Bitcoin is establishing itself as a viable asset in traditional finance.