How to seek a breakthrough under this double squeeze, maintain technological innovation while not losing market competitiveness, these are the key challenges that Ethereum must face head-on in seeking a breakthrough.

Author: Boca Boca

Cover: Photo by Yong Chuan Tan on Unsplash

Recently, the industry has been hotly discussing the FUD around Ethereum. A few weeks ago, a 3-hour Space discussion was launched on Twitter about "What's going on with Ethereum?". Boca participated in the entire discussion, and heard many brilliant perspectives, from the game relationship between Ethereum and Layer2, to the perspectives of ideology, organizational structure, and historical lessons, comprehensively learning about the current dilemma facing Ethereum and the industry.

During the Space, I had already brewed some ideas in my mind, but I was very hesitant, because I knew that my views were clearly different from the majority of Web3 Native views, and I was afraid of being attacked (deeply aware of the gloomy atmosphere in the industry), so I did not express my views throughout the process. But afterwards, I still decided to stand up and express my own views, trying to provide a new perspective for everyone to observe the challenges currently facing Ethereum and the entire industry from the application layer, which is often discussed. Although this view may not be mainstream enough, I believe that only through rational and honest discussion can we drive the industry to develop in a healthier direction.

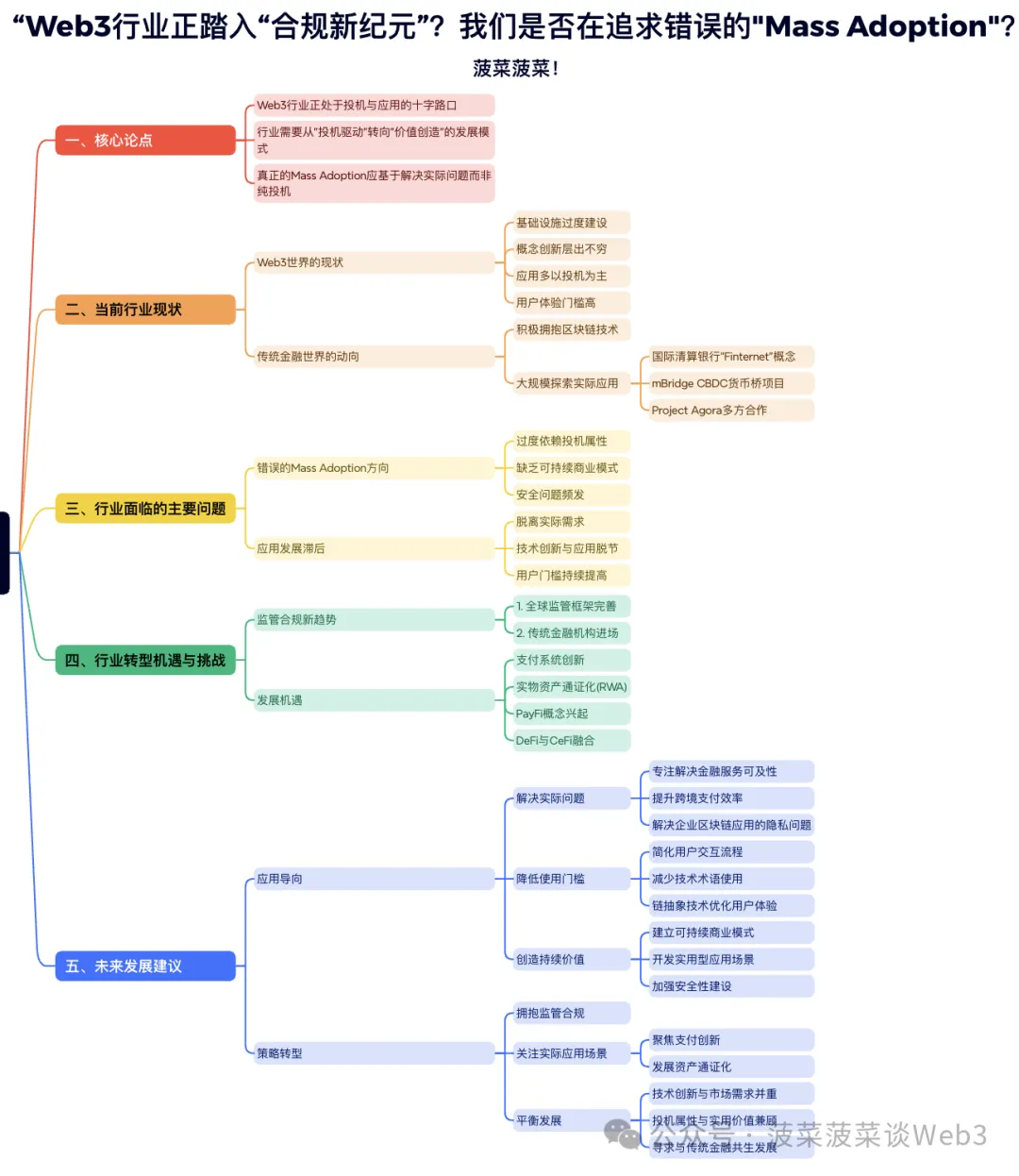

The article is quite long, and Boca has summarized an AI summary for those who don't want to read the long text.

Background

Before presenting my views, let me first introduce my current work background. Many of the followers of Boca should also have noticed that the frequency of my output has decreased a lot in the past year, and I have also rarely expressed my views on the industry.

This is because over the past year, as a founding member of the Singapore FinTech startup Ample FinTech, I have been deeply involved in project collaborations with the central banks of three countries on tokenization and cross-border payments. This experience has also expanded my mindset and attention beyond the pure Web3 circle, and I have turned my gaze to the strategic moves of global central banks and traditional financial institutions.

During this period, I have spent a lot of time studying the research reports and papers on blockchain and tokenization published by traditional forces, understanding the projects they are doing, while also keeping track of industry dynamics on Twitter and exchanging with friends to understand the development trends of the Web3 industry. By focusing on the application development trajectories of both the Web3 circle and the traditional financial system, I have been able to establish a more comprehensive cognitive framework, which has also given me a different perspective on the future of the industry.

A Divided Parallel World

It is this dual perspective of being in two different worlds that has made me increasingly aware of the disconnect between the two realms in terms of atmosphere and development paths. In the Web3 world, the common complaint is: more and more technical infrastructure is emerging, more and more new concepts and new terminologies are emerging, deliberately creating complexity and raising the barrier to understanding, with the ultimate goal of most of them being oriented towards Vitalik and crypto exchanges, and after TGE they almost become "ghost towns", and who really cares whether they have real use value?

The focus of recent discussions has also shifted to questioning Vitalik and the Ethereum Foundation. Increasingly, voices are complaining that Vitalik and the Foundation seem to be too obsessed with "technical discourse" and "pursuit of ideals", investing a large amount of energy in exploring technical details, but showing little interest in users' actual needs and commercialization exploration. This tendency has caused widespread concern in the industry.

In this Space, Professor Meng Yan drew on the historical experience of the development of the Internet, and pointed out incisively: this development path of being detached from the market is unsustainable. If Ethereum continues to maintain this "technology-first" development orientation, then the concerns of the community are not unfounded.

However, when we turn our gaze to the world outside the Crypto circle, we find a completely different landscape: the traditional financial forces and the governments of various countries are undergoing a significant change in their attitude towards Web3 technology. They not only see blockchain and tokenization as an important upgrade opportunity for the existing payment and financial system, but are also actively exploring the path of transformation. This change is undoubtedly rooted in the recognition of new technologies, but the deeper motivation may be the sense of the impact and threat that Web3 technology brings to the existing pattern.

In 2024, a milestone turning point occurred, as the Bank for International Settlements (BIS), known as the "central bank of central banks", formally proposed the concept of "Finternet" (Financial Internet).

This move is of far-reaching significance - it positions tokenization and blockchain technology as the next-generation paradigm of the human financial and monetary system, instantly causing a huge wave in the traditional financial world, becoming one of the most concerned topics.

This is not just the introduction of a new concept, but also an important endorsement of blockchain and tokenization technology by the traditional financial community. Its influence has quickly spread: major financial institutions and central banks around the world are accelerating their efforts to actively explore the construction of tokenization infrastructure, asset digitization, and payment application implementation.

Behind this series of major initiatives, it is not a hasty decision made by the Bank for International Settlements on a whim, but a strategic choice based on years of in-depth research. I have spent a lot of time tracing and studying the decision-making trajectory of the Bank for International Settlements, and found a gradual development context: as early as 2018, the institution began to systematically study Web3 technology and successively published dozens of highly professional research papers.

In 2019, the Bank for International Settlements took a critical step - establishing the BIS Innovation Center to systematically carry out experimental projects related to blockchain and tokenization. This series of in-depth research and practice has ultimately made them recognize an important fact: the blockchain technology and tokenization revolution contain huge potential to reshape the global financial landscape.

Among the many experimental projects of the Bank for International Settlements, the most iconic one is mBridge - a CBDC cross-border payment bridge jointly launched in 2019 by its Hong Kong Innovation Center, the People's Bank of China, the Hong Kong Monetary Authority, the Bank of Thailand, and the Central Bank of the United Arab Emirates. From a technical architecture perspective, mBridge is essentially a public permissioned chain based on EVM, with the central banks of the participating countries as node operators, supporting direct on-chain settlement of the central bank digital currencies (CBDCs) of various countries.

However, history is always full of dramatic twists and turns. In the current complex geopolitical landscape, especially after the outbreak of the Russia-Ukraine conflict, this project, which was originally intended to improve cross-border payment efficiency, has unexpectedly become an important tool for the BRICS countries to avoid SWIFT international sanctions.

This situation has forced the Bank for International Settlements to withdraw from the mBridge project at this stage. Recently, Russia has even formally launched the BRICS Pay international payment settlement system based on blockchain technology, taking blockchain technology to the forefront of geopolitical competition.

Another major initiative of the Bank for International Settlements is to launch the largest public-private cooperation project in the history of blockchain - Project Agora. This project has an unprecedented participation lineup: the seven major central banks (the Federal Reserve, the Banque de France representing the EU, the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, and the Bank of England), as well as more than 40 global financial giants including SWIFT, VISA, MasterCard, and HSBC.

Such large-scale international cooperation has an outstandingly clear goal: to use blockchain technology and smart contracts to build a globally unified ledger system, in order to optimize the existing financial and monetary system, while maintaining the existing financial order. This initiative itself is a strong signal: the development momentum of blockchain technology is unstoppable, and traditional financial forces have shifted from observation to full embrace, actively promoting its application in real scenarios.

Looking at the Web3 industry, although they are constantly shouting the slogan of "Mass Adoption", in reality they are obsessed with hyping meme coins and immersed in the short-term attention economy. This stark contrast inevitably makes one ponder: when traditional financial institutions are taking concrete actions to promote the large-scale application of blockchain technology, should the Web3 industry also rethink its development direction?

Mass Adoption: Casino or Application?

In this divided development trend, we have to consider a fundamental question: "What is the true meaning of Mass Adoption?" Although this term frequently appears in the discussions of the Web3 industry, it seems that everyone has a significant difference in their understanding of it.

Reviewing the so-called "hit projects" in the Web3 field in recent years, an intriguing pattern emerges: those projects that claim to achieve "Mass Adoption" are essentially speculative games dressed up in the guise of innovation. Whether it's the endless MEME coins, the "P2E" model (such as the once-popular sneaker projects) under the banner of GameFi, or the SocialFi (such as http://Friend.tech) that claims social innovation, when examined closely, they are nothing more than "digital casinos" carefully packaged. Although these projects have attracted a large number of users in the short term, they are not truly solving users' actual needs and pain points.

If allowing more and more people to participate in speculative trading and driving up coin prices is considered Mass Adoption, then this "Adoption" is merely a zero-sum game of wealth concentration to a few, whose unsustainability is self-evident.

I have witnessed too many cases of friends outside the circle losing everything after entering the crypto world, with only a handful able to truly profit. This phenomenon is also confirmed by recent data: a recent on-chain data analyst's research shows that on the http://pump.fun platform, only 3% of users have profited more than $1,000, and this cold figure reflects that making a profit from speculation is a game for only a few.

Even more worrying is that the entire industry has become a breeding ground for hackers, phishing, and fraud, where one can occasionally see on Twitter news of some whales suffering heavy losses from Permit phishing. Not to mention ordinary retail investors, according to the latest FBI report, in 2023 alone, American citizens suffered over $5.6 billion in crypto-related fraud losses, and victims aged 60 and above surprisingly accounted for 50% of the total, with the interests of many ordinary investors in this "dark forest" unable to be protected at all.

The speculation and increasingly serious hacking activities have led to a deteriorating industry environment, which inevitably makes us ponder: are we pursuing the wrong direction of "Mass Adoption"? In the frenzy of speculation, have we overlooked the true sustainable value creation?

It needs to be clarified that I am not completely rejecting the speculative nature of Web3. After all, the vast majority of participants entered this field with the intention of obtaining investment returns, and this profit-seeking motive is understandable, and the speculative nature will continue to exist. However, Web3 should not and cannot simply stop at being a global casino. It needs to develop truly sustainable and valuable application scenarios.

Among them, payments and finance are undoubtedly the application areas with the greatest potential for Web3 technology to be implemented. This has already reached a consensus from traditional financial forces, national governments, and the market level: we have seen traditional financial forces are exploring a wide range of innovative applications, including payment system innovation, tokenization of real-world assets (RWA), the integration of DeFi and traditional finance, and the emerging concept of PayFi. These positive explorations and practices clearly point to the most urgent needs in the current market.

In my personal opinion, the core problem for Ethereum or the industry may not be whether the technical direction is correct, but whether we truly understand what valuable applications are. When we are overly focused on technological innovation but neglect market demand; when we are passionate about creating concepts but are far from real scenarios, is this really the right direction of development?

This reflection has triggered a deeper concern: if we continue to develop in this way, will the traditional financial system or the SWIFT network that we once aspired to disrupt become the main force driving the real large-scale adoption of blockchain? Furthermore, will there be a situation where traditional financial forces and government-led permissioned blockchain systems dominate the vast majority of actual application scenarios, while public chains may be marginalized as a "speculative playground" for niche players?

While the Web3 industry's attention is still focused on Ethereum "challengers" like Solana, it seems that no one is paying attention to the fact that traditional financial forces have also sounded the bugle to march into this field. Faced with this huge change, for Ethereum or the entire industry, should we not only think about the current development strategy, but also how to position ourselves and our value proposition in the wave of industry compliance in the future? This may be the real challenge facing the industry.

The first priority is to solve real problems:

Whether it's infrastructure or applications, we should be based on real demand, focusing on solving real pain points, such as the fact that many ordinary people and small and medium-sized enterprises around the world still have difficulty accessing financial services; or the privacy issues faced by enterprises using blockchain, etc. The value of technological innovation must ultimately be reflected in solving real problems.

Secondly, it is to lower the usage threshold:

The ultimate goal of technology is to serve users, not to create barriers. The endless jargon and complex concepts in the current Web3 world have to some extent hindered real popularization. We need to make technology more user-friendly, such as using (Based Chain Abstraction) chain abstraction technology to solve user experience issues.

The third is to create sustained value:

The healthy development of the industry must be based on a sustainable business model, rather than relying too much on speculative hype. Only projects that truly create value can survive the market test in the long run, such as Web3 payments, PayFi, and RWA, etc.

The importance of technological innovation is beyond doubt, but we also need to recognize that applications are the primary productive force. Without real applications as a foundation, no matter how much infrastructure or advanced technology, it will ultimately be just castles in the air.

The turning point of Web3 application Mass Adoption has arrived

Looking back on history, the attempts to integrate blockchain with the real world have never stopped, but they have often failed to truly take root due to factors such as untimely timing, regulatory constraints, or technical bottlenecks. However, the current situation is showing an unprecedented turning point: the technical infrastructure is becoming increasingly mature, traditional financial forces are actively embracing innovation and exploring practical applications, and the regulatory frameworks of countries around the world are also gradually improving. These signs all indicate that the next few years are likely to become a critical turning point for Web3 applications to move towards mass adoption.

At this important juncture, regulatory compliance is both the biggest challenge and the most promising opportunity. More and more signals indicate that the Web3 industry is gradually transitioning from the initial "wild west era" to a "new era of compliance". This transformation not only means a more standardized market environment, but also heralds the beginning of truly sustainable development.

This transformation is reflected at multiple levels:

1. Regulatory frameworks are becoming more comprehensive

- Hong Kong has introduced a comprehensive regulatory system for Virtual Asset Service Providers (VASPs)

- The EU's MiCA legislation has been formally implemented

- The US FIT21 bill is expected to pass in the House in 2024

- Japan has revised the "Payment Services Act" to provide a clear definition of crypto assets

2. Participation of traditional financial institutions is becoming more standardized

- Large asset management firms like BlackRock have launched Bitcoin and Ethereum ETFs

- Traditional banks have started providing custody services for crypto companies and launching tokenized bank deposits

- Mainstream payment companies have launched compliant stablecoins

- Investment banks have set up digital asset trading departments

3. Infrastructure is being upgraded to comply with regulations

- More exchanges are proactively applying for compliant licenses

- KYC/AML solutions are widely applied

- Compliant stablecoins are emerging

- Privacy computing technologies are being applied in compliant scenarios

- Central bank-level blockchains are being launched (CBDC mBridge, Singapore Global Layer 1, BIS Project Agora, etc.)

4. Web3 is facing regulatory pressure and projects are transforming to comply

- The largest decentralized stablecoin project MakerDAO is transforming to embrace compliance

- The FBI has conducted sting operations on meme project market makers

- DeFi projects are increasingly introducing KYC/AML mechanisms

Under this trend, we are seeing:

- More traditional financial institutions entering the Web3 field through acquisitions or partnerships

- Traditional financial forces are constantly gaining control over the pricing power of Bitcoin through BTC ETFs

- A new generation of compliant Web3 applications are rapidly emerging

- The entire industry is gradually establishing order under regulatory pressure, and the opportunities for overnight wealth will continue to diminish

- The application scenarios of stablecoins are shifting from speculation to substantive uses such as international trade

Undoubtedly, the main battlefield for the future of blockchain technology will focus on several key areas: payment system innovation, tokenization of physical assets (RWA), the emerging PayFi concept, and the deep integration of DeFi and traditional finance (CeFi). This reality brings an unavoidable proposition: if the industry wants to achieve a breakthrough in real applications, it must face the interaction with regulatory authorities and traditional financial institutions. This is not a choice, but an inevitable path of development.

The reality is that regulation is always at the top of the industry ecosystem. This is not only an objective fact, but also an iron law repeatedly verified in the development history of the crypto industry over the past decade. Every major industry turning point is almost always closely related to regulatory policies.

Therefore, we need to seriously consider several fundamental questions: do we choose to embrace regulation and seek a symbiotic path with the existing financial system, or do we cling to the "decentralization" ideology and continue to linger in the regulatory gray area? Do we pursue a purely "casino-like" Mass Adoption, repeating the speculative-driven path of the past decade, or do we strive to create real, sustainable value and truly realize the innovative potential of blockchain technology?

At present, the Ethereum ecosystem is facing a significant structural imbalance: on the one hand, there is a continuous accumulation of infrastructure and an endless stream of technological innovations, while on the other hand, the development of the application ecosystem is relatively lagging. Under this contrast, Ethereum is facing a dual challenge: it not only has to deal with the strong offensive of new public chains like Solana in terms of performance and user experience, but also needs to be vigilant about the encroachment of compliant public permissioned chains led by traditional financial forces in the actual application market.

The more challenging aspect is that Ethereum also faces competitive pressure from two directions: on one hand, public chains such as Solana are gaining an increasing market share and user attention in the meme market due to their performance advantages; on the other hand, public permissioned chains led by traditional financial institutions are gradually deploying in practical application scenarios such as payments and asset tokenization, leveraging their inherent compliance advantages and large user bases, and are likely to occupy the first-mover advantage in these key areas in the future. How to seek a breakthrough under this double squeeze, maintaining technological innovation while not losing market competitiveness, are the key challenges that Ethereum must face head-on in its quest for a breakthrough. The above views only represent my personal perspective, hoping to spark more constructive thinking and discussion within the industry. As industry participants, we should all contribute to pushing Web3 towards a healthier and more valuable direction. Due to the limitations of my own understanding, I welcome friendly discussions from everyone to jointly explore the future development direction of the industry.