Introduction

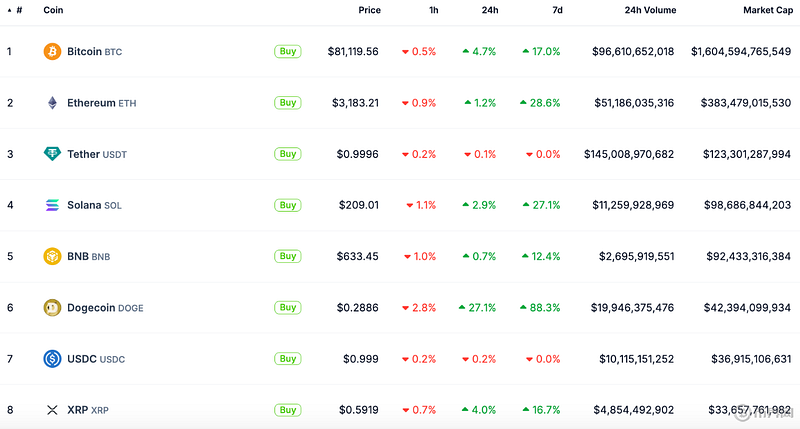

With the continued heating up of the Altcoin market, the prices of major cryptocurrencies such as Ethereum, Bitcoin, and Doge have recently surged, once again attracting widespread market attention. In particular, Ethereum, after experiencing a slump for nearly three months, has broken through $3,200 again, with a gain of nearly 30% in the past week, showing an extremely strong upward momentum. The news of Trump's election as the US president has become a catalyst for the explosion of the Altcoin market, not only pushing Bitcoin to a historic high of $81,858, but also making Doge one of the top six cryptocurrencies by market capitalization. Accompanied by the entry of smart money addresses, Musk's continuous support for Doge, and the bullish operations of whales on Bitcoin, the upward trend of the Altcoin market seems far from over. In this context, how will investors respond to the new round of Altcoin fever?

Latest price trends of Bitcoin BTC, Ethereum ETH, and Doge DOGE

Ethereum (Ethereum) price breaks through three-month high

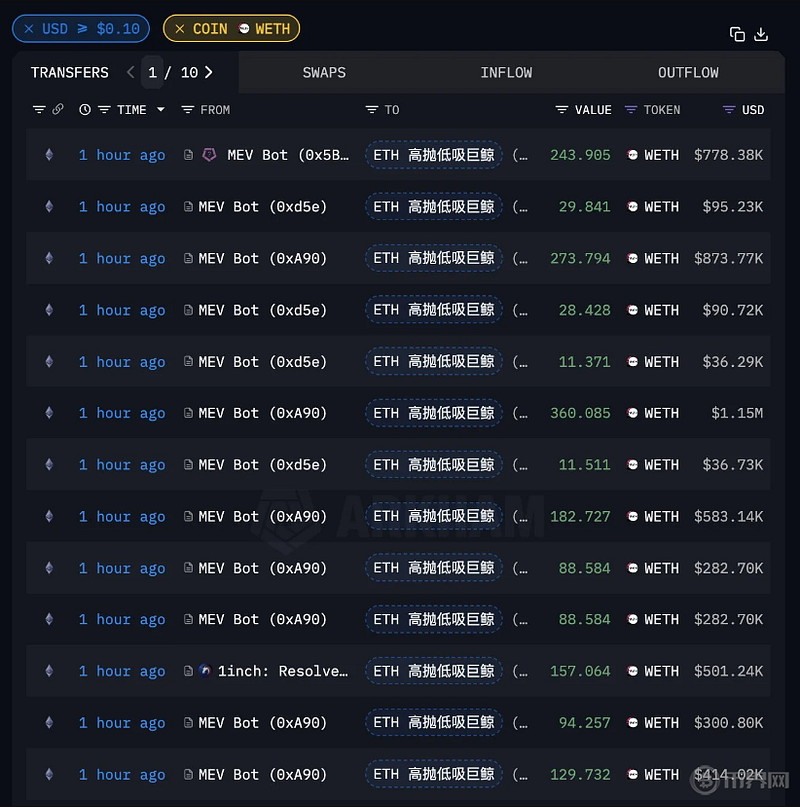

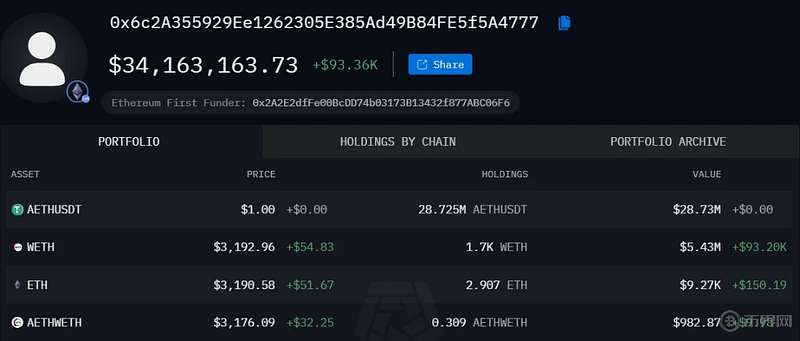

In the early morning of November 11th, the price of Ethereum broke through $3,200, reaching a new high in nearly three months. According to data from CoinGecko, Ethereum's gain in the past week was close to 30%, showing a very bright performance. An important factor driving this rise is the entry of "smart money" addresses. According to on-chain data analyst @ai_9684xtpa's monitoring, a whale account with a hit rate of 86.7% spent $5.42 million to buy about 1,700 WETH when the Ethereum price was $3,193. This large-scale move is considered to be a pre-positioning, and the account may further increase its position based on the market trend, thereby driving the market sentiment to heat up.

Arkham data shows that this address not only holds 1,700 WETH, but also holds 28.72 million USDT, with a total position value of about $34.16 million. Through statistics, it is found that this account has made a profit in 13 out of the 15 wave transactions, with a hit rate of 86.7% and a cumulative profit of $5.38 million. Its accurate entry timing and high hit rate have made the market full of expectations for Ethereum's future.

At the same time, BitMEX founder Arthur Hayes was also found to have purchased 1,071.7 ETH through Wintermute. Hayes has recently expressed optimism about Ethereum's future prospects, saying that with the reduction in transaction fees and the launch of Layer 2 scaling solutions, Ethereum's transaction volume will further increase. He expects Ethereum's performance to outperform other on-chain projects in the next 12 to 18 months, and this bullish view has further boosted market confidence.

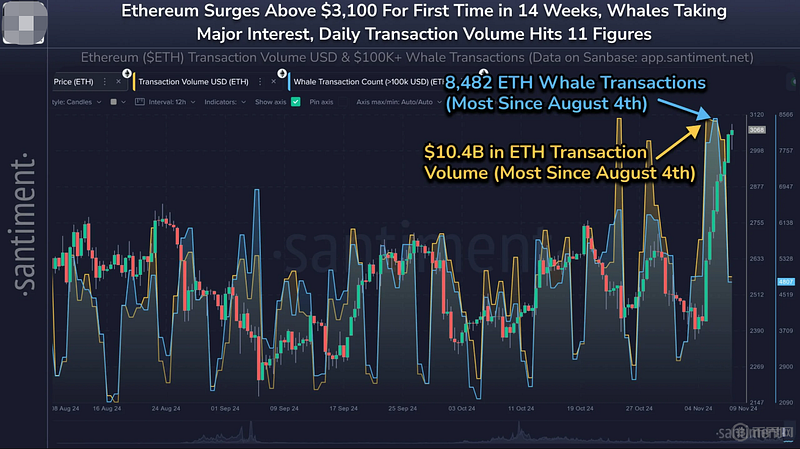

According to Santiment data, the trading volume of Ethereum whales has reached the highest point since August 4th, driving the price to reach the highest level in nearly 14 weeks. Ethereum's trading volume has also risen to $10.4 billion recently, indicating that the market's attention and participation in it are continuing to increase. Santiment pointed out that the rise of Bitcoin will often cause some of the profits to flow into Ethereum, thereby pushing the latter to reach higher price levels. This "capital rotation" may allow Ethereum to set a new historical high in this bull market.

Trump's victory triggers a surge in the Altcoin market, with Bitcoin hitting a new high

The news of Trump's election as the US president has become the main catalyst for the rise of the Altcoin market, especially having a significant pulling effect on Bitcoin. In the past week, Bitcoin has risen 18%, breaking through the historical high of $81,858, and its market capitalization has once exceeded $1.6 trillion, entering the top 10 global assets. As the "digital gold", Bitcoin has once again demonstrated its hedging and value-preserving attributes, attracting a large amount of capital inflow.

After Trump's election, he was dubbed the "first US president to support Altcoins", and this identity has given investors confidence in the future of the Altcoin market. The market once showed FOMO (Fear of Missing Out) sentiment, and a large number of investors rushed to enter the market, pushing Bitcoin to break through the previous high of $73,000. According to data from Coinglass, the total Altcoin liquidation amount in the past 24 hours reached $63 billion, and the liquidation volume of Bitcoin alone reached $121 million. The large increase in short liquidation has further boosted the upward momentum of Bitcoin.

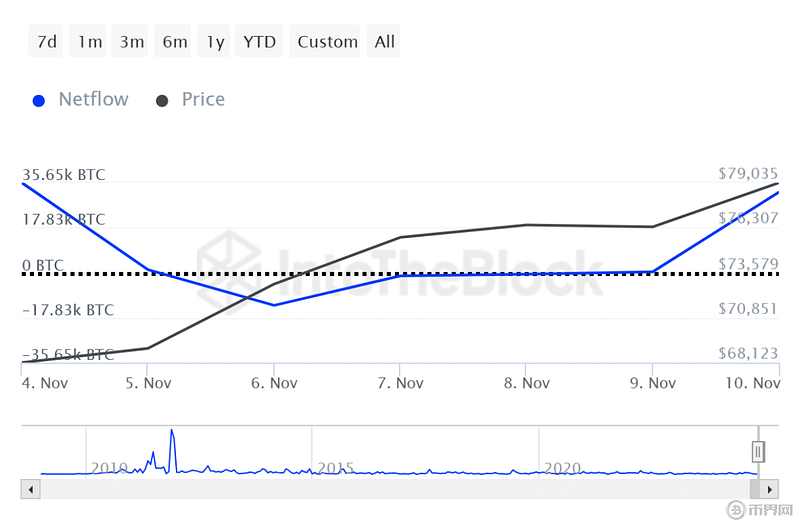

Data from IntoTheBlock shows that during the market surge on November 10th, Altcoin whale accounts cumulatively purchased 32,000 BTC, indicating that whales have continued to increase their positions in this round of uptrend. Since Election Day, the holding activities of whale accounts have been frequent, and they have been moving in the same direction as the Bitcoin price, and this large-scale capital flow has undoubtedly exacerbated the volatility of the market.

Doge price soars, ranking sixth in market capitalization

The news of Trump's victory has also ignited investors' enthusiasm for Doge. The price of Doge once broke through $0.3, with a gain of 27.1%, and surpassed USDC in market capitalization, becoming the sixth largest Altcoin. Since Trump's election, the Altcoin market has generally risen, and among the top 30 Altcoins by market capitalization, Doge's gain is the most eye-catching.

This round of Doge's rise is believed to be related to Musk's political moves. Musk has proposed to establish a department called the "Department of Government Efficiency" (D.O.G.E), aiming to optimize government spending, and the name coincides with Doge's ticker "DOGE". Subsequently, Trump adopted this idea and promised to establish this department led by Musk if elected, which has also brought new attention to Doge.

In addition, under the push of market sentiment, other dog-themed meme Altcoins have also risen sharply, such as WIF surging 24.1% with a market capitalization of $3.11 billion; FLOKI up 22.3% with a market capitalization of $1.77 billion; Shiba Inu SHIB up 18.6% with a market capitalization of $15.6 billion, approaching the threshold of the top 10 by market capitalization. The price fluctuations of Doge have also triggered large-scale liquidation activities, with Coinglass data showing that the liquidation amount of Doge in the past 24 hours reached $64.3 million.

Doge DOGE surges to the sixth most popular Altcoin - Coin World

Affected by Doge, other dog-themed meme Altcoins also start to surge - Coin World

The surge of Doge inevitably reminds people of its rise in 2021, when Doge hit a new high with Musk's support. Musk frequently tweeted in support of Doge, calling it the "people's Altcoin", and even referred to himself as the "Doge father". He even allowed Tesla, SpaceX and other companies to accept Doge as payment for certain products, further enhancing market confidence in Doge's application scenarios.

Conclusion

This round of the cryptocurrency market's surge has shown strong "capital rotation" characteristics, with some profits from the rise in Bitcoin prices flowing into Ethereum and other Altcoins, forming a multi-currency linked upward trend. In addition, the continuous increase in positions by whales and the election of Trump have also filled the market with confidence in the future performance of cryptocurrencies.

In this bull market, major cryptocurrencies such as Ethereum, Bitcoin, and Doge have performed well, each attracting a large amount of capital due to their different market dynamics and investment logic. In particular, Doge has become a focus under the "political and business interaction" of Musk and Trump, showing strong price volatility and market appeal.

In the future, with changes in the global macroeconomic environment and policy adjustments in various countries, the volatility of the cryptocurrency market may increase. For investors, how to grasp market opportunities and respond to risks in a timely manner is still a key issue to consider. At the same time, with the continuous advancement of policies both inside and outside the crypto market, the technical expansion of Ethereum, the hedging attributes of Bitcoin, and the meme effect of Doge may continue to attract new investors, adding more variables to the future market.