Author: Gyroscope Finance

The Trump effect continues, and Bit reaches a new high.

Less than a week after the election results were announced, even before being sworn in and with the House of Representatives still undecided, the president-elect Trump has already had a comprehensive impact on the crypto sector. Recently, the crypto market has continued to rise, with Bit even breaking through the $81,000 mark after breaking its previous high on election day, leaving a nice green candle on the K-line chart.

It is clear that Trump's arrival has greatly boosted the sentiment in the crypto market, and this is naturally due in no small part to the verbal checks promised by politicians. However, looking at the data, the fulfillment rate of past presidents' terms does not seem optimistic.

Whether crypto regulation will be as the president has promised remains unclear, but what can be confirmed is that the crypto industry, which has splashed out $240 million, has officially moved from the obscure backstage to the center of the political stage.

In the aftermath of the U.S. election, the industry that stands tall and proud, aside from the local fossil fuel industry, is none other than the crypto industry.

Under the influence of the Trump effect and the subsequent rate cuts, the crypto market has seen an amazing rise, with Bit leading the charge, rising from $67,000 to over $81,000 in just one week, reaching a high of $81,500 in the early hours of today, a 17.79% increase in 7 days. The mainstream currencies are all rising, with the long-dormant Ethereum also reaching $3,200, and the market cap of SOL briefly exceeding $100 billion. MEME is not to be outdone either, with the political MEME representative Doge seeing a pleasing rise, up more than 33% in the past 24 hours to $0.292, with a market cap of $42.3 billion, even surpassing the stablecoin USDC to become the 6th largest crypto currency by market cap.

With such violent volatility, liquidations are naturally the norm. According to Coinglass data, as of 14:54, the 24-hour crypto market had 216,612 liquidations, with a total liquidation amount of $650 million, with both long and short positions being liquidated, $365 million in long positions and $285 million in short positions.

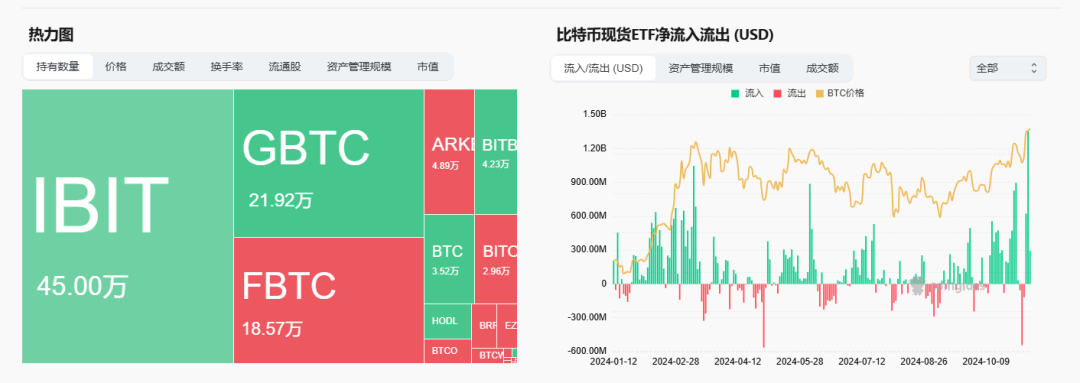

Overall, although the volatility has increased, the crypto market is clearly on the upswing. A typical example is that Wall Street institutions are continuously betting on Bit, with significant net inflows into Bit ETFs starting on November 6, reaching a record high of $1.359 billion on November 7. BlackRock's IBIT now has a total asset management of $17.243 billion, with a total asset size of $17.443 billion, surpassing the second largest gold fund IAU in the U.S. stock market, further confirming the "digital gold" title of Bit.

Before Trump's election, many market participants had analyzed and predicted that the market would fall due to profit-taking after the election, but in reality, the positive news for the crypto market has shown strong sustainability. This strong sustainability comes on the one hand from a more accommodative macroeconomic environment, as although Wall Street expects the rate hike to slow down next year, the rate cut is still on schedule in November; on the other hand, it comes from the industry's more positive expectations for Trump.

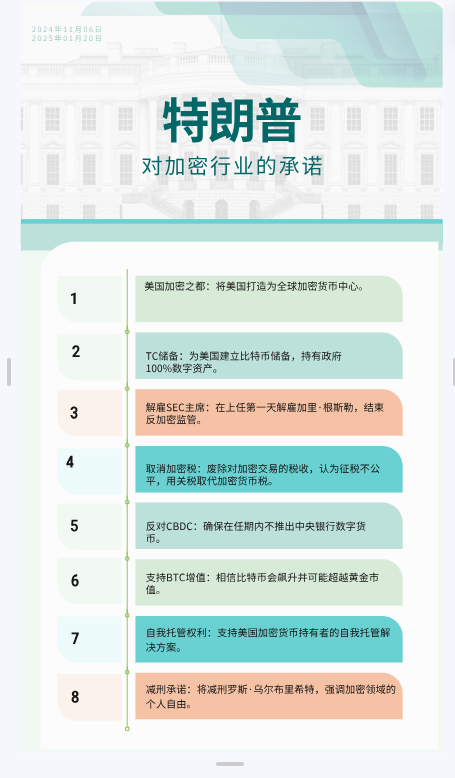

If we look back at Trump's previous verbal promises, they can be divided into two main categories, one on the regulatory side and the other on the currency price side. Trump clearly stated in his speech at the Bit conference that the market cap of Bit will continue to increase since its inception, and will soon surpass silver, and in the future will surpass gold, and also emphasized that after being elected, the U.S. will treat Bit as a strategic asset reserve, not selling any Bit, hoping that Bit will be mined, minted and manufactured in the U.S. and not anywhere else, and will ensure that the U.S. will become the world's crypto center and Bit superpower.

On the regulatory side, Trump has provided more room for imagination. Trump said that there will never be a central bank digital currency (CBDC), and on the first day of taking office as president, he will fire the current SEC chairman Gray Gensler, who is known for his anti-crypto stance, and appoint a new chairman, and at the same time will immediately appoint a Bit and crypto currency presidential advisory council to "design transparent regulatory guidance for the entire industry, and complete it within 100 days. From now on, these rules will be made by people who love your industry, not people who hate your industry, and these people want the rules to be clear, simple, direct and fair, and they want to see your industry thrive, not decline."

In addition to verbal promises, Trump has also led by example, not only being the first president to accept crypto currency donations, but his family has also launched a DeFi project for operation, earning him the title of the "first Bit president" of the U.S., and he has repeatedly mentioned it in his campaign speeches.

What is even more exciting is that in this election, the Republican Party can be said to have won a resounding victory, and with control of the Senate, they are highly likely to also take control of the House of Representatives, at which point, whether it is legislation, personnel appointments, or financial support, Trump will have much stronger party support, rather than being constrained as in 2016.

From this, it can be seen that the crypto industry seems to be about to usher in a completely new regulatory environment, and industry insiders are also very excited about this. Today, the policy director of a16z wrote that building on the bipartisan cooperation of the previous Congress, they will advocate for a clear regulatory framework to promote and support innovation and decentralization, bringing higher regulatory clarity, and the industry should all feel empowered to explore all groundbreaking products and services supported by blockchain, especially in the areas of token issuance and community building, many plans that have been shelved due to regulatory concerns may finally be able to be restarted.

Looking at specific regulations, a research report by the blockchain infrastructure company Blockdaemon points out that two key bills are likely to be pushed forward, one is the 21st Century Financial Innovation and Technology Act, which is expected to be passed by the Senate and signed into law by 2025; the other is the previously vetoed SAB 121 repeal proposal, which may now take effect.

Paul Grewal, Chief Legal Officer of crypto giant Coinbase, also said directly that crypto currencies have reached a watershed moment, and its CEO said that next year the U.S. Congress members will be very friendly to the crypto market, "it will be the most crypto-friendly Congress in history".

This is indeed not an empty claim, as while the presidential candidate is key, in the actual formulation and implementation of regulations, the "separation of powers" model of the U.S. Congress is actually the most important part. Against this backdrop, the crypto industry has expanded its strategic vision, focusing not only on supporting the president, but also on getting more crypto-friendly supporters in Congress.

According to data from the Stand With Crypto website initiated by Coinbase, as of November 11, 268 candidates supporting crypto currencies won House seats in this election, while only 122 House members opposed crypto currencies. The new Senate is also more inclined towards supporting crypto currencies, with 19 supporters and 12 opponents.

And all this is the result of real money being spent. The crypto super PAC Fairshake, funded by companies like Coinbase, Ripple and Andreessen Horowitz, raised $245 million, making it the largest single-period super PAC in U.S. history, surpassing traditional corporate donors, and since the 2010 Supreme Court decision on corporate political donations, it is now second only to the fossil fuel industry in political spending.

The Action Committee not only raised huge funds, but also had a lot of experience in selecting candidates, following the principle of betting on both sides, focusing on funding the Republican "Defending American Jobs" and supporting the Democratic "Protecting Progress". It is reported that 48 candidates supported by the encrypted PAC have almost all won, with a success rate of as high as 98%, setting a historical record. In key electoral positions, the encrypted group spent millions of dollars, spending $40 million to successfully help Ohio auto dealer and blockchain entrepreneur, Republican Bernie Moreno, overturn a 6% lead and defeat the well-known chairman of the Senate Banking Committee, a strong critic of cryptocurrencies, Ohio Democratic Senator Sherrod Brown, and further help the Republicans secure a Senate victory. $40 million has also become the largest amount of funds invested by an organization in the Ohio election so far.

Beyond this election, Fairshake has already planned ahead for the midterm elections in 2 years, and has accumulated more than $78 million so far for the 2026 midterm elections, striving to eliminate the possible mid-term power-sharing effect among the public.

The expectation of weak regulation and the return of small government are driving the growth of the industry, and Altcoins have also been revived, and many industry insiders are once again looking forward to the process of Altcoins becoming mainstream.

But to return to reality, apart from the relatively rapid personnel changes, as long as it involves legislation and strategic direction, the chain involved is quite extensive, and the personal power of the president should not be overstated. In a federal system with a high degree of checks and balances between the three powers, the actual power of the president is far less than that of a centralized country, and in the highly ideologically divided United States, the greater the political polarization, the stronger the constraints of the opposition party on the ruling party. Voters will also take advantage of this, usually not allowing one party to dominate, even if they win temporarily, they will be constrained in the midterm elections, which is also the reason for Fairshake's early layout. And in elections, in order to win more votes, the president will also tend to exaggerate or make more radical promises, but will return to reality after taking office.

Citing data from Zhiben Society, the fulfillment rate of promises by presidents during their term of office is generally low. During Biden's term, the overall fulfillment rate of promises was only 28%. Among them, the fulfillment rate of 19 healthcare issues was only 42%; only 2 out of 18 economic issues were fulfilled, 10 were completely unfulfilled, with a fulfillment rate of only 11%; the fulfillment rate of judicial issues was 20%; the fulfillment rate of national security was 21%; the fulfillment rate of administrative improvement was 33%. In the remaining six or fewer issues, immigration was 50%, education was 0%, climate and environment was 75%, and trade was 33%.

During Trump's first term, the overall fulfillment rate of promises was 31%. Among them, all 5 trade issues were fulfilled, with a fulfillment rate of 100%; apart from that, the fulfillment rates of other major issues were relatively low, with 10 out of 13 economic issues completely unfulfilled, with a fulfillment rate of only 7.6%; the fulfillment rate of immigration was 27%; the fulfillment rate of administrative improvement was 20%. In the remaining six or fewer issues, healthcare was 10%, judicial was 50%, education was 25%, national security was 66%, and climate and environment was 33%.

Therefore, the US president should be judged more by his actions than his words, focusing on Trump's speech on January 20 after his formal inauguration and his subsequent actions. On the other hand, the market does not need to be overly pessimistic, compared to the extremely heretical Trump in 2016, the Republican's complete victory in this election and its own strong party prestige will greatly increase the fulfillment rate of the term. What is more worth noting is that the Altcoins have already "bought" Congress, coupled with the large number of voters, whether they are congressmen or the president, they will not miss this highly politicized ecological industry.

From now on, the Altcoin industry may truly step onto the stage of history.