XRP has seen a sharp rise in value over the past week, similar to other altcoins. However, it has experienced a slight decline in the past 24 hours, and according to the XRP liquidation heatmap, this appears to be temporary.

Currently trading at $0.58, the recent decline in XRP's price is likely a short-term consolidation. I will explain why this consolidation can soon be reversed.

Bullish Signals for XRP on the Liquidation Heatmap

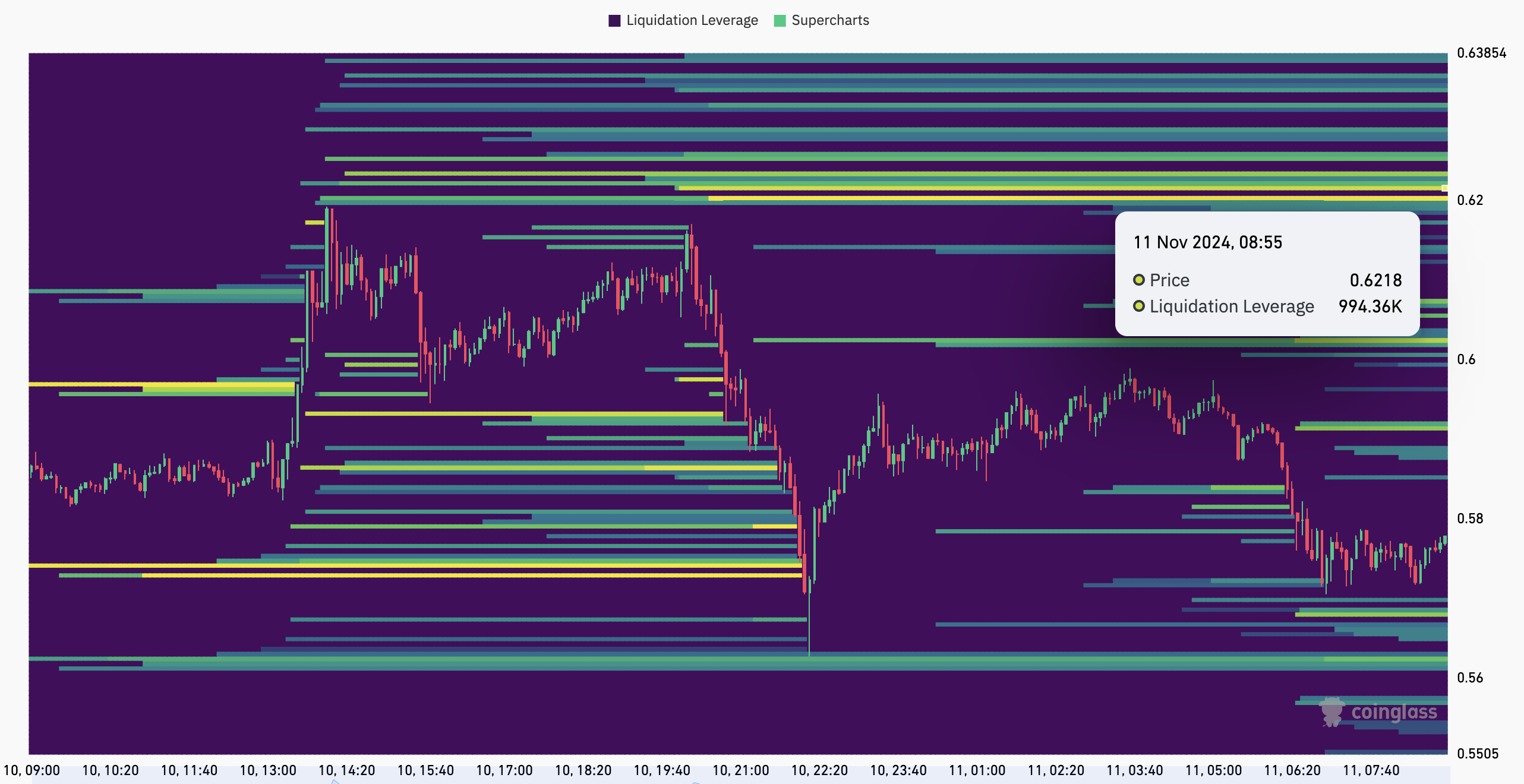

According to CoinGlass, XRP has multiple price levels and significant liquidity, but the area around $0.62 is particularly noteworthy. As shown below, the color of the XRP liquidation heatmap has shifted from purple to a vibrant yellow at that level.

For those unfamiliar, the liquidation heatmap predicts the price ranges where large-scale liquidations can occur. It also helps traders identify high-liquidity regions. In most cases, the higher the liquidity, the more likely the price will move towards that area.

In the case of XRP, there was high liquidity around $0.57 on November 10th. However, since the altcoin has moved past that region, the next key level is the $0.62 mark.

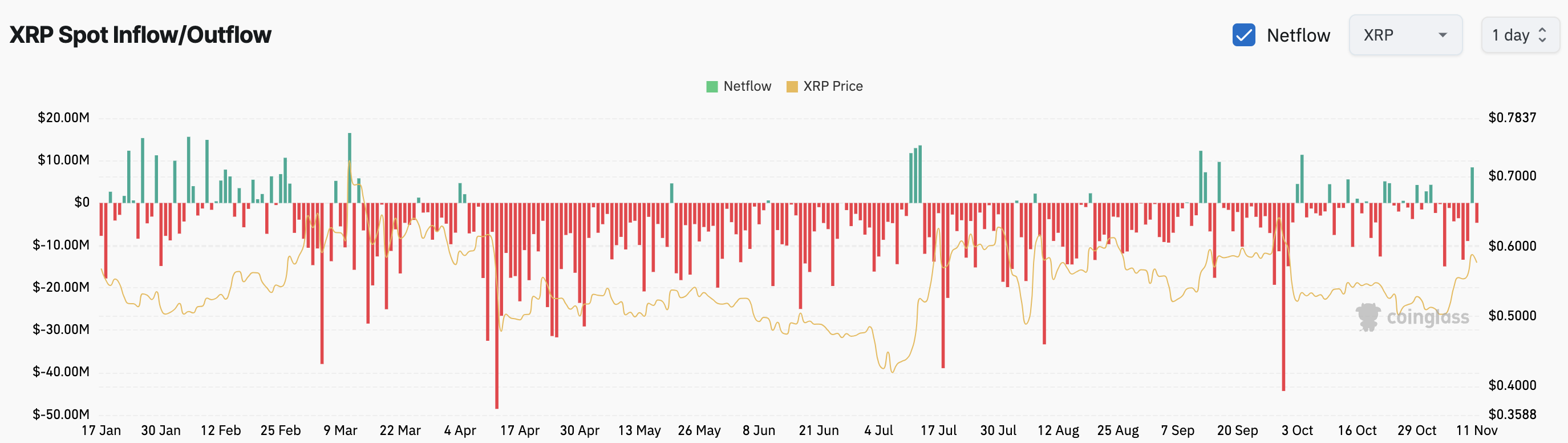

Additionally, the metric that monitors token inflows and outflows to and from exchanges also presents a bullish outlook.

When large amounts of tokens flow into exchanges, it can signal selling intent and increase downward price pressure. However, in this case, around $5 million worth of XRP has flowed out of exchanges in the past 24 hours.

This outflow suggests that most XRP holders are choosing to hold rather than sell, reflecting a bullish sentiment among investors who are confident in the token's further upside potential.

XRP Price Prediction: Uptrend Still Alive

From a technical perspective, XRP's price trading above the 20-day and 50-day Exponential Moving Averages (EMAs) indicates potential upward momentum. These EMAs often act as support and resistance levels, and a price above them suggests an uptrend.

If XRP's price had been below these EMAs, the trend would have been bearish. Therefore, the current readings suggest that XRP may be primed for further upside. If this condition persists and buying pressure increases, the altcoin's value could rise by 7% to reach $0.62.

Interestingly, this level also coincides with an important 23.6% Fibonacci retracement level. However, if the liquidation heatmap shows a move towards regions with lower liquidity, the altcoin's value could decline. In that scenario, XRP's price could fall to the 61.8% Fibonacci level of $0.55.