In 2023, when UNIswap launched UniswapX, the market was not greeted with admiration, but controversy. UniswapX was accused of plagiarizing CoWSwap and 1inch. Curve officials said that 1inch and CoWSwap had already changed the rules of the game, and UniswapX was not the first. CoWSwap emphasized its pioneering position in Intent Based Trading.

1. What is CoW Protocol?

CoW Protocol is a DEX aggregator with MEV protection for transactions. The CoW Protocol matches transactions for various on-chain liquidity sources through batch auctions. It can provide users with better prices and save a lot of money in gas fee optimization and liquidity provider fees.

The Cowswap module in the CoW protocol shows significant innovation and advantages compared to the traditional automated market maker (AMM) model. It does not pursue instant execution of transactions, but adopts a strategy of off-chain order aggregation and batch processing to determine a more fair and unified settlement price. This mechanism not only optimizes the transaction process, but also brings users a better trading experience.

CoW Protocol has a deep insight into the potential threat of miner extractable value (MEV) to transaction fairness. In order to fundamentally solve this problem, Cowswap chose to develop based on the second version of the Gnosis protocol, which was created by the Gnosis team. Through the aggregation of off-chain orders and unified on-chain settlement, Cowswap effectively avoids front-running transactions and sandwich attacks caused by MEV, creating a more fair and transparent trading environment for users.

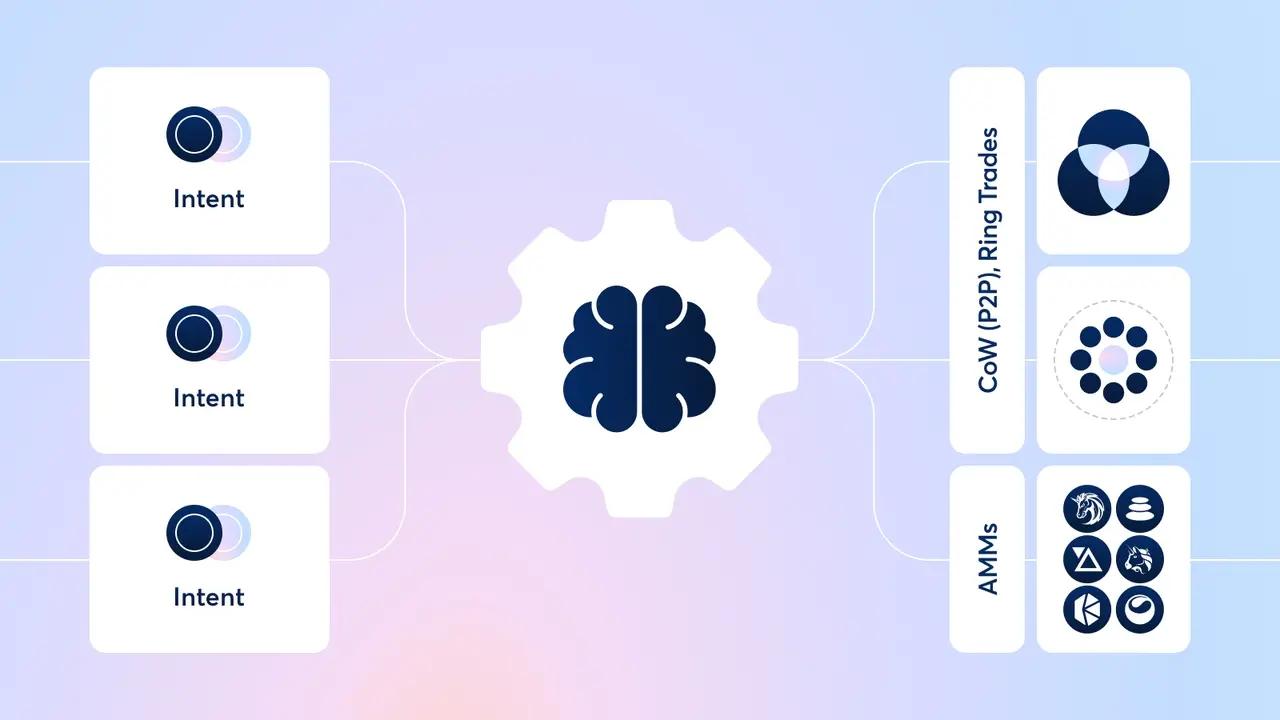

Its core mechanism cleverly combines the essence of batch auctions and peer-to-peer transactions to ensure that each participant can lock in the most competitive transaction price. This mechanism is enhanced by a fully permissionless architecture, achieving seamless participation and broad inclusion. As the core driving force of price discovery, it is deeply rooted in the concept of "Coincidence of Wants" (CoWs). It maximizes liquidity potential by accurately capturing the overlapping moments of transaction demand and ensures efficient and accurate transaction execution. This mechanism not only optimizes pricing strategies, but also effectively cuts gas costs and reduces execution risks because all transactions are executed in batches rather than one by one.

In the operation of the CoW protocol, solvers play a vital role. As the key force in optimizing transaction exchange rates, they compete fiercely for the right to execute transactions as a reward for obtaining the best exchange rate. This competitive situation forces solvers to make full use of all on-chain liquidity resources, including decentralized exchanges (DEXs) and DEX aggregators, to ensure the successful completion of transaction orders.

In short, Cowswap not only provides users with a better trading experience through its unique transaction processing mechanism, but also solves the unfairness problems in transactions through technical means, creating a safer and more reliable trading space for users.

2. CoW Protocol Operation Mechanism

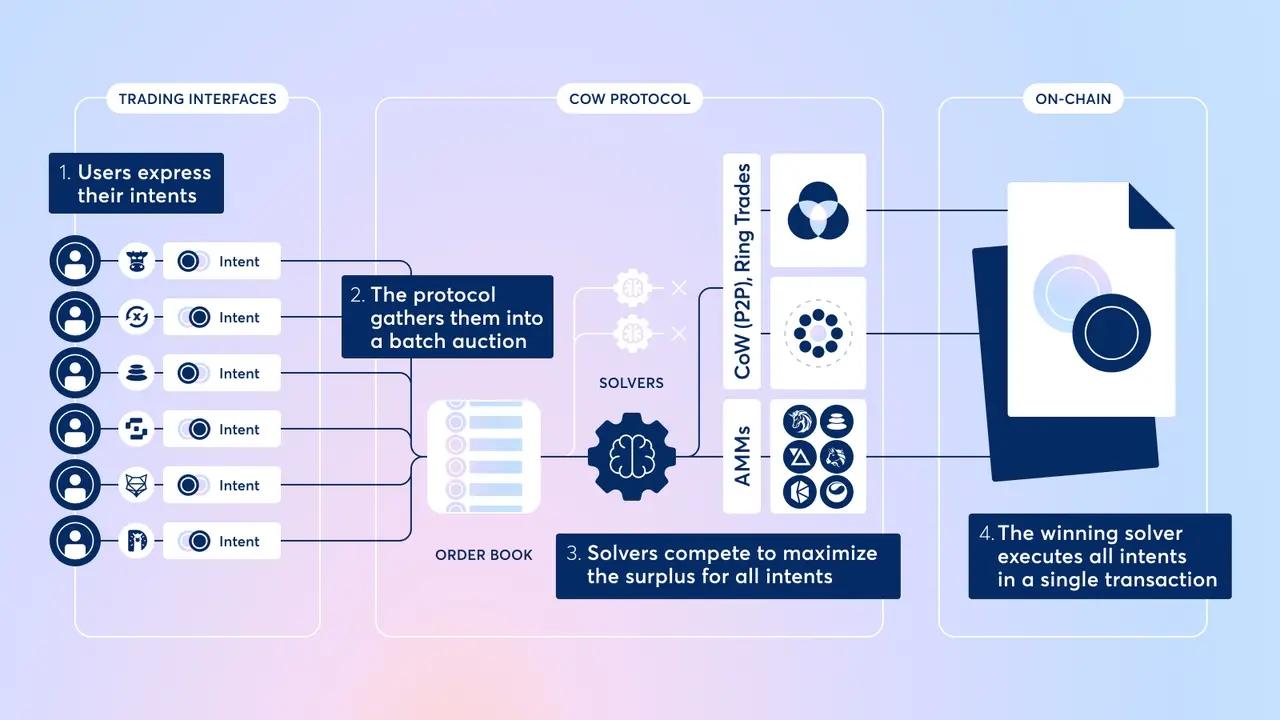

In the traditional trading market, market makers play a key role in providing liquidity, while in the current decentralized exchange (DEX) field, this task is mostly undertaken by liquidity providers. However, CowSwap, with its unique batch auction mechanism, matches CoW orders for traders, opening up a new trading path.

On the CowSwap platform, when two traders each hold the assets needed by the other party, the system can directly match them for transactions without relying on market makers or liquidity providers for matching. This innovative mechanism not only brings the best price to individual traders, but also eliminates the fees generated by intermediaries, maximizing transaction benefits.

In addition, CowSwap also supports users to trade directly using the CoW method. For orders that cannot be settled through CoW, the system will automatically transfer to the automatic market maker (AMM) for matching. If the batch auction order includes CoW orders, small orders will be fully matched first, and the remaining unmatched orders will be matched again by the liquidity market integrated by CowSwap. In the end, the settlement price of the entire order will be based on the remaining order price obtained through external liquidity to ensure the fairness and transparency of the transaction.

For transactions that rely on external liquidity matching on the chain, CowSwap introduces the concept of "seekers". As a third-party tool within the protocol, seekers compete to find the best transactions on the chain, and publish matching transactions in batches after off-chain matching. The protocol strictly limits the slippage of seekers in executing transactions, making the MEV arbitrage space minimal. At the same time, batch order settlement is limited to submission by certified seekers, further compressing the operating space of miners and MEV arbitrageurs.

CoW transactions do not require third-party liquidity, so there is no transaction cost. However, transactions on CowSwap have a handling fee, which is composed of basic execution fees and protocol fees, part of which is used to incentivize searchers to provide the best transactions. Currently, users only need to pay the gas fee (basic transaction fee), and the protocol fee is temporarily waived.

CowSwap currently supports buy and sell orders at the current price, and the transaction process only requires one off-chain signature. After the user submits the transaction, the searcher will be responsible for matching, and only fees are charged when the order is executed, and no fees are borne for failed transactions.

At present, CowSwap has integrated Uniswap's liquidity resources and will continue to expand in the future. It plans to integrate the liquidity of more DEXs such as Balancer to provide more abundant trading options and better service experience.

3. Core Technology of CoW Protocol

As an innovative decentralized trading mechanism, CoW Protocol aims to optimize transaction security and integrity and address the challenges of DeFi and cryptocurrency transactions.

It uses batch auctions, peer-to-peer transactions, and off-chain order matching, allowing users to sign their intention to exchange, and then solvers compete to provide the best exchange rate and execute the transaction, reducing front-running and slippage risks.

Solvers create coincidences of want (CoWs) by batching transactions, making transactions more efficient and cost-effective. When direct matching is not feasible, solvers compare quotes from different sources to ensure competitive pricing. The CoW Protocol also implements measures to protect users from miner extractable value (MEV) attacks, reducing malicious behavior through the network of solving algorithms.

Governance and infrastructure are overseen by CowDAO, and COW token holders participate in decision-making and enjoy benefits such as CowSwap fee discounts, which are aligned with the long-term success and security of the protocol. CoW Protocol facilitates direct peer-to-peer transactions between users, reduces slippage and transaction costs, and ensures best execution rates by widely scanning decentralized exchanges and aggregators.

4. CoW Protocol Team and Financing Information

CoW Protocol is led by Anna George (co-founder and CEO) and Olga Fetisova (head of data). The team has a deep technical background and industry experience and is committed to building a safe and fair decentralized trading platform.

In March 2022, CoW Protocol completed a US$23 million private round of financing. Investors 0x, 1kx, Blockchain Capital, Ethereal Ventures, Robot Ventures, SevenX Ventures, Delphi Digital, Hack VC, mgnr, Dialectic, Collider Ventures, imToken Ventures, LongHash Ventures, P2P Capital, Kronos Research, etc. raised US$15 million, and the remaining funds were raised from 5,000 community members.

5. CoW Token Economics

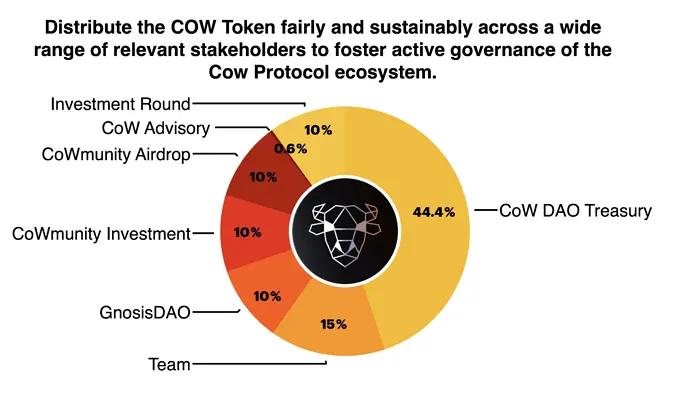

The native token of CoW Protocol is COW, and its token economics is designed to promote the governance, incentives and value capture of the protocol. Total supply: 1 billion COW tokens. In terms of governance, COW token holders can participate in the governance of CoW DAO, vote on the key parameters and development direction of the protocol, and safeguard the common interests of the community. COW tokens are used to reward solvers who provide the best transaction path in the protocol, incentivizing them to continuously optimize transaction execution and improve user experience.

The main distribution methods are as follows:

Cow DAO Treasury: 44.4% (444,000,000 COW)

Development team: 15% (150,000,000 COW)

Community investors: 10% (100,000,000 COW)

Gnosis DAO: 10% (100,000,000 COW)

Airdrop: 10% (100,000,000 COW)

Partners: 10% (100,000,000 COW)

Advisors: 0.6% (6,000,000 COW)

CoW Protocol plans to implement a protocol fee mechanism, and part of the revenue will be used to repurchase and destroy COW tokens, aiming to reduce market supply and potentially increase token value.

6. Analysis of the Future Value of CoW

Overseas analysts predict that if Cowswap successfully implements the "fee switch" strategy, that is, using ETH or stablecoins to pay solver rewards, the issuance of COW is expected to be significantly reduced by more than 40%. The implementation of this proposal means that the CoW Protocol will have the ability to charge fees independently. As transaction demand continues to grow, protocol fees will continue to be injected into the DAO treasury in the form of COW tokens, thereby effectively reducing the circulation of COW in the market.

From a theoretical perspective, Cowswap's increased real income, reduced circulation, MEV protection and intentional narrative are all positive factors for its token price. With these factors working together, COW's market value is expected to increase.

However, we must also be aware that Cowswap still has a large gap in market value and volume compared with the leading companies in the DEX field. Therefore, whether Cowswap can continue to attract users and expand its market share will become a key factor in determining its future development.