Author:blackb-rd

Translated by: Bai Hua Blockchain

I can't make enough money from Bit to buy a new house or car, but overall, I think Bit is a good idea. Maybe I don't understand the deeper political nuances behind Bit, but in reality, it has brought benefits to my life in a positive and legal way.

I feel like I'm in between two types of users: on the one hand, those who are still easily deceived or don't know how to save on gas fees, and on the other hand, those who have already seen what Bit can offer. This allows me to connect and interact with all kinds of people, from the newbies just getting started, to those who have already built businesses on Bit. In this article, I want to share some of my thoughts and reflect on the widespread adoption of Bit.

1. Where did I start?

My profession is a content manager, focusing on educational practices. Currently, I design introductory content for beginners as well as those who consider themselves advanced users. In fact, I first developed a Blockchain course for a master's program at a university, where I had to start with directed acyclic graphs (although I've never used them) and 51% attacks. But even so, that didn't save me: despite having this knowledge, it wasn't until about a year later that I finally figured out how to save on gas fees on the Ethereum network. At that time, words like Optimism, Avalanche, and Arbitrum were just empty buzzwords to me. It's embarrassing to admit, but it's also very true.

Over time, as information became clearer, everything became clear when I understood the connection between consensus mechanisms, block formation in Blockchain, and transaction placement. In fact, it took me two rounds of learning Blockchain technology to truly understand it. Is that slow? Maybe. The comments will tell.

Anyway, after two years of moderate learning, I finally feel like I basically understand most of it (including some minor details). However, many concepts only started to become intuitive when I focused on learning them. For example, to understand Ethereum's L2 solutions, you first need to understand the problems Ethereum faces, and then understand the solutions L2 provides - or you can just blindly believe others and start using L2. Even so, ordinary users won't feel these solutions are that important to them - they care about how to save on gas fees and avoid spending more on Ethereum than they earn in a day's pool rewards. When I opened the Avalanche website, the first thing I saw was a call to "Build without Limits".

Avalanche website - not a word about how retail users can save on gas fees.

Then, when I clicked on "New to Web3?", I was bombarded with terms like "smart contracts" and "Web3". Your parents don't even know they're on Web2, let alone being invited into a world called Web3 that has smart contracts. Some may even still remember Web1.

This may be a place to discuss whether ordinary people should go beyond centralized trading platforms. But my thoughts tend to make the decentralized space accessible to everyone, not just geeks, content managers like me, businessmen, and developers. So, how do ordinary people feel about the Bit industry? Through conversations with about 100 people and observing thousands of messages, I've gained some understanding.

2. The public's perspective

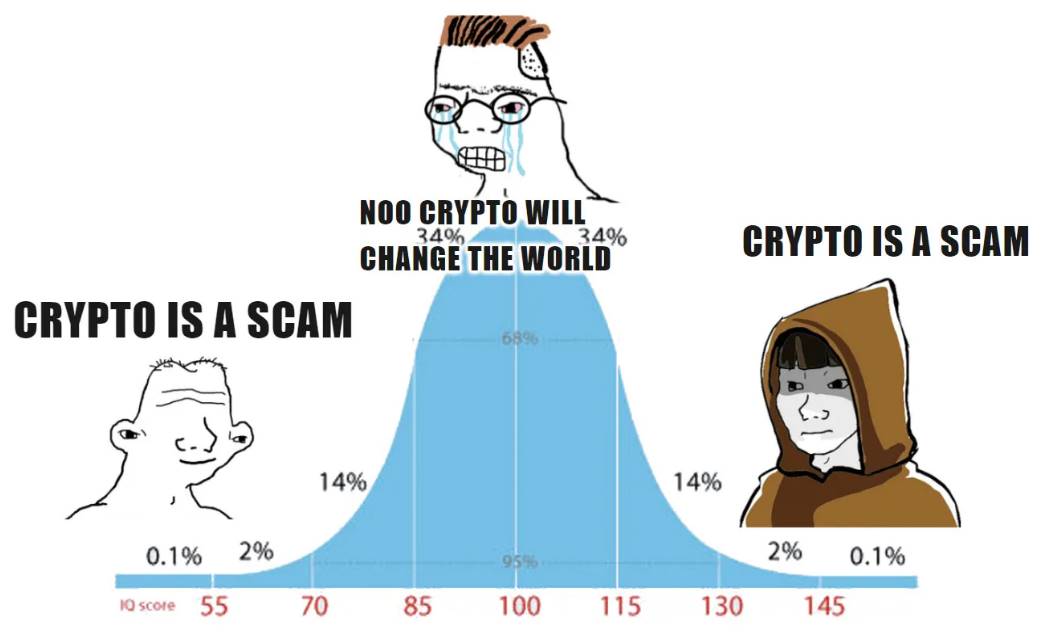

There are still people who think Bit is a scam by the end of 2024. Interestingly, this is almost like a "bell curve" meme: Bit is seen as a scam by those who have never even touched it, or by those involved in project development. I'm not at the IQ 145 level, I'm in the middle of this distribution.

These people are victims of unrealized narratives, and you can't expect constructive thinking from a narrative - it just tells a story. For example, "Buy my Bit Token and get a 10x return, buy a Lamborghini." This narrative seems to trace back to the ICO craze of 2016-2017. Later, this narrative failed, and a counter-narrative emerged: Bit is a scam. Of course, the root of this negative attitude is the ancient aversion to new things, which has been nurtured by scams in the past few years and scams in the present. Nowadays, "Buy my Token" has become a meme coin, but fortunately, meme coins no longer represent the entire industry.

Those top influencers who don't focus on Bit still mix up centralized trading platforms and decentralized trading platforms. And ordinary people (even advanced IT professionals, even former NASA employees) don't understand the role of Bit at all, who can blame them? The Bit industry hasn't simplified the user experience, let alone explain its relationship with traditional finance.

At one point, I tried to delve into Blockchain - beyond the "distributed database" analogy - and figure out the role of blocks and transactions within it. Even language models keep feeding me the same analogies, making the problem more complex: "Imagine a ledger that records transactions..." Imagine the frustration of an ordinary person trying to understand a Blockchain explorer, let alone figure out when their transactions are confirmed. This hasn't improved in four years.

Do I need to watch a Stanford University mini-course just to send some money to a friend without losing $50 in gas fees when Ethereum gas fees spike? This is a rhetorical question.

Seeing the huge gap between the professional jargon of Bit and the communication style of non-Bit users, it feels like the current user experience is built by developers for developers - or at best, by hardcore Bit enthusiasts for other hardcore enthusiasts. These are completely different language worlds, and it's hard for someone unrelated to technology to break through. This complexity generally helps maintain exit liquidity, but if we want more people to come in, it becomes a disadvantage. For basic operations like buying and selling, having such a complex language environment seems a bit excessive.

But on the other hand, should we really try to get people to understand beyond USDT? Or is it enough to just let them be able to buy an Avalanche card for daily consumption?

3. "I still consider myself a beginner"

This is the self-assessment of those familiar with centralized trading platforms, aware of decentralization (but not using its "benefits"), and trying to invest in Bit assets. Again, this is not directly related to educational level - these people are very diverse. Almost no one has gone further, AAVE is their "boundary" (TVL data also confirms this). Some don't even know they can avoid Ethereum's high fees, let alone how to check fees, but everyone is struggling with protocol interfaces. Each protocol feels different, making it unclear what to do, creating a fear of continuing to operate, and ultimately leading them to stop participating - this is the real words of a Bit venture capital employee.

It's hard to blame the protocols for not caring about user-friendliness, as these issues should be addressed through standardization. But now, imagine a standardized Bit protocol webpage and mobile interface, it does seem a bit far-fetched. And they don't know how to check the status of their own transactions: why are transactions stuck for hours, are funds lost, or where to seek support (there isn't any). Almost no one understands Blockchain explorers. If they've heard of them, they don't know where to find them. Not to mention how difficult it is to find the links to these explorers without being scammed?

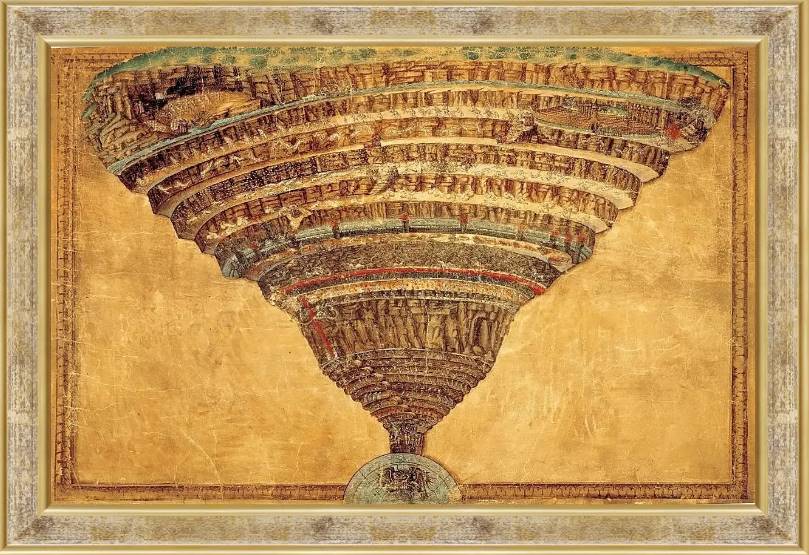

Based on my experience, a simple and obvious conclusion is: the fewer additional steps required to achieve a goal, the more likely people are to succeed. But now the customer journey map (CJM) is more like that infamous funnel, with Vitalik seemingly sitting at the bottom.

For example, for these people, "staking ETH to support network security" is meaningless. To understand this concept, you first need to understand the PoS consensus mechanism, which means you have to understand why the consensus mechanism is important.

The sad reality is that even those "beginners" who appear more "advanced" than true newbies are still just exit liquidity. In the worst case, these "beginners" will lose access to their own funds. For example, one of my clients panicked after creating a second wallet on the Fuel Network that was linked to her MetaMask account, thinking she had lost her money. This makes me feel that the current crypto industry is really just a traditional financial tool, where people are invited to enter, make money, or at best break even, and then return to the traditional financial field.

Considering that I still can't buy sausages with Bitcoin in Europe, this seems to be the case. Is this terrible? Not necessarily. Is anyone to blame? It's hard to say, because using cryptocurrencies to buy sausages requires explicit government approval. Enthusiasts and developers alone cannot make it happen. However, despite our frequent discussions about borderless transactions and the tokenization of sausages, this aspect has surprisingly little attention in the industry, even though it could indeed improve people's lives.

4. Advanced Users - Myth or Reality?

This question, of course, is to highlight the toxic situation in the industry, where people often see each other as fools, or at best, beginners. In the crypto industry, the so-called "advanced users" are essentially those with fully professional skills. The "advanced" users I see are those who depend on the industry for their livelihood: algorithmic traders, analysts, developers, and those who abuse various profit mechanisms (such as wash trading, node operators, gamblers, etc.).

Interestingly, they are divided into two types: highly empathetic and highly toxic. The reason is simple - there is a huge gap between the beginners mentioned in the previous paragraph and the advanced users mentioned in this paragraph. Toxic users are unwilling to help beginners bridge this gap, and only those with empathy can explain what is happening. People in the crypto industry usually help each other. But on the other hand, I've seen a chat group where even a question like "What's the difference between staking and liquid staking?" will get you banned.

For these people, becoming an advanced user requires years of learning and unequal financial investment. However, even "advanced" is a relative term - someone may have a lot of experience analyzing the business models of crypto projects, but they can still become exit liquidity in a meme coin, or become a victim of a MEV attack. They may even be scammed into a phishing address in a hurry.

By the way, the security issues in the crypto industry deserve a separate article. In addition to all the complexities I mentioned above, users will soon face issues of security and fund protection. And this challenge will never lose its relevance, regardless of skill level. I've even heard a story about someone stealing a private key by monitoring screen radiation. But these are just some thoughts; this is a conceptual issue in the industry: more freedom = more responsibility.

From a practical perspective, based on our user onboarding experience, I would consider users to be advanced when they start using non-custodial wallets regularly. Coincidentally, these people are usually able to navigate protocols well and not get lost in specialized technical areas like Uni V3. At this point, the level of advancement begins to show a right-skewed distribution: the level of advancement far exceeds any level of ignorance. In general, understanding all the basic concepts in the industry requires 3 to 6 months of focused study, while reaching the skill ceiling and understanding the details may take even longer. This seems to be the key to dividing people into highly toxic or highly empathetic.

By the way, 3 to 6 months is not just a random number. This is the time a former banker spent immersed in crypto concepts.

5. My Focus

Perhaps I seem to be criticizing or doubting. In part, that may be the case, but from a global perspective, I understand that this is how it is now, and I cannot simply go to the customer success department of Avalanche and demand that they "simplify" everything. What I want to draw attention to is the paradox of this situation. Many in the industry are waiting for retail liquidity to flow in - mass adoption. It seems this should be the reason for Bitcoin's valuation to reach millions or billions of dollars, or to alleviate regulatory pressure, or to protect people's assets from bank errors or abuse. Essentially, different stakeholders - crypto investors, crypto anarchists, and ordinary globalists - all have their own reasons. However, the situation becomes absurd - mass adoption is impossible, as even a basic user onboarding process cannot be found, not even on the homepages of the L2s that claim to improve user experience.

More interestingly, this task often falls on the shoulders of ordinary users (or YouTubers). Most beginners are stuck on centralized exchange (CEX) platforms, which are only loosely connected to the blockchain and decentralization ideals. And while beginners are trapped on CEXs, the decentralized space remains just a subcategory of traditional finance, as it is a playground for technically savvy users with ample free time to self-actualize.

Telegram has tried to attract traffic through airdrops and TG mini-apps, providing an interactive immersive experience. This is better than nothing, but it also leads to two problems:

1) The entire immersive experience is limited to the TON ecosystem (hopefully only for now).

2) A large group of people (131 million) were disappointed by the Hamster Kombat airdrop, becoming victims of the "crypto is a scam" narrative.

One of the most interesting drivers of mass adoption I've seen is the call to learn Bitcoin. This is undoubtedly a good approach, but first, there was a political theory in the mid-19th century that was also touted as the gateway to a bright future (of course, the masses never went to study it). Secondly, I bet people are more likely to jokingly buy Bitcoin due to the influence of crypto Twitter than after reading the white paper. Here, I advocate for some realism.

I don't know if we really need mass adoption, or if the entire industry is just a quirky wealth redistribution mechanism. Or perhaps we do need mass adoption, but the developers are currently scratching their heads, trying to explain to a store owner in Alabama why it's cool to keep their funds in a Rabby wallet instead of a bank. Now, the crypto industry's positioning around mass adoption feels completely disconnected. Financial transactions - the most common activity in our lives - should not create such a huge cognitive burden, nor should they consume so much time.