Source: Jinse Finance, Binance, Usual Whitepaper, Usual Official Website, Twitter Compiled by: Jinse Finance

On November 14, 2024, Binance announced the launch of the 61st project on Binance Launchpool - Usual (USUAL), a decentralized fiat-backed stablecoin issuer. Users can deposit BNB and FDUSD into the USUAL reward pool on the Launchpool website to earn USUAL after 8:00 AM (UTC+8) on November 15, 2024. The USUAL event will last for 4 days. The website is expected to be updated with the activity opening approximately 24 hours after this announcement.

Pre-trading

Usual (USUAL) will be listed on Binance pre-trading at 6:00 PM (UTC+8) on November 19, 2024, and the USUAL/USDT trading market will be opened. The end time of pre-trading and the time of spot listing will be announced later. The eligibility to participate in Binance pre-trading depends on the user's country or region of residence. Individual maximum holding limit: 40,000 USUAL

I. Launchpool Details

Token Name: Usual (USUAL)

Total Token Supply: 4,000,000,000 USUAL

Initial Circulating Supply: 494,600,000 USUAL (12.37% of the total token supply)

Launchpool Total: 300,000,000 USUAL (7.5% of the maximum token supply)

Smart Contract Details: Ethereum Network (0x430a2712cEFaaC8cb66E9cb29fF267CFcfA38a42)

II. Usual (USUAL) Project Introduction

1. What is Usual?

USUAL is a secure and decentralized fiat-backed stablecoin issuer that redistributes ownership and governance through the $USUAL token.

Usual is a multi-chain infrastructure that aggregates a growing pool of tokenized real-world assets (RWA) from entities like BlackRock, Ondo, Mountain Protocol, M0, or Hashnote, and converts them into permissionless, on-chain verifiable, and composable stablecoins (USD0).

Usual is built around redistributing power and ownership back to users and third parties, similar to the Tether TVL provider-owned company and its associated revenue scenario.

2. Why Choose Usual?

Usual is based on three key observations:

Tether and Circle generated over $10 billion in revenue in 2023, with valuations exceeding $200 billion. The wealth created has not been shared with the users who contributed to their success.

Real-world assets (RWA) are growing, but despite the emergence of on-chain US Treasuries, their integration with DeFi remains challenging. This is evident from the fact that there are fewer than 5,000 RWA holders on the mainnet.

DeFi users want to see the success of the projects they support. The current revenue distribution models fail to adequately incentivize users who take on greater risks by joining early and contributing to the project's success.

III. Usual's Vision

1. Rebuilding Tether On-Chain: Neutrality and Transparency

Crypto needs a fully on-chain fiat-backed stablecoin supported by infrastructure that ensures enhanced neutrality, transparency, and security.

Usual introduces a model aimed at fully rebuilding Tether on-chain. In this system, the issuer is controlled by the holders of the Usual governance token. This includes decision-making on risk policies, collateral nature, and liquidity incentive strategies.

2. Fiat-Backed Stablecoins Need to Move Away from Bankruptcy

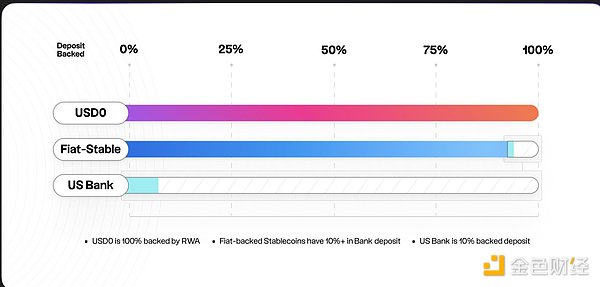

Fiat-backed stablecoins are partially collateralized by reserve funds held by commercial banks. This makes them susceptible to the fractional reserve practices of these banks, compromising the security and stability of the stablecoins. The recent collapse of SVB Bank has highlighted the systemic risk that commercial banks pose to DeFi due to undercollateralization.

Fiat-backed stablecoins face greater risks due to commercial banks' fractional reserve exposure

The primary requirement for stablecoins is to ensure their value remains stable relative to the currency they represent. Users must have unwavering confidence in the safety of their capital. Usual's collateral model is not tied to the traditional banking system, but rather directly to short-term bonds. This prudent approach provides security that is further strengthened by strict risk policies and an insurance fund.

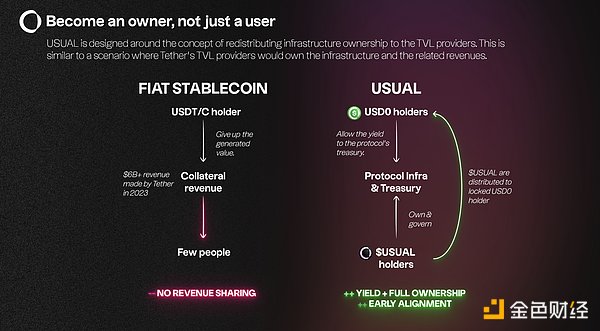

3. Ending the Privatization of Profits

Tether and Circle generated over $10 billion in revenue in 2023, with valuations exceeding $200 billion. However, this wealth has not been shared with the users who contributed to their success. Usual aims to provide an alternative to fiat-backed stablecoins that privatizes the profits from customer deposits while socializing the losses. The centralized participants behind the major fiat-backed stablecoins have replicated the problematic structures of traditional banking, which is at odds with the principles of decentralized finance.

Usual's approach aims to create a fairer financial system by more equitably redistributing value and power among all users.

Usual's goal is to make users the owners of the protocol infrastructure, capital, and governance. By redistributing 100% of the value and control through its governance token, Usual ensures its community is in the driver's seat.

The Usual protocol will distribute its governance tokens to users and third parties who contribute value, realigning financial incentives and returning power to the participants within the ecosystem.

Usual redistributes 100% of the value and control through its governance token.

4. Fundamentally Changing Stablecoin Ownership and Revenue Redistribution

Some models may redistribute a portion of the revenue generated by the stablecoin. However, Usual adopts a different model where the earnings from the stablecoin collateral are pooled together. This revenue constitutes the protocol's capital. In return, users will receive governance tokens, allowing them to control the protocol, the capital, and future earnings.

This mechanism not only redistributes the revenue but also redistributes the ownership of the system. It provides strong incentives for early adopters, offering them significant upside potential.

The transparent and open distribution of the governance tokens ensures the alignment of interests for all participants.

IV. Usual Token Economics

Token Distribution

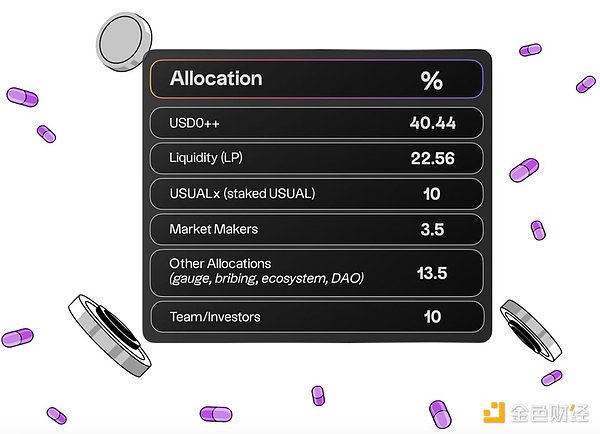

The $Usual distribution is community-centric:

73% of the tokens are for the public and liquidity provision

13.5% is allocated to MM/team and investors

13.5% is for DAO/buybacks/voting