The price of Bitcoin (BTC) has risen 21.70% over the past 7 days, continuing to set new all-time highs. BTC is now just about 10% away from breaking the $100,000 mark, and the technical indicators such as the DMI and EMA lines show a very strong uptrend.

Market sentiment is moving into a confident stage, but has not yet reached euphoria, so there is still room for growth before potential corrections. However, as the momentum is maintained, traders should be mindful of possible pullbacks as this important milestone is approached.

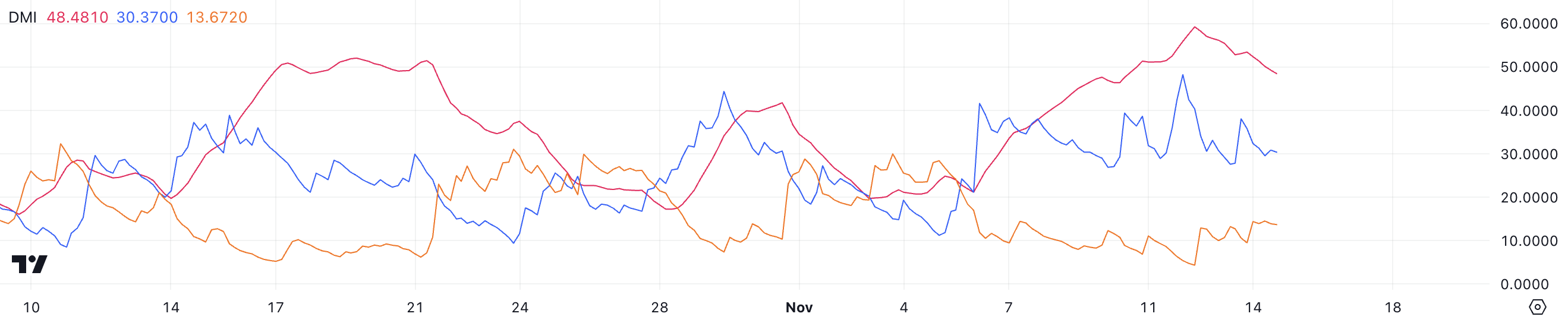

Bitcoin, Extremely Strong Uptrend on the ADX Indicator

The BTC DMI chart emphasizes the strong uptrend in Bitcoin. The current ADX is at 48, indicating substantial trend strength. ADX measures the strength of a trend, with values above 25 indicating a strong trend and above 40 indicating a very strong trend.

A few days ago, the ADX approached 60, indicating an even stronger uptrend at that time.

The Directional Movement Index (+DI and -DI) further clarifies the direction of this trend. The +DI at 30.37 indicates the dominance of the upward movement, while the -DI at 13.67 suggests weak selling pressure. This combination shows that buyers currently have a firm upper hand over sellers.

The difference in these values suggests that the bullish forces continue to dominate the market, despite the recent sharp rise.

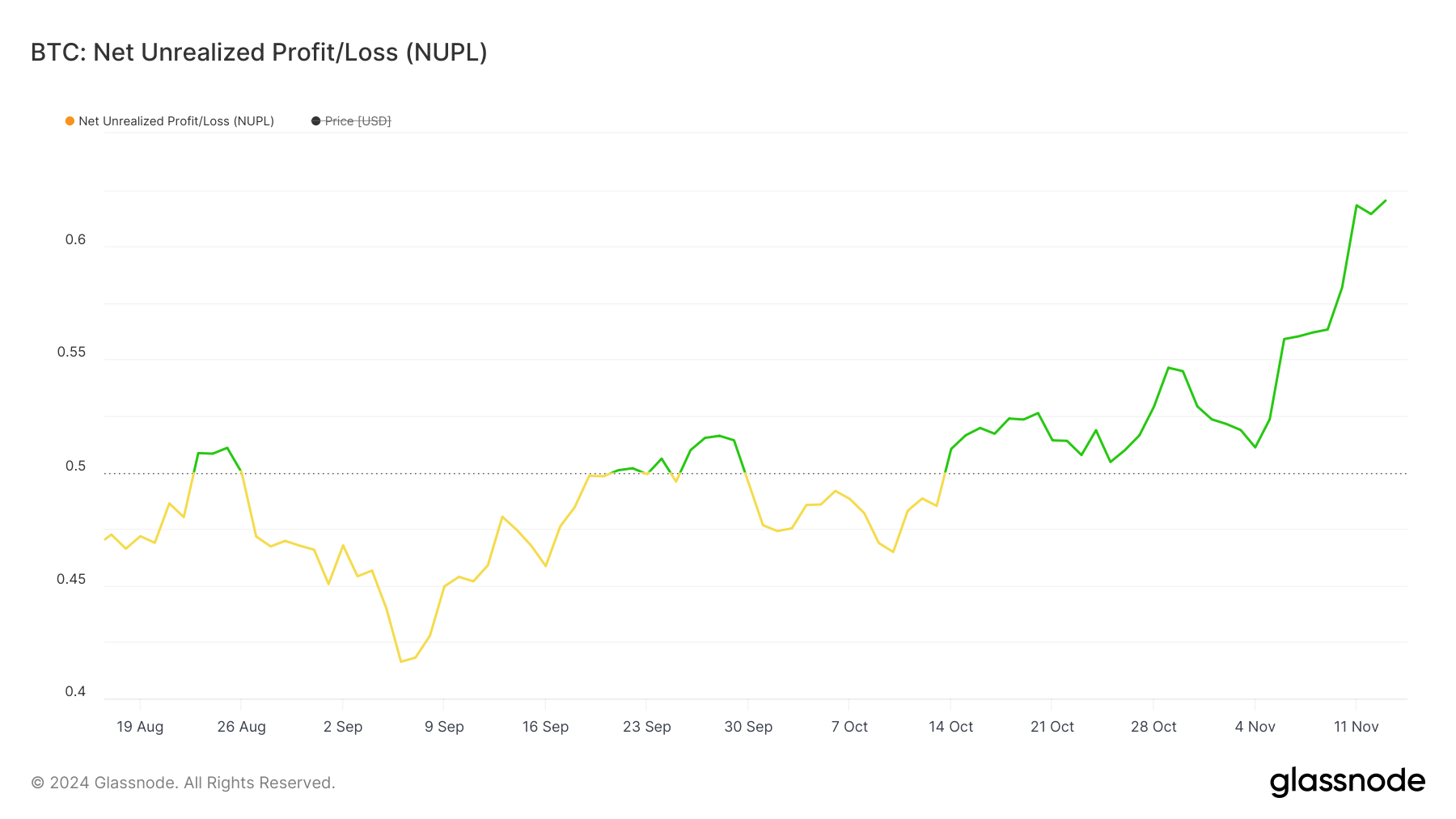

Bitcoin NUPL Indicator Still Far from Euphoria

Bitcoin's NUPL (Net Unrealized Profit/Loss) indicator is currently at 0.62, in the "Belief - Denial" phase. NUPL helps gauge the overall market psychology by measuring the total unrealized profits or losses of all Bitcoin holders.

At 0.62, the market sentiment has shifted from cautious belief to confident growth, but has not yet reached the extreme optimism stage.

Despite being in the "Belief - Denial" phase, the NUPL level is still significantly below the 0.7 "Euphoria - Greed" threshold. Historically, the next stage has often been marked by Bitcoin experiencing a strong correction as market sentiment transitions to unsustainable greed.

With the current NUPL value below this critical threshold, BTC price may still have room to grow before reaching levels associated with overheating.

BTC Price Prediction: Will $100,000 Be Reached by November?

Bitcoin's moving average (EMA) lines are currently showing a very strong bullish setup, with the price above all EMAs and the short-term EMA positioned above the long-term EMA.

This alignment is a classic indicator of a well-supported uptrend, suggesting favorable momentum for further gains.

BTC's price is just about 10% away from the historic $100,000 milestone, and considering the strength of the current trend and supportive indicators like NUPL, it appears possible for this milestone to be reached in the near future. However, corrections can always occur before new all-time highs are established.

If the strength of the trend weakens, Bitcoin's price may experience a pullback and test the key support levels of $85,000 and $78,400.