In recent times, the surge in MEME coins has surprised many investors. In particular, ACT and PNUT, two MEME coins listed on Binance, have surged by hundreds of times, allowing many investors to achieve financial freedom overnight. The performance of MEME coins seems to always achieve crazy gains in the extreme emotions and speculative fervor of the market. So, how can one seize the next explosive opportunity in these highly volatile MEME coin markets and achieve similar hundred-fold or even thousand-fold returns? This article will take you in-depth to analyze how to use factors such as Binance's listing dynamics, market sentiment, and social platform heat to uncover the next explosive MEME coin.

The market driving factors behind MEME coins: liquidity, social media heat, and monetary policy

The surge in MEME coins is not entirely due to random market fluctuations, but often quickly ferments under specific market conditions and social emotions, thereby attracting capital inflows. We can understand the growth mechanism of MEME coins from the following aspects.

1. The macro impact of monetary policy

The global monetary policy easing, especially the large-scale monetary stimulus by central banks after the pandemic, has led to an increase in market liquidity. In this case, investors with higher risk appetites begin to seek out higher-risk assets with greater potential, and MEME coins have become a focus of capital inflows due to their low prices, low entry barriers, and potential for high returns.

In Binance's latest article, the official has explained in detail the reasons for the surge in MEME coins. In short, the inflow of market funds is the key factor driving the rise of MEME coins.

The increase in money supply has not only promoted the growth of traditional assets, but also made risk assets, especially MEME coins, another choice for capital to seek high returns. The influx of a large amount of capital into the MEME coin market has not only driven their short-term price surge, but also further intensified the speculative atmosphere in the market.

2. The participation of retail investors and the role of social media

The rise of MEME coins is not only driven by market funds, but also inseparable from the widespread participation of retail investors and social media. A core feature of MEME coins is their "sociality", as these assets often generate widespread discussions on social platforms, especially on Twitter and Reddit, and the heat of project discussions and user sentiment can directly affect the short-term price fluctuations of the coins.

KOL, the main driver of ACT

KOL, the main driver of ACT

For example, the surge of $ACT and $PNUT after their listing on Binance was largely driven by the heat of discussion by social media KOLs. As these projects do not have traditional fundamental advantages, their prices are more determined by market sentiment and short-term capital flows. Therefore, the price fluctuations of MEME coins are highly dependent on market sentiment, and investors need to closely follow the dynamics of the market and pay close attention to trends on social platforms.

3. The high risk and high return of low market cap assets

Unlike traditional mature assets, MEME coins generally have a relatively low market capitalization, which makes their short-term price volatility extremely high. Low market cap assets are more easily favored by capital, and once a large amount of capital flows in, their prices can surge in the short term. However, this surge is often accompanied by a rapid outflow of funds, which also leads to the high instability of MEME coins. Therefore, although the gains of MEME coins are astonishing, they also face extremely high risks.

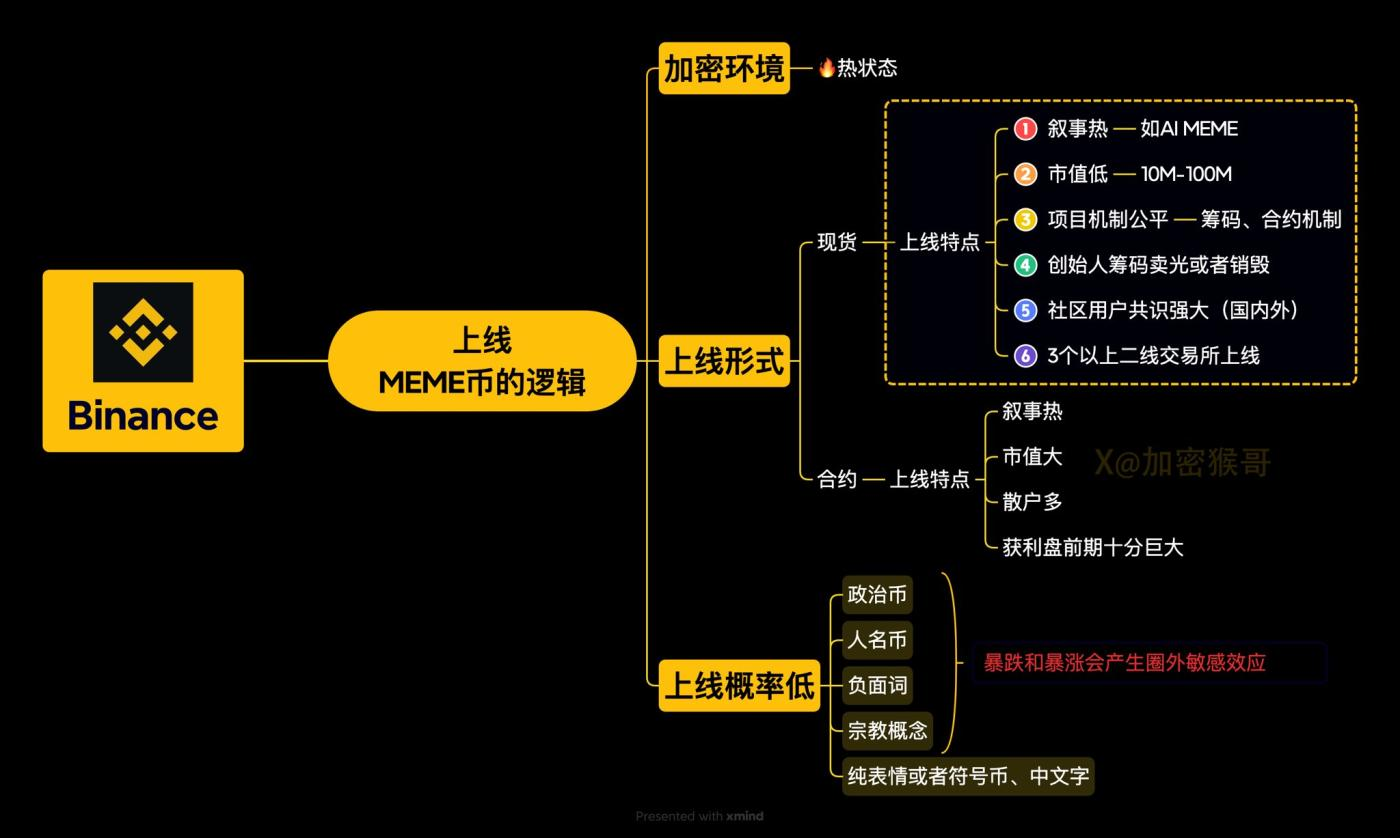

The impact of Binance listing: the logic from announcement to surge

As one of the world's largest cryptocurrency exchanges, Binance's impact on the listing of MEME coins cannot be underestimated. Binance's listing is not only an endorsement of the project, but also a market validation of its potential. Whenever Binance announces the listing of a project, it often triggers a frenzy in the market, with investors' attention and buying enthusiasm quickly heating up. Specifically, Binance's impact can be analyzed from the following aspects:

1. Market reaction to listing announcements

According to Binance's announcement, the prices of the two MEME coins ACT and PNUT surged 42 times and 20 times respectively after their announcement of listing. This surge not only reflects the market's recognition of Binance's platform liquidity and capital security, but also means that Binance's exposure has a profound impact on MEME coins. Binance's liquidity, trading pairs, and global user base enable the listed coins to quickly attract a large influx of capital, thereby driving their prices to rise rapidly.

2. Impact on liquidity and trading volume

Binance's listing not only increases the market liquidity of MEME coins, but also promotes the growth of their trading volume. Taking $HIPPO as an example, the coin surged 4 times within 5 minutes after being listed on Binance, significantly exceeding investors' expectations. Binance's listing provides a powerful channel for capital inflows into these projects, and the platform's large user base ensures the continuous attention and investment enthusiasm for the projects.

How to select potential MEME coins: screening criteria and tools

1. Screening hot projects: starting from decentralized exchanges (DEXs)

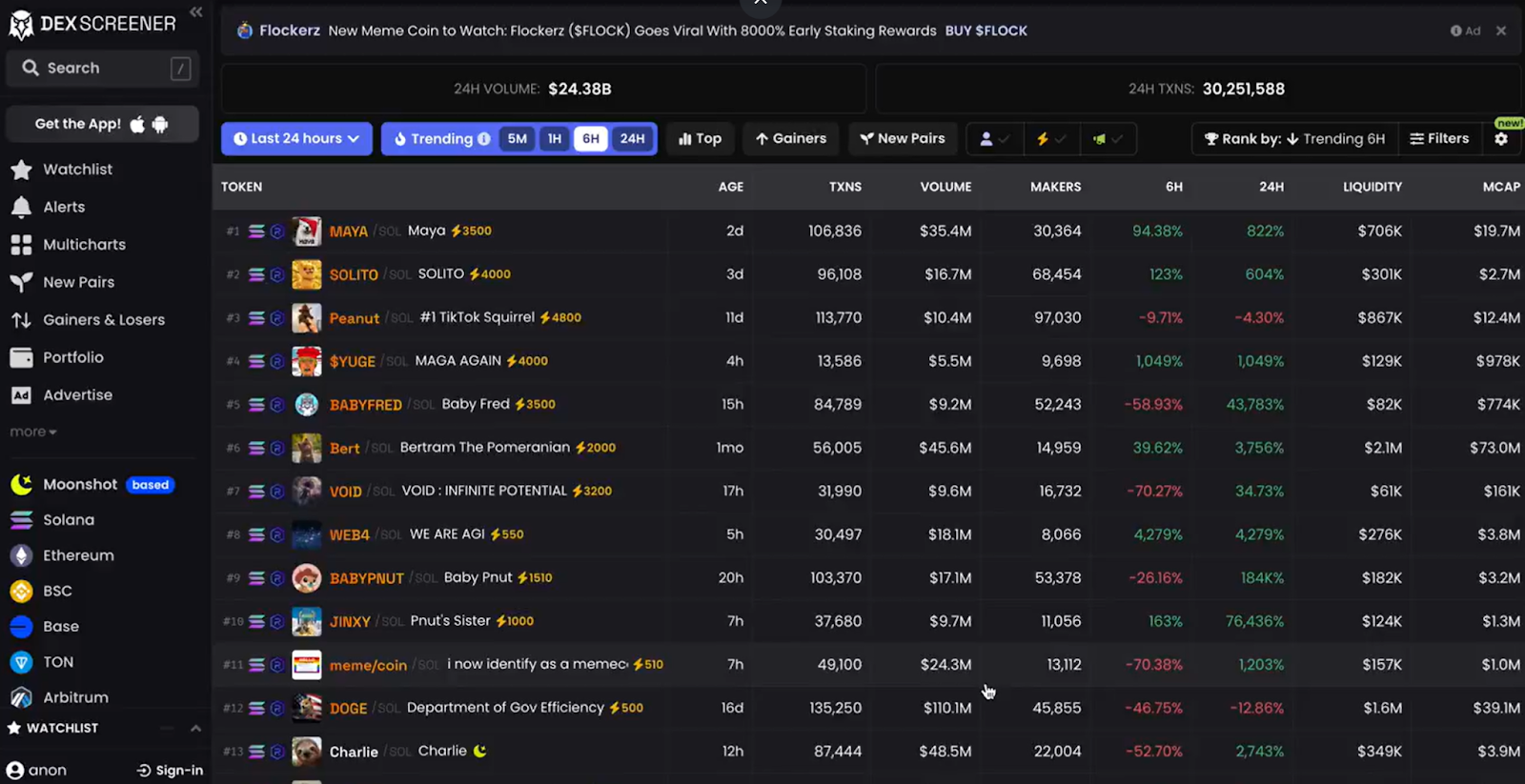

To uncover potential MEME coins,first focus on the coins that are currently active on decentralized exchanges (DEXs).

Throughtools like @dexscreener, investors can view the coins with the largest 24-hour gains and highest trading volumes. By preliminary screening of these coins, potential investment opportunities can be discovered. The specific screening criteria include:

- Market cap greater than $15 million

- 24-hour trading volume greater than $5 million

- Liquidity greater than $300,000

- Listing time greater than 3 days

Tokens with a market cap below $5 million are not very safe for the long-term prospects of MEME coins and have high risks.

2. Use ToxiSolanaBot to analyze project potential

For each potential project, investors can use tools like @ToxiSolanaBot for further screening.

This tool can help analyze the project's contract address, market sentiment, and historical performance, providing investors with more comprehensive data support. When using this tool, investors need to pay attention to:

- Select the contract address for analysis;

- Select the correct purchase amount and check the project's liquidity and market activity.

Through these analysis tools, investors can better assess whether a project has the potential to explode.

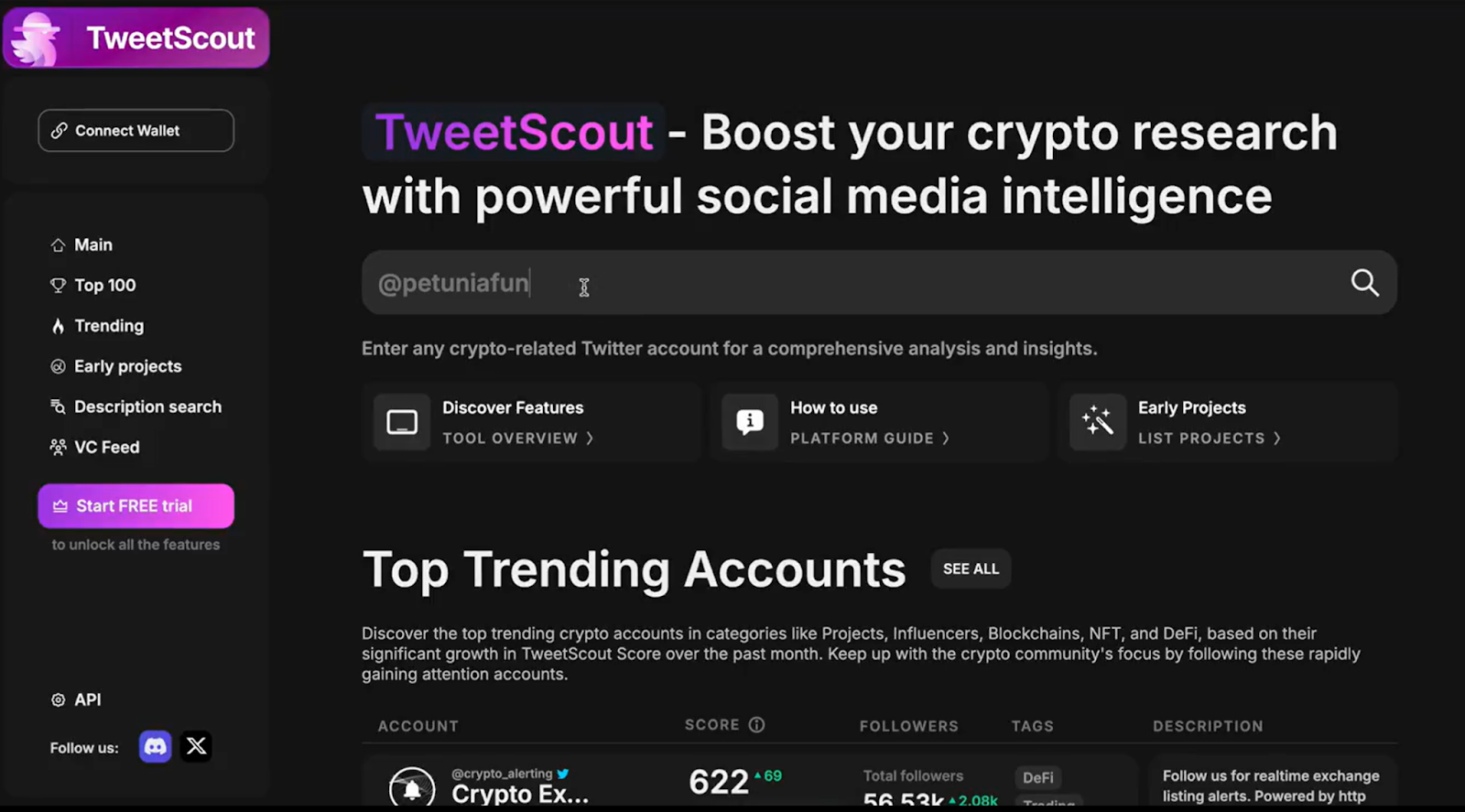

3. Social platform heat analysis

Investors can also further verify a project's potential through social platforms.On Twitter, the heat of project discussions often directly reflects the market's attention to it. By checking the official account of the project and the related discussions, investors can obtain real-time feedback on the project. At the same time, using platforms like @TweetScout_io, investors can analyze the project's fan base and market influence to help judge its potential.

Avoid risks and ensure stable investment

Although the surge of MEME coins is tempting, their high risk cannot be ignored. Investors should reasonably diversify their investments before investing funds, and avoid concentrating all their funds on a single project. In addition to technical analysis and social platform analysis, investors also need to closely monitor market dynamics, especially policy changes, platform announcements, and other external factors that may affect the price of MEME coins.

1. Diversify investments to avoid single risk

It is recommended that investors diversify their assets and avoid concentrating all their funds on a single asset, especially projects with low market capitalization and poor liquidity. You can choose a diversified investment portfolio, including some mature projects and some potential stocks. By reasonably allocating funds, you can not only ensure safety, but also obtain higher returns.

2. Track market dynamics and seize key opportunities

The volatility of the MEME coin market is very large, and investors need to constantly track market dynamics, especially announcements from major exchanges, policy changes, and other information. Announcements of listings on exchanges like Binance, and the performance of projects on social media, may have a significant impact on prices. Maintaining sensitivity to the market and promptly adjusting investment strategies is the key to success.

Summary: Grasp the trend and seize opportunities

As a high-risk, high-return investment tool, MEME coins undoubtedly provide investors with great opportunities with their potential for explosive growth. However, to seize the next project with a hundredfold return, investors must fully utilize the market's liquidity, the heat of social platforms, and the listing dynamics of exchanges like Binance. Through scientific screening methods, technical analysis, and social media heat analysis, investors can increase the probability of discovering potential projects, and thus stand undefeated in this volatile market.

But like all high-risk investments, the speculative nature of MEME coins also comes with great risks. While pursuing high returns, investors should also ensure reasonable risk control and asset allocation to avoid major losses due to excessive market fluctuations.