The investment management company VanEck expects the upward trend of Bit will continue into next year, and has set a target price of $180,000.

Matthew Sigel, head of digital asset research at VanEck, said in an interview with CNBC's "Squawk Box" on November 14:

"This is just the beginning."

He added that the cryptocurrency market is now entering an uncapped area with no technical resistance. Over the next two quarters, it is possible that new highs will be repeatedly set.

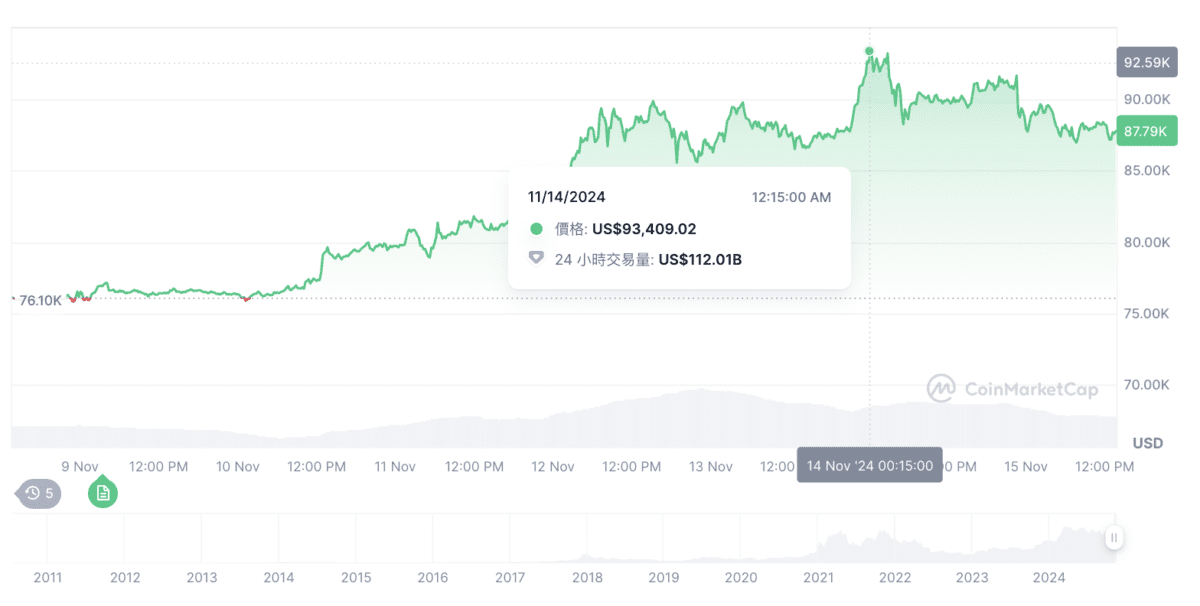

Since the election of President Trump, who supports cryptocurrencies, on November 5, the price of Bit has risen about 30%, leading to a general rebound in the cryptocurrency market. According to CoinMarketCap data, Bit reached a new high of $93,409 on November 14. At the time of writing, the Bit uptrend has slowed down, and the current trading price is around $87,790.

Matthew Sigel said that VanEck expects a wave of increases after the election, and pointed out that the current trend is similar to the pattern after the 2020 election, when Bit doubled between election day and the end of the year.

"Our target price is $180,000. We believe this price level can be reached next year. This means that the increase from the low to the high of this cycle will be 1000%, but compared to past cycles, this is still the smallest increase for Bit."

He also pointed out that the Google search volume for "Bit" and the ranking of the Coinbase app in the Apple and Google app stores are still far below the levels of four years ago. According to Google Trends data, the search heat for "Bit" peaked in May 2021, but has increased by nearly three times since early November.

According to Appfigures data, Coinbase is ranked 1st in the finance category of the US Apple App Store, 16th overall, and 5th in the finance category of Google Play, 66th overall.