Unichain aims to become the central hub of cross-chain DeFi liquidity, a super app that is building application chains to capture the value created by the protocol itself.

Key points: Unichain aims to become the central hub of cross-chain DeFi liquidity, a super app that is building application chains to capture the value created by the protocol itself.

Built on the OP Stack, its core innovations include:

- Verifiable Block Building: Collaborating with Flashbots to develop, process transactions quickly, capture MEV and protect user transactions.

- Unichain Validation Network: Solving the centralization risk of a single sequencer, achieving "verifiable ordering", and faster economic finality.

- Intent-driven interaction model: Users only need to care about their own needs and intentions, and the system will automatically choose the optimal path to execute cross-chain interactions, without needing to worry about the underlying complexity of inter-chain execution.

- Super apps can make it possible to capture the unique value of the protocol by building application chains.

Research Report

Verifiable Block Building

Unichain's Verifiable Block Building process relies on the development of Rollup-Boost in collaboration with Flashbots. It mainly solves three problems:

- Reduce MEV risks

- Improve transaction speed

- Provide transaction revert protection (reduce the risk of users paying high fees due to failed transactions)

How it works

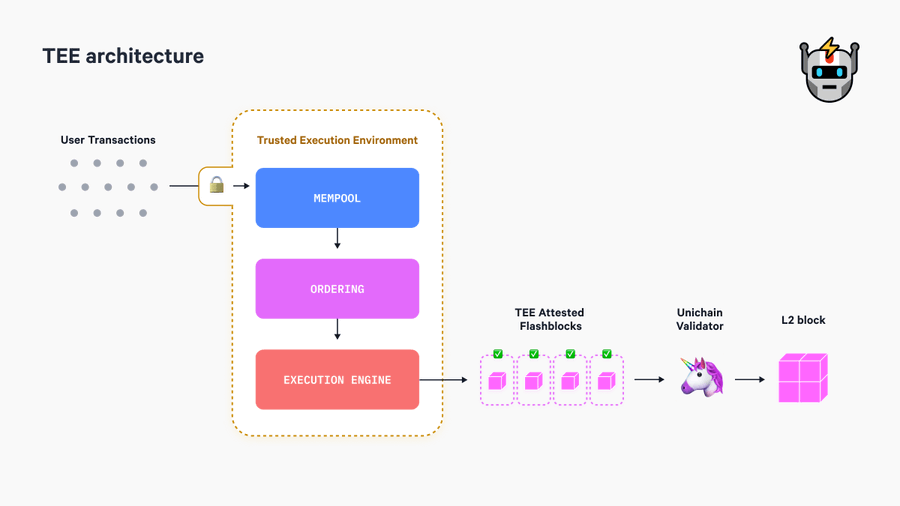

- Unichain separates the roles of block building and sequencing, with the Verifiable Block Builder responsible for block construction. This builder runs in a trusted execution environment (TEE), a secure hardware environment that can execute programs and generate verifiable execution proofs without exposing internal data, allowing external users to verify that the block building follows the specified rules.

- The Flashblocks pre-confirmation mechanism, which is like pre-confirming the set of transactions that will be included in the block. Each block is divided into multiple Flashblocks, which compresses the block time to 200-250 milliseconds, much faster than the current block times of most Rollups. Additionally, the transaction ordering rules within each Flashblock will be enforced in the TEE environment, meaning that users and applications can transparently know the execution order of transactions, thereby reducing the unfairness caused by MEV.

- The TEE provides trustless revert protection by simulating transactions during the block building process, detecting and removing any potentially failing transactions. This can prevent users from paying unnecessary fees due to failed transactions.

In summary, two things have been done: first, the roles of block building and sequencing have been separated, and Flashblocks are built in a publicly transparent environment (TEE) to enhance verifiability, while also improving transaction efficiency and reducing MEV; then, a "pre-confirmation" mechanism is introduced in the block confirmation process, where transactions are pre-included in the block, allowing users and applications to know in advance, and after passing the pre-confirmation time window, the final packing and confirmation is performed.

Although pre-confirmation accelerates the block confirmation process, pre-confirmation is not the same as final confirmation. It means that before the transactions are packed into the final block, users can know in advance that these transactions will be included, which helps to reduce transaction latency. The white paper mentions that the expected block time of Flashblocks is 200-250 milliseconds. This means that Flashblocks can pre-confirm transactions within this time window. But the actual final confirmation will take more time, as the block will eventually be merged and its state updated and submitted with other blocks to ensure the consistency of the entire chain's state.

So the time window of pre-confirmation is theoretically manageable, and its length directly affects the user's transaction experience and the risk management of liquidity providers. A shorter time window means faster transaction confirmation, but it may also bring higher technical requirements and network pressure. Overall, the setting of this pre-confirmation time window is to balance accelerating transaction speed and ensuring network security.

Unichain Validation Network

UVN (Unichain Validation Network) is the decentralized validation system designed by Unichain to solve the potential risks of a single sequencer architecture, combining Flashblocks and the trusted execution environment (TEE) to achieve "verifiable ordering".

How it works

- The validators are node operators in the UVN, who need to stake UNI to become validators. Each validator has the right to participate in the validation process and receive corresponding rewards based on the amount of UNI they have staked.

- The blocks of Unichain are divided into fixed-length Epochs. At the beginning of each Epoch, the staking amount of all current validators is recorded as a snapshot, and the reward value for each staked token is calculated. The validators with the highest UNI staking weight will be selected into the active validator set, and these validators have the right to participate in the block validation of the current Epoch.

- The active validators need to keep their Unichain nodes online to validate the blocks proposed by the sequencer.

- Validators verify each proposed block and generate a hash value signature for the block, which they publish to the service smart contract of the UVN. The contract will verify these signatures and distribute rewards based on the staking weight of the validators. If a validator fails to effectively validate blocks within an Epoch, or participates in publishing invalid block signatures, they will lose the rewards for that period and may face staking token penalties.

In summary, the main risks of a single sequencer are the uncertainty of blocks, unfair transaction ordering, and adverse effects on network security and fairness caused by the centralization of the sequencer.

The solutions that have appeared in the market are to introduce a decentralized sequencer and design incentive and punishment mechanisms for it, such as Metis. Unichain combines decentralized validation (UVN) and a transparent sequencing mechanism (verifiable block construction), which has both validation capabilities and the transparency of sequencing, mitigating the problems caused by centralization. The two have their own characteristics, and the difference lies in the balance between efficiency, cost, and security, which will not be elaborated on here.

Some common problems we often encounter are: a single sequencer has the power to order transactions, and can decide which transactions to include in a block when packing transactions. This power allows the sequencer to potentially extract maximum extractable value (MEV) by reordering or inserting their own transactions to profit from other users' transactions.

Intent-Driven Interaction Model

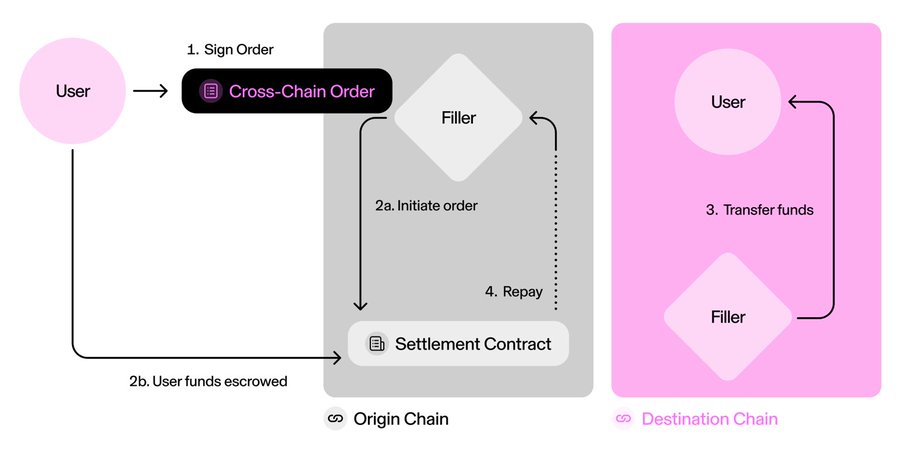

The whitepaper mentions intent-based cross-chain interaction (ERC-7683: Cross Chain Intents), which converts user's transaction requirements into executable "intents", and then the system automatically selects the optimal path to complete these intents, without the user having to manually operate between multiple blockchains.

Users can submit an intent to transfer 100 USDC from Unichain to the Ethereum mainnet to purchase an NFT. The intent-driven model will automatically identify the intent and choose the best path to complete the cross-chain interaction automatically. This design achieves automation and decentralization of the cross-chain transaction process without the need for a trusted intermediary, reducing the risks of third-party dependence and manual operations, while also realizing the ultimate goal of chain abstraction - separating the complexity of blockchain interaction from the final user experience, allowing users to only focus on their own needs and intents, and solving the problems of liquidity fragmentation and fragmented cross-chain interaction experience.

Ultimate Goal: Becoming the DeFi Liquidity Center

Unichain has chosen the OP Stack camp, and can deeply integrate with mainstream L2s such as Base, Mode, and OP Mainnet through the native interoperability of Superchain on the external side. Within these chains, Unichain can easily utilize the intent-driven model.

For chains outside the OP camp, the standardized design of ERC-7683 allows Unichain's intent-driven model to interact with other non-OP Stack chains. This is achieved through standardized interfaces and smart contract structures (such as the CrossChainOrder and ISettlementContract interfaces). As long as different chains follow this standard, or certain cross-chain bridges are compatible with this standard, they can parse and process cross-chain intents and participate in Unichain's cross-chain order execution process.

The ultimate goal is to become an important connection point in the entire DeFi ecosystem, providing users with broad and fast access to liquidity.

Value Capture of UNI

Based on the current information, $UNI will be used as the collateral for validators in the UVN network, and they will receive rewards. Its value capture may come from the following aspects:

- Potential opening of the transaction fee switch (this has been controversial for a long time and has not been opened yet, also facing pressure from regulators and other aspects)

- Blockchain node staking rewards (receiving block rewards for completing node validation work)

- MEV capture and distribution: Unichain has control over transaction ordering based on the UVN validation network and verifiable block construction, so it can capture a large amount of MEV, including MEV generated by intent-based cross-chain transactions (for example, by optimizing the execution path of cross-chain orders to ensure the orders are completed at the lowest cost and highest profit when the transaction occurs). However, this MEV value can be distributed, either to users or to validators who have staked UNI.

- Capture of cross-chain interaction fees: Unichain's ultimate goal is to become the DeFi liquidity center, and the key factor to achieve this is ERC-7683, which can enable users to interact seamlessly between multi-chain liquidity, approaching the effect of chain abstraction. This cross-chain transaction and intent-driven interaction model requires the participation of fillers and validators to complete the transactions. These roles can obtain revenue from the order fees or settlement fees when processing cross-chain orders and settlements.

Compared to ordinary L2s, Unichain's additional value capture is in 3 and 4. Before the launch of Unichain, the MEV generated by Uniswap was captured by Ethereum validators and L2 sequencers, and with the launch of Unichain, this value will be transferred to Unichain. The cross-chain interaction fees will depend on Uniswap's transaction volume across chains, and whether the smooth interoperability of multi-chain transactions will bring an increase in transaction scale, the fees originally incurred through cross-chain bridges will also flow entirely into Unichain itself. (Of course, the above does not consider the potential governance value and the value brought by the future growth of the ecosystem, which are unpredictable.) This is a unique way for a super-app to recapture the value it creates by building an application chain.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and are not related to the stance of Web3Caff. The information in the articles is for reference only and does not constitute any investment advice or offer, and please comply with the relevant laws and regulations of your country or region.

Welcome to the official Web3Caff community: X(Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram discussion group