Author: WOO

On November 13, Bitcoin surged to $92,000, and the total market capitalization of cryptocurrencies reached $3.2 trillion, both hitting new all-time highs. This round has only seen the frenzy of Bitcoin and meme coins, with Altcoins completely failing to keep up with the surge.

The reasons for the sluggish performance of Altcoins are roughly as follows:

The market is not buying into the token economic model of new projects with low market capitalization and high fully diluted valuation, and is instead investing in meme coins.

There has been no killer application this round.

The chart below shows the Bitcoin dominance index BTC.D, which is currently as high as 61%, a new high in the past three and a half years. Will BTC.D continue to rise? Can the above-mentioned sluggish reasons be solved in this cycle? Is there still an Altcoin season? Let's take a look with WOO X Research.

Reference: TradingView

The Logic of Altcoin Appreciation

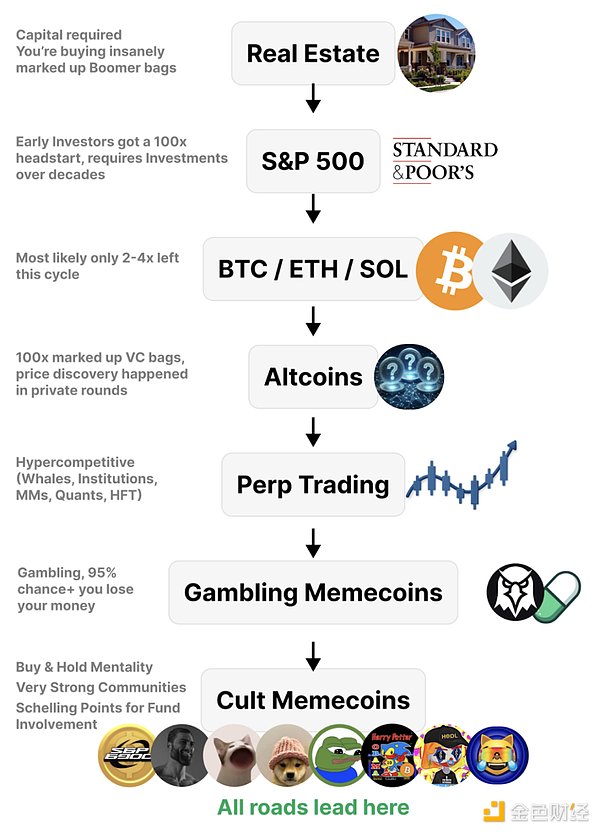

We are currently in the early stage of a rate cut cycle, which means that the US is releasing more liquidity into the risk market, and the transmission path of capital has directionality. It starts from the traditional real estate market, then spills over to the stock market, and when the stock market reaches a certain market capitalization, the surplus capital will flow into the mainstream crypto assets (BTC/ETH/SOL), and when the mainstream crypto assets have risen enough and met the market capitalization threshold, the capital will flow into the smaller market capitalization Altcoin market, thereby driving up the prices of Altcoins.

One can imagine that all these asset categories are like a series of water basins of decreasing size, and when the water poured down is enough to fill the upper basins, the water will naturally overflow into the smaller basins below. This path of capital flow indicates that capital will follow the characteristics of market liquidity, flowing from assets with relatively lower risk and larger scale to assets with higher risk and smaller scale.

Therefore, the prerequisite for Altcoin appreciation is: Bitcoin must rise first, until it can't rise anymore, and capital is willing to leave Bitcoin and buy Altcoins.

Reference: @MustStopMurad

Current Market Cycle: On the Eve of Altcoin Explosion

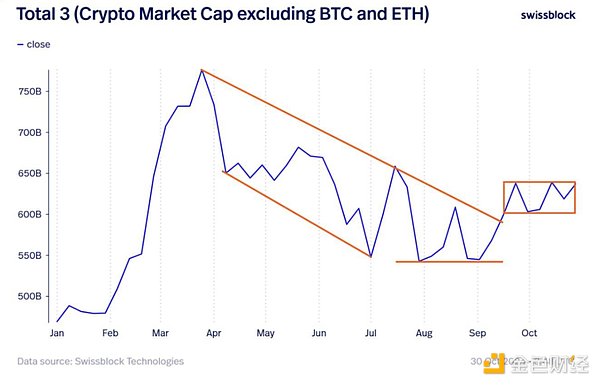

The chart below shows the change in the total market capitalization of the crypto market excluding Bitcoin and Ethereum (Total 3), which also represents whether Altcoins can explode or not. It can be seen that from April to September this year, the overall Altcoin market capitalization showed a significant downward trend, from $750 billion to $550 billion, but since September, the market capitalization has stopped falling and rebounded from $550 billion to the $600-650 billion range, breaking the downward trend, which also means that we have passed the most sluggish period for Altcoins.

And the aforementioned BTC.D is currently close to 61%, a new high for this cycle and the past three and a half years. Based on past experience, the start of the Altcoin season is always preceded by Bitcoin rising and sucking blood from Altcoins, causing BTC.D to soar, and when it rises to a certain level, BTC.D will fall from the high point to the 50%-55% range, and Altcoins will catch up, and we are now in the cycle where BTC.D is soaring to its peak.

The current total cryptocurrency market capitalization is about $3.2 trillion. If the total market capitalization remains unchanged, and BTC.D drops from 61% to 50%, it is estimated that $320 billion in liquidity will be injected into the Altcoin market, which also means that Total 2 (excluding Bitcoin market capitalization) will grow by 28%!

* Calculation formula: [3.2T*(61-50%)] / [3.2T*(1-61%)] = 28%

Future Outlook from the Financing Perspective: Focus on DeFi and Applications

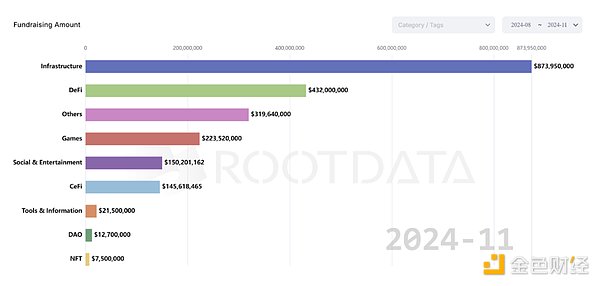

We have just judged the current market position from various market capitalization data, and the future outlook requires reference to the current financing situation, as financing represents confidence in the crypto market for the next 6-12 months, and is a leading indicator of the development of Altcoins in this cycle.

Over the past three months, the financing amount has been concentrated in infrastructure, with $870 million in financing completed. Infrastructure is the key track in the crypto market financing landscape, as blockchain is still in the early development stage, and investors are still very interested in taking the lead in building infrastructure. We can focus on the second and third tracks, which are DeFi and others (usually referring to DApps), with the former having a total financing amount of $430 million and the latter $310 million, far surpassing other tracks.

The essence of financing is to invest in early potential projects, and while everyone is cursing the sluggish price performance of Altcoins, investment institutions are starting to layout early DeFi and application projects, and are expected to usher in a new round of explosion by 2025.

Reference: Rootdata